Stock Market Valuations: BofA's Reassuring View For Investors

Table of Contents

BofA's Key Arguments for a Less-Pessimistic View

BofA's recent market outlook presents a less pessimistic view of current equity valuations than some other analysts. Their core arguments revolve around several key valuation metrics and a considered assessment of macroeconomic factors. They are not dismissing potential risks entirely, but rather suggesting that the market is not as overvalued as some fear.

- BofA's analysis highlights forward price-to-earnings (P/E) ratios, indicating a relative undervaluation compared to historical averages when adjusted for inflation and projected earnings growth. This suggests that the market isn't as expensive as headline numbers might suggest.

- They account for inflation by adjusting earnings estimates to reflect the impact of rising prices on corporate profits and consumer spending. This nuanced approach leads to a more accurate picture of underlying value.

- Their models incorporate potential future earnings growth, suggesting sustainable market gains, especially in sectors poised for growth despite economic headwinds. They are looking beyond short-term volatility to long-term fundamentals.

Understanding the Underlying Data and Methodology

Transparency is crucial in understanding any market analysis. BofA's research methodology employs a robust combination of quantitative and qualitative factors to reach its conclusions.

- BofA's analysis is based on a wide range of data sources, including company earnings reports, macroeconomic data from reputable sources like the Federal Reserve and the Bureau of Economic Analysis, and industry-specific reports. This provides a comprehensive foundation for their models.

- Their models utilize sophisticated financial modeling techniques, including discounted cash flow (DCF) analysis and relative valuation techniques, comparing current valuations to historical benchmarks and similar companies. This ensures a rigorous and comprehensive approach.

- They considered various qualitative factors, such as geopolitical risks (e.g., the war in Ukraine), regulatory changes, and potential shifts in consumer behavior. Acknowledging these non-quantifiable elements adds depth to their analysis.

Addressing Potential Counterarguments

While BofA presents a relatively optimistic outlook, it's important to acknowledge potential counterarguments and risks. A balanced perspective is essential for responsible investing.

- While a recession is possible, BofA suggests that its impact on stock market valuations would be limited, given current corporate balance sheets and potential government intervention. Their analysis suggests a degree of resilience.

- Concerns about high inflation are addressed by BofA's analysis of future inflation expectations. They project a gradual decline in inflation, reducing its impact on corporate profitability over time.

- The potential for a market correction is acknowledged, but considered a healthy adjustment rather than a major crash, providing opportunities for long-term investors. They are not predicting a runaway bull market, but rather a market that is reasonably valued.

Practical Implications for Investors

BofA's analysis offers several key takeaways for investors looking to navigate the complexities of stock market valuations:

- Consider a long-term buy-and-hold approach. Focusing on the long-term fundamentals of strong companies can help mitigate the impact of short-term market volatility.

- Maintain a well-diversified portfolio across different asset classes to reduce risk and limit exposure to any single sector or market segment.

- Adjust your risk tolerance based on your individual circumstances, financial goals, and time horizon. What's suitable for one investor might not be suitable for another.

Conclusion

This article explored BofA's analysis of current stock market valuations, highlighting their relatively reassuring outlook. While acknowledging potential risks such as recession and inflation, BofA's methodology and data, considering factors like forward P/E ratios and future earnings growth, suggest opportunities for investors with a long-term perspective. Understanding stock market valuations is crucial for making informed investment decisions. Stay informed about BofA's ongoing market analysis and adapt your investment strategy accordingly to navigate the complexities of stock market valuations effectively. Consider consulting a financial advisor to help determine the best investment strategy based on your unique risk tolerance and financial objectives.

