D-Wave Quantum (QBTS) Stock Market Movement On Monday: An In-Depth Look

Table of Contents

Monday's trading session witnessed notable activity surrounding D-Wave Quantum (QBTS) stock, prompting a closer examination of its market behavior. This in-depth analysis will dissect the key factors influencing QBTS's price fluctuations on Monday, providing insights for investors interested in this burgeoning quantum computing company. Understanding these movements is crucial for navigating the complexities of the quantum computing investment landscape.

Pre-Market Indicators and Opening Bell

The pre-market performance of QBTS often sets the tone for the day's trading. Analyzing pre-market trends provides valuable clues about the anticipated stock movement. Several factors can contribute to pre-market fluctuations:

- Press Releases and Announcements: Any pre-market news releases, such as partnerships, contract wins, or product updates concerning D-Wave's quantum annealing technology, could significantly impact the opening price. A positive announcement would likely lead to a higher opening price, while negative news could push it down.

- Overall Market Sentiment: The broader market's mood plays a significant role. A positive overall market sentiment, typically indicated by rising major indices, can boost QBTS's opening price. Conversely, a negative market sentiment can weigh down even the most promising stocks.

- Comparison to Other Tech Stocks: Comparing QBTS's pre-market performance to other technology stocks, particularly those involved in quantum computing or related fields, provides context. Strong performance among peers often indicates a positive overall tech sector sentiment, benefiting QBTS.

- Opening Price Deviation: The difference between QBTS's opening price and its Friday closing price is a crucial indicator. A significant gap up suggests strong positive sentiment, whereas a gap down signals the opposite.

Intraday QBTS Stock Price Fluctuations and Volume

Analyzing QBTS's intraday price fluctuations and trading volume offers a granular understanding of Monday's market activity.

- Highs and Lows: Tracking the daily highs and lows helps identify the price range within which the stock traded. Significant intraday swings suggest volatility, which can be influenced by various factors, including news, trading algorithms, and overall market conditions.

- Specific Events and Price Changes: Correlating specific times or events with price changes is crucial. For example, a sudden spike in price could be linked to a positive news report or announcement.

- Trading Volume: High trading volume often indicates increased investor interest. A surge in volume alongside a price increase suggests strong buying pressure, while high volume with a price drop points to strong selling pressure. Low volume can suggest a lack of interest.

- Price Volatility and Causes: High price volatility indicates uncertainty in the market regarding QBTS's future prospects. Factors contributing to volatility can range from general market uncertainty to specific news concerning the company's technology or business strategy. Visualizing this volatility through charts and graphs helps understand the magnitude of these fluctuations. [Insert Chart/Graph here]

Impact of News and Announcements (if any)

Any news released on Monday regarding D-Wave Quantum directly influenced the stock price. For instance:

- Partnerships and Contract Wins: New collaborations or large contracts secured by D-Wave could boost investor confidence and drive up the stock price.

- Technological Breakthroughs: Announcements of significant technological advancements in D-Wave's quantum computing technology would positively impact investor perception and, consequently, the stock price.

- Market Reaction Analysis: Analyzing how the market reacted to any positive or negative news is crucial. A strong positive reaction to good news indicates investor confidence, while a muted response might suggest skepticism. Conversely, negative reactions to bad news show market sensitivity.

- Long-Term Implications: Assessing the long-term implications of any announcements is important for long-term investment strategies. A significant breakthrough might lead to sustained growth, while a minor setback might have minimal long-term effects.

Comparison to Competitor Stock Performance

Comparing QBTS's performance to its competitors in the quantum computing sector provides valuable context.

- Key Competitors: Companies like IonQ and Rigetti Computing are key competitors to D-Wave Quantum. Analyzing their Monday stock performance helps determine if the sector experienced a general upward or downward trend, or if QBTS's movement was unique.

- Performance Comparison: A comparison of the percentage change in stock price for QBTS and its competitors highlights whether QBTS outperformed or underperformed the sector as a whole.

- Factors Contributing to Differences: Identifying factors that contributed to differences in performance helps investors understand the specific influences on QBTS's stock price. These factors could include news specific to QBTS, differences in business models, or investor sentiment toward individual companies.

Technical Analysis of QBTS Stock Chart

Employing technical analysis provides another perspective on QBTS's stock chart for Monday:

- Support and Resistance Levels: Identifying key support and resistance levels on the stock chart indicates price levels where buying or selling pressure is expected to be strong.

- Candlestick Patterns: Analyzing candlestick patterns can provide insight into market sentiment. Bullish patterns suggest positive momentum, while bearish patterns indicate negative momentum.

