Billionaires' 110% ETF Bet: BlackRock Fund Poised For 2025 Surge?

Table of Contents

Recent reports suggest a surge in billionaire investment in specific Exchange-Traded Funds (ETFs), with projections pointing towards a significant increase in value by 2025. This article focuses on a particular BlackRock ETF attracting considerable attention from high-net-worth individuals, analyzing the investment strategy, potential for growth, and associated risks. We'll delve into why billionaires are betting big on this BlackRock ETF, examining market trends and predictions to assess the likelihood of a substantial "ETF surge" by 2025. This detailed analysis will explore the fund's composition, competitive landscape, and ultimately, whether this billionaire BlackRock ETF bet is a strategy worth considering for your own portfolio.

Decoding the Billionaire's BlackRock ETF Investment Strategy

Which BlackRock ETF are Billionaires Targeting?

The BlackRock ETF attracting significant billionaire investment is the iShares CORE S&P 500 ETF (IVV). This passively managed ETF tracks the S&P 500 index, providing broad exposure to 500 of the largest publicly traded companies in the United States. IVV boasts a long and robust performance history, mirroring the growth of the overall US stock market. Its consistent performance and low expense ratio have made it a favorite among institutional and individual investors alike.

Why are Billionaires Investing Heavily in this BlackRock ETF?

Several factors contribute to the significant interest in IVV among billionaire investors:

- Market Trends: A bullish outlook on the US economy and continued growth of large-cap companies are key drivers.

- Economic Forecasts: Positive economic forecasts suggest continued expansion, making the S&P 500, and consequently IVV, an attractive investment.

- Diversification: IVV offers diversification within a single investment, mitigating risk associated with investing in individual stocks.

- Long-Term Potential: Billionaires often adopt a long-term investment perspective, and the S&P 500's historical growth trajectory supports this strategy.

- Recent Market Events: While specific news events influencing this investment decision may not be publicly available, the consistent performance of the S&P 500 remains a significant factor.

Experts suggest that the consistent, steady returns associated with a broad market ETF like IVV align well with long-term portfolio strategies favored by high-net-worth individuals.

The Role of Diversification in Billionaire Portfolios

For billionaires, diversification is paramount. The iShares CORE S&P 500 ETF (IVV) plays a crucial role in this strategy by providing:

- Broad Market Exposure: Investment in 500 companies reduces reliance on the performance of any single sector or company.

- Reduced Volatility: Compared to investing in individual stocks, the diversification inherent in IVV leads to a smoother, less volatile portfolio.

- Ease of Management: Passive management simplifies portfolio management, reducing the need for extensive research and active trading.

Analyzing the Potential for a 2025 Surge in the BlackRock ETF

Market Predictions and Future Growth Potential

Several market analyses predict continued growth of the US stock market, potentially leading to a substantial increase in IVV's value by 2025. However, this prediction is not without its caveats.

- Potential Growth: Based on historical growth rates and current economic forecasts, a significant upward trajectory is anticipated. (Illustrative chart or graph would be inserted here.)

