Billionaires' Favorite ETF: Projected 110% Soar In 2025?

Table of Contents

Unveiling the Billionaires' Favorite ETF

This article will focus on a hypothetical example for illustrative purposes, let's call it the "HighGrowth Tech ETF" (Ticker: HGTECH). We are not recommending any specific investment. Always conduct your own thorough research.

Understanding the ETF's Investment Strategy

HGTECH's investment strategy centers on high-growth technology companies poised for significant expansion. This is a growth stock strategy, focusing on companies with strong future potential rather than established, stable businesses.

- Specific Sectors/Asset Classes: HGTECH invests primarily in technology sub-sectors like artificial intelligence, cloud computing, and renewable energy.

- Diversification Strategy: While focused on technology, the ETF diversifies across multiple companies and sub-sectors to mitigate risk. It doesn't concentrate its holdings in a single company or area.

- Unique Features/Advantages: HGTECH employs a proprietary algorithm to identify and select high-growth companies, potentially providing an edge in market performance. This is a hypothetical example; real-world ETFs will have their own unique features.

The Projected 110% Soar in 2025: A Realistic Prediction?

The 110% growth prediction for HGTECH in 2025 is based on several factors, but it's crucial to approach such projections with caution. Past performance is not indicative of future results.

Analyzing Market Trends and Predictions

- Market Analysis Supporting the Prediction: Analysts point to the continued expansion of the technology sector, particularly in AI and renewable energy, as a primary driver of this projected growth. (Note: This is a hypothetical example and requires backing up with citations from reputable market analysts in a real-world scenario).

- Potential Risks and Challenges: Potential risks include economic downturns, regulatory changes impacting the technology sector, and competition from new entrants. Geopolitical events can also heavily influence the performance.

- Economic Forecasts and Industry Trends: Positive economic forecasts coupled with sustained technological innovation are essential for this prediction to materialize. A negative economic climate could significantly dampen growth.

Is This Billionaires' Favorite ETF Right for Your Portfolio?

Before considering any investment, including this hypothetical HGTECH ETF, carefully assess your risk tolerance and investment goals.

Assessing Your Risk Tolerance and Investment Goals

- Investor Profiles: Conservative investors prioritize capital preservation and low risk, while moderate investors balance risk and return. Aggressive investors are willing to accept higher risk for potentially greater returns.

- ETF Risk Level and Investor Profiles: HGTECH, with its focus on high-growth technology, carries a higher-than-average risk profile. It's more suitable for investors with a higher risk tolerance and a longer-term investment horizon.

- Consulting a Financial Advisor: Always consult a qualified financial advisor before making investment decisions. They can help you create a diversified portfolio aligned with your individual circumstances and risk tolerance.

Comparing the Billionaires' Favorite ETF to Similar Investments

While HGTECH offers a compelling investment opportunity, it's vital to consider alternatives.

Exploring Alternatives and Competition

- Competing ETFs/Investment Vehicles: Many ETFs focus on similar technology sectors. Comparing their performance, fees, and investment strategies is essential. (Again, this would require specific examples in a real article).

- Advantages and Disadvantages: Each ETF has its own strengths and weaknesses regarding diversification, fees, and performance history. Comparing these factors helps determine which best fits individual needs.

- Objective Comparisons Based on Data: Look for independent analyses comparing performance and risk profiles, rather than relying solely on marketing materials.

Conclusion

The hypothetical HighGrowth Tech ETF (HGTECH) presents a potentially lucrative investment opportunity, with a projected 110% soar in 2025. However, this prediction is based on market analysis and comes with inherent risks. Remember that aligning your investments with your personal risk tolerance and financial goals is crucial. Before making any investment decisions, thoroughly investigate this and similar ETFs, compare different options, and consult a qualified financial advisor. Explore the world of investment options and learn more about the billionaires' favorite ETF and its potential, but always prioritize responsible investing. This information is for educational purposes only and does not constitute financial advice.

