BigBear.ai (BBAI): Growth Uncertainty Prompts Analyst Downgrade

Table of Contents

Analyst Downgrade: Reasons and Implications

The downgrade of BigBear.ai (BBAI) stock was initiated by [insert analyst firm name(s) here], citing several key concerns. Their rationale revolved around slower-than-anticipated revenue growth, intensifying competition within the AI and analytics sector, and lingering concerns regarding the company's path to profitability. This negative sentiment has significantly impacted BBAI's stock price and investor confidence.

- Key Concerns from Analyst Reports:

- Revenue Growth Projections: The analysts revised their revenue growth projections downwards, predicting a significantly slower pace of expansion than previously anticipated. This reflects concerns about the company's ability to secure and deliver large contracts, crucial for its growth trajectory.

- Competitive Landscape Analysis: The increasingly crowded AI and analytics market presents a significant challenge. The report highlighted the emergence of strong competitors with potentially disruptive technologies and aggressive market strategies.

- Profitability Concerns: The analysts expressed doubt about BigBear.ai's ability to achieve profitability in the near term, pointing to high operating costs and a need for further operational efficiencies.

- Valuation Concerns: Given the revised growth projections and profitability concerns, the analysts adjusted their valuation of BBAI stock downwards, leading to the downgrade.

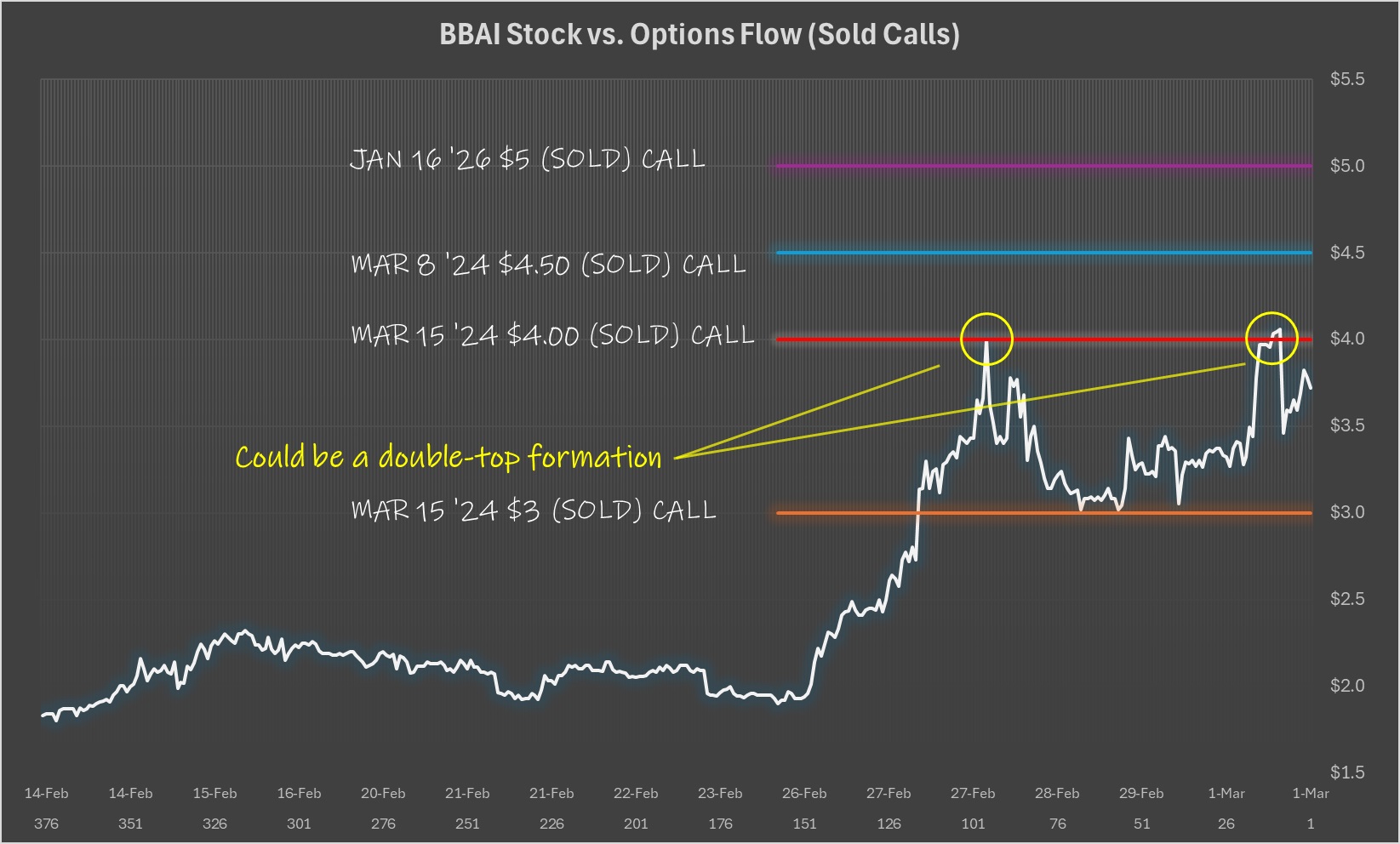

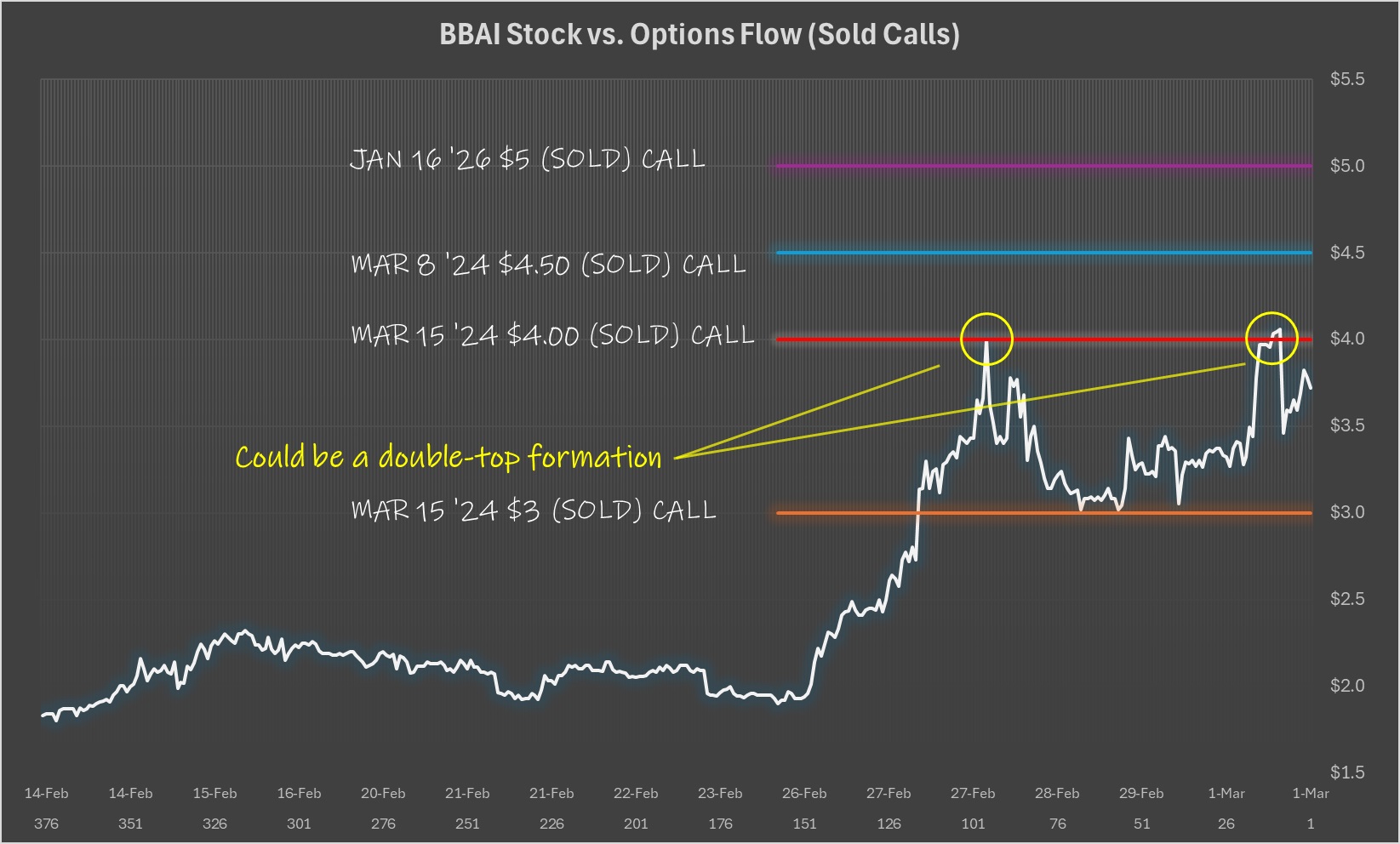

The impact of this downgrade was immediate, resulting in a [insert percentage] drop in BBAI's stock price within [timeframe]. Investor sentiment shifted noticeably, reflecting the concerns outlined in the analyst report. [Insert chart or graph showing stock price fluctuation if available].

BigBear.ai's Current Financial Performance and Outlook

BigBear.ai's recent financial reports reveal a mixed picture. While [insert positive financial data, e.g., revenue growth in specific areas], other metrics point to challenges. A comparison of actual performance to previous guidance shows [explain discrepancies and their significance]. Key financial metrics require close scrutiny:

- Key Financial Metrics:

- Revenue Growth Year-over-Year: [Insert data and percentage change]

- Profit Margins: [Insert data and analysis of trends]

- Debt Levels: [Insert data and analysis of debt burden]

- Cash Flow from Operations: [Insert data and analysis of cash flow health]

The company's future outlook hinges on its ability to overcome these challenges. Opportunities exist in [mention specific market segments or technological advancements], but success depends on effective execution and navigating the competitive landscape.

