XRP Explained: How Ripple's Cryptocurrency Works

Table of Contents

What is XRP and How Does it Differ from Other Cryptocurrencies?

XRP, Ripple's digital asset, isn't just another cryptocurrency; it's designed to be a bridge currency, facilitating seamless and efficient cross-border transactions. Unlike Bitcoin or Ethereum, which rely on Proof-of-Work or Proof-of-Stake consensus mechanisms, XRP utilizes a unique consensus mechanism called the Ripple Protocol Consensus Algorithm (RPCA). This allows for significantly faster transaction times and lower fees.

Here's a comparison highlighting key differences:

- Transaction Speed: XRP boasts incredibly fast transaction speeds, typically settling in a matter of seconds, compared to minutes or even hours for other cryptocurrencies.

- Transaction Fees: XRP transactions are significantly cheaper than those on Bitcoin or Ethereum, making it a cost-effective solution for large-scale transactions.

- Consensus Mechanism: XRP uses RPCA, a unique energy-efficient consensus mechanism, differing from the energy-intensive Proof-of-Work used by Bitcoin.

- Scalability: XRP's design allows for high scalability, handling a large volume of transactions concurrently without compromising speed or efficiency.

- Use Cases: While primarily known for its payment capabilities, XRP has potential applications beyond simple payments, including as a store of value and in decentralized exchange (DEX) platforms.