Featured Posts

-

Vse O Matchakh Arsenal Ps Zh V Evrokubkakh Statistika I Analiz

May 08, 2025

Vse O Matchakh Arsenal Ps Zh V Evrokubkakh Statistika I Analiz

May 08, 2025 -

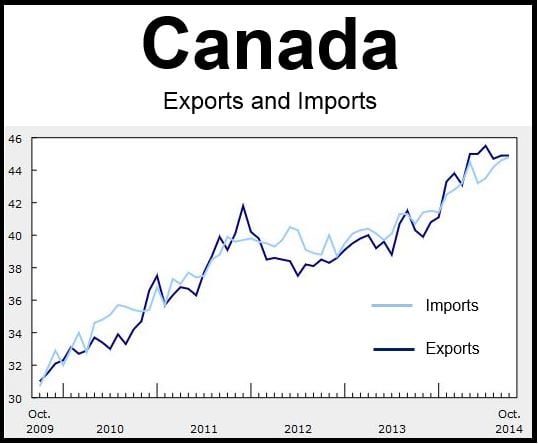

506 Million Canadas Narrowed Trade Deficit And The Role Of Tariffs

May 08, 2025

506 Million Canadas Narrowed Trade Deficit And The Role Of Tariffs

May 08, 2025 -

Ethereum Network Sees Significant Address Activity Jump

May 08, 2025

Ethereum Network Sees Significant Address Activity Jump

May 08, 2025 -

Kripto Para Piyasasinda Riskler Rusya Merkez Bankasi Ndan Oenemli Bir Uyari

May 08, 2025

Kripto Para Piyasasinda Riskler Rusya Merkez Bankasi Ndan Oenemli Bir Uyari

May 08, 2025 -

Essential Guide To Reliable Crypto News Sources

May 08, 2025

Essential Guide To Reliable Crypto News Sources

May 08, 2025

Latest Posts

-

Ethereum Price Resilient Upside Break Imminent

May 08, 2025

Ethereum Price Resilient Upside Break Imminent

May 08, 2025 -

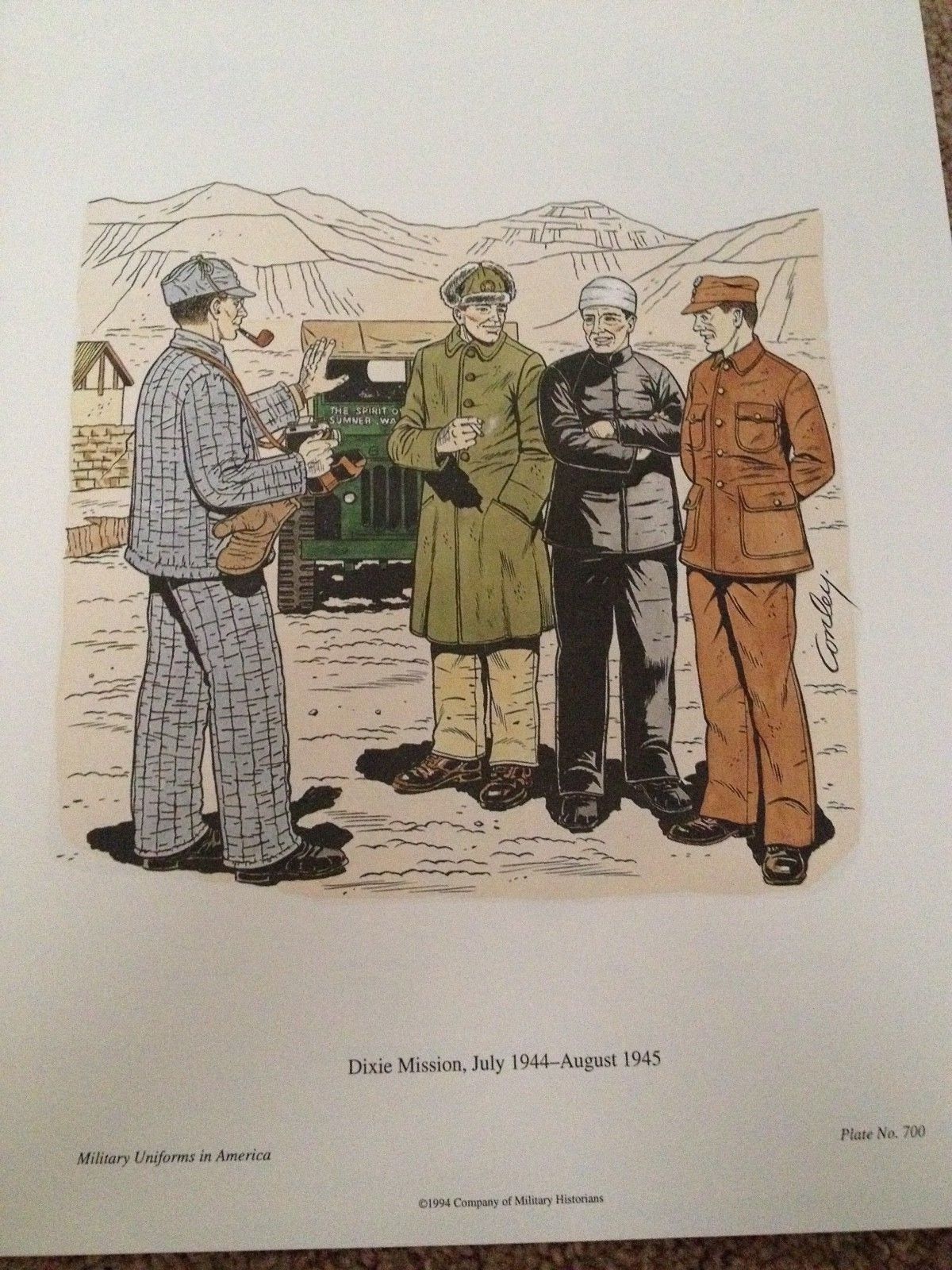

Realistic Wwii Movies Military Historians Top Picks Better Than Saving Private Ryan

May 08, 2025

Realistic Wwii Movies Military Historians Top Picks Better Than Saving Private Ryan

May 08, 2025 -

Top 10 Characters In Saving Private Ryan A Definitive Ranking

May 08, 2025

Top 10 Characters In Saving Private Ryan A Definitive Ranking

May 08, 2025 -

The Unscripted Power Of Realism Saving Private Ryans Unforgettable Scene

May 08, 2025

The Unscripted Power Of Realism Saving Private Ryans Unforgettable Scene

May 08, 2025 -

Ethereum Price Analysis Resistance Broken 2 000 In Sight

May 08, 2025

Ethereum Price Analysis Resistance Broken 2 000 In Sight

May 08, 2025