BofA's View: Why Current Stock Market Valuations Are Not A Cause For Alarm

Table of Contents

Strong Corporate Earnings and Revenue Growth Despite Inflation

Headline keyword: Earnings growth

BofA's analysis of recent corporate earnings reports reveals a surprising resilience. Despite persistent inflationary pressures, many companies have demonstrated strong earnings growth and revenue expansion. This suggests a robust underlying economy capable of weathering the current storm.

- Sector-Specific Strength: The technology and consumer staples sectors, for example, have shown remarkable resilience, indicating a diversified strength within the market. These sectors have leveraged pricing power to maintain profit margins, even with increased input costs.

- Pricing Power: Many companies have successfully passed on increased costs to consumers, demonstrating effective pricing power and mitigating the impact of inflation on profit margins. This is a key factor underpinning the strong earnings reports.

- Data Points: BofA's research indicates a [Insert percentage]% increase in aggregate earnings year-over-year, exceeding initial market expectations. [Insert Chart/Graph showing earnings growth across sectors]. This data strongly suggests that the current market valuation isn't solely driven by speculative bubbles.

- Keywords: Corporate earnings, Revenue growth, Inflation, Profit margins, Pricing power

The Impact of Interest Rate Hikes on Stock Market Valuations

Headline keyword: Interest rate hikes

The Federal Reserve's (Fed) interest rate hikes have understandably raised concerns about stock market valuations. However, BofA contends that the market has already largely priced in many of the expected rate increases.

- Market Adaptation: Stock valuations, according to BofA's models, already reflect the anticipated interest rate trajectory. This suggests that any further rate adjustments are less likely to cause significant shocks to the market.

- Sectoral Variations: While interest rate hikes impact different sectors differently, BofA's analysis suggests that some sectors (e.g., technology) may be less sensitive than others due to their growth trajectories.

- Bond Yields: The relationship between bond yields and stock valuations is complex. While higher bond yields increase the discount rate used in stock valuation models, BofA's analysis suggests that the potential for future growth in certain sectors still outweighs the increased discount rate.

- Keywords: Interest rates, Federal Reserve, Bond yields, Stock valuation models, Discount rates

Long-Term Growth Prospects and Future Economic Predictions

Headline keyword: Long-term growth

BofA maintains a positive long-term outlook for the economy, which supports their view on current stock market valuations.

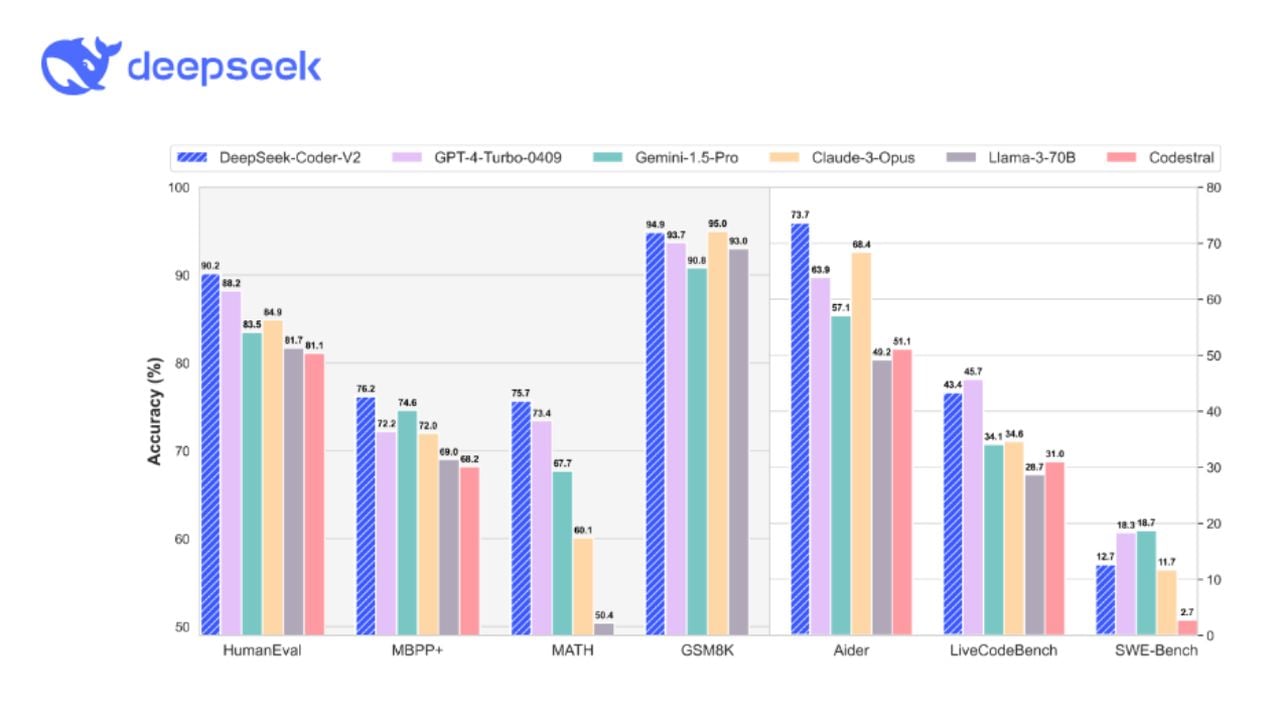

- Technological Innovation: Continued advancements in technology, particularly in areas like artificial intelligence and renewable energy, are projected to drive significant economic growth over the next decade.