Featured Posts

-

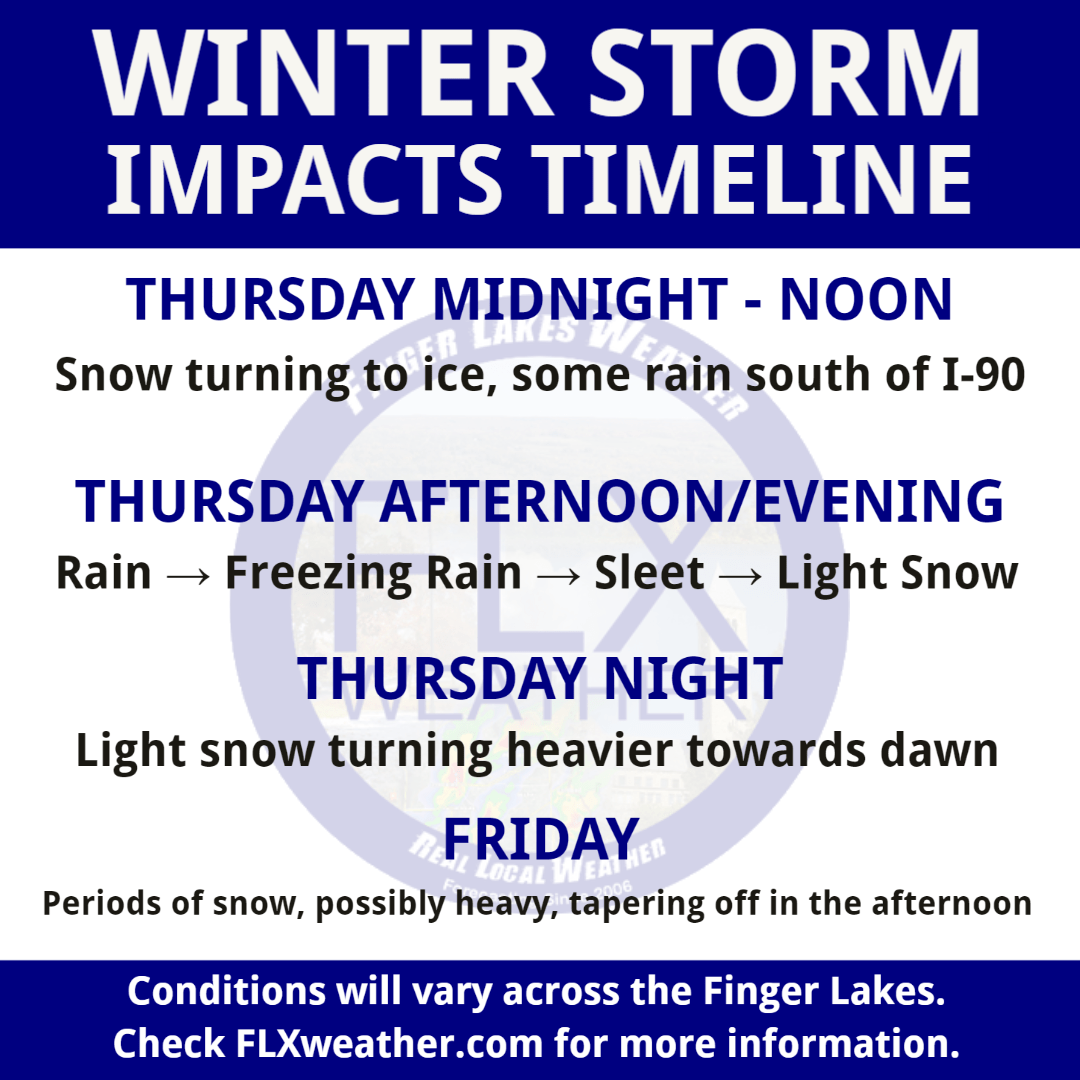

Winter Weather Timeline Planning And Preparation Guide

Apr 25, 2025

Winter Weather Timeline Planning And Preparation Guide

Apr 25, 2025 -

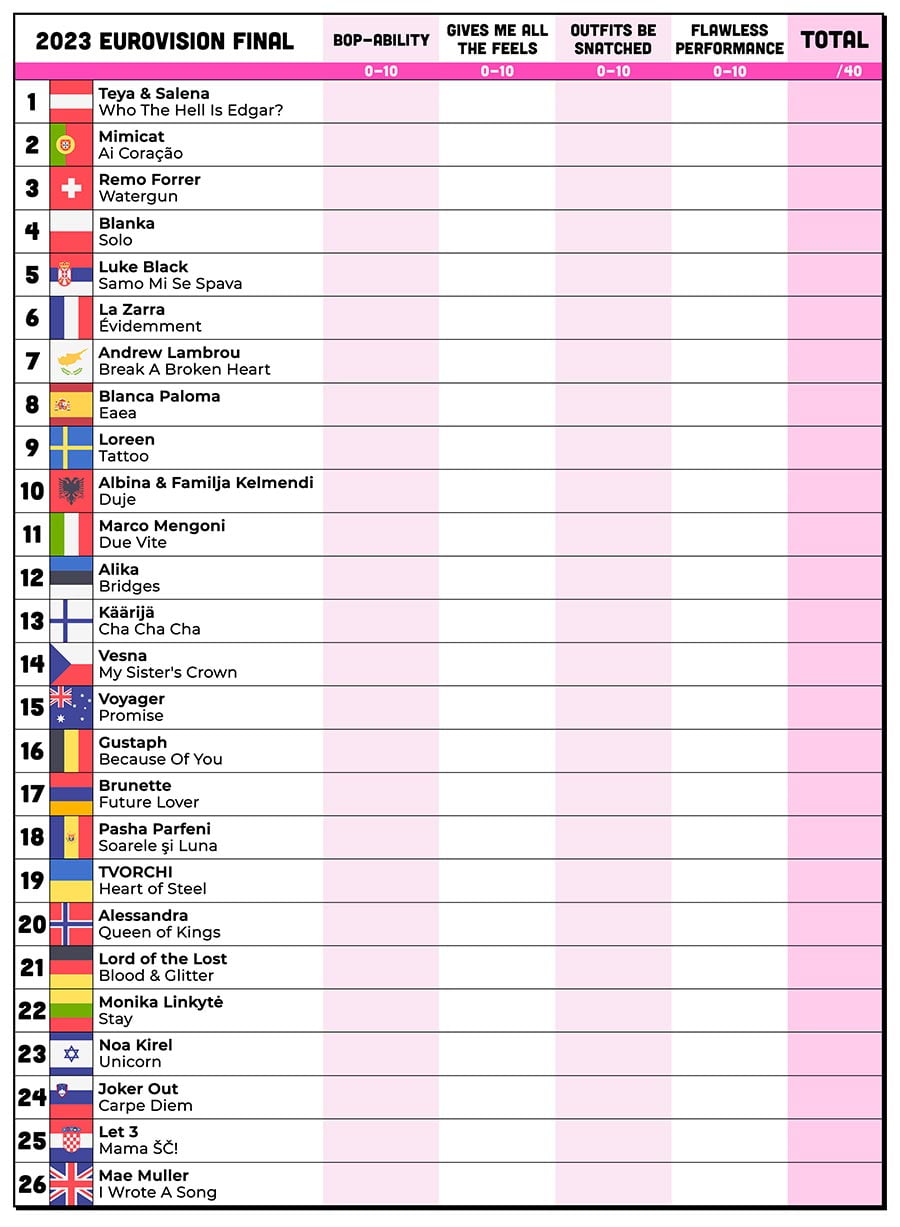

Eurovision 2024 On Sbs Meet Your Hosts Courtney Act And Tony Armstrong

Apr 25, 2025

Eurovision 2024 On Sbs Meet Your Hosts Courtney Act And Tony Armstrong

Apr 25, 2025 -

Blue Origin Cancels Launch Vehicle Subsystem Problem Delays Mission

Apr 25, 2025

Blue Origin Cancels Launch Vehicle Subsystem Problem Delays Mission

Apr 25, 2025 -

Canakkale Zaferi Nin 100 Yilindan Sonra 2025 Te Anma Toerenleri Ve Oenemi

Apr 25, 2025

Canakkale Zaferi Nin 100 Yilindan Sonra 2025 Te Anma Toerenleri Ve Oenemi

Apr 25, 2025 -

Auto Dealers Push Back Against Mandatory Ev Sales

Apr 25, 2025

Auto Dealers Push Back Against Mandatory Ev Sales

Apr 25, 2025

Latest Posts

-

Abcs High Potential Find Out When The Next Episode Airs

May 10, 2025

Abcs High Potential Find Out When The Next Episode Airs

May 10, 2025 -

The Lasting Impact Of High Potential An 11 Year Retrospective On Psych Spiritual Success

May 10, 2025

The Lasting Impact Of High Potential An 11 Year Retrospective On Psych Spiritual Success

