Big Oil Holds Firm On Production Despite Global Demand

Table of Contents

Profit Maximization Strategies of Big Oil Companies

The primary driver behind big oil's reluctance to boost production is a focus on short-term profit maximization. While global demand screams for more oil, increasing production significantly comes with inherent risks and potentially lower returns. These companies prioritize shareholder returns above all else, leading to strategic decisions that may seem counterintuitive to consumers facing high energy prices.

- Focus on Shareholder Returns over Immediate Market Needs: Big oil companies are publicly traded entities with a fiduciary duty to maximize returns for their shareholders. Increased production might temporarily lower prices, impacting profit margins. They are betting on maintaining higher prices for longer, ensuring greater overall profitability.

- Strategic Investment in Alternative Energy Sources as a Long-Term Hedge: Many major oil companies are actively investing in renewable energy sources like solar, wind, and geothermal. This diversification strategy positions them for the long-term energy transition, hedging against the eventual decline in fossil fuel demand. This shift also improves their ESG (Environmental, Social, and Governance) profiles, attracting environmentally conscious investors.

- Limited Capacity for Rapid Production Increases Due to Infrastructure Constraints: Scaling up oil production isn't a simple switch. It requires significant investment in infrastructure, including exploration, drilling, refining, and transportation. These projects take time and substantial capital investment, limiting the capacity for rapid responses to increased demand.

- Concerns about Volatile Market Fluctuations Impacting Future Investments: The oil market is notoriously volatile. A sudden surge in production could lead to a price crash, eroding profits and jeopardizing future investment plans. Big oil companies are prioritizing careful, calculated growth to minimize risk and maximize long-term profitability.

Recent financial reports show record profits and substantial dividend payouts for many major oil companies, underscoring their commitment to shareholder value over immediate market pressures.

Geopolitical Factors Influencing Oil Production

Geopolitical instability significantly impacts oil production decisions. International relations, sanctions, and political risks in key oil-producing regions create uncertainty and hesitation among major players. This cautionary approach contributes to the restrained increase in big oil production.

- Sanctions and Trade Restrictions Limiting Production and Export Capabilities: Sanctions imposed on certain countries restrict their oil production and export capabilities, thereby impacting the overall global supply. This further complicates the ability of other companies to easily fill the gap.

- Political Uncertainty in Major Oil-Producing Countries Causing Hesitation in Investment and Expansion: Political instability and risks in major oil-producing nations deter investment and expansion in the sector. Companies are reluctant to commit significant capital in uncertain environments, further contributing to the limited production increase.

- The Role of OPEC+ in Regulating Global Oil Supply and Influencing Prices: The Organization of the Petroleum Exporting Countries (OPEC+), a coalition of oil-producing countries, plays a crucial role in managing global oil supply. Their decisions significantly impact prices and influence the production strategies of major oil companies.

The ongoing war in Ukraine, for example, has significantly impacted global oil supply chains and created further uncertainty, contributing to the reluctance of major oil companies to significantly increase production.

The Role of Renewable Energy and the Energy Transition

The global shift towards renewable energy sources is a significant factor influencing big oil's production strategies. While current demand remains high for fossil fuels, these companies recognize the long-term trend and are adapting their strategies accordingly.

- Long-Term Investment in Renewable Energy Projects to Diversify Portfolios: Major oil companies are increasingly investing in renewable energy projects, diversifying their portfolios and preparing for a future with lower fossil fuel demand. This strategy helps secure their long-term viability.

- Gradual Phasing Out of Fossil Fuel Production in Favor of Cleaner Energy Solutions: While immediate profit maximization is a priority, big oil companies are gradually shifting their focus towards cleaner energy solutions, acknowledging the global imperative for reducing carbon emissions.

- Balancing Immediate Demand with Long-Term Sustainability Goals: The challenge lies in balancing the immediate need to meet current oil demand with the long-term goal of transitioning to a more sustainable energy future. This requires careful planning and strategic investment.

Global renewable energy capacity additions are increasing at an impressive rate, further pushing big oil to adapt and invest in alternative energy solutions.

Sustainability Concerns and ESG Investing

Increasingly, investors are demanding that oil companies prioritize Environmental, Social, and Governance (ESG) factors. This pressure influences production strategies and investment decisions.

- Growing Investor Demand for Responsible Investments: More investors are seeking companies with strong ESG profiles, pushing oil companies to demonstrate a commitment to sustainability and responsible business practices.

- The Impact of Climate Change Regulations on Future Production Plans: Stringent climate change regulations are impacting future production plans, limiting expansion and encouraging investments in renewable energy.

- Corporate Social Responsibility Initiatives Undertaken by Oil Companies: Many oil companies are investing in corporate social responsibility initiatives to enhance their public image and attract investors concerned about environmental and social issues.

Conclusion

Big oil companies' decision to maintain relatively stable production levels, despite high global demand, is a complex issue driven by a multitude of factors. Profit maximization strategies, geopolitical uncertainties, and the energy transition all play significant roles. Understanding the interplay between these elements is crucial for navigating the complexities of the global energy market. The future of big oil production remains intertwined with geopolitical stability, investor sentiment, and the accelerating transition towards renewable energy. The decision of big oil to hold firm on production despite global demand raises crucial questions about the future of energy. Understanding the factors influencing big oil production is essential for navigating the complexities of the global energy market. Stay informed on the latest developments in the energy sector to make informed decisions about investments and energy consumption. Continue to follow our coverage on big oil production trends and their impact on the world economy.

Featured Posts

-

Christian Horners Joke About Max Verstappens Child

May 05, 2025

Christian Horners Joke About Max Verstappens Child

May 05, 2025 -

Australian National Election Testing The Waters Of Global Politics

May 05, 2025

Australian National Election Testing The Waters Of Global Politics

May 05, 2025 -

Section 230 And Banned Chemicals A Recent E Bay Case Ruling

May 05, 2025

Section 230 And Banned Chemicals A Recent E Bay Case Ruling

May 05, 2025 -

Resistance Mounts Car Dealerships Push Back On Ev Mandate

May 05, 2025

Resistance Mounts Car Dealerships Push Back On Ev Mandate

May 05, 2025 -

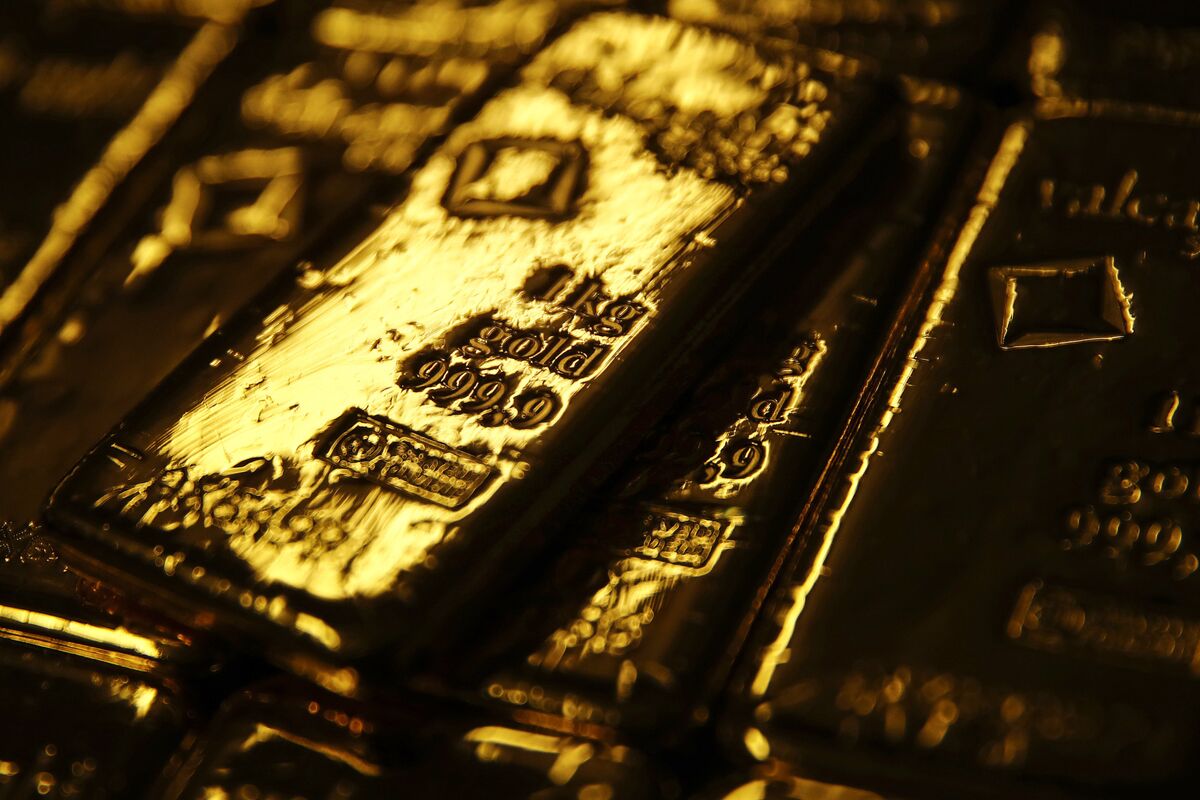

Is Golds Bull Run Over Two Consecutive Weekly Losses In 2025

May 05, 2025

Is Golds Bull Run Over Two Consecutive Weekly Losses In 2025

May 05, 2025

Latest Posts

-

Britney Spears Janet Jackson Impression Lizzos Remarks Spark Heated Fan Discussion