How Ripple's Technology Enables Fast and Efficient Transactions

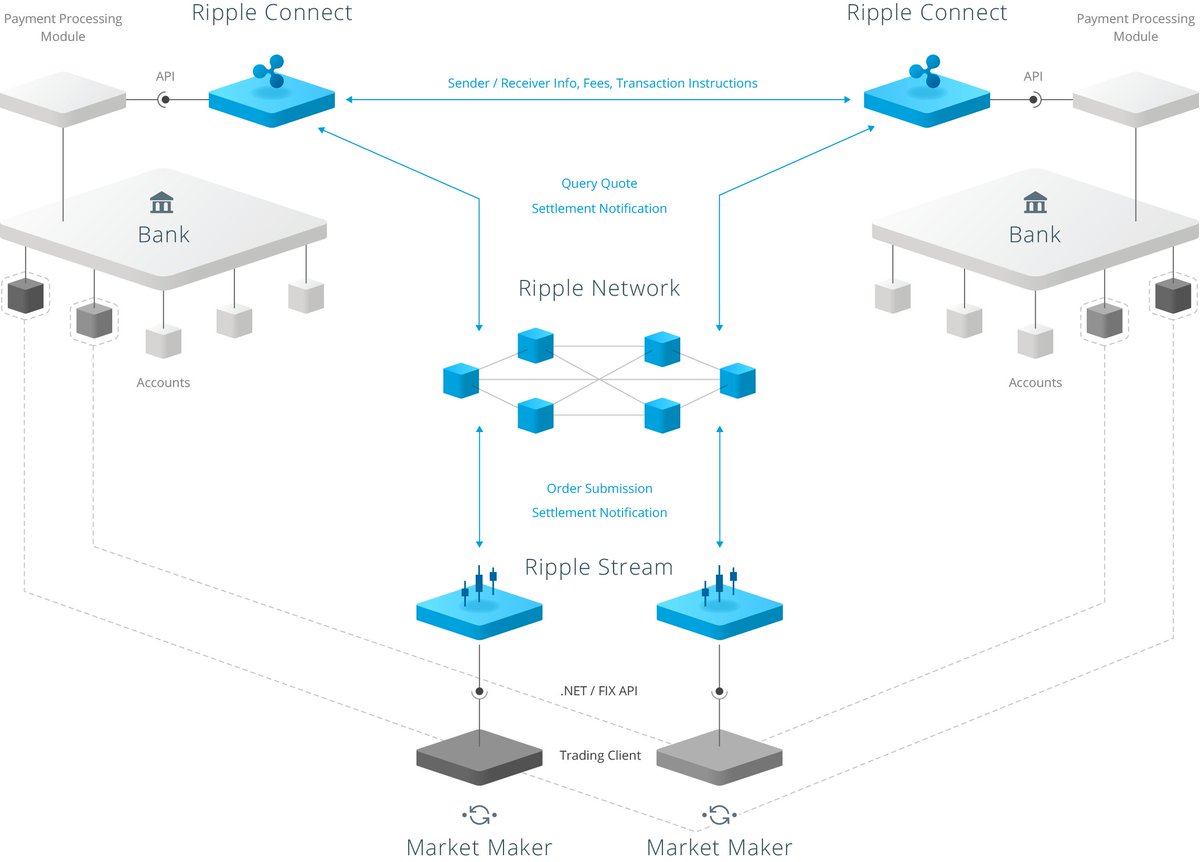

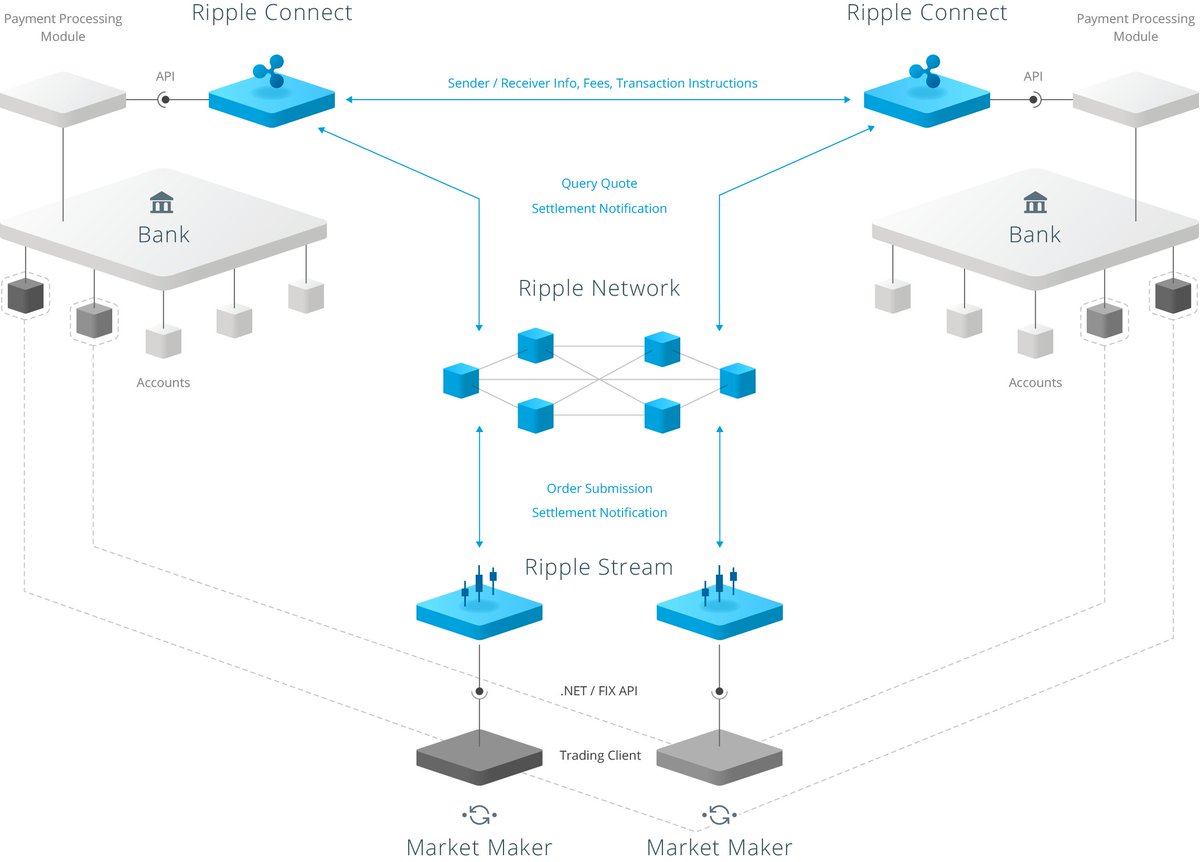

RippleNet, Ripple's global payments network, leverages XRP to facilitate faster and more cost-effective cross-border transactions for financial institutions. The process involves converting various currencies into XRP, transferring it across the network, and then converting it back to the recipient's desired currency. This streamlined process significantly reduces the time and cost associated with traditional banking systems.

Key benefits for financial institutions using Ripple's technology include:

- Reduced Costs: Lower transaction fees compared to traditional SWIFT transfers.

- Increased Speed: Near-instantaneous transaction settlements.

- Improved Transparency: Increased visibility and tracking of transactions.

- Enhanced Security: Leveraging blockchain technology for enhanced security and immutability.

The Role of XRP in the Ripple Ecosystem

XRP is intrinsically linked to RippleNet; it serves as the fuel powering the network's efficient and rapid transactions. However, its potential extends beyond RippleNet. While its primary function is facilitating transactions within the Ripple ecosystem, XRP's future applications are still evolving. However, it's important to note that XRP's regulatory status is an ongoing discussion, with ongoing legal battles affecting its overall adoption and price. Therefore, keeping abreast of regulatory developments is crucial for anyone considering XRP.

Investing in XRP: Risks and Rewards

Investing in XRP, like any cryptocurrency, involves significant risk. The cryptocurrency market is highly volatile, and XRP's price can fluctuate dramatically. Factors influencing XRP's price include market sentiment, regulatory developments, adoption rates by financial institutions, and overall market conditions.

While potential rewards exist, it's crucial to acknowledge the risks. Before investing in XRP or any cryptocurrency, conduct thorough research, understand the technology, and assess your risk tolerance. Remember that diversification is key to mitigating risk within a broader investment portfolio.

Conclusion: Investing in XRP’s Future

XRP, Ripple's cryptocurrency, offers a unique approach to cross-border payments, leveraging its speed, low fees, and energy-efficient consensus mechanism. Its integration into RippleNet provides a compelling solution for financial institutions seeking faster and cheaper global transactions. However, investing in XRP involves significant risks due to market volatility and ongoing regulatory uncertainties. Before making any investment decisions, it's crucial to learn more about XRP, understand its potential, and carefully consider the associated risks. Explore the world of XRP and Ripple’s technology further by visiting the official Ripple website and reviewing relevant white papers. Understanding XRP's potential requires diligent research and a realistic assessment of its inherent volatility.

Featured Posts

-

Find The Latest Lotto Lotto Plus 1 And Lotto Plus 2 Results Here

May 02, 2025

Find The Latest Lotto Lotto Plus 1 And Lotto Plus 2 Results Here

May 02, 2025 -

Poppys Family Offers Moving Tribute After Death Of Beloved Manchester United Supporter

May 02, 2025

Poppys Family Offers Moving Tribute After Death Of Beloved Manchester United Supporter

May 02, 2025 -

Supreme Court Case Norfolk Mp Challenges Nhs Hospital Over Gender Policy

May 02, 2025

Supreme Court Case Norfolk Mp Challenges Nhs Hospital Over Gender Policy

May 02, 2025 -

Negotiating With Dragons Securing Investment On Dragons Den

May 02, 2025

Negotiating With Dragons Securing Investment On Dragons Den

May 02, 2025 -

Kl Ma Tryd Merfth En Blay Styshn 6 Dlyl Shaml

May 02, 2025

Kl Ma Tryd Merfth En Blay Styshn 6 Dlyl Shaml

May 02, 2025