BBVA's Long-Term Investment Banking Strategy: A CFO Perspective

Table of Contents

BBVA, a global financial institution with a significant presence in key markets, has implemented a robust long-term investment banking strategy crucial for its continued success. This article provides a CFO-focused perspective on this multifaceted strategy, examining its key aspects and their implications for the bank's future within the dynamic global financial landscape. We will delve into the strategic pillars that underpin BBVA's approach, focusing on elements critical to sustainable growth and long-term value creation.

Focus on Digital Transformation and Technological Innovation

BBVA's investment banking strategy prioritizes digital transformation and technological innovation as cornerstones of its future growth. This commitment manifests in two key areas: enhancing client experience and streamlining internal processes.

Enhancing Client Experience through Digital Platforms

The modern investment banking client expects seamless, efficient, and personalized service. BBVA is responding by:

- Developing user-friendly online banking and investment platforms: These platforms offer intuitive interfaces, real-time data access, and sophisticated tools for portfolio management and investment analysis. This enhances the client experience and fosters greater engagement.

- Leveraging fintech partnerships to offer innovative financial solutions: Collaborations with fintech companies provide access to cutting-edge technologies and allow BBVA to offer a wider array of tailored financial products and services, including robo-advisory, mobile payment solutions and advanced wealth management tools.

- Improving data analytics for personalized client service and risk assessment: By leveraging big data and advanced analytics, BBVA can gain deeper insights into client needs and preferences, enabling personalized service and more accurate risk assessment for customized investment strategies.

- Investing in cybersecurity to protect client data and maintain trust: Robust cybersecurity measures are paramount. BBVA invests heavily in protecting client data and maintaining the highest levels of security to build and maintain client trust, a critical element for long-term success in investment banking.

Streamlining Internal Processes with AI and Automation

Internal efficiency is crucial for competitiveness. BBVA is employing AI and automation to:

- Automating tasks to increase efficiency and reduce operational costs: Automating repetitive tasks frees up human capital for more strategic activities, enhancing productivity and reducing operational expenses.

- Employing AI-driven risk management systems for better decision-making: AI-powered systems analyze vast datasets to identify and assess risks more effectively, leading to better informed decisions and improved risk mitigation strategies.

- Utilizing data analytics for improved forecasting and strategic planning: Data analytics provides valuable insights into market trends, client behavior, and economic indicators, enabling more accurate forecasting and strategic planning within the corporate finance and M&A advisory divisions.

- Implementing blockchain technology for secure and transparent transactions: Blockchain technology enhances the security and transparency of transactions, increasing efficiency and reducing the risk of fraud.

Strategic Partnerships and Acquisitions for Growth

Growth in investment banking often requires strategic expansion. BBVA's strategy leverages both partnerships and acquisitions.

Expanding Market Reach through Strategic Alliances

BBVA actively pursues strategic alliances to broaden its reach and capabilities:

- Collaborating with fintech companies to access new technologies and markets: These partnerships provide access to innovative technologies and help BBVA expand into new market segments.

- Partnering with regional banks to broaden geographic reach and client base: This approach accelerates market penetration and expands access to a wider client base across various geographical regions.

- Joint ventures to offer specialized financial products and services: Joint ventures allow BBVA to offer niche financial products and services, leveraging the expertise of its partners.

- Strategic alliances to improve operational efficiency and reduce costs: Collaborations can improve operational efficiency and reduce costs through shared resources and expertise.

Targeted Acquisitions to Enhance Capabilities

BBVA carefully selects acquisitions that align with its long-term strategic goals:

- Acquiring companies with complementary technologies and expertise: This strategy enhances BBVA's technological capabilities and expands its service offerings.

- Expanding into new geographical markets through strategic acquisitions: Acquisitions can accelerate entry into new markets and provide immediate access to established client bases and distribution networks.

- Focusing on acquisitions that align with BBVA's long-term strategic goals: This ensures that acquisitions contribute to the overall strategic direction and enhance long-term value creation.

- Thorough due diligence and integration planning for successful acquisitions: Careful planning and execution are crucial for successful integration and maximizing the return on investment from acquisitions.

Sustainable and Responsible Investing

BBVA integrates Environmental, Social, and Governance (ESG) factors into its investment decisions:

Integrating ESG (Environmental, Social, and Governance) factors into Investment Decisions

BBVA's commitment to responsible investing is reflected in:

- Prioritizing investments in sustainable and responsible businesses: This reflects growing investor demand for investments that align with ESG principles.

- Developing green finance initiatives to support environmental sustainability: BBVA actively supports projects that promote environmental sustainability through dedicated green finance initiatives.

- Promoting diversity and inclusion within the workplace and client base: BBVA fosters a diverse and inclusive workplace and strives to serve a diverse client base.

- Implementing strong corporate governance practices to ensure ethical behavior: Strong corporate governance ensures ethical behavior and transparency in all operations.

Engaging with Stakeholders on Sustainability Initiatives

BBVA actively engages with stakeholders to promote sustainability:

- Transparent reporting on ESG performance: Open and transparent reporting on ESG performance builds trust and accountability.

- Collaborating with NGOs and other stakeholders on sustainability projects: Collaboration with external stakeholders enhances impact and fosters innovation in sustainability initiatives.

- Promoting sustainable finance through educational programs and initiatives: Education plays a key role in increasing awareness and driving adoption of sustainable finance practices.

- Setting ambitious targets for reducing the bank's environmental impact: Setting clear targets demonstrates commitment and promotes accountability for environmental sustainability efforts.

