11 Million ETH Accumulated: Implications For Ethereum's Price

Table of Contents

Who is Accumulating ETH and Why?

The accumulation of 11 million ETH isn't happening in a vacuum. Several key players are driving this trend, each with their own motivations.

Large Institutional Investors

Whales, institutional investors, and major investment firms are significant contributors to this ETH accumulation. Their involvement reflects a growing confidence in Ethereum's long-term potential.

- Examples: Grayscale Investments, Coinbase, and other large hedge funds are known to hold substantial amounts of ETH.

- Investment Strategies: Many institutions are employing long-term holding strategies, seeing ETH as a store of value and a key component of their diversified cryptocurrency portfolios. Staking, which involves locking up ETH to help secure the network, is also a popular strategy among institutional investors.

- Reasons for Accumulation: The belief in Ethereum's future as a leading smart contract platform and the burgeoning opportunities within the DeFi (Decentralized Finance) ecosystem are primary drivers for institutional ETH accumulation. The growing adoption of ETH in various sectors also boosts investor confidence.

Retail Investors

The surge in retail investor interest in Ethereum is another key factor. The growing accessibility of cryptocurrency, combined with increased awareness of Ethereum's utility, has attracted a significant number of smaller investors.

- Growing Retail Interest: The simplicity of purchasing ETH through various exchanges and the increasing availability of educational resources have made it more accessible to individual investors.

- Factors Driving Retail Investment: The anticipated launch of ETH 2.0, the explosive growth of the DeFi space, and the popularity of Non-Fungible Tokens (NFTs) all contribute to the excitement around ETH among retail investors.

- Impact of Exchange Inflows and Outflows: While exchange inflows can reflect selling pressure, consistent outflows suggest that investors are moving their ETH to personal wallets, indicating a long-term holding strategy which contributes to the accumulation.

Ethereum Developers and Ecosystem Participants

Ethereum developers and active participants in the ecosystem are also likely accumulating ETH. Their involvement is often driven by incentives and a belief in the long-term success of the project.

- Staking Rewards: Validators who stake their ETH to secure the network earn rewards, incentivizing participation and accumulation.

- Incentives for Network Participation: Many DeFi protocols and applications offer incentives to users in ETH, contributing to accumulation within the ecosystem.

- Long-Term Commitment: Developers and those deeply involved in the Ethereum ecosystem often hold ETH as a demonstration of their long-term commitment to the platform’s success.

The Impact of ETH Accumulation on Supply and Demand

The massive ETH accumulation directly impacts the supply and demand dynamics of the cryptocurrency.

Reduced Circulating Supply

The accumulation of 11 million ETH effectively reduces the circulating supply available in the market. This scarcity plays a pivotal role in shaping the Ethereum price.

- Relationship between Scarcity and Price: Basic economics dictates that decreased supply, when demand remains constant or increases, typically leads to price appreciation.

- Comparison with other Cryptocurrencies: The accumulation of ETH can be compared to similar trends in other cryptocurrencies, highlighting the impact of reduced supply on market valuation. Bitcoin's scarcity is often cited as a key factor in its price appreciation.

- Historical Examples: Numerous historical examples within the cryptocurrency market demonstrate the correlation between supply reduction and price increases.

Increased Demand

The ongoing accumulation doesn't just reduce supply; it also signals increased demand for ETH. This heightened demand further contributes to price pressure.

- Impact on Order Books: Large-scale accumulation can influence order books, creating a strong buying pressure that can push the price upward.

- Market Capitalization: The increased demand and reduced supply directly impact Ethereum's market capitalization, potentially leading to a substantial increase in its overall valuation.

- Potential for Price Appreciation: The combined effect of reduced supply and increased demand creates a potent recipe for potential price appreciation driven by the fundamentals of supply and demand.

Potential Scenarios for Ethereum's Price

The 11 million ETH accumulation presents several potential scenarios for Ethereum's price, ranging from bullish to bearish and neutral.

Bullish Outlook

A bullish outlook suggests that the accumulation could trigger a significant price increase.

