Bitcoin's Critical Juncture: Price Levels And Predictions

Table of Contents

Current Bitcoin Price Levels and Market Sentiment

At the time of writing, Bitcoin (BTC) is trading at [Insert Current Bitcoin Price Here – Remember to update this before publishing]. This represents a [Percentage Change from previous day/week/month – Remember to update this before publishing ] change compared to [Reference point, e.g., yesterday's closing price]. Market sentiment, while fluctuating, currently leans towards [Bullish/Bearish/Neutral – Remember to update this before publishing]. This is reflected in the relatively [High/Low/Moderate – Remember to update this before publishing] trading volume of [Insert Trading Volume Data Here – Remember to update this before publishing ] BTC and a market capitalization of approximately [Insert Market Cap Data Here – Remember to update this before publishing].

- Key Indicators: The Fear & Greed Index, a popular measure of market sentiment, currently sits at [Insert Fear & Greed Index Score Here – Remember to update this before publishing], indicating [Explain what the score indicates – e.g., extreme fear, slight greed, etc.].

- Recent News: Recent regulatory developments in [Mention specific countries/regions and their actions – e.g., the US, EU] have influenced the market. For instance, [Give a specific example of recent news – e.g., the SEC's recent stance on certain cryptocurrencies]. Similarly, the adoption of Bitcoin by [Mention companies that have recently adopted Bitcoin – e.g., a major corporation] has impacted investor confidence.

- Macroeconomic Factors: Current macroeconomic conditions, including [Mention relevant factors – e.g., high inflation rates, rising interest rates], are significant factors influencing Bitcoin's price. These factors affect investor risk appetite, potentially impacting the flow of capital into the cryptocurrency market.

Factors Influencing Bitcoin Price Predictions

Several key factors contribute to the wide range of Bitcoin price predictions circulating in the market.

Technological Advancements

- Bitcoin Halving: The upcoming Bitcoin halving event [mention the year], which will reduce the rate of new Bitcoin creation, is expected to contribute to increased scarcity and potentially drive price appreciation. This is based on historical precedent.

- Layer-2 Scaling: The adoption and development of Layer-2 scaling solutions like the Lightning Network are crucial. These solutions aim to improve transaction speed and reduce fees, increasing Bitcoin's usability and potentially boosting its appeal to a wider audience. This increased efficiency could lead to higher adoption rates.

- Technological Upgrades: Ongoing developments and upgrades within the Bitcoin ecosystem, such as [Mention any specific upgrades – e.g., improvements in mining efficiency], also impact its long-term prospects and price.

Regulatory Landscape

- Government Regulations: The regulatory landscape surrounding Bitcoin varies widely across different jurisdictions. More favorable regulations generally lead to increased investor confidence and adoption, while stricter regulations can have the opposite effect.

- Regulatory Clarity: A clearer and more consistent regulatory framework globally could positively impact Bitcoin's price by reducing uncertainty and attracting institutional investment.

- Legal Battles: Ongoing legal challenges and court cases involving Bitcoin or related cryptocurrencies can create volatility and uncertainty in the market.

Institutional Adoption and Investor Sentiment

- Institutional Investors: The involvement of major institutional investors, such as MicroStrategy and Tesla, has significantly influenced Bitcoin's price. Their continued investment signals a growing level of confidence in the asset.

- Mainstream Media: Positive or negative media coverage influences public perception and, consequently, investor sentiment. Wider adoption relies on favorable media portrayal.

- Large-Scale Transactions: Large-scale purchases or sales of Bitcoin by institutional investors can create significant short-term price fluctuations.

