Prediction: Two Stocks Outperforming Palantir In 3 Years

Table of Contents

- Stock #1: Snowflake – A Data Analytics Disruptor

- Superior Scalability and Market Penetration

- Stronger Revenue Growth Projections

- Stock #2: Datadog – The Emerging Leader in Cloud Monitoring

- Niche Market Domination

- High Growth Potential & Strategic Partnerships

- Comparative Analysis: Palantir vs. Snowflake & Datadog

- Conclusion

Stock #1: Snowflake – A Data Analytics Disruptor

Snowflake (SNOW) has emerged as a major player in the cloud data warehousing space, presenting a compelling alternative to Palantir's on-premise and hybrid solutions. Its innovative architecture and scalable platform offer several advantages that position it for significant growth.

Superior Scalability and Market Penetration

Unlike Palantir, Snowflake's cloud-based architecture allows for unparalleled scalability. This means it can effortlessly handle massive datasets and rapidly adjust to fluctuating demands, a key advantage in today's dynamic data landscape. Snowflake's market penetration is also rapidly expanding, fueled by its ease of use and robust feature set.

- Faster processing speeds: Snowflake’s architecture leverages the power of cloud computing to deliver significantly faster query processing times compared to traditional data warehouses.

- Cost-effective solutions for large datasets: Its pay-as-you-go model makes it a more cost-effective option for organizations dealing with large volumes of data.

- Stronger partnerships with key industry players: Snowflake has established strategic partnerships with major cloud providers like AWS, Azure, and GCP, further enhancing its reach and capabilities.

Stronger Revenue Growth Projections

Financial analysts consistently project higher revenue growth for Snowflake compared to Palantir. This is driven by several factors:

- Year-over-year revenue growth percentages: Snowflake has consistently demonstrated impressive year-over-year revenue growth, exceeding industry benchmarks.

- Projected market share increase: Analysts predict a substantial increase in Snowflake’s market share within the cloud data warehousing segment.

- Successful new product launches: Snowflake's continuous innovation and successful new product launches further fuel its revenue growth trajectory.

Stock #2: Datadog – The Emerging Leader in Cloud Monitoring

Datadog (DDOG) is a leading provider of cloud monitoring and analytics, focusing on a specific high-growth niche within the broader technology sector. This focused approach gives it a strong competitive advantage.

Niche Market Domination

Datadog dominates the cloud monitoring and observability market. Its comprehensive platform offers real-time insights into the performance of cloud-based applications and infrastructure. This is a critical need for organizations rapidly migrating to cloud environments. Barriers to entry are high due to its established customer base and deep integration with various cloud platforms.

- Unique technology and intellectual property: Datadog's proprietary technology provides a unified view of complex cloud environments, which is difficult for competitors to replicate.

- Strong network effects: As more customers use Datadog, its value proposition increases, creating a strong network effect.

- High switching costs for customers: The integration of Datadog into an organization's infrastructure creates high switching costs, making it difficult for customers to switch to a competitor.

High Growth Potential & Strategic Partnerships

The market for cloud monitoring and observability is experiencing rapid growth, fueling Datadog's exceptional potential. Strategic partnerships further accelerate its growth.

- Partnerships with major corporations: Datadog has established strong partnerships with major technology providers and enterprises, expanding its reach and reinforcing its position in the market.

- Government contracts: Datadog is also securing significant government contracts, adding another layer of revenue stability and growth.

- Potential for international expansion: Datadog has significant potential for international expansion, tapping into growing cloud adoption globally.

Comparative Analysis: Palantir vs. Snowflake & Datadog

| Metric | Palantir | Snowflake | Datadog |

|---|---|---|---|

| Revenue Growth (YoY) | Moderate | High | High |

| Market Capitalization | Significant | Significant | Significant |

| Profit Margins | Improving | Improving | Improving |

| Market Focus | Broad Data Analytics | Cloud Data Warehousing | Cloud Monitoring |

While Palantir operates in a large market, Snowflake and Datadog benefit from focusing on high-growth, specific niches within the broader data analytics and cloud technology sectors. Their specialized approaches and superior scalability allow them to capture significant market share and fuel faster growth. Counterarguments might cite Palantir's government contracts, but Snowflake's and Datadog’s diversified customer bases and faster growth trajectories ultimately make them stronger candidates for outperformance in the next three years.

Conclusion

Our analysis suggests that Snowflake and Datadog are well-positioned to outperform Palantir in the next three years. Their strong revenue growth projections, superior scalability, and focus on high-growth niche markets give them a significant competitive advantage. While Palantir remains a significant player, consider diversifying your portfolio with high-growth stocks like Snowflake and Datadog for potentially higher returns in the data analytics sector. Start your research on these promising alternatives to Palantir today!

Williams F1 Team On Doohan Addressing Colapinto Transfer Rumors

Williams F1 Team On Doohan Addressing Colapinto Transfer Rumors

Jayson Tatum On Grooming Confidence And A Full Circle Coaching Moment

Jayson Tatum On Grooming Confidence And A Full Circle Coaching Moment

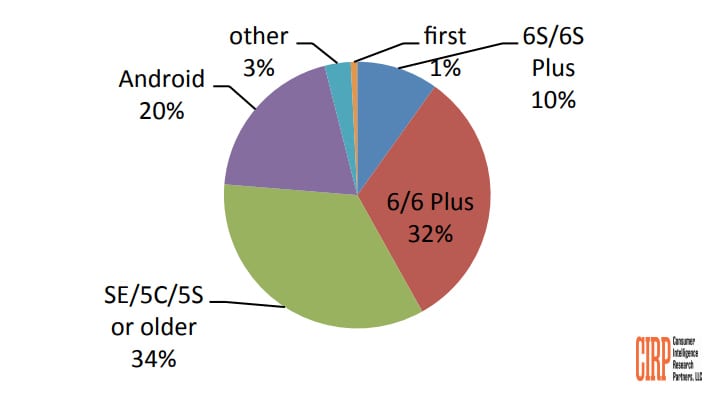

Will Androids Updated Interface Win Over Young I Phone Users

Will Androids Updated Interface Win Over Young I Phone Users

Fox News Jeanine Pirro In The Running For Dc Prosecutor

Fox News Jeanine Pirro In The Running For Dc Prosecutor