Understanding Proxy Statements (Form DEF 14A): A Comprehensive Guide

Table of Contents

Proxy statements, specifically those filed with the Securities and Exchange Commission (SEC) as Form DEF 14A, are crucial documents for investors seeking to make informed decisions. Understanding DEF 14A is not just for financial professionals; individual investors and corporate governance enthusiasts can significantly benefit from deciphering this often-overlooked resource. This comprehensive guide will demystify proxy statements, equipping you with the knowledge to leverage them for better investment outcomes. We will explore what a proxy statement is, its key components, how to interpret it, and ultimately, how to use this information to strengthen your investment strategy. Keywords throughout this article will include: proxy statement, DEF 14A, investor, corporate governance, SEC filing, proxy voting, and more.

What is a Proxy Statement (DEF 14A)?

A proxy statement is a formal document sent to shareholders by a publicly traded company. It informs them about important matters requiring a vote, such as electing board members, approving mergers and acquisitions, or considering shareholder proposals. Essentially, it's your invitation to participate in corporate decisions. DEF 14A signifies that this document has been filed with the SEC, ensuring transparency and adherence to SEC regulations. Companies are required to file a proxy statement in various situations, including:

- Annual Shareholder Meetings: To vote on routine matters and elect directors.

- Special Meetings: Called to address specific issues, such as a merger or acquisition.

- Major Corporate Actions: Significant transactions like mergers, acquisitions, or significant changes in the company’s structure.

Understanding DEF 14A and the associated proxy voting process is essential for every investor. It’s a fundamental aspect of corporate actions and effective SEC regulations.

Key Components of a Proxy Statement (Form DEF 14A)

Proxy statements contain vital information allowing shareholders to make educated voting decisions. Here are some key components:

Shareholder Proposals

Shareholder proposals, often concerning corporate social responsibility or ESG investing, allow shareholders to suggest changes in company policies or practices. The DEF 14A outlines these proposals, including the proponent's reasoning and the company's response. Understanding these proposals allows investors to assess a company's responsiveness to shareholder activism.

- Analyzing shareholder proposals reveals the company’s commitment to environmental, social, and governance (ESG) factors.

- It provides insights into the alignment of management with shareholder interests.

- Voting on proposals enables active participation in shaping the company’s future.

Executive Compensation

This section details the compensation packages of company executives, including salaries, bonuses, stock options, and other benefits. Scrutinizing executive pay helps investors assess whether compensation aligns with performance and company strategy. Red flags, like excessive golden parachutes, can be identified here. Keywords: executive pay, golden parachutes, compensation disclosure.

- Analyze compensation relative to company performance and industry benchmarks.

- Identify potential conflicts of interest.

- Evaluate the fairness and transparency of the compensation structure.

Director Elections

The DEF 14A provides information about the nominees for the board of directors, their backgrounds, and qualifications. This section is crucial for assessing the corporate governance of the company. Investors should carefully review the director candidates’ experience and independence to ensure strong oversight. Keywords: board of directors, corporate governance, director nominations.

- Evaluate the independence and expertise of the board candidates.

- Assess the board's composition and diversity.

- Understand the board's committees and their responsibilities.

Auditor Information

The proxy statement includes information about the company's independent auditor, including their audit report and any fees paid. This section is critical for assessing the quality of the company's financial statements. Reviewing auditor information is an essential part of due diligence. Keywords: independent auditor, financial statements, audit report.

- Review the auditor's opinion on the financial statements.

- Examine any significant accounting changes or issues.

- Assess the auditor's independence and objectivity.

How to Read and Interpret a Proxy Statement (Form DEF 14A)

Analyzing a proxy statement effectively requires a systematic approach. Begin by reviewing the executive summary, then focus on the sections most relevant to your investment thesis. Pay close attention to the voting instructions and deadlines to ensure timely participation. For complex financial analysis, consider seeking assistance from financial professionals or utilizing online resources that explain interpreting financial statements. Keywords: proxy voting instructions, voting deadlines, financial analysis, interpreting financial statements.

- Read the executive summary for an overview of key proposals.

- Carefully review the sections relevant to your investment decisions.

- Understand the voting procedures and deadlines.

- Seek professional help if needed to understand complex financial information.

Using Proxy Statements for Informed Investment Decisions

By analyzing proxy statements, investors can gain valuable insights into a company's management, corporate governance practices, and long-term strategy. This information can significantly impact investment decisions. For example, consistently high executive compensation without corresponding performance might signal potential problems, influencing investment choices. Keywords: investment strategy, due diligence, corporate governance analysis, informed investing.

- Assess management's alignment with shareholder interests.

