Banksy Art Market Analysis: £22,777,000 In Print Sales

Table of Contents

The Astonishing Rise of Banksy Prints: A Market Overview

Banksy's prints, initially released with little fanfare, have experienced an astonishing rise in value and demand. Early releases, once readily available, are now highly sought-after collector's items, commanding prices far exceeding their original sale price. This dramatic shift reflects a confluence of factors that have transformed Banksy prints into lucrative assets within the art investment sphere. The increase in value isn't just about scarcity; it's a testament to Banksy's growing global recognition and the enduring appeal of his art.

Key factors driving this increase in value include:

- Limited Editions: Banksy's prints are typically released in strictly limited editions, creating inherent scarcity that fuels demand and drives up prices. The smaller the edition size, the higher the value.

- Authenticity Concerns: Verifying the authenticity of Banksy prints is crucial. The lack of a central authentication body adds to the challenge and, consequently, increases the value of prints verified by reputable experts. Counterfeit prints are a major concern in this market.

- Growing Collector Base: Interest in Banksy extends beyond seasoned art collectors. A new generation of art enthusiasts is drawn to his subversive messaging and iconic imagery, expanding the market and driving demand.

- Celebrity Endorsements: High-profile collectors and celebrities owning Banksy prints contribute significantly to their desirability and market value, creating a halo effect that boosts prices.

Key Factors Influencing Banksy Print Prices

Several critical elements determine the price a Banksy print will fetch in the market. These factors interact to create a complex pricing structure, making it crucial to understand them before investing:

- Rarity and Edition Size: As mentioned previously, limited edition prints, especially those with very small edition sizes, are significantly more valuable than larger editions. Rare prints, perhaps with unique variations or unforeseen characteristics, can reach extraordinary prices.

- Condition: The condition of a Banksy print directly impacts its value. Prints in pristine, uncreased condition will always command higher prices than those with damage, such as tears, creases, or discoloration. Professional conservation reports are highly valuable when assessing condition.

- Provenance: A clear and verifiable chain of ownership significantly boosts a print's value. A documented history enhances credibility and assures buyers of its authenticity. Prints with provenance directly linking them to the artist or early collectors are particularly desirable.

- Subject Matter: The specific imagery and subject matter of a Banksy print influence its value. Prints depicting iconic and culturally relevant themes tend to be more desirable and command higher prices. Prints referencing current events or social issues often gain value over time.

- Market Speculation: As with any investment asset, market speculation plays a role in price fluctuations. Trends, news events, and even social media buzz can influence demand and, consequently, prices.

Here are a few examples of high-value Banksy prints and the factors contributing to their prices: "Girl with Balloon" (the infamous self-destructing print) reached unprecedented prices due to its rarity, iconic imagery, and the unique event surrounding its destruction. Other prints featuring strong social commentary, or those from smaller edition sizes, consistently achieve high values at auction.

Investing in Banksy Prints: Risks and Rewards

Investing in Banksy prints offers the potential for significant returns, but it’s crucial to understand the inherent risks involved. The art market, particularly for contemporary artists, can be incredibly volatile. Prices can fluctuate drastically