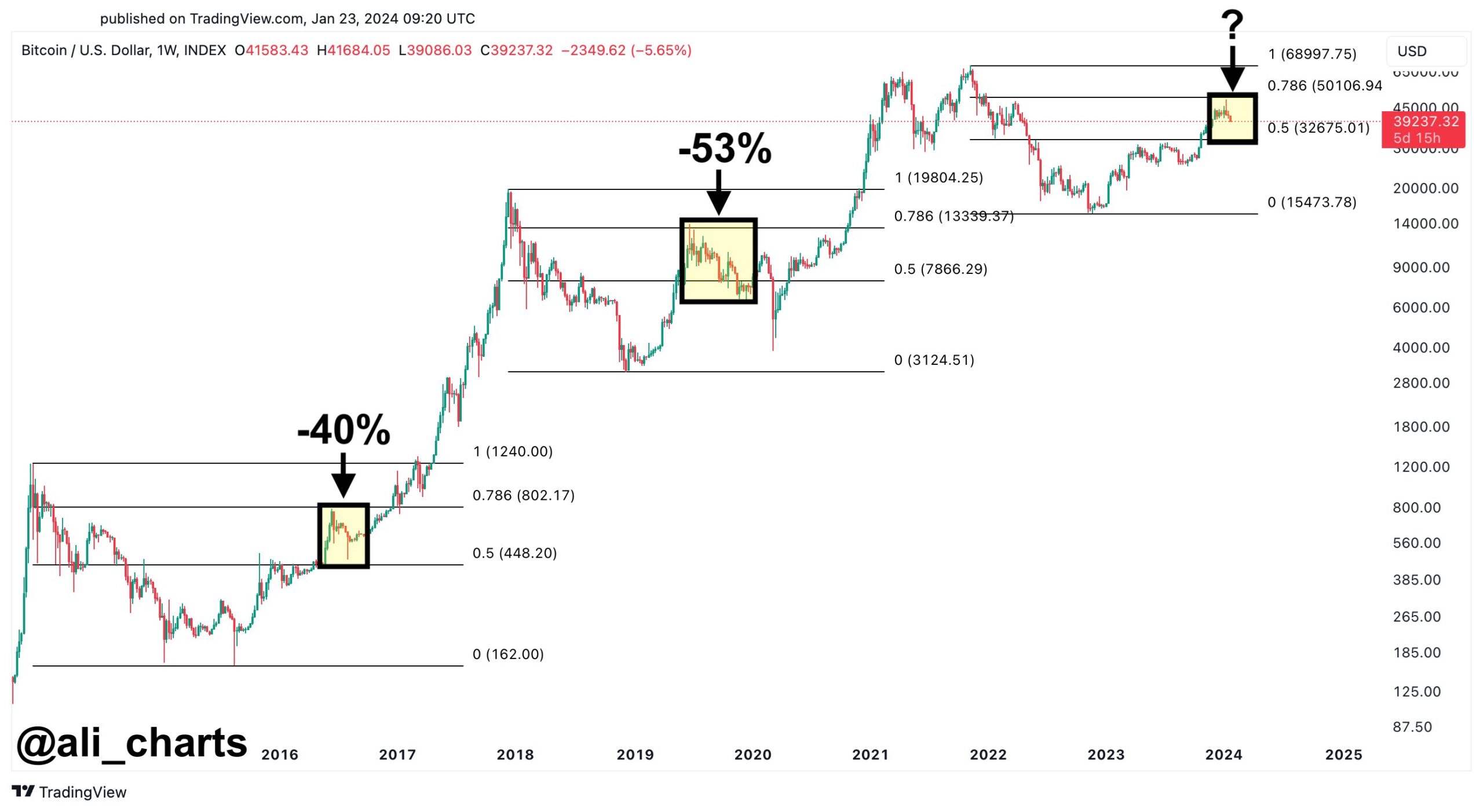

Bitcoin Price Predictions: Bullish vs. Bearish Scenarios

Predicting Bitcoin's price is inherently speculative. However, by analyzing various predictions from reputable sources, we can identify potential scenarios.

- Bullish Scenarios: Some analysts predict Bitcoin could reach [Insert Price Target] within the next [Timeframe], citing factors like increasing institutional adoption, the upcoming halving, and growing global acceptance of cryptocurrencies. [Cite source].

- Bearish Scenarios: Conversely, other analysts express concerns about macroeconomic conditions and potential regulatory hurdles, predicting a price correction to [Insert Price Target] within the next [Timeframe]. [Cite source].

Important Disclaimer: All price predictions are speculative and should not be considered financial advice. Conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Conclusion

Bitcoin's price currently sits at [Reiterate the current price – Remember to update this before publishing], reflecting a [Reiterate the market sentiment – Remember to update this before publishing] market. Key factors influencing future price movements include technological advancements, regulatory developments, and institutional adoption. While bullish predictions anticipate significant price increases, bearish scenarios highlight potential challenges. The volatility inherent in Bitcoin underscores the importance of careful research and risk management. Continue your research on Bitcoin price prediction to make informed decisions about your investments. Stay updated on the latest news and analysis to effectively manage your cryptocurrency portfolio. Understanding the nuances of Bitcoin price prediction and its influencing factors is crucial for navigating this dynamic market.

Featured Posts

-

Mlb Analysts Rank Angels Farm System Among The Worst

May 08, 2025

Mlb Analysts Rank Angels Farm System Among The Worst

May 08, 2025 -

Tri Poljupca Deandre Dzordan Otkriva Zasto On I Nikola Jokic Tako Cine

May 08, 2025

Tri Poljupca Deandre Dzordan Otkriva Zasto On I Nikola Jokic Tako Cine

May 08, 2025 -

Nintendo Direct March 2025 What Ps 5 And Ps 4 Games To Expect

May 08, 2025

Nintendo Direct March 2025 What Ps 5 And Ps 4 Games To Expect

May 08, 2025 -

Fetterman Vows To Remain In Senate Despite Health Questions

May 08, 2025

Fetterman Vows To Remain In Senate Despite Health Questions

May 08, 2025 -

Bitcoin Ile Maas Oedemesi Brezilya Nin Yeni Duezeni

May 08, 2025

Bitcoin Ile Maas Oedemesi Brezilya Nin Yeni Duezeni

May 08, 2025

Latest Posts

-

Ethereums Price Trajectory A Deep Dive Into Market Dynamics And Future Predictions

May 08, 2025

Ethereums Price Trajectory A Deep Dive Into Market Dynamics And Future Predictions

May 08, 2025 -

Predicting The Future Of Ethereum A Comprehensive Price Forecast

May 08, 2025

Predicting The Future Of Ethereum A Comprehensive Price Forecast

May 08, 2025 -

Ethereum Price Prediction 2024 And Beyond A Comprehensive Analysis

May 08, 2025

Ethereum Price Prediction 2024 And Beyond A Comprehensive Analysis

May 08, 2025 -

Comprehensive Ethereum Price Prediction Analyzing Future Trends And Market Dynamics

May 08, 2025

Comprehensive Ethereum Price Prediction Analyzing Future Trends And Market Dynamics

May 08, 2025 -

Kripto Para Yatirimi Kripto Lider I Degerlendirmeniz Icin Kapsamli Bir Rehber

May 08, 2025

Kripto Para Yatirimi Kripto Lider I Degerlendirmeniz Icin Kapsamli Bir Rehber

May 08, 2025