- Demographic Trends: While some demographics present challenges, others – such as a growing global middle class – are expected to fuel demand and spur economic activity, contributing to long-term growth.

- Offsetting Near-Term Challenges: BofA acknowledges near-term challenges like inflation and geopolitical instability. However, their long-term forecasts suggest that these challenges are temporary and will be offset by powerful structural growth drivers.

- Keywords: Economic growth, Long-term investment, Technological innovation, Demographic trends, Future outlook

Sector-Specific Analysis: Identifying Undervalued Opportunities

Headline keyword: Undervalued stocks

BofA's research identifies specific sectors and companies that they believe are currently undervalued relative to their long-term growth potential.

- Growth Potential: Sectors demonstrating strong fundamentals and future growth potential, despite near-term headwinds, are highlighted as attractive investment opportunities.

- Risk Assessment: BofA provides a thorough risk assessment for each identified opportunity, acknowledging potential downsides while emphasizing the upside potential.

- Diversification: BofA advocates for a diversified investment strategy, encouraging investors to spread their investments across multiple sectors to mitigate risk.

- Keywords: Sector performance, Stock picking, Investment strategy, Portfolio diversification, Risk management

Conclusion: Why BofA Believes Current Stock Market Valuations Warrant a Cautiously Optimistic Stance

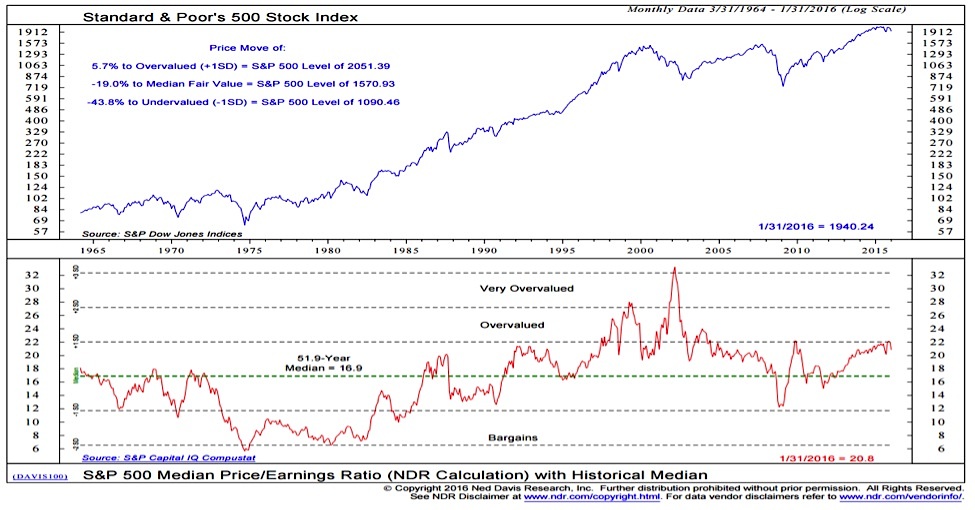

BofA's analysis shows that while risks exist, current stock market valuations are not necessarily a cause for alarm. Strong corporate earnings, market adaptation to interest rate hikes, and positive long-term growth prospects all contribute to a cautiously optimistic outlook. The resilience of corporate earnings despite inflation, along with the market's seeming preparedness for further interest rate adjustments, suggest that the current valuations are not overly inflated. While navigating the current economic climate requires vigilance, BofA's research suggests that long-term investors should maintain a balanced perspective, considering the potential for continued growth. For a detailed breakdown of BofA's analysis and sector-specific recommendations, review their full report or consult with a financial advisor to develop a personalized investment strategy that aligns with your risk tolerance and investment goals. Understanding stock market valuations is crucial for making informed investment decisions.

Featured Posts

-

How Trump Is Driving The Republican Partys Agenda

May 26, 2025

How Trump Is Driving The Republican Partys Agenda

May 26, 2025 -

Nonton Live Streaming Moto Gp Inggris 2025 Sprint Race Jam 20 00 Wib

May 26, 2025

Nonton Live Streaming Moto Gp Inggris 2025 Sprint Race Jam 20 00 Wib

May 26, 2025 -

Google Vs Open Ai A Deep Dive Into I O And Io Technologies

May 26, 2025

Google Vs Open Ai A Deep Dive Into I O And Io Technologies

May 26, 2025 -

Nome Do Filme Como Um Trailer Mudou A Historia Do Cinema

May 26, 2025

Nome Do Filme Como Um Trailer Mudou A Historia Do Cinema

May 26, 2025 -

Le Sketch Du 128e Sexe Du Grand Cactus Analyse De La Decision Du Csa

May 26, 2025

Le Sketch Du 128e Sexe Du Grand Cactus Analyse De La Decision Du Csa

May 26, 2025