- Technical Indicators (RSI, MACD): Using indicators such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) can confirm the interpretations drawn from candlestick patterns and support/resistance levels.

Investor Sentiment and Social Media Buzz

Monitoring investor sentiment through social media and news articles reveals the overall market perception of QBTS.

- Social Media Tone: Analyzing the overall tone of social media conversations about QBTS – whether positive, negative, or neutral – provides a real-time pulse on investor sentiment.

- Key Themes and Concerns: Identifying key themes and concerns expressed by investors reveals areas of focus and potential risks or opportunities.

- Changes in Sentiment: Noting any significant shifts in sentiment throughout Monday's trading session can highlight potential catalysts for price movements.

Conclusion

Monday's D-Wave Quantum (QBTS) stock market movement was influenced by a complex interplay of pre-market indicators, intraday price fluctuations, news announcements, competitor performance, technical analysis, and investor sentiment. Understanding these factors provides a more holistic view of QBTS's market behavior. Analyzing the interaction between these elements is key to making informed investment decisions.

Call to Action: Stay informed about the dynamic world of quantum computing and D-Wave Quantum (QBTS) stock. Continue monitoring QBTS and other quantum computing stocks to identify future investment opportunities. Deepen your understanding of QBTS's technology, business strategy, and competitive landscape to make well-informed decisions regarding D-Wave Quantum (QBTS) stock investments.