Competitive Landscape and Market Analysis for BigBear.ai

BigBear.ai operates in a highly competitive market, facing established players like [list major competitors] and emerging startups with innovative AI solutions. The competitive landscape is characterized by intense competition for government contracts and commercial clients.

- Key Competitive Factors:

- Technological Innovation: The pace of technological advancement in AI is rapid, requiring continuous investment in R&D to maintain a competitive edge.

- Market Share: BigBear.ai's market share needs to be analyzed against its competitors to assess its position.

- Pricing Strategies: Competitive pricing strategies are crucial in securing contracts and maintaining market share.

- Government Contracts: Government contracts represent a significant revenue stream for BigBear.ai, making the acquisition process a critical factor.

- Client Acquisition: The ability to acquire and retain clients is crucial for sustainable growth.

The potential for future market growth is substantial, driven by increasing demand for AI and analytics solutions across various sectors. However, BigBear.ai's ability to capitalize on this growth depends on its capacity to innovate, secure contracts, and manage costs effectively.

Risk Assessment and Investment Considerations for BigBear.ai (BBAI)

Investing in BigBear.ai (BBAI) entails several significant risks. Investors must carefully consider these factors before making any investment decisions.

- Key Risks and Uncertainties:

- Geopolitical Risks: Global instability and geopolitical events can significantly impact government spending on defense and intelligence, impacting BigBear.ai's revenue streams.

- Regulatory Hurdles: Changes in government regulations could affect BigBear.ai's operations and ability to secure contracts.

- Dependence on Government Contracts: A significant portion of BigBear.ai's revenue comes from government contracts, making it vulnerable to fluctuations in government spending.

- Technological Obsolescence: Rapid technological advancements in the AI field could render BigBear.ai's technology obsolete.

The potential upside of investing in BBAI lies in its strong technological capabilities and potential for market growth. However, the downside is significant, given the various risks and uncertainties outlined above.

The Future of BigBear.ai (BBAI) Investment

In conclusion, the future of BigBear.ai (BBAI) remains uncertain. The recent analyst downgrade underscores the challenges the company faces, including slower-than-expected revenue growth, intense competition, and concerns about profitability. While the company possesses strong technological capabilities and operates in a rapidly expanding market, investors must carefully weigh the potential risks and rewards before investing. This analysis highlights the need for thorough due diligence. Before investing in BigBear.ai (BBAI) or any similar AI-related stocks, conduct independent research, scrutinize financial statements, analyze the competitive landscape, and carefully assess the company's future growth potential. Only with comprehensive understanding can you make informed investment decisions regarding BigBear.ai (BBAI).

Featured Posts

-

D Wave Quantum Qbts Stock Plunge Explained Thursdays Market Activity

May 21, 2025

D Wave Quantum Qbts Stock Plunge Explained Thursdays Market Activity

May 21, 2025 -

Vybz Kartels Barclay Center Concert Nyc April Show Announced

May 21, 2025

Vybz Kartels Barclay Center Concert Nyc April Show Announced

May 21, 2025 -

Robert Burke Retired Admiral Faces Bribery Charges Guilty Verdict

May 21, 2025

Robert Burke Retired Admiral Faces Bribery Charges Guilty Verdict

May 21, 2025 -

Little Britains Future Matt Lucas Addresses Revival Speculation

May 21, 2025

Little Britains Future Matt Lucas Addresses Revival Speculation

May 21, 2025 -

Mulhouse Le Hellfest Au Noumatrouff Billetterie Et Programme

May 21, 2025

Mulhouse Le Hellfest Au Noumatrouff Billetterie Et Programme

May 21, 2025

Latest Posts

-

United Kingdom News Tory Wifes Imprisonment For Southport Incident

May 22, 2025

United Kingdom News Tory Wifes Imprisonment For Southport Incident

May 22, 2025 -

Jail Term Stands Update On Tory Politicians Wifes Migrant Remarks Case

May 22, 2025

Jail Term Stands Update On Tory Politicians Wifes Migrant Remarks Case

May 22, 2025 -

Update Ex Tory Councillors Wifes Appeal For Racial Hatred Tweet

May 22, 2025

Update Ex Tory Councillors Wifes Appeal For Racial Hatred Tweet

May 22, 2025 -

Connollys Racial Hatred Conviction Upheld Appeal Rejected

May 22, 2025

Connollys Racial Hatred Conviction Upheld Appeal Rejected

May 22, 2025 -

Southport Stabbing Mothers Tweet Imprisonment And Housing Struggle

May 22, 2025

Southport Stabbing Mothers Tweet Imprisonment And Housing Struggle

May 22, 2025