BBAI Stock Tanks: Deep Dive Into The 17.87% Drop

Table of Contents

Market Sentiment and Investor Confidence

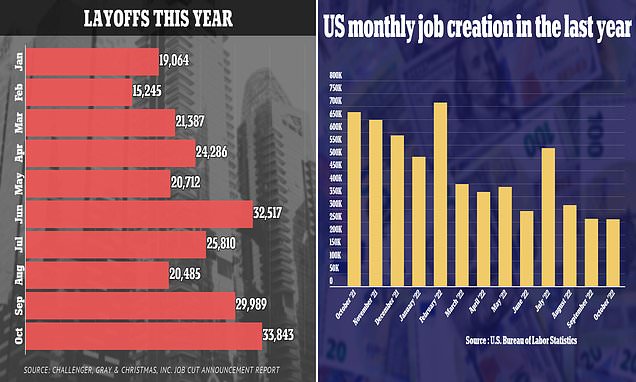

The dramatic BBAI stock drop wasn't isolated; it reflects broader market anxieties. Negative market sentiment, often fueled by economic uncertainty and inflation concerns, played a significant role. Investor confidence in the tech sector, where BBAI operates, has been particularly fragile recently. Any negative news concerning BBAI, even marginally related to the company, was likely amplified by this pre-existing bearish sentiment.

- Impact of broader market trends: The overall downturn in the technology sector significantly impacted BBAI's stock price, regardless of its specific performance.

- Specific negative news related to BBAI: [Insert any specific negative news related to BBAI, such as regulatory hurdles, lawsuits, or negative press. If no specific news is available, replace this with a general statement about the lack of specific negative news and the impact of general market sentiment.]

- Analysis of sell-off volume and trading activity: High trading volume during the drop suggests a significant number of investors simultaneously decided to sell their BBAI shares, accelerating the decline in BBAI price.

Financial Performance and Company Fundamentals

An analysis of BBAI's recent financial reports is crucial to understanding the stock decline. While [Insert positive aspects if any, e.g., revenue growth], [Insert negative aspects impacting the BBAI price, e.g., disappointing earnings, increased debt, or widening losses] likely contributed to the negative investor reaction. Key financial ratios and indicators need careful scrutiny.

- Analysis of recent earnings reports and revenue figures: [Insert specific data from recent financial reports. Compare year-over-year performance and highlight any significant deviations from expectations.]

- Debt levels and credit rating: High levels of debt or a downgraded credit rating can severely impact investor confidence and contribute to a stock price decline. [Insert relevant information about BBAI's debt and credit rating.]

- Profitability and margins: Declining profitability or shrinking margins are major red flags that can trigger a sell-off. [Analyze BBAI’s profitability and margins, comparing them to previous periods and industry averages.]

Geopolitical Factors and Industry-Specific Risks

Global events and industry-specific risks can significantly impact a company's stock price. BBAI's operations [Mention geographical spread of operations] could make it particularly vulnerable to geopolitical risks. Changes in international trade policies or escalating geopolitical tensions in key markets might negatively influence BBAI's revenue streams and overall performance.

- Impact of international trade policies: Trade wars or sanctions targeting BBAI's industry or geographic markets can lead to significant financial challenges and impact the BBAI price.

- Competition within the industry: Increased competition from other companies in the same sector could put downward pressure on BBAI's market share and profitability.

- Regulatory changes affecting BBAI's operations: New regulations or stricter enforcement of existing ones in BBAI's industry could lead to increased costs and reduced profitability.

Technical Analysis of the BBAI Stock Chart

Analyzing the BBAI stock chart using technical indicators can offer insights into the price movement. A technical analysis might reveal significant chart patterns that contributed to the decline. For example, the breaking of key support levels or the formation of bearish patterns like head and shoulders could have signaled the impending drop in BBAI shares.

- Chart patterns (head and shoulders, double top, etc.): Identify any bearish chart patterns that might have preceded the 17.87% drop in BBAI stock price.

- Support and resistance levels breached: Examine whether key support levels were breached, triggering further selling pressure.

- Moving average crossover signals: Analyze moving average crossovers (e.g., 50-day and 200-day moving averages) to identify potential sell signals.

Conclusion: Navigating the BBAI Stock Volatility and Future Outlook

The 17.87% drop in BBAI stock resulted from a confluence of factors, including negative market sentiment, concerns about the company's financial performance, potential geopolitical risks, and technical indicators suggesting a bearish trend. While the future prospects of BBAI stock remain uncertain, a cautious outlook is warranted. Before investing in BBAI shares or making any trading decisions, thorough due diligence is crucial. Understanding the interplay of market conditions, company fundamentals, and geopolitical factors is paramount when assessing the risks and rewards associated with BBAI stock. Before making any investment decisions related to BBAI stock, further research into the company's fundamentals and market conditions is crucial.