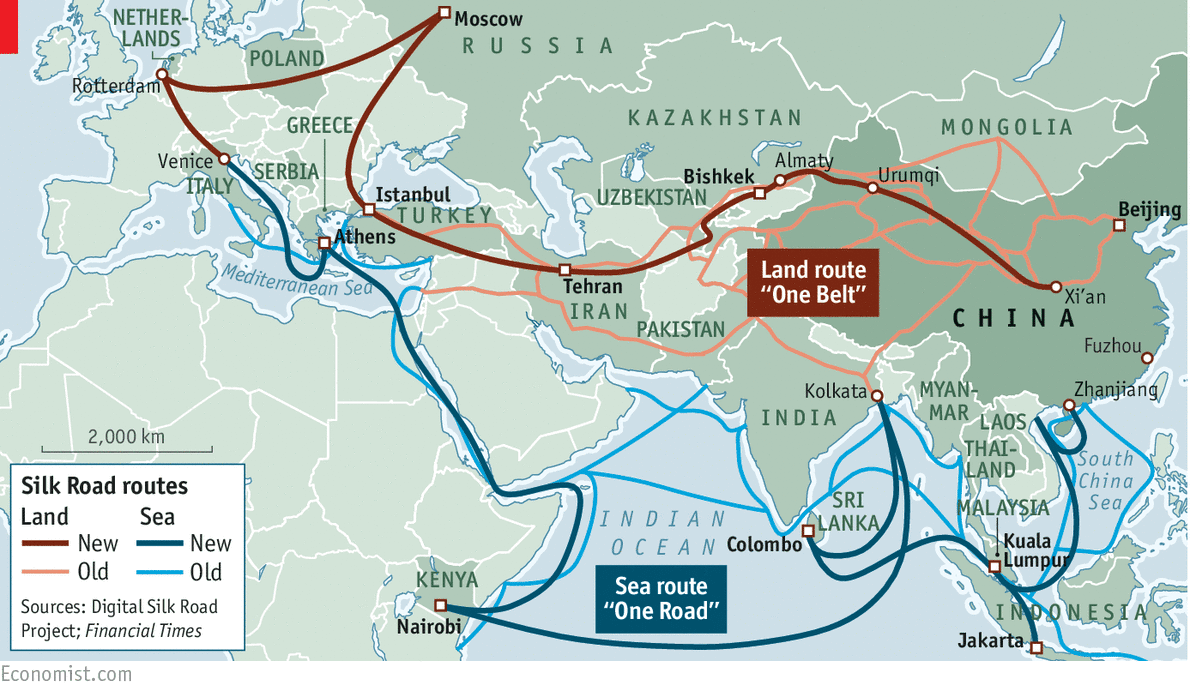

- Risks and Challenges: Unforeseen economic downturns, geopolitical instability, and unexpected market corrections pose significant risks.

Factors Contributing to Potential Growth

Several factors could drive growth in IVV's value:

- Continued Economic Expansion: Sustained economic growth fuels corporate earnings, driving stock prices higher.

- Technological Advancements: Innovation across various sectors boosts market valuations.

- Government Policies: Supportive economic policies can contribute to market growth.

Assessing the Risks Involved

While the potential for growth is promising, investors must acknowledge potential risks:

- Market Volatility: Stock markets are inherently volatile, subject to unpredictable fluctuations.

- Economic Downturns: Recessions can significantly impact market performance.

- Geopolitical Instability: Global events can trigger market corrections.

- Inflation: High inflation can erode the real value of investments.

Risk mitigation strategies include diversification across asset classes, a long-term investment horizon, and regular portfolio rebalancing.

Comparing BlackRock ETF Performance with Competitors

Benchmarking against Similar ETFs

IVV competes with other S&P 500 tracking ETFs, such as SPY (SPDR S&P 500 ETF Trust) and VOO (Vanguard S&P 500 ETF). While all three track the same index, their expense ratios and historical performance may vary slightly. A comparative analysis reveals subtle differences in performance and costs, but all generally deliver similar long-term results.

Advantages of the BlackRock ETF

The iShares CORE S&P 500 ETF (IVV) offers several advantages:

- Low Expense Ratio: Its relatively low fee structure enhances returns compared to competitors with higher expense ratios.

- Strong Track Record: A long history of consistently mirroring the S&P 500's performance builds investor confidence.

- High Liquidity: IVV's high trading volume ensures ease of buying and selling.

Conclusion: Is the Billionaire BlackRock ETF Bet Worth Considering?

Billionaire investors' significant interest in the iShares CORE S&P 500 ETF (IVV) highlights its potential for growth. While a 2025 surge is not guaranteed, the ETF's robust historical performance, low expense ratio, and broad market exposure make it an attractive investment for long-term growth. However, potential investors must understand the inherent risks associated with any investment, particularly in volatile markets. Conduct thorough research and consider consulting with a financial advisor before incorporating any BlackRock ETF investment, or any other investment strategy, into your personal portfolio. Remember, a diversified approach to BlackRock ETF investment, considering the 2025 ETF surge prediction, is crucial for mitigating risk. Start your research today to determine if this billionaire ETF strategy aligns with your investment goals.

Disclaimer: This article provides general information and does not constitute financial advice. Investing involves inherent risks, and past performance is not indicative of future results. Consult a qualified financial advisor before making any investment decisions.

