D-Wave Quantum (QBTS) Stock: Deciphering Thursday's Price Drop

Table of Contents

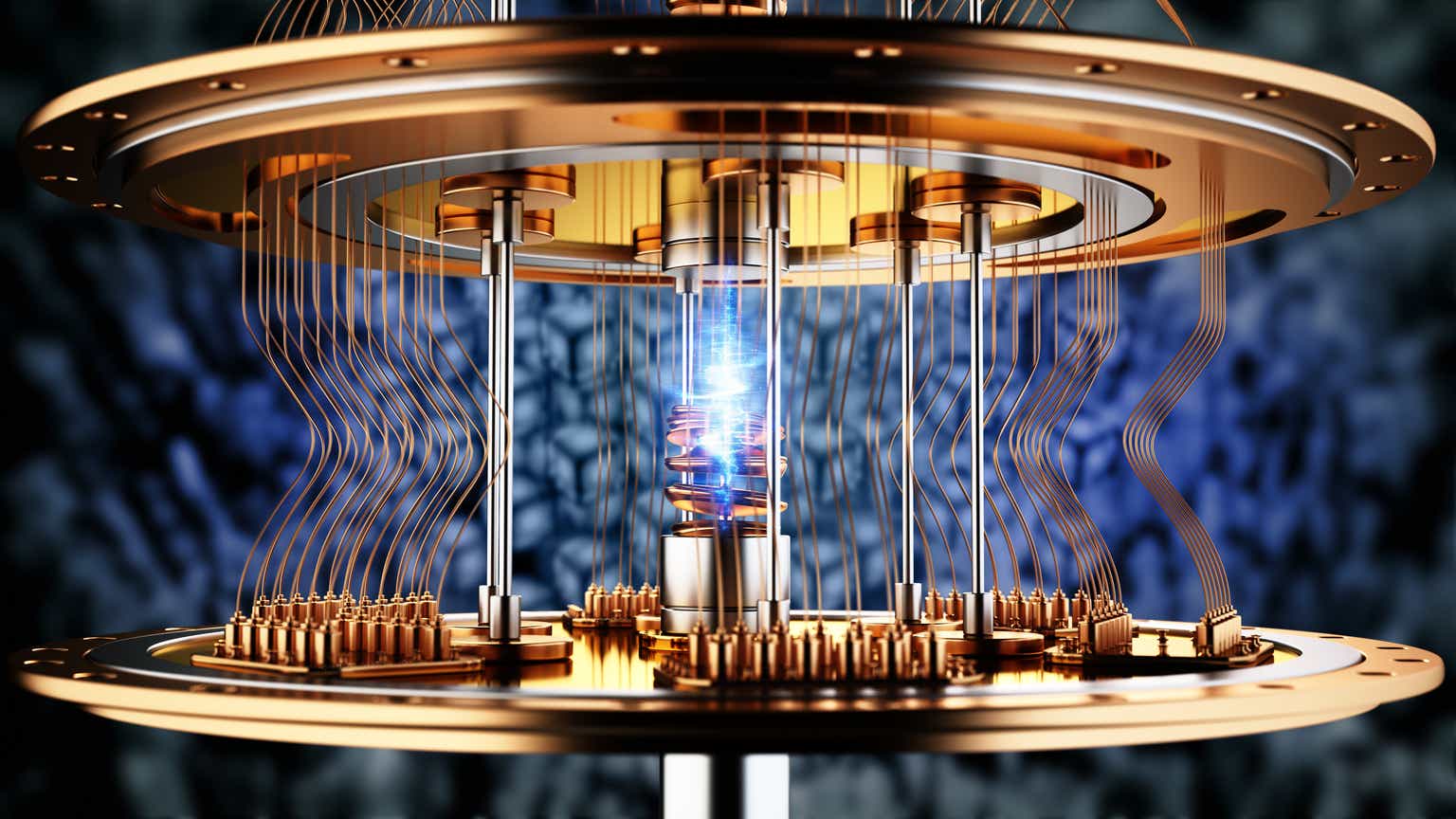

Thursday saw a significant drop in D-Wave Quantum (QBTS) stock price, leaving many investors scrambling to understand the reasons behind this sudden downturn. This article delves into the potential factors contributing to this decline, examining macroeconomic trends, sector-specific influences, company-specific news, and investor sentiment to provide a comprehensive analysis of Thursday's QBTS stock plunge and offer insights into the future trajectory of this quantum computing pioneer.