Featured Posts

-

Hell Of A Run A Deep Dive Into Ftv Lives Reporting Practices

May 21, 2025

Hell Of A Run A Deep Dive Into Ftv Lives Reporting Practices

May 21, 2025 -

School District Procedures For Winter Weather Advisories And Delays

May 21, 2025

School District Procedures For Winter Weather Advisories And Delays

May 21, 2025 -

Walliams Slams Cowell Amid Britains Got Talent Dispute

May 21, 2025

Walliams Slams Cowell Amid Britains Got Talent Dispute

May 21, 2025 -

D Wave Quantum Qbts Stock Market Movement On Monday An In Depth Look

May 21, 2025

D Wave Quantum Qbts Stock Market Movement On Monday An In Depth Look

May 21, 2025 -

Fear Of Job Cuts Grips Good Morning America Amidst Internal Chaos

May 21, 2025

Fear Of Job Cuts Grips Good Morning America Amidst Internal Chaos

May 21, 2025

Latest Posts

-

Wife Of Ex Tory Councillor Appeals Conviction For Racist Tweet

May 22, 2025

Wife Of Ex Tory Councillor Appeals Conviction For Racist Tweet

May 22, 2025 -

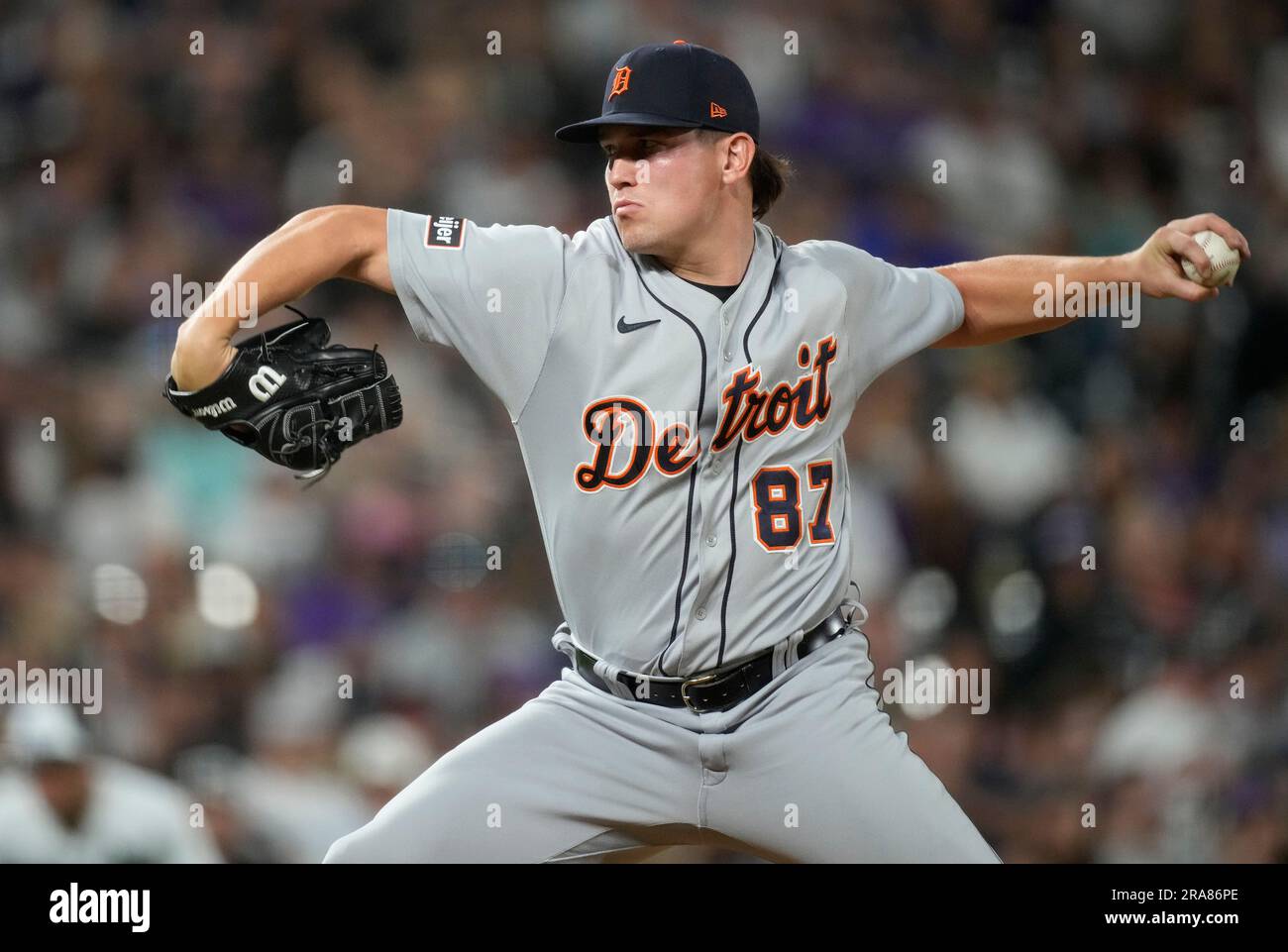

Detroit Tigers 8 6 Victory Over Rockies A Deeper Look

May 22, 2025

Detroit Tigers 8 6 Victory Over Rockies A Deeper Look

May 22, 2025 -

Ex Tory Councillors Wifes Racial Hatred Tweet Appeal The Latest

May 22, 2025

Ex Tory Councillors Wifes Racial Hatred Tweet Appeal The Latest

May 22, 2025 -

Colorado Rockies Vs Detroit Tigers 8 6 Upset

May 22, 2025

Colorado Rockies Vs Detroit Tigers 8 6 Upset

May 22, 2025 -

Racial Hatred Tweet Ex Tory Councillors Wife Faces Appeal Delay

May 22, 2025

Racial Hatred Tweet Ex Tory Councillors Wife Faces Appeal Delay

May 22, 2025