Featured Posts

-

Cassis Blackcurrant Uses Benefits And Production

May 21, 2025

Cassis Blackcurrant Uses Benefits And Production

May 21, 2025 -

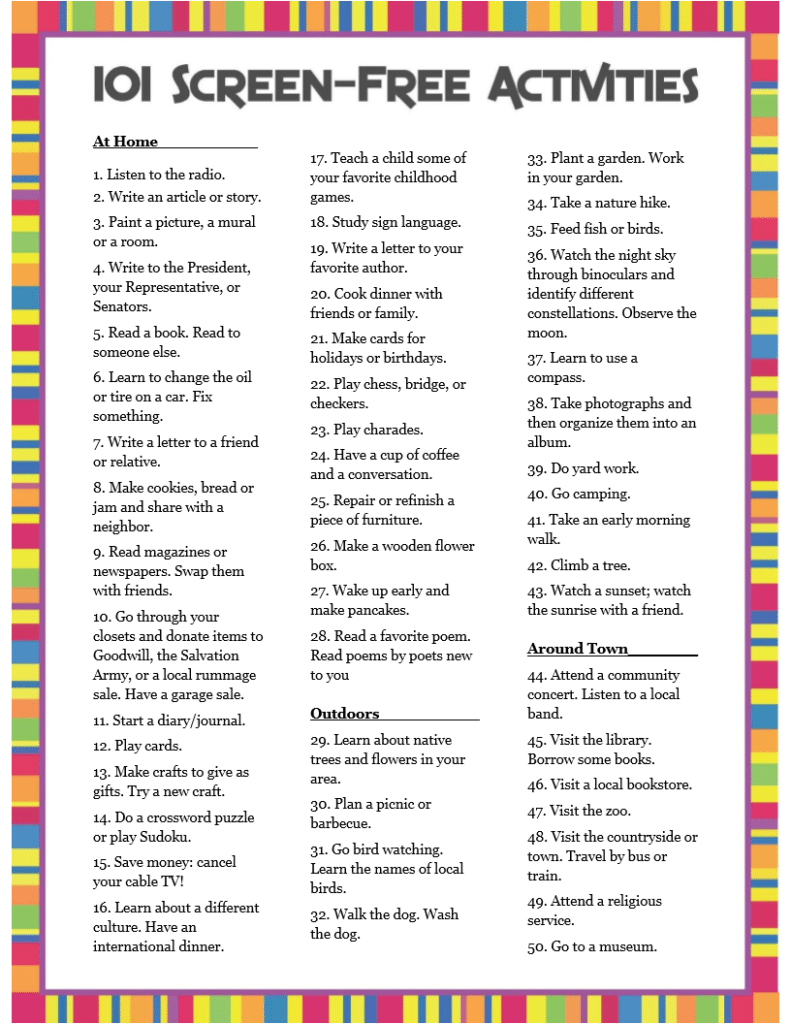

A Practical Guide To A Screen Free Week For Families

May 21, 2025

A Practical Guide To A Screen Free Week For Families

May 21, 2025 -

Manhattan Outdoor Dining Where To Dine Alfresco This Season

May 21, 2025

Manhattan Outdoor Dining Where To Dine Alfresco This Season

May 21, 2025 -

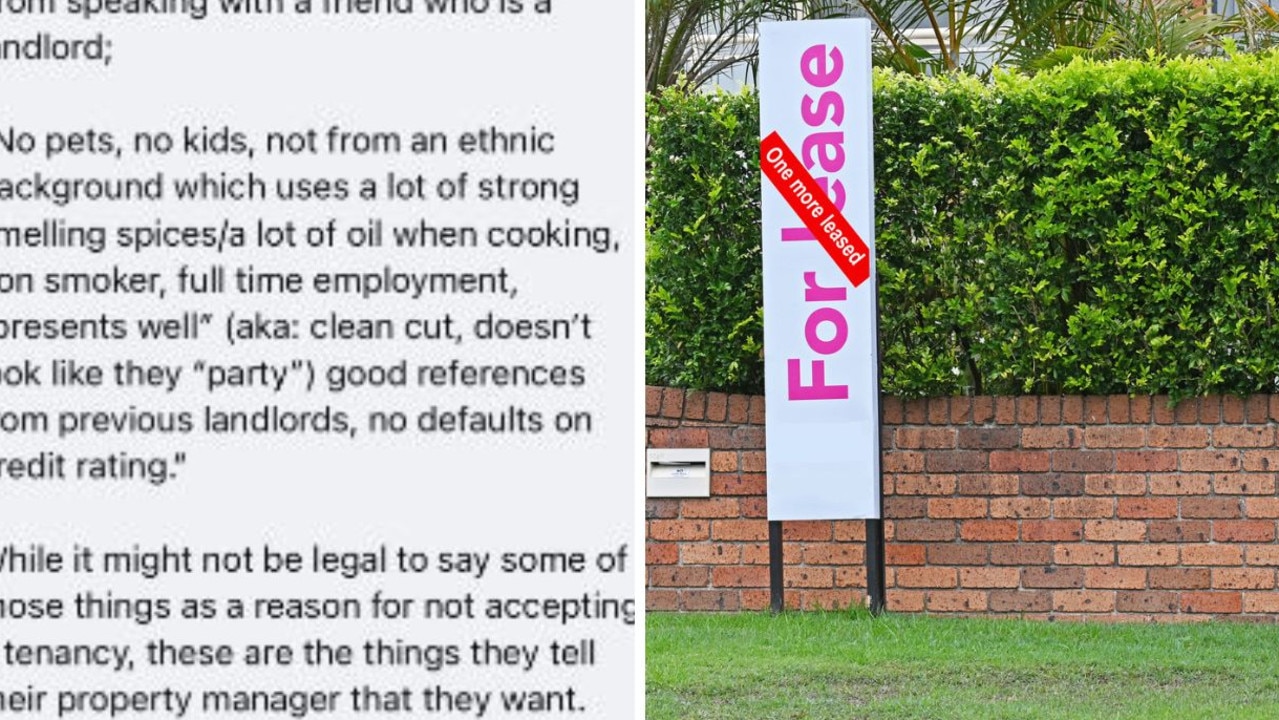

La Renters Face Exploitation After Fires Claims Reality Star

May 21, 2025

La Renters Face Exploitation After Fires Claims Reality Star

May 21, 2025 -

Robin Roberts And The Gma Layoffs A Look At The Fallout

May 21, 2025

Robin Roberts And The Gma Layoffs A Look At The Fallout

May 21, 2025

Latest Posts

-

Tory Councillors Wife Jailed For Racist Tweets The Southport Case

May 22, 2025

Tory Councillors Wife Jailed For Racist Tweets The Southport Case

May 22, 2025 -

Councillors Wife Faces Jail After Anti Migrant Social Media Post

May 22, 2025

Councillors Wife Faces Jail After Anti Migrant Social Media Post

May 22, 2025 -

Southport Stabbing Mums Tweet Costs Her Freedom And Home

May 22, 2025

Southport Stabbing Mums Tweet Costs Her Freedom And Home

May 22, 2025 -

Southport Stabbing Tweet Leads To Mums Imprisonment And Housing Crisis

May 22, 2025

Southport Stabbing Tweet Leads To Mums Imprisonment And Housing Crisis

May 22, 2025 -

Councillors Wife Fails To Overturn Sentence For Anti Migrant Social Media Post

May 22, 2025

Councillors Wife Fails To Overturn Sentence For Anti Migrant Social Media Post

May 22, 2025