- Evaluate the quality of the company's corporate governance.

- Identify potential risks and opportunities based on proposed changes.

Conclusion: Mastering Proxy Statements for Successful Investing

Proxy statements (Form DEF 14A) are indispensable tools for informed investing. Understanding their components and effectively interpreting their contents empowers you to participate actively in corporate governance and make better investment decisions. By actively engaging with proxy materials and exercising your shareholder rights, you contribute to a more responsible and efficient market. Learn more about effectively using proxy statements (Form DEF 14A) to enhance your investment strategy and participate in corporate governance. Start analyzing proxy statements today!

Featured Posts

-

Angel Reese X Reebok Ss 25 Capsule Collection Drop

May 17, 2025

Angel Reese X Reebok Ss 25 Capsule Collection Drop

May 17, 2025 -

1050 Price Surge At And Ts Outcry Over Broadcoms V Mware Acquisition

May 17, 2025

1050 Price Surge At And Ts Outcry Over Broadcoms V Mware Acquisition

May 17, 2025 -

The Studio Seth Rogen Breaks His Own Rotten Tomatoes Record

May 17, 2025

The Studio Seth Rogen Breaks His Own Rotten Tomatoes Record

May 17, 2025 -

Air Traffic Controller Prevents Midair Collision An Exclusive Interview

May 17, 2025

Air Traffic Controller Prevents Midair Collision An Exclusive Interview

May 17, 2025 -

Cassie Ventura Testifies In Diddy Trial Details Emerge About Sean Combs

May 17, 2025

Cassie Ventura Testifies In Diddy Trial Details Emerge About Sean Combs

May 17, 2025

Latest Posts

-

Tvs Jupiter Ather 450 X Hero Pleasure

May 17, 2025

Tvs Jupiter Ather 450 X Hero Pleasure

May 17, 2025 -

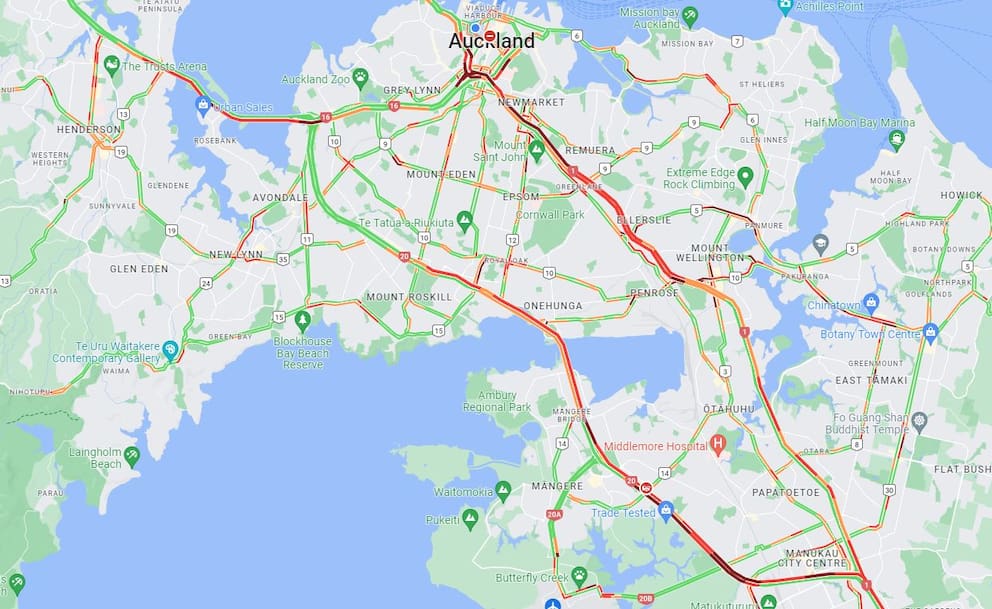

Risky E Scooter Ride On Aucklands Southern Motorway Dashcam Footage Released

May 17, 2025

Risky E Scooter Ride On Aucklands Southern Motorway Dashcam Footage Released

May 17, 2025 -

Dashcam Catches E Scooter On Busy Auckland Southern Motorway A Safety Concern

May 17, 2025

Dashcam Catches E Scooter On Busy Auckland Southern Motorway A Safety Concern

May 17, 2025 -

Tvs Jupiter Cng

May 17, 2025

Tvs Jupiter Cng

May 17, 2025 -

Comparatif Xiaomi Scooter 5 5 Pro Et 5 Max Laquelle Choisir

May 17, 2025

Comparatif Xiaomi Scooter 5 5 Pro Et 5 Max Laquelle Choisir

May 17, 2025