Analyzing the Market Conditions on Thursday

Macroeconomic Factors

The overall market environment plays a crucial role in influencing individual stock performance. Thursday's drop in QBTS stock coincided with a broader negative trend in the technology sector. Several macroeconomic factors likely contributed to this wider market downturn.

- Increased volatility in the tech sector: The tech sector, known for its susceptibility to rapid shifts in investor sentiment, experienced heightened volatility on Thursday. This increased risk aversion impacted many technology stocks, including QBTS.

- General market downturn impacting growth stocks: Concerns about rising interest rates, persistent inflation, and potential recessionary pressures created a negative climate for growth stocks, particularly those in the still-developing quantum computing space. D-Wave Quantum, being a relatively young company, is more vulnerable to these broader economic headwinds.

- Negative investor sentiment: A prevailing sense of pessimism in the market can lead to widespread selling, irrespective of individual company performance. This overall negative sentiment likely exacerbated the price drop in QBTS stock.

Sector-Specific Influences

Beyond the macroeconomic environment, specific events within the quantum computing sector may have also contributed to the QBTS stock decline.

- Competitor advancements: News of breakthroughs or significant funding secured by competitors in the quantum computing field could negatively impact investor confidence in D-Wave Quantum, leading to a shift in investment allocation.

- Slowdown in government funding for quantum research: Government funding is a crucial catalyst for innovation in the quantum computing industry. Any indication of a slowdown in funding could create uncertainty and negatively impact stock prices across the sector, including QBTS.

- Lack of near-term commercial applications: The quantum computing industry is still in its nascent stages. The absence of widespread, commercially viable applications can make investors hesitant, leading to price drops in companies that haven't yet demonstrated significant revenue generation.

Examining D-Wave Quantum's Recent News and Activities

Company-Specific Developments

Analyzing D-Wave Quantum's recent activities is crucial in understanding Thursday's stock price drop. While no specific news directly preceded the drop, the absence of positive announcements could have contributed to the negative sentiment.

- Potential delays in product launch: Any hints of delays in the development or launch of key products could negatively impact investor confidence. Missed deadlines can signal challenges in execution and potentially diminished future prospects.

- Revised financial projections: If D-Wave Quantum had recently revised its financial projections downward, this could trigger investor concerns and sell-offs, especially if the revisions were substantial.

- Changes in management or strategic direction: Unexpected changes in leadership or a significant shift in company strategy could create uncertainty among investors, prompting them to sell their shares.

Investor Sentiment and Analyst Ratings

Investor sentiment and analyst ratings significantly impact stock prices. A shift in either can lead to dramatic changes in market valuation.

- Downgrades from investment firms: Negative analyst ratings or downgrades from prominent investment firms can trigger significant selling pressure, as investors react to the perceived negative outlook.

- Decreased buy recommendations: A decrease in the number of "buy" recommendations from analysts indicates a reduction in overall investor confidence. This can lead to a decline in stock prices.

- Negative analyst commentary: Public statements from analysts expressing negative views about the company's future prospects can also create negative sentiment and lead to price declines.

Speculative Factors and Future Outlook for QBTS Stock

Potential Short-Term and Long-Term Impacts

The short-term impact of Thursday's drop is likely to be continued volatility in QBTS stock price. However, the long-term prospects of the quantum computing market remain positive.

- Short-term volatility expected: In the wake of a significant price drop, expect continued fluctuations in the QBTS stock price as investors react to the news and reassess their positions.

- Long-term potential of the quantum computing market remains strong: Despite short-term challenges, the long-term growth potential for quantum computing remains substantial. As the technology matures and finds wider commercial applications, D-Wave Quantum is likely to benefit.

- Need for further company developments to regain investor confidence: For QBTS stock to recover, D-Wave Quantum will need to demonstrate progress on key milestones, such as product launches, securing new contracts, and showcasing successful commercial applications of its technology.

Risk Assessment and Investment Strategies

Investing in QBTS stock carries significant risk, but also offers potentially high rewards.

- High-risk, high-reward investment: Quantum computing stocks are considered high-risk, high-reward investments due to the inherent uncertainties of the nascent technology.

