BofA's View: Why Current Stock Market Valuations Shouldn't Deter Investors

Table of Contents

BofA's Bullish Case: Underlying Economic Strength

BofA's positive outlook stems from a strong belief in the resilience of the underlying economy. Despite inflationary pressures, several key indicators point towards continued growth.

Robust Corporate Earnings Despite Inflation

- Strong Profit Margins: Many companies have successfully navigated inflationary pressures, maintaining robust profit margins through pricing power and efficiency gains. Specific sectors like technology and healthcare have shown particular strength.

- Revenue Growth: Revenue growth across numerous sectors remains healthy, indicating strong consumer demand and business investment. BofA's research suggests continued revenue expansion throughout 2024.

- BofA's Predictions: BofA analysts predict continued corporate earnings growth, even factoring in potential economic slowdowns. Their models incorporate various scenarios, including persistent inflation and interest rate hikes, and still project positive overall earnings. This resilience counters concerns about high stock market valuations.

Resilient Consumer Spending and Employment

- High Consumer Confidence: Despite inflation, consumer confidence remains relatively high, indicating continued spending power. This is supported by strong retail sales figures and sustained demand for goods and services.

- Low Unemployment Rates: Unemployment rates remain historically low, suggesting a robust labor market that supports consumer spending and overall economic growth. This translates to continued demand for goods and services.

- Wage Growth: While inflation is a concern, wage growth is also evident, helping to mitigate the impact of rising prices on consumer purchasing power. BofA's economic forecasts incorporate these factors, predicting sustained consumer spending in the coming quarters.

Addressing Valuation Concerns: A Long-Term Perspective

While current valuations may seem high compared to historical averages, a long-term perspective is crucial.

Historical Comparisons and Market Cycles

- Cyclical Nature: Market cycles are inherently cyclical. Periods of high valuations have historically been followed by periods of growth, demonstrating the resilience of the market over the long term.

- Similar Valuations in the Past: BofA's analysis highlights several instances in history where valuations were similarly high, followed by periods of significant market expansion. While past performance doesn't guarantee future results, it provides valuable context.

- (Ideally, include a chart or graph here comparing current P/E ratios to historical averages.)

- Potential for Future Growth: Despite current valuations, numerous growth opportunities remain across various sectors. Technological advancements, demographic shifts, and evolving consumer preferences are all potential drivers of future market expansion.

The Importance of Long-Term Investment Strategies

Short-term market fluctuations should not dictate long-term investment decisions.

- Long-Term Growth: A long-term investment horizon allows investors to weather short-term market volatility and benefit from the compounding effect of returns over time.

- Mitigating Valuation Concerns: Focusing on the long-term growth potential of underlying businesses minimizes the impact of short-term valuation concerns.

- Diversification and Risk Management: A well-diversified portfolio across different asset classes and sectors is crucial for managing risk and maximizing returns over the long term.

BofA's Recommended Investment Strategies

BofA offers specific investment strategies to navigate the current market environment.

Sector-Specific Opportunities

- Technology: BofA remains bullish on the technology sector, citing ongoing innovation and strong growth potential in areas like artificial intelligence and cloud computing. Specific companies or indices within this sector could offer attractive investment opportunities.

- Healthcare: The aging global population and continued advancements in medical technology are driving growth in the healthcare sector. BofA points to several promising sub-sectors within healthcare.

- (Other Sectors): Include other sectors recommended by BofA, with supporting rationale and examples.

Tactical Asset Allocation

BofA suggests a balanced approach to asset allocation, considering current market conditions. This may include:

- Diversification: Maintaining a diversified portfolio across different asset classes (equities, bonds, real estate, etc.) to mitigate risk and optimize returns.

- Risk Management: Implementing appropriate risk management strategies, such as stop-loss orders and hedging techniques, to protect against potential market downturns.

- Strategic Allocation: Adjusting portfolio allocations based on BofA's market outlook and individual risk tolerance.

Conclusion: Why Current Stock Market Valuations Shouldn't Deter You – A BofA Perspective

In summary, BofA's optimistic outlook is grounded in strong economic fundamentals, including resilient corporate earnings, robust consumer spending, and a healthy employment market. By considering historical context and adopting a long-term investment strategy, investors can navigate current valuation concerns effectively. BofA's recommended sector-specific opportunities and tactical asset allocation strategies offer a framework for capitalizing on market potential. Don't let current stock market valuations deter you from pursuing long-term investment goals. Learn more about BofA's market outlook and investment strategies today! Consult with a financial advisor to discuss your investment options based on BofA's analysis.