- Factors that could fuel a bull run: Positive market sentiment, the successful rollout of ETH 2.0, and continued growth within the DeFi ecosystem are all factors that could contribute to a bull run.

- Potential Price Targets: While predicting specific price targets is speculative, significant price appreciation is a plausible outcome given the substantial accumulation.

Bearish Outlook

A bearish outlook acknowledges that the impact of accumulation might be less significant or even negative.

- Factors that could limit price increases: A general downturn in the overall cryptocurrency market, increased regulatory uncertainty, or intense competition from other blockchain platforms could limit the positive impact of the accumulation.

- Potential Downside Risks: While less likely given the current accumulation, external market factors could still negatively influence the Ethereum price.

Neutral Outlook

A neutral outlook suggests that the accumulation may not have an immediate or dramatic effect on the Ethereum price.

- Reasons for a neutral outlook: The accumulation could be offset by selling pressure from other market participants, leading to sideways price movements.

- Factors to watch for changes in outlook: Monitoring on-chain metrics and overall market sentiment is crucial for assessing whether the accumulation will translate into significant price changes.

Analyzing On-Chain Metrics for Further Insights

Analyzing on-chain metrics provides valuable insights into the health and potential future performance of the Ethereum network.

Transaction Volume and Fees

High transaction volume and fees often indicate increased network usage and potential for price growth. This is because high activity shows strong demand for the network's services.

Staking Ratios and Participation

Higher staking ratios indicate a larger portion of the ETH supply is locked up, further reducing the circulating supply and potentially boosting the price. Increased staking participation also demonstrates confidence in the network.

Exchange Reserves

Decreasing exchange reserves often suggest a bullish trend, as it indicates that coins are being moved off exchanges into long-term storage, reducing the available supply for selling.

Conclusion

The accumulation of 11 million ETH presents a fascinating case study in the dynamics of cryptocurrency markets. While a bullish outlook is certainly plausible given the reduced circulating supply and increased demand, it's crucial to consider potential bearish and neutral scenarios. Monitoring on-chain metrics like transaction volume, staking ratios, and exchange reserves, combined with a keen eye on market sentiment, will provide valuable insights into future Ethereum price movements. Stay informed about Ethereum price developments and continue researching the complex interplay of factors influencing ETH accumulation and price prediction methodologies. Understanding the dynamics of ETH accumulation is key to navigating the exciting world of Ethereum and its future price.