- Diversification crucial for risk management: Investors should diversify their portfolios to mitigate the risk associated with investing in a single quantum computing stock like QBTS.

- Consider a long-term investment horizon: Given the long-term growth potential of the quantum computing market, a long-term investment horizon is recommended for investors interested in QBTS stock.

Conclusion:

The recent drop in D-Wave Quantum (QBTS) stock price reflects a complex interplay of macroeconomic factors, sector-specific trends, and company-specific developments. While Thursday's drop was significant, the long-term potential of the quantum computing market remains strong. Investors considering QBTS stock should carefully assess the risks and rewards, maintain a diversified portfolio, and adopt a long-term investment strategy. Continue to monitor D-Wave Quantum's progress and market trends to make informed decisions regarding your D-Wave Quantum (QBTS) stock investments. Thorough due diligence is paramount when navigating the complexities of this promising but volatile sector of the quantum computing market.

Featured Posts

-

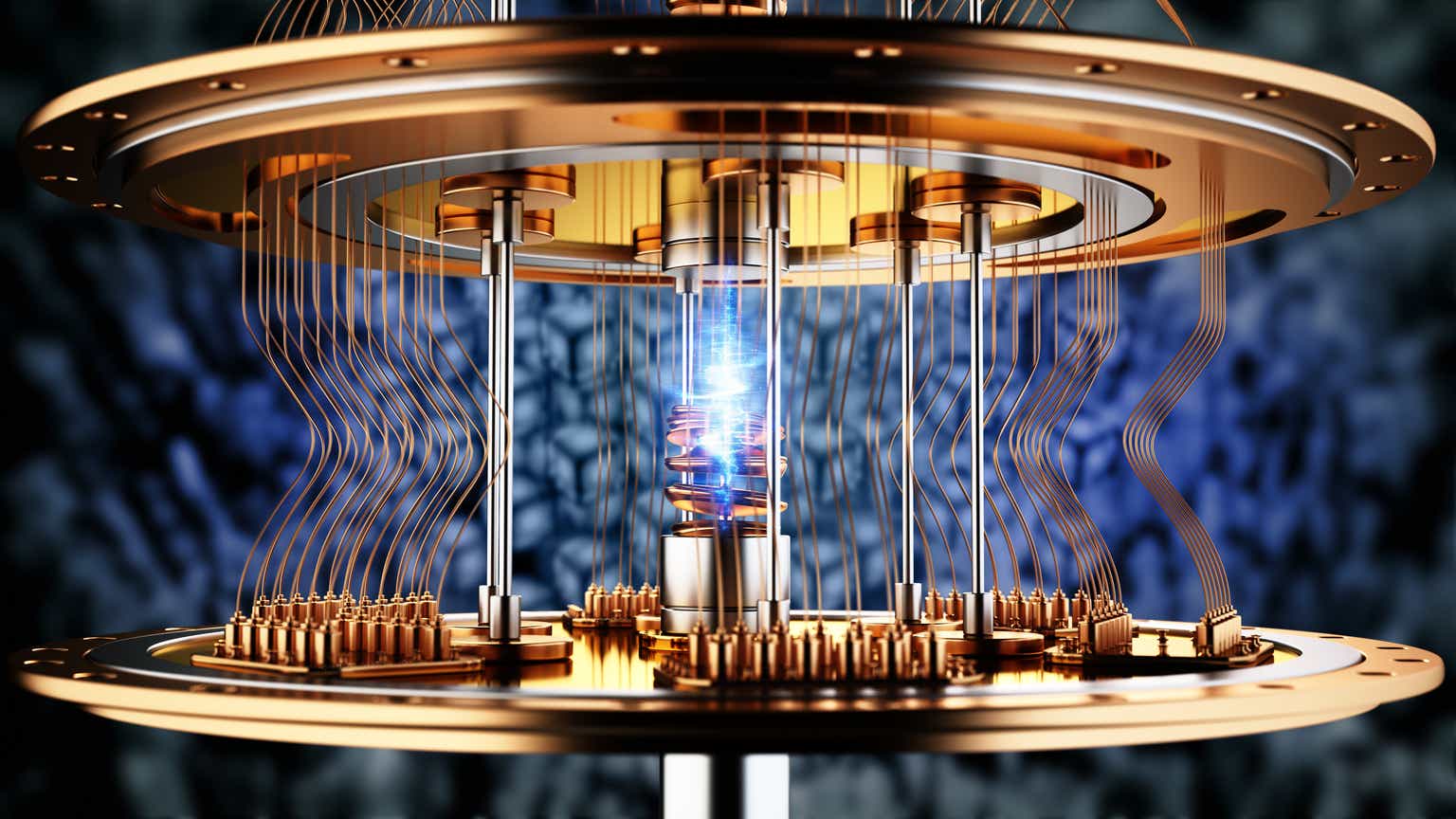

Nyt Mini Crossword April 25th Answers Revealed

May 20, 2025

Nyt Mini Crossword April 25th Answers Revealed

May 20, 2025 -

Suki Waterhouses Spring Beauty Mastering The Baby Doll Makeup Trend

May 20, 2025

Suki Waterhouses Spring Beauty Mastering The Baby Doll Makeup Trend