Featured Posts

-

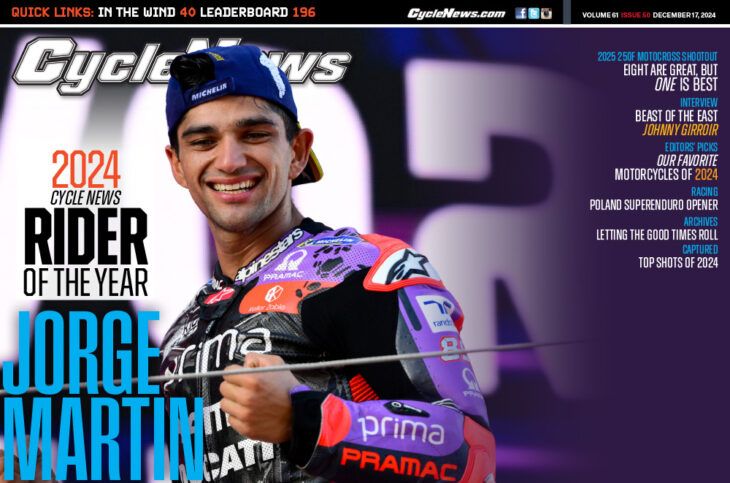

2025 Cycle News Magazine Issue 18 In Depth Analysis And Reports

May 31, 2025

2025 Cycle News Magazine Issue 18 In Depth Analysis And Reports

May 31, 2025 -

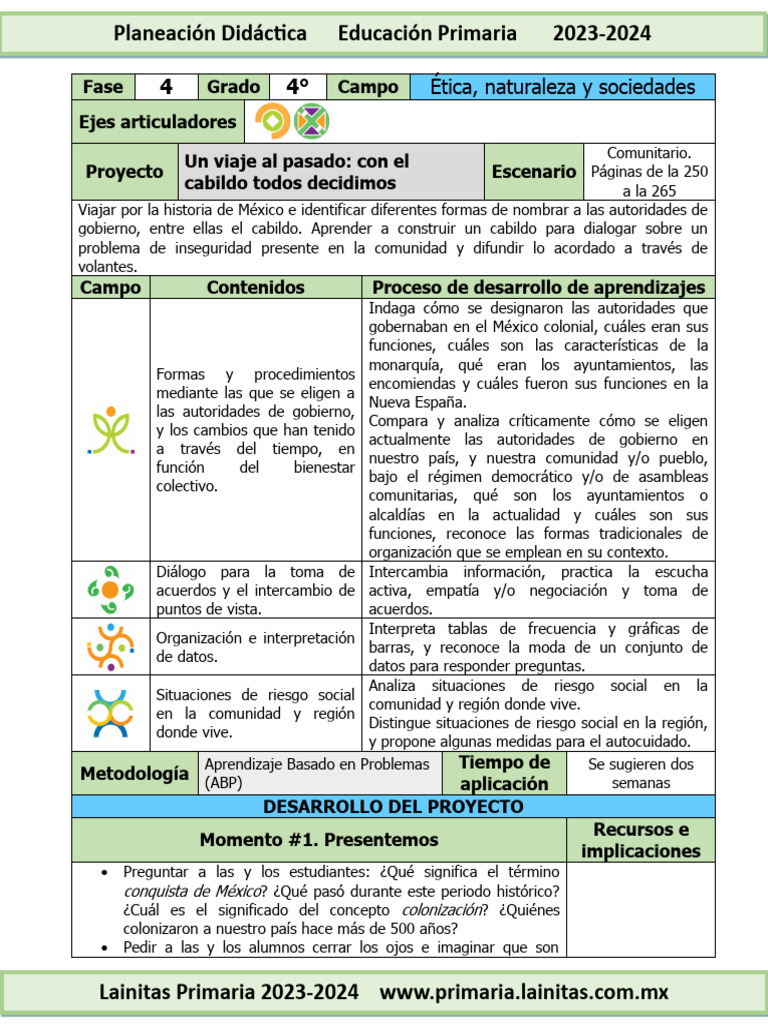

Receta Aragonesa 3 Ingredientes Para Un Viaje Al Pasado

May 31, 2025

Receta Aragonesa 3 Ingredientes Para Un Viaje Al Pasado

May 31, 2025 -

Far Left Reaction To French Muslim Mans Killing Islamophobia Debate Reignited

May 31, 2025

Far Left Reaction To French Muslim Mans Killing Islamophobia Debate Reignited

May 31, 2025 -

Horoscope May 27 2025 Christine Haas

May 31, 2025

Horoscope May 27 2025 Christine Haas

May 31, 2025 -

Enroll Now Meteorologist Tom Atkins Bi Annual Skywarn Class

May 31, 2025

Enroll Now Meteorologist Tom Atkins Bi Annual Skywarn Class

May 31, 2025