Featured Posts

-

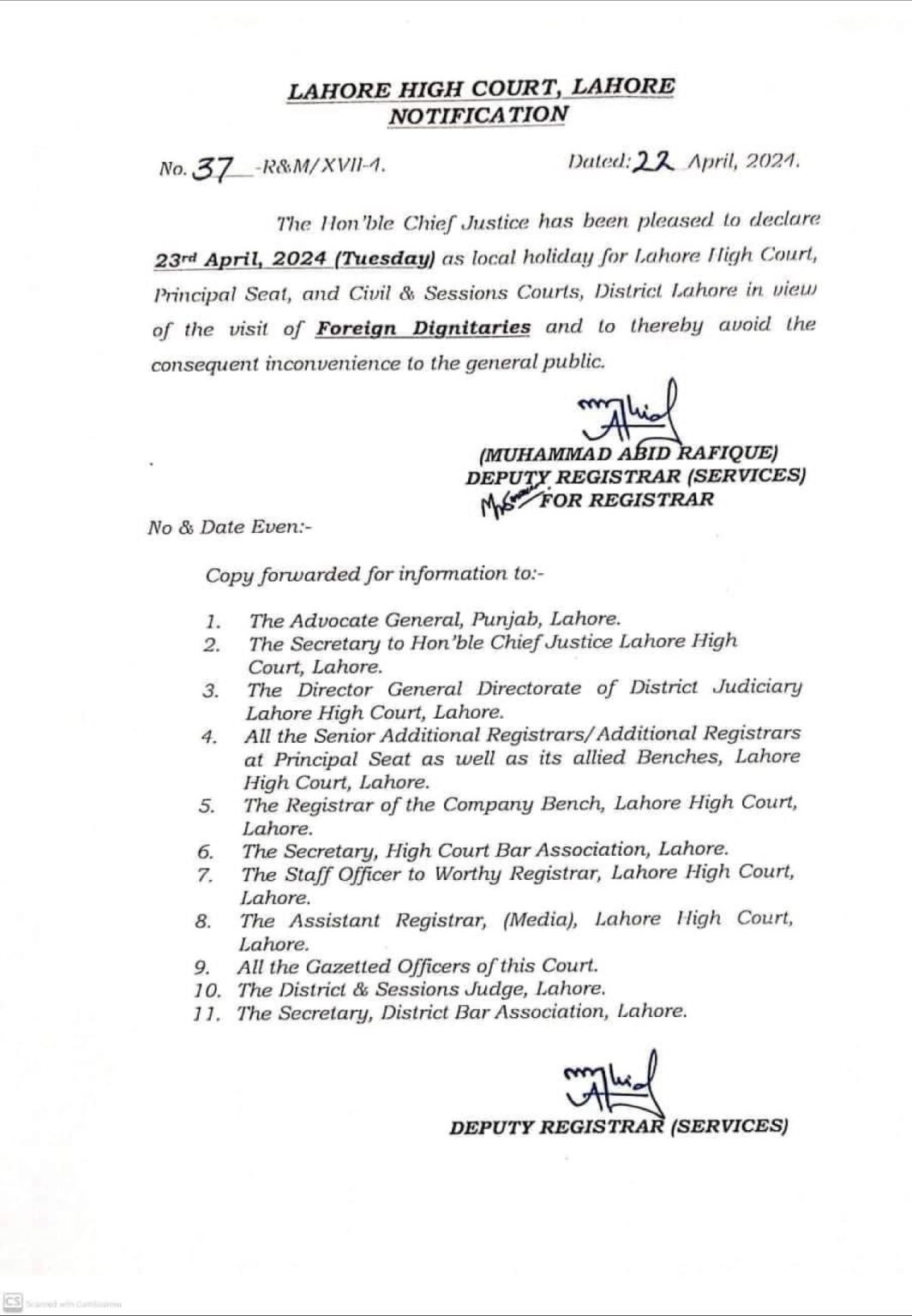

Class Action Lawsuit Filed Against Lidl Concerning Its Plus App

May 08, 2025

Class Action Lawsuit Filed Against Lidl Concerning Its Plus App

May 08, 2025 -

Trump Vs China The Fight For Greenlands Future

May 08, 2025

Trump Vs China The Fight For Greenlands Future

May 08, 2025 -

Lahwr 5 Ahtsab Edaltyn Khtm Wfaqy Hkwmt Ka Aelan

May 08, 2025

Lahwr 5 Ahtsab Edaltyn Khtm Wfaqy Hkwmt Ka Aelan

May 08, 2025 -

Canadian Dollars High Value Economic Experts Sound The Alarm

May 08, 2025

Canadian Dollars High Value Economic Experts Sound The Alarm

May 08, 2025 -

Lahore Weather Forecast Eid Ul Fitr Update Next Two Days

May 08, 2025

Lahore Weather Forecast Eid Ul Fitr Update Next Two Days

May 08, 2025

Latest Posts

-

Lahore Punjab Eid Ul Fitr Weather Prediction Next 48 Hours

May 08, 2025

Lahore Punjab Eid Ul Fitr Weather Prediction Next 48 Hours

May 08, 2025 -

Impact Of Psl Matches On Lahore School Timings

May 08, 2025

Impact Of Psl Matches On Lahore School Timings

May 08, 2025 -

Two Day Lahore Weather Forecast For Eid Ul Fitr In Punjab

May 08, 2025

Two Day Lahore Weather Forecast For Eid Ul Fitr In Punjab

May 08, 2025 -

Lahore School Timetable Adjustments Psl Impact

May 08, 2025

Lahore School Timetable Adjustments Psl Impact

May 08, 2025 -

Lahore Zoo Ticket Price Increase Minister Aurangzebs Response

May 08, 2025

Lahore Zoo Ticket Price Increase Minister Aurangzebs Response

May 08, 2025