BigBear.ai (BBAI) Shares Fall On Weak Q1 Earnings Report

Table of Contents

Disappointing Revenue Figures Fuel BBAI Stock Drop

BBAI's Q1 2024 financial results significantly missed analyst expectations, triggering a sharp drop in its stock price. This underperformance fueled concerns among investors about the company's growth trajectory.

-

Revenue Shortfall: BBAI reported Q1 revenue of [Insert Actual Revenue Figure], considerably below the consensus analyst estimate of [Insert Analyst Estimate]. This represents a [Insert Percentage] shortfall and a [Insert Percentage] decrease compared to Q1 2023 revenue of [Insert Previous Year's Q1 Revenue].

-

Reasons for Underperformance: Several factors contributed to this revenue shortfall. Contract delays, particularly in the [mention specific sector if applicable] sector, played a significant role. Increased competition in the [mention specific market segment] market also impacted BBAI's ability to secure new contracts and maintain its market share. Internal challenges in project execution may also have contributed to the underperformance.

-

Year-over-Year Comparison: The significant year-over-year decline in revenue highlights the severity of the situation. The [Insert Percentage] drop compared to the previous year's Q1 underscores the need for immediate strategic adjustments within BigBear.ai.

Negative Guidance for Future Quarters Adds to Investor Concerns

The negative guidance provided by BBAI for the remaining quarters of 2024 further exacerbated investor concerns. The lowered expectations cast a shadow on the company's short-term and long-term growth prospects.

-

Revised Guidance: BBAI revised its full-year revenue guidance downwards to [Insert Revised Guidance], significantly lower than the previous forecast of [Insert Previous Guidance]. This reflects a pessimistic outlook on the company's ability to overcome current challenges and secure new business.

-

Implications of Lowered Guidance: This lowered guidance implies a considerable impact on BBAI's overall financial performance for 2024. It suggests reduced profitability and potentially impacts the company's ability to invest in future growth initiatives.

-

Reasons for Negative Revision: The negative revision in guidance is attributed to a combination of factors. Macroeconomic headwinds, including potential government spending cuts and tighter budgets across various sectors, have impacted the company's ability to acquire new contracts. Internal operational challenges and delays in project delivery also contributed to the pessimistic forecast.

Market Reaction and Analyst Commentary on BBAI Stock Performance

The market reacted swiftly and negatively to BBAI's disappointing Q1 earnings report. The immediate aftermath saw a significant sell-off, with the BBAI stock price plummeting by [Insert Percentage] in a single trading session.

-

Share Price Drop: The sharp decline in the share price reflects the negative sentiment among investors concerning the company's current performance and future outlook. Trading volume also spiked, indicating significant investor activity following the news.

-

Analyst Ratings and Comments: Several financial analysts have downgraded their ratings on BBAI stock following the earnings report. [Mention specific analysts and their comments, if available]. These downgrades reflect the concerns surrounding the company's revenue shortfall and negative guidance.

-

Investor Sentiment and Trading Volume: Investor sentiment towards BBAI has shifted dramatically following the Q1 results. The high trading volume indicates a substantial increase in both buying and selling activity, highlighting the uncertainty surrounding the future of BBAI.

Long-Term Implications for BigBear.ai (BBAI)

The weak Q1 results raise crucial questions about the long-term prospects of BigBear.ai. The company's ability to successfully navigate these challenges and return to a growth trajectory will be critical.

-

Growth Strategy: BBAI needs to re-evaluate its growth strategy to address the current challenges and secure future revenue streams. This may involve focusing on specific high-growth market segments, strengthening its sales and marketing efforts, and streamlining its operations.

-

Strategic Initiatives: The success of BBAI's long-term prospects will depend on the effectiveness of its strategic initiatives. These initiatives may include [Mention any specific strategic plans the company has announced]. The successful execution of these plans is crucial for regaining investor confidence and returning to growth.

-

Competitive Landscape: BBAI operates in a competitive landscape. Maintaining a strong market position requires continuous innovation, strategic partnerships, and a keen understanding of market dynamics. The company needs to adapt quickly to the competitive pressures and emerging trends in the market.

Conclusion

The disappointing Q1 earnings report from BigBear.ai (BBAI) led to a significant drop in its share price, fueled by lower-than-expected revenue and negative future guidance. Investor sentiment has been negatively impacted, raising concerns about the company's near-term prospects. The company's ability to address the underlying issues, improve its operational efficiency, and execute its strategic initiatives will be key to restoring investor confidence and achieving long-term growth.

Call to Action: Stay informed about the evolving situation with BigBear.ai (BBAI) and monitor future earnings reports and company announcements to assess the long-term impact of this recent setback on the BBAI stock and the overall BigBear.ai performance. Further analysis is required to understand whether this represents a temporary dip or a more significant shift in the company's trajectory. Consider diversifying your portfolio to mitigate risk and always conduct thorough due diligence before making any investment decisions related to BBAI or other similar stocks.