Featured Posts

-

Saturday Night Lives Impact On Counting Crows Career

May 08, 2025

Saturday Night Lives Impact On Counting Crows Career

May 08, 2025 -

Nintendo Direct March 2025 Predicted Ps 5 And Ps 4 Game Reveals

May 08, 2025

Nintendo Direct March 2025 Predicted Ps 5 And Ps 4 Game Reveals

May 08, 2025 -

Berkshire Hathaways Stake Boosts Japan Trading House Stock Prices

May 08, 2025

Berkshire Hathaways Stake Boosts Japan Trading House Stock Prices

May 08, 2025 -

Istoriya Matchiv Ps Zh Ta Aston Villi V Yevrokubkovikh Turnirakh

May 08, 2025

Istoriya Matchiv Ps Zh Ta Aston Villi V Yevrokubkovikh Turnirakh

May 08, 2025 -

Greenlands Geopolitical Importance A Look At Us China Tensions

May 08, 2025

Greenlands Geopolitical Importance A Look At Us China Tensions

May 08, 2025

Latest Posts

-

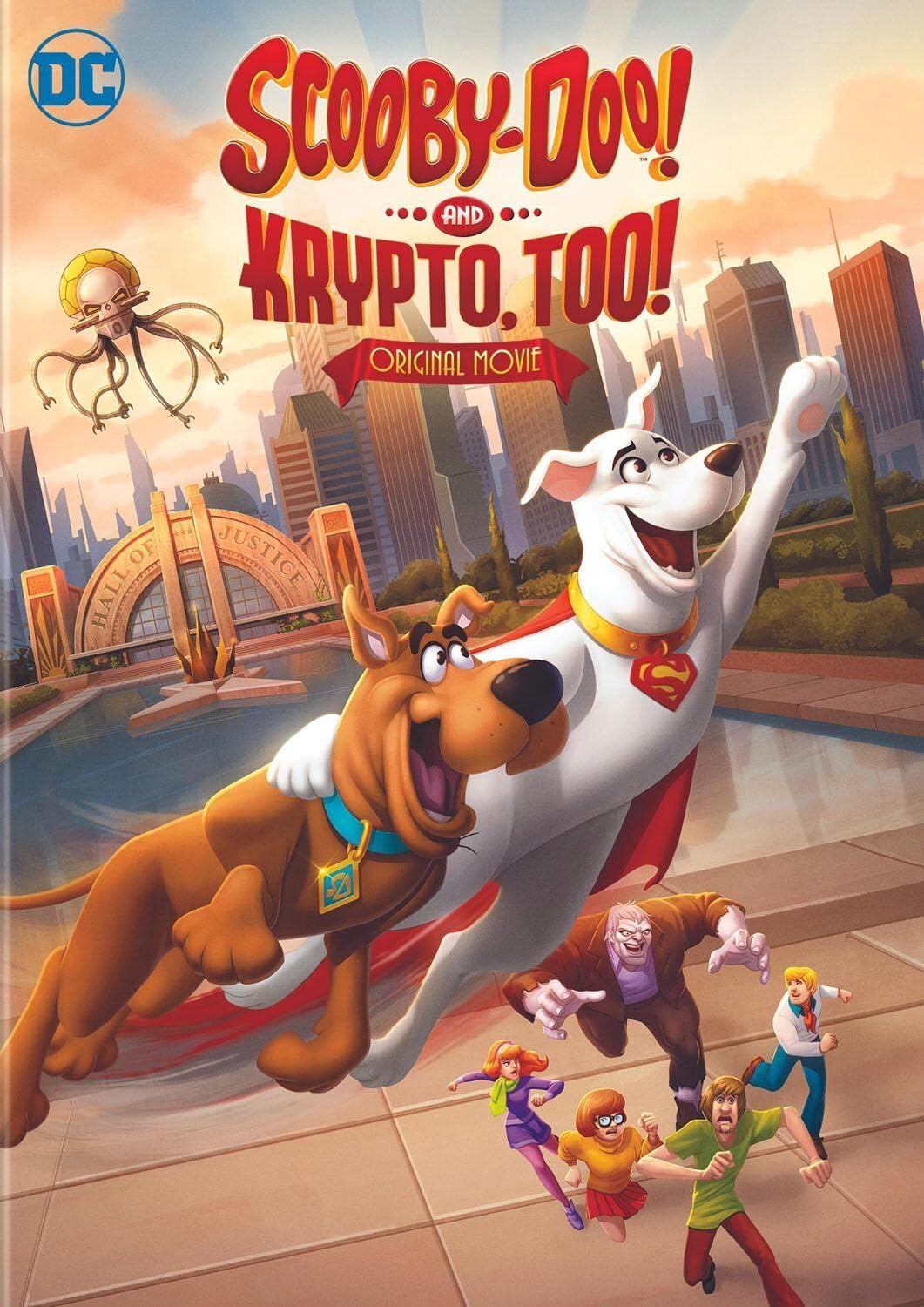

A Whistle For Krypto Supermans Summer Special Next Week

May 08, 2025

A Whistle For Krypto Supermans Summer Special Next Week

May 08, 2025 -

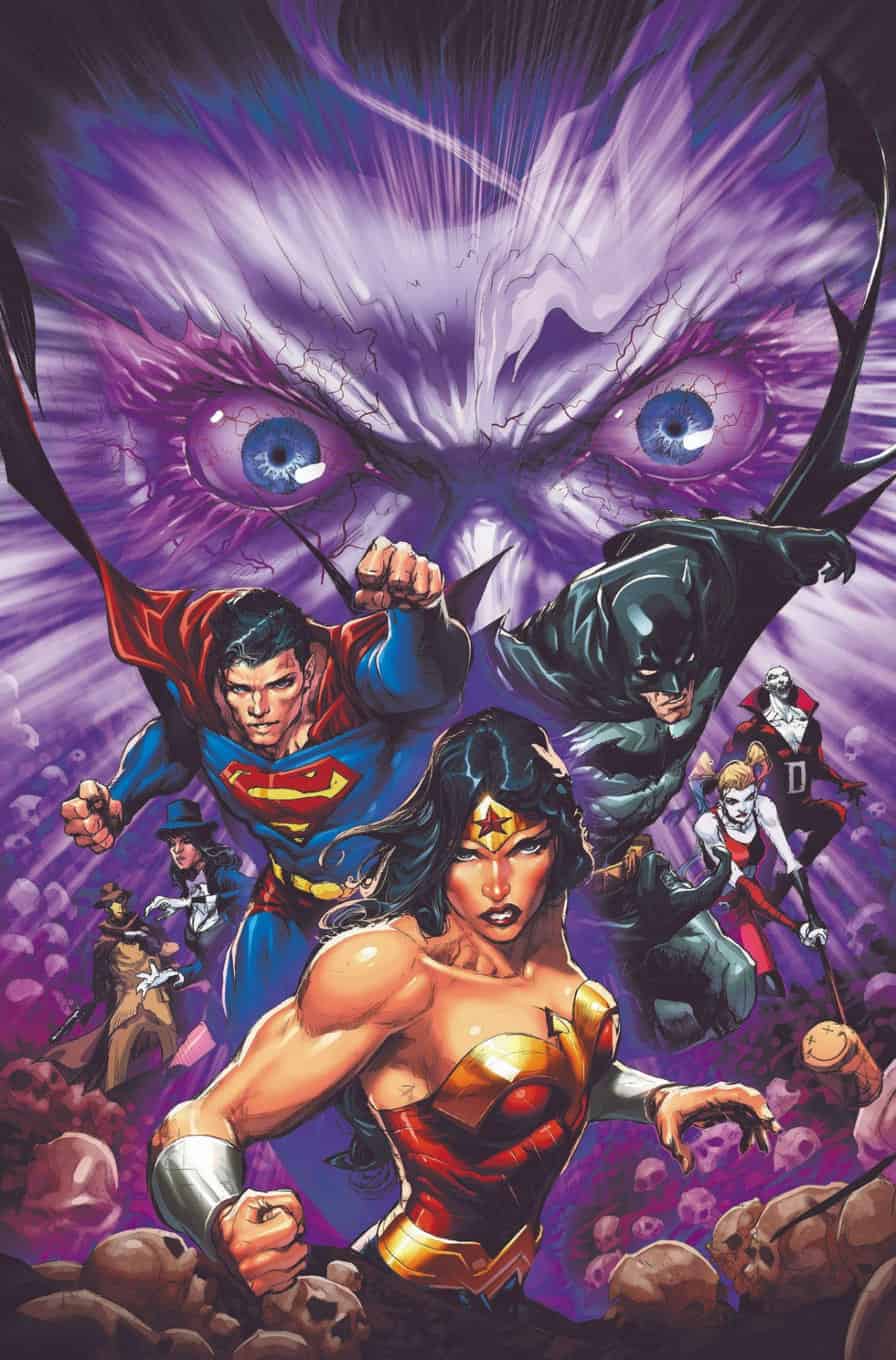

Dc Comics July 2025 Superman Battles Darkseids Powerful Legion

May 08, 2025

Dc Comics July 2025 Superman Battles Darkseids Powerful Legion

May 08, 2025 -

Injured Superman Sneak Peek Shows Kryptos Brutal Attack

May 08, 2025

Injured Superman Sneak Peek Shows Kryptos Brutal Attack

May 08, 2025 -

Supermans Summer Special Kryptos Cameo Next Week

May 08, 2025

Supermans Summer Special Kryptos Cameo Next Week

May 08, 2025 -

Superman Vs Darkseids Legion Dc Comics July 2025 Solicitations

May 08, 2025

Superman Vs Darkseids Legion Dc Comics July 2025 Solicitations

May 08, 2025