May 20, 2025 -

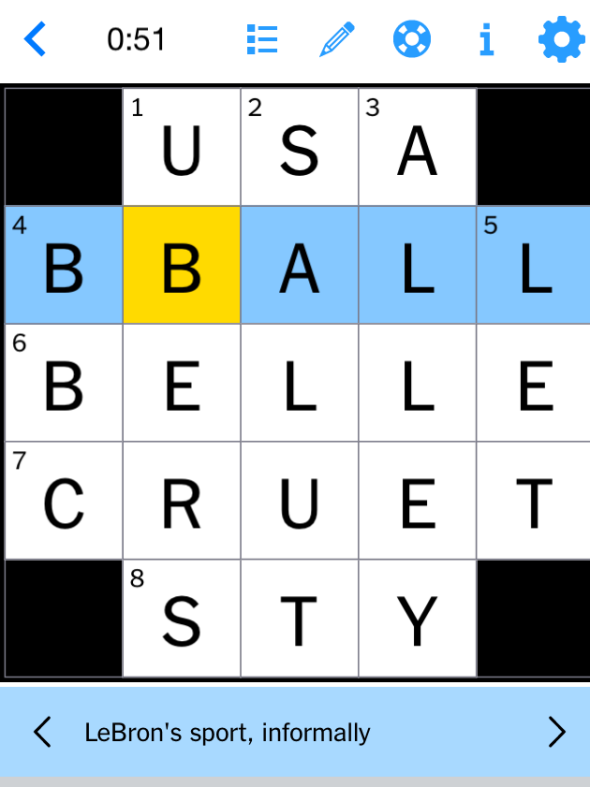

Violence Against Women Recent Murders Of Colombian Model And Mexican Influencer Ignite Global Concern

May 20, 2025

Violence Against Women Recent Murders Of Colombian Model And Mexican Influencer Ignite Global Concern

May 20, 2025 -

Taiwans Post Nuclear Energy Landscape Focusing On Lng

May 20, 2025

Taiwans Post Nuclear Energy Landscape Focusing On Lng

May 20, 2025 -

Find The Nyt Mini Crossword Answers For April 13

May 20, 2025

Find The Nyt Mini Crossword Answers For April 13

May 20, 2025

Latest Posts

-

Malta Besegrat Jacob Friis Inleder Landslagskarriaeren Med Seger

May 20, 2025

Malta Besegrat Jacob Friis Inleder Landslagskarriaeren Med Seger

May 20, 2025 -

Wwe News Road To Money In The Bank Ripley And Perez Secure Qualification

May 20, 2025

Wwe News Road To Money In The Bank Ripley And Perez Secure Qualification

May 20, 2025 -

Latest Wwe Rumors Ronda Rousey Logan Paul Jey Uso And Big Es Relationship News

May 20, 2025

Latest Wwe Rumors Ronda Rousey Logan Paul Jey Uso And Big Es Relationship News

May 20, 2025 -

Svart Men Segerrikt Jacob Friis Inleder Med Bortaseger Oever Malta

May 20, 2025

Svart Men Segerrikt Jacob Friis Inleder Med Bortaseger Oever Malta

May 20, 2025 -

Wwe Money In The Bank Ripley And Perez Punch Their Tickets

May 20, 2025

Wwe Money In The Bank Ripley And Perez Punch Their Tickets

May 20, 2025