No Money? Practical Ways To Improve Your Financial Situation

Table of Contents

Creating a Realistic Budget

The cornerstone of improving your financial situation is creating and sticking to a realistic budget. This involves understanding where your money is going and making conscious choices about how you spend it.

Tracking Your Spending

The first step to budgeting is tracking your spending. This can be done manually using a spreadsheet or notebook, or with the help of budgeting apps.

- Use budgeting apps: Popular budgeting apps like Mint, YNAB (You Need A Budget), and Personal Capital automatically categorize your transactions, providing a clear overview of your spending habits. These apps often offer helpful features like budgeting tools and financial goal setting.

- Manual tracking: If you prefer a more hands-on approach, meticulously track every expense for a month. This detailed record will reveal spending patterns you might not have noticed otherwise. Categorize each expense (housing, utilities, groceries, transportation, entertainment, etc.) to identify areas where you can cut back.

- Categorize spending: Categorizing expenses is crucial for understanding your spending habits. This allows you to pinpoint areas of overspending and make informed decisions about your budget. For example, you might discover that dining out is consuming a larger portion of your income than you realized.

Identifying Areas to Cut Back

Once you've tracked your spending, analyze your expenses to identify areas where you can reduce spending without sacrificing your quality of life.

- Non-essential spending: Scrutinize non-essential expenses like eating out, subscription services (streaming, gym memberships), and entertainment. These are often areas where significant savings can be made.

- Cheaper alternatives: Explore cheaper alternatives to your current spending habits. Instead of eating out, try cooking at home more often. Look for free or low-cost entertainment options, such as visiting parks, libraries, or attending free community events.

- Negotiate lower bills: Don't hesitate to negotiate lower rates with service providers. Contact your internet, phone, and cable companies to inquire about discounts or better plans. Sometimes, simply asking for a lower price can lead to significant savings.

Setting Financial Goals

Setting clear financial goals is essential for staying motivated and tracking your progress. These goals should be both short-term and long-term.

- Short-term goals: Short-term goals, such as saving $500 in three months or paying off a small debt, provide quick wins that boost morale and keep you on track.

- Long-term goals: Long-term goals, such as buying a house, paying off student loans, or saving for retirement, provide a broader vision for your financial future.

- Break down large goals: Break down large, daunting goals into smaller, more manageable steps. This makes the process less overwhelming and helps you celebrate small victories along the way.

Increasing Your Income

While reducing expenses is important, increasing your income is equally crucial for improving your financial situation.

Exploring Additional Income Streams

Consider exploring additional income streams to supplement your primary income.

- Freelancing or gig work: Platforms like Upwork and Fiverr offer opportunities for freelance work in various fields. This can be a flexible way to earn extra money based on your skills and availability.

- Part-time job or side hustle: A part-time job or side hustle, such as driving for a ride-sharing service or delivering food, can provide a consistent stream of income.

- Renting out unused assets: If you have unused assets like a spare room, a parking space, or a car, consider renting them out through platforms like Airbnb or Turo.

- Selling unused items: Declutter your home by selling unused items online through platforms like eBay, Craigslist, or Facebook Marketplace.

Negotiating a Raise

If you're employed, consider negotiating a raise based on your performance and contributions.

- Research salary standards: Research industry salary standards to understand the appropriate compensation for your role and experience level.

- Document accomplishments: Document your accomplishments and contributions to the company to support your case for a raise.

- Prepare a presentation: Prepare a confident and professional presentation to your employer, highlighting your value and justifying your request for a raise.

Developing New Skills

Investing in your skillset can increase your earning potential in the long run.

- Identify high-demand skills: Identify in-demand skills in your field or related areas. This will ensure your skills remain relevant and marketable.

- Take online courses: Take online courses or workshops to enhance your existing skills or acquire new ones.

- Seek certifications: Consider obtaining certifications to demonstrate your expertise and increase your earning potential.

Managing Debt Effectively

Effectively managing debt is crucial for improving your financial situation.

Prioritizing Debt Repayment

Develop a strategy for prioritizing debt repayment.

- Debt snowball method: Pay off the smallest debt first, regardless of interest rate, for motivational wins.

- Debt avalanche method: Pay off the highest-interest debt first to minimize overall interest paid.

Negotiating with Creditors

Contact your creditors to discuss possible payment options if you're struggling to make payments.

- Contact creditors: Reach out to your creditors to explain your situation and explore options like payment plans or debt consolidation.

- Debt consolidation: Consider debt consolidation programs to combine multiple debts into a single, lower-interest payment.

- Credit counseling: Consider seeking help from a reputable credit counseling agency.

Avoiding Future Debt

Learn from past mistakes and take steps to avoid accumulating more debt in the future.

- Stick to your budget: Create and stick to a budget to ensure you're living within your means.

- Live below your means: Avoid impulsive purchases and prioritize saving over spending.

- Use credit responsibly: Use credit cards responsibly, paying off your balance in full each month to avoid interest charges.

Building an Emergency Fund

Building an emergency fund is crucial for protecting yourself from unexpected financial setbacks.

Starting Small

Start with a small, achievable savings goal.

- Small savings goal: Begin with a small goal, such as saving $1000, to build momentum and confidence.

- Automate savings: Automate regular transfers from your checking account to your savings account to make saving effortless.

- High-yield savings account: Use a high-yield savings account to maximize your interest earnings.