Featured Posts

-

New York Times Mini Crossword Answers February 25th

May 20, 2025

New York Times Mini Crossword Answers February 25th

May 20, 2025 -

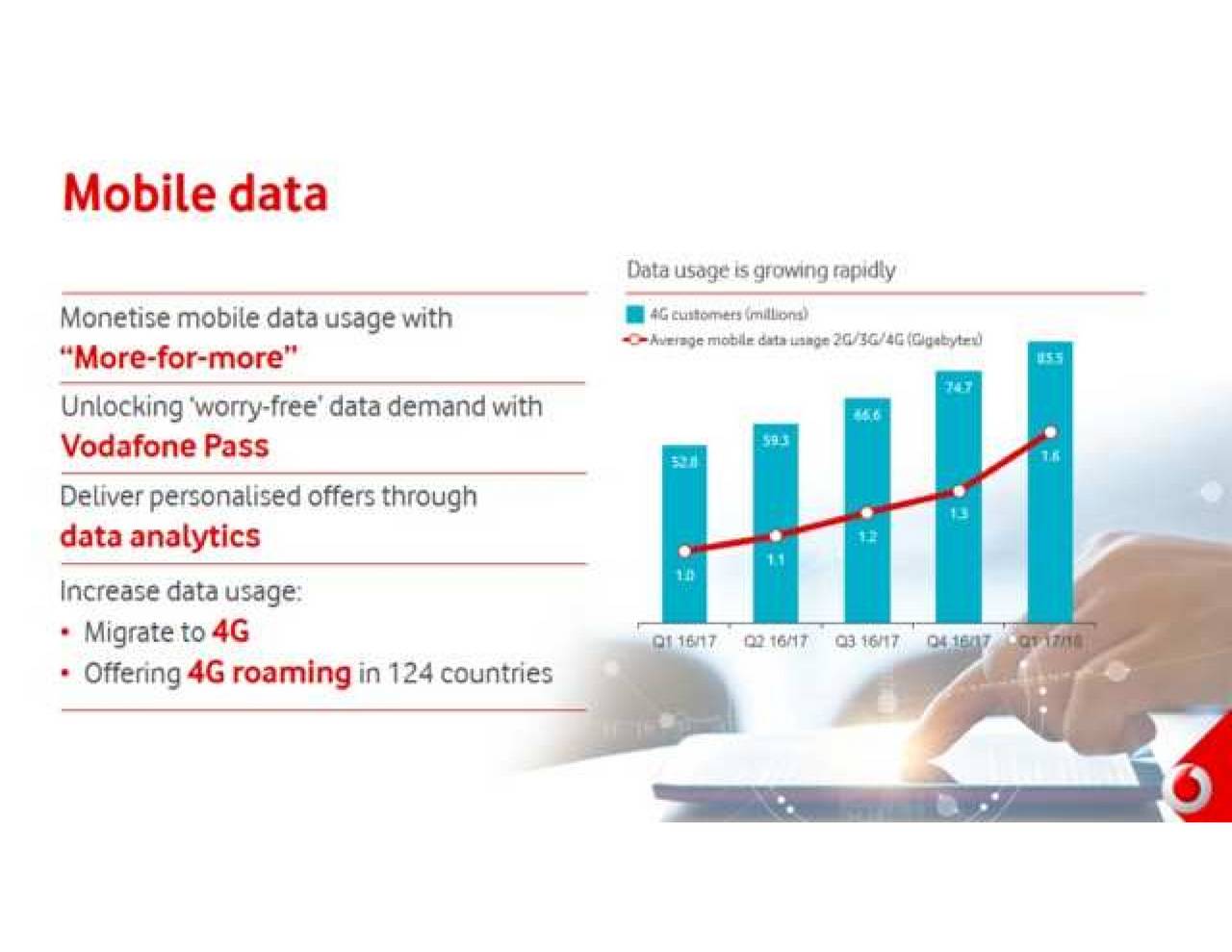

Vodacoms Vod Improved Earnings Drive Higher Than Expected Payout

May 20, 2025

Vodacoms Vod Improved Earnings Drive Higher Than Expected Payout

May 20, 2025 -

Jennifer Lawrence Surpreende Com Aparencia Esguia Apos Noticias De Nascimento

May 20, 2025

Jennifer Lawrence Surpreende Com Aparencia Esguia Apos Noticias De Nascimento

May 20, 2025 -

Jennifer Lawrence Welcomes Second Child With Cooke Maroney

May 20, 2025

Jennifer Lawrence Welcomes Second Child With Cooke Maroney

May 20, 2025 -

Travels With Agatha Christie And Sir David Suchet A Comprehensive Review

May 20, 2025

Travels With Agatha Christie And Sir David Suchet A Comprehensive Review

May 20, 2025

Latest Posts

-

Sandylands U On Tv A Comprehensive Guide To Episodes And Airtimes

May 21, 2025

Sandylands U On Tv A Comprehensive Guide To Episodes And Airtimes

May 21, 2025 -

Stans Approval A Look At David Walliams New Fantasy Fing

May 21, 2025

Stans Approval A Look At David Walliams New Fantasy Fing

May 21, 2025 -

Find Your Next Sandylands U Show The Ultimate Tv Guide

May 21, 2025

Find Your Next Sandylands U Show The Ultimate Tv Guide

May 21, 2025 -

Sandylands U Tv Guide What To Watch And When

May 21, 2025

Sandylands U Tv Guide What To Watch And When

May 21, 2025 -

Your Guide To Watching Sandylands U On Tv

May 21, 2025

Your Guide To Watching Sandylands U On Tv

May 21, 2025