Brace For A Credit Score Drop: The Impact Of Missed Student Loan Payments

Table of Contents

How Missed Student Loan Payments Affect Your Credit Score

Missed student loan payments are a serious matter that can severely damage your creditworthiness. Let's explore how this impacts your credit report and your FICO score.

Understanding the Credit Reporting Process

When you miss a student loan payment, your lender reports this delinquency to the three major credit bureaus: Equifax, Experian, and TransUnion.

- Timeline: The reporting process usually begins after 30 days of missed payment. However, some lenders may report sooner.

- Credit Score Impact: A missed payment immediately begins to negatively impact your credit score, potentially dropping your FICO score significantly. The longer the delinquency, the more your score suffers.

- Length of Negative Mark: Negative marks from missed payments can remain on your credit report for up to seven years. This can make it difficult to obtain loans, credit cards, or even rent an apartment during this period.

The Severity of the Impact

The severity of the impact on your credit score depends on several factors:

- Number of Missed Payments: One missed payment is less damaging than multiple missed payments. Multiple missed payments show a pattern of irresponsible financial behavior.

- Length of Delinquency: The longer the delinquency (30 days, 60 days, 90 days, or more), the more negative the impact on your credit score. A 90-day delinquency is far more serious than a 30-day delinquency.

- Future Implications: A significantly damaged credit score due to missed student loan payments can severely impact your ability to secure future loans, including mortgages, auto loans, and even credit cards. You might face higher interest rates or even loan applications being denied.

Types of Delinquency

Delinquency is categorized based on the number of days past due:

-

30-Day Delinquency: The first stage, often resulting in a late payment fee.

-

60-Day Delinquency: Your credit score takes a more substantial hit. Collection agencies might become involved.

-

90-Day Delinquency: This is considered a serious delinquency, significantly impacting your credit score. Your lender may take more aggressive collection actions.

-

Default: After prolonged delinquency, your loan may be considered defaulted. This has severe consequences.

-

Collection Actions: At each stage, lenders may take actions such as sending collection letters, calling you repeatedly, and potentially pursuing legal action.

Beyond the Credit Score: Other Financial Ramifications

The consequences of missed student loan payments extend far beyond a damaged credit score.

Wage Garnishment

The government can garnish your wages to repay your defaulted student loans.

- Legal Process: This involves a court order requiring your employer to deduct a portion of your paycheck to pay your debt.

- Financial Hardship: Wage garnishment can create significant financial hardship, making it difficult to meet your basic living expenses.

Tax Refund Offset

The IRS can offset your federal tax refund to repay your student loan debt.

- Process: The Department of Education informs the IRS of your outstanding debt, and the IRS offsets your refund accordingly.

- Impact on Financial Planning: This unexpected deduction can disrupt your financial planning and make it harder to manage your finances.

Difficulty Obtaining Future Loans

A poor credit history makes obtaining future loans significantly more challenging.

- Higher Interest Rates: Lenders perceive you as a higher risk, leading to higher interest rates on any future loans.

- Stricter Lending Criteria: You may encounter more stringent lending criteria and find it harder to qualify for loans.

Strategies to Avoid a Credit Score Drop from Student Loan Defaults

Proactive management of your student loans is crucial to avoid a credit score drop.