May 10, 2025 -

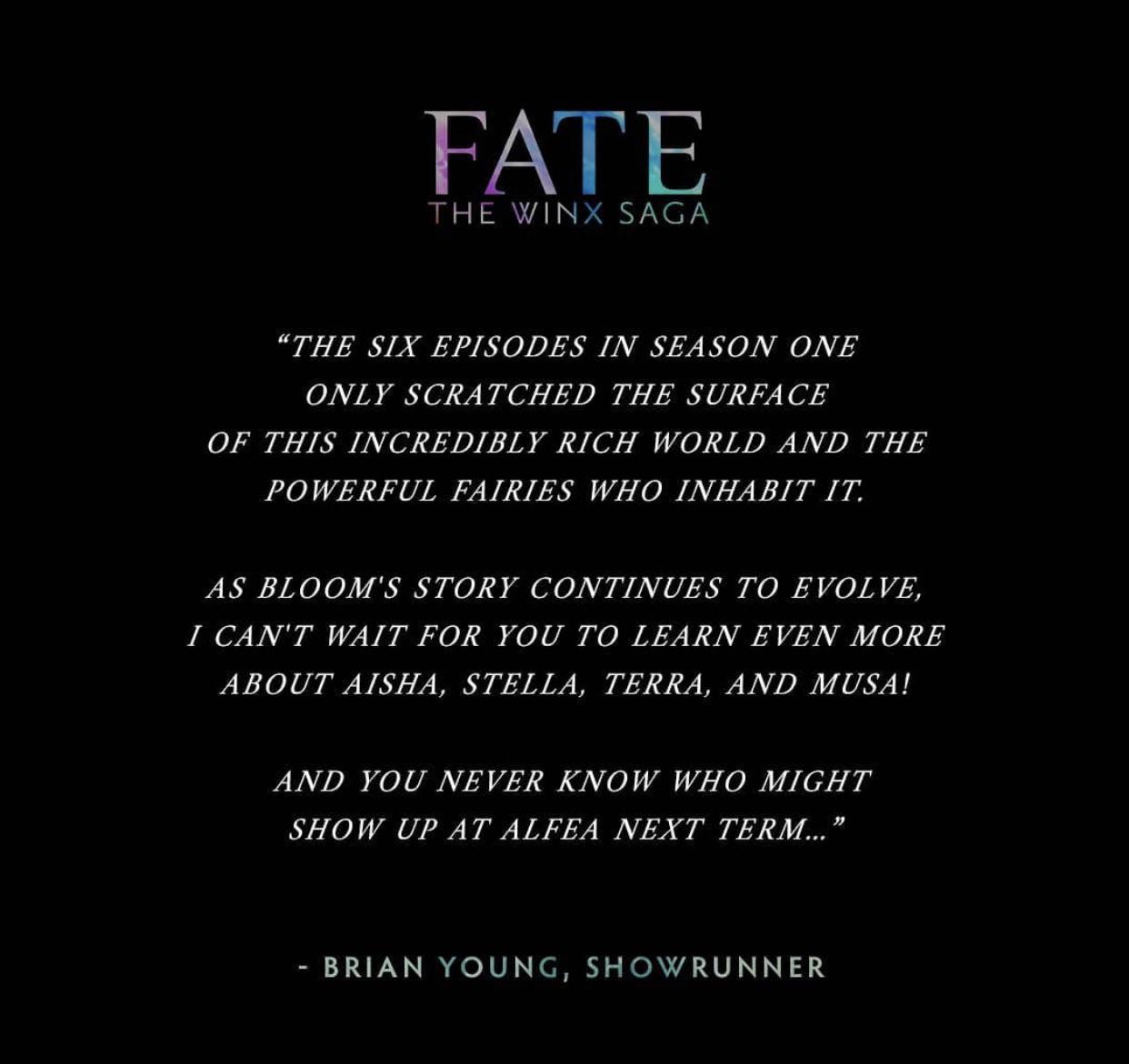

Roman Fate Season 2 Spoilers This High Potential Show Is The Perfect Alternative

May 10, 2025

Roman Fate Season 2 Spoilers This High Potential Show Is The Perfect Alternative

May 10, 2025 -

The High Potential Season 1 Sleeper Hit Why This Character Deserves Season 2 Focus

May 10, 2025

The High Potential Season 1 Sleeper Hit Why This Character Deserves Season 2 Focus

May 10, 2025 -

High Potential Season 2 Everything We Know About The Renewal And Episode Count

May 10, 2025

High Potential Season 2 Everything We Know About The Renewal And Episode Count

May 10, 2025