Risk Management and Regulatory Compliance

BBVA’s investment banking strategy includes a robust risk management framework:

Proactive Risk Management Framework

BBVA's risk management approach is proactive and comprehensive:

- Implementing robust risk assessment and mitigation strategies: This involves identifying, assessing, and mitigating various risks throughout the investment banking process.

- Maintaining compliance with all relevant regulations and laws: Strict adherence to regulatory requirements is paramount.

- Continuous monitoring of market risks, credit risks, and operational risks: Constant monitoring allows for timely responses to emerging risks.

- Strengthening internal controls to prevent fraud and other financial crimes: Robust internal controls are essential to maintaining integrity and preventing financial crime.

Adapting to Evolving Regulatory Landscape

The regulatory environment is constantly evolving. BBVA's response includes:

- Staying ahead of regulatory changes and adapting business practices accordingly: Proactive adaptation ensures continued compliance and minimizes disruption.

- Investing in compliance technology and training: Investing in technology and training equips staff to manage the complexities of regulatory compliance effectively.

- Maintaining open communication with regulatory bodies: Open communication facilitates clear understanding and proactive risk management.

- Ensuring the bank's operations meet the highest ethical standards: Ethical conduct is a cornerstone of BBVA's operations.

Conclusion

BBVA's long-term investment banking strategy, from a CFO perspective, prioritizes a balanced approach. The combination of digital transformation, strategic partnerships, sustainable investing, and robust risk management forms a powerful foundation for sustainable growth and maintaining its position as a leading global financial institution. This strategy is crucial for navigating the complexities of the modern financial landscape and ensuring long-term value creation. To gain deeper insights into BBVA's financial strategies and their impact on the banking sector, stay updated on their financial reports and industry news. Learn more about BBVA's commitment to long-term investment banking and its continued evolution.

Featured Posts

-

Harrogate Spring Flower Show 2024 Dates Tickets And Highlights

Apr 25, 2025

Harrogate Spring Flower Show 2024 Dates Tickets And Highlights

Apr 25, 2025 -

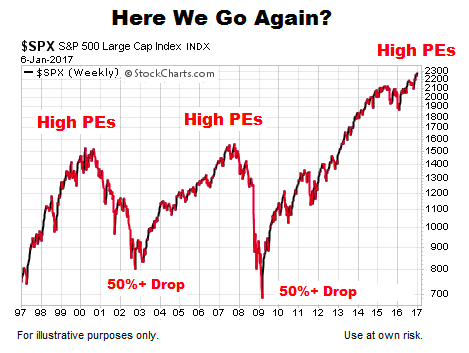

Stock Market Valuations Bof As Reassuring View For Investors

Apr 25, 2025

Stock Market Valuations Bof As Reassuring View For Investors

Apr 25, 2025 -

Hollywood Production Grinds To Halt As Actors And Writers Strike

Apr 25, 2025

Hollywood Production Grinds To Halt As Actors And Writers Strike

Apr 25, 2025 -

Emilia Pereyra Y Carlos Manuel Estrella Reciben Los Premios Caonabo De Oro 2025

Apr 25, 2025

Emilia Pereyra Y Carlos Manuel Estrella Reciben Los Premios Caonabo De Oro 2025

Apr 25, 2025 -

Cassidy Hutchinsons Planned Memoir Insights Into The January 6th Hearings

Apr 25, 2025

Cassidy Hutchinsons Planned Memoir Insights Into The January 6th Hearings

Apr 25, 2025

Latest Posts

-

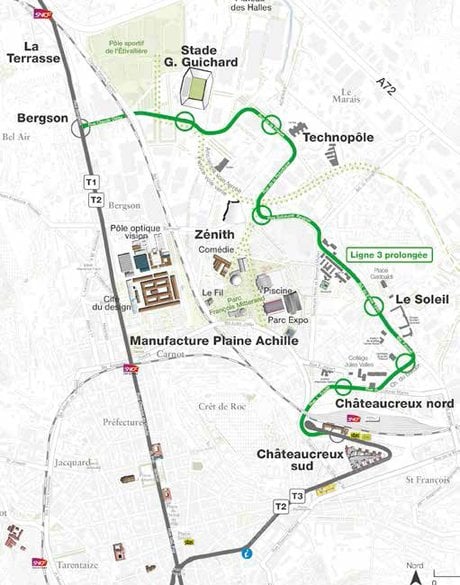

Dijon Concertation Lancee Pour La Troisieme Ligne De Tram

May 10, 2025

Dijon Concertation Lancee Pour La Troisieme Ligne De Tram

May 10, 2025 -

L Heritage Meconnu De Melanie Eiffel A Dijon

May 10, 2025

L Heritage Meconnu De Melanie Eiffel A Dijon

May 10, 2025 -

La Cite De La Gastronomie Et La Crise D Epicure A Dijon

May 10, 2025

La Cite De La Gastronomie Et La Crise D Epicure A Dijon

May 10, 2025 -

Conseil Metropolitain De Dijon La 3e Ligne De Tram Concertation Adoptee

May 10, 2025

Conseil Metropolitain De Dijon La 3e Ligne De Tram Concertation Adoptee

May 10, 2025 -

Dijon Revele Le Role Crucial De Melanie Eiffel Dans La Construction De La Tour

May 10, 2025

Dijon Revele Le Role Crucial De Melanie Eiffel Dans La Construction De La Tour

May 10, 2025