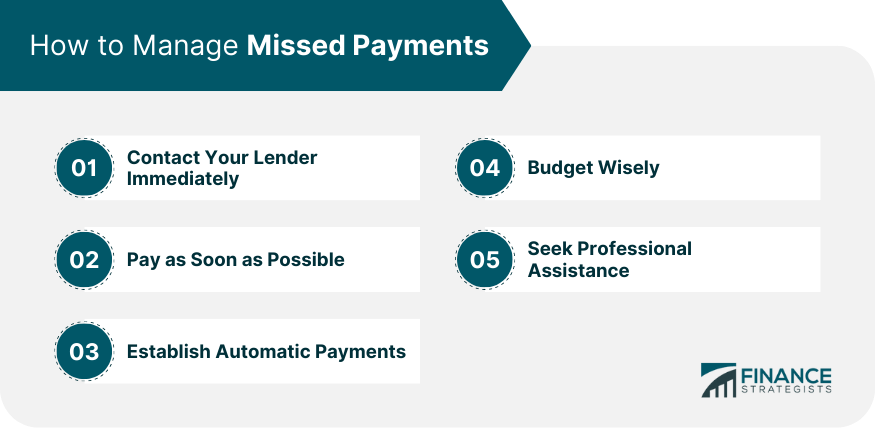

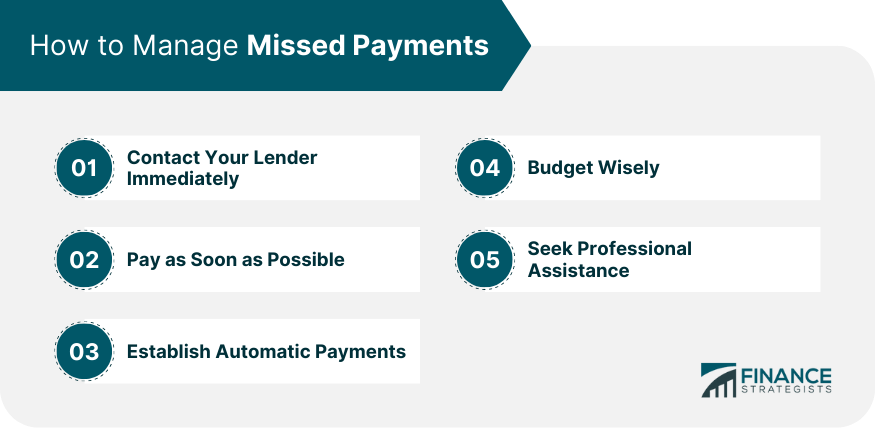

Budgeting and Financial Planning

Creating a realistic budget and prioritizing student loan payments are essential.

- Budgeting Tools: Utilize budgeting apps and spreadsheets to track your income and expenses.

- Financial Planning Resources: Seek advice from financial advisors or utilize free online resources to create a comprehensive financial plan.

Exploring Repayment Options

Several repayment plans can help manage your student loan debt.

- Income-Driven Repayment (IDR): Your monthly payment is based on your income and family size. [Link to relevant government website]

- Deferment: Temporarily postpones your payments, but interest may still accrue. [Link to relevant government website]

- Forbearance: Temporarily reduces or suspends your payments, but interest may still accrue. [Link to relevant government website]

- Consolidation: Combining multiple loans into a single loan to simplify repayment.

Communicating with Your Lender

Open communication with your lender is vital if you're facing financial difficulties.

- Negotiating a Repayment Plan: Explain your situation and explore the possibility of negotiating a more manageable repayment plan.

- Seeking Hardship Assistance: Inquire about hardship programs offered by your lender.

Conclusion

Missed student loan payments have significant negative consequences, impacting your credit score, financial stability, and future borrowing capacity. Proactive debt management, including budgeting, exploring repayment options, and open communication with your lender, is crucial to avoid these detrimental effects. Don't let missed student loan payments negatively affect your credit history; take action today! Contact your lender immediately if you are struggling to make your payments and explore available options to protect your credit score and financial future. Proper student loan payment management is key to building a strong financial foundation.

Featured Posts

-

Analysis Japans Economic Slowdown Before Trump Tariffs

May 17, 2025

Analysis Japans Economic Slowdown Before Trump Tariffs

May 17, 2025 -

Bayern Munich Edges Past Stuttgart After Early Pressure

May 17, 2025

Bayern Munich Edges Past Stuttgart After Early Pressure

May 17, 2025 -

Predicting The Mariners Vs Tigers Mlb Game Odds Picks And Analysis For Today

May 17, 2025

Predicting The Mariners Vs Tigers Mlb Game Odds Picks And Analysis For Today

May 17, 2025 -

Anunoby Brilla Con 27 Puntos Triunfo De Knicks Sobre 76ers

May 17, 2025

Anunoby Brilla Con 27 Puntos Triunfo De Knicks Sobre 76ers

May 17, 2025 -

Understanding Proxy Statements Form Def 14 A A Comprehensive Guide

May 17, 2025

Understanding Proxy Statements Form Def 14 A A Comprehensive Guide

May 17, 2025

Latest Posts

-

Bayern Munich Academy Angelo Stillers Rise And Persistent Flaws

May 17, 2025

Bayern Munich Academy Angelo Stillers Rise And Persistent Flaws

May 17, 2025 -

Reddit Fixes Outage Platform Back Online After Service Interruption

May 17, 2025

Reddit Fixes Outage Platform Back Online After Service Interruption

May 17, 2025 -

Arsenals Strong Interest In Stuttgart Midfielder

May 17, 2025

Arsenals Strong Interest In Stuttgart Midfielder

May 17, 2025 -

Reddit Service Restored Following Outage Users Report Normal Functionality

May 17, 2025

Reddit Service Restored Following Outage Users Report Normal Functionality

May 17, 2025 -

Arsenal In Pole Position To Sign Stuttgart Star

May 17, 2025

Arsenal In Pole Position To Sign Stuttgart Star

May 17, 2025