May 05, 2025

Britney Spears Janet Jackson Impression Lizzos Remarks Spark Heated Fan Discussion

May 05, 2025 -

Lizzo Compares Britney Spears To Janet Jackson Igniting Online Firestorm

May 05, 2025

Lizzo Compares Britney Spears To Janet Jackson Igniting Online Firestorm

May 05, 2025 -

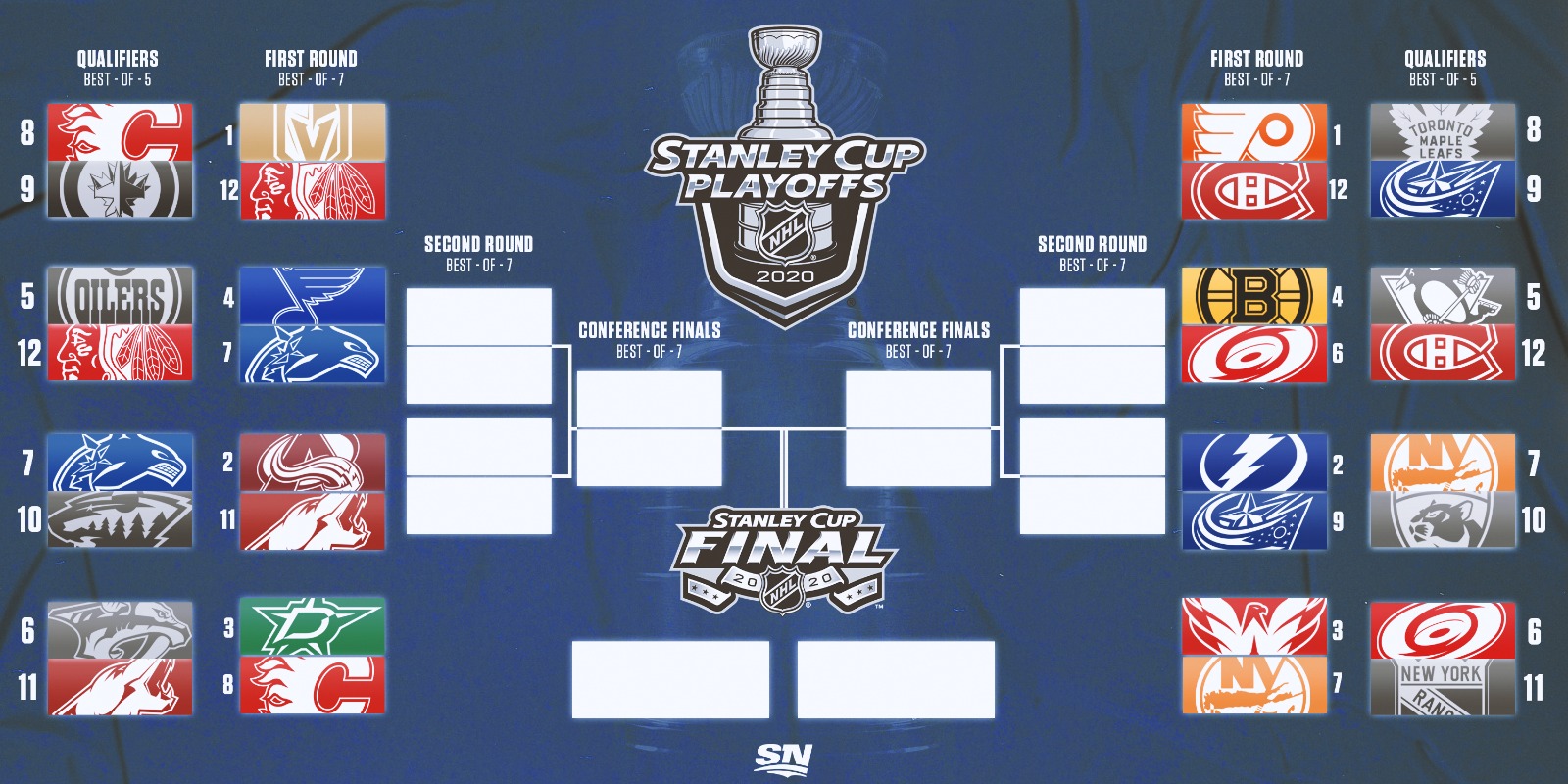

Nhl First Round Matchups Predictions And Analysis

May 05, 2025

Nhl First Round Matchups Predictions And Analysis

May 05, 2025 -

Understanding The Nhl Playoffs Key Insights Into First Round Series

May 05, 2025

Understanding The Nhl Playoffs Key Insights Into First Round Series

May 05, 2025 -

Lizzos Trainer Shaun T Speaks Out Against Ozempic Claims

May 05, 2025

Lizzos Trainer Shaun T Speaks Out Against Ozempic Claims

May 05, 2025