Gradually Increasing Savings

Gradually increase your savings contributions as your income increases.

- Increase contributions: Increase your savings contributions periodically as your income grows.

- Regular savings goals: Set regular savings goals to track your progress and stay motivated.

- Review savings plan: Review and adjust your savings plan periodically to ensure it aligns with your financial goals.

Protecting Your Savings

Choose a secure and FDIC-insured bank account to protect your savings.

- FDIC-insured account: Choose a bank account insured by the FDIC to protect your deposits.

- Diversify savings: Consider diversifying your savings into different accounts for added security.

- Avoid unnecessary withdrawals: Avoid unnecessary withdrawals except for genuine emergencies.

Conclusion

Improving your financial situation is a journey, not a destination. By implementing these practical strategies – creating a realistic budget, increasing your income, managing debt effectively, and building an emergency fund – you can steadily improve your financial health. Remember, even small steps contribute to significant progress over time. Don't hesitate to start taking control of your finances today. Begin improving your financial situation by taking the first step towards a brighter financial future.

Featured Posts

-

A Bid To Break The Trans Australia Run World Record

May 22, 2025

A Bid To Break The Trans Australia Run World Record

May 22, 2025 -

Ultrarunning British Athlete Targets Australian Speed Record

May 22, 2025

Ultrarunning British Athlete Targets Australian Speed Record

May 22, 2025 -

The Goldbergs A Deep Dive Into The Shows Humor And Success

May 22, 2025

The Goldbergs A Deep Dive Into The Shows Humor And Success

May 22, 2025 -

Une Navette Gratuite Entre La Haye Fouassiere Et Haute Goulaine Test En Cours

May 22, 2025

Une Navette Gratuite Entre La Haye Fouassiere Et Haute Goulaine Test En Cours

May 22, 2025 -

Hout Bay Fcs Rise The Klopp Connection

May 22, 2025

Hout Bay Fcs Rise The Klopp Connection

May 22, 2025

Latest Posts

-

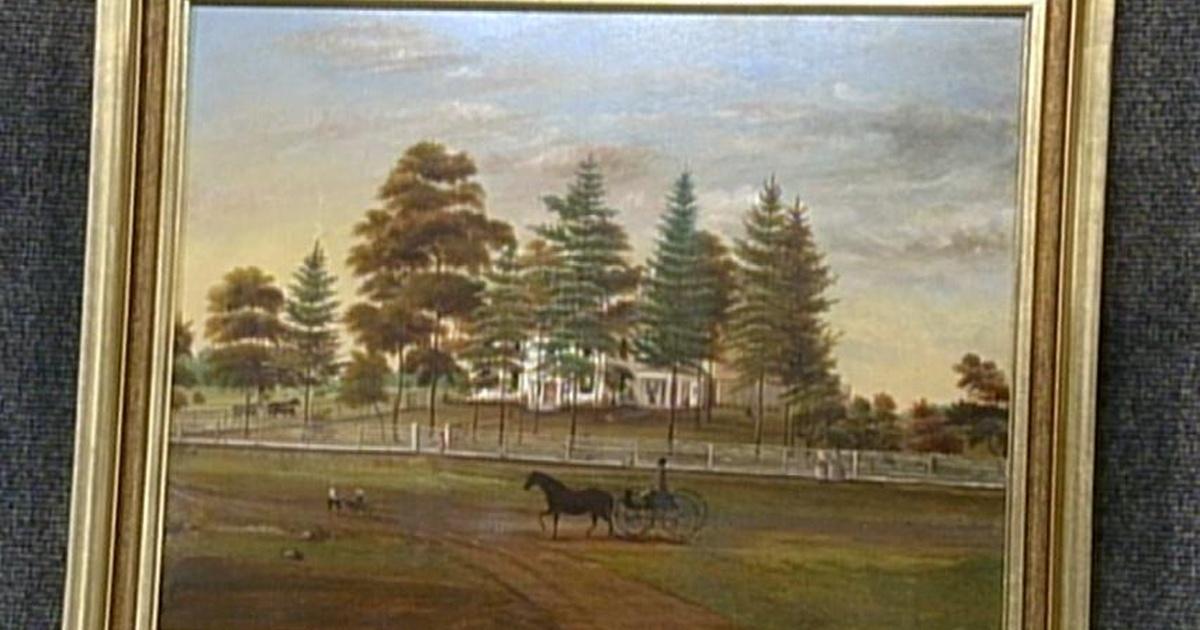

Antiques Roadshow Couples Appraisal Results In Serious Charges

May 22, 2025

Antiques Roadshow Couples Appraisal Results In Serious Charges

May 22, 2025 -

National Treasure Trafficking Antiques Roadshow Episode Ends In Arrest

May 22, 2025

National Treasure Trafficking Antiques Roadshow Episode Ends In Arrest

May 22, 2025 -

Antiques Roadshow Stolen Goods Discovery Leads To Arrests

May 22, 2025

Antiques Roadshow Stolen Goods Discovery Leads To Arrests

May 22, 2025 -

Antiques Roadshow Couple Arrested After National Treasure Appraisal

May 22, 2025

Antiques Roadshow Couple Arrested After National Treasure Appraisal

May 22, 2025 -

Appraisal On Antiques Roadshow Results In Jail Sentences

May 22, 2025

Appraisal On Antiques Roadshow Results In Jail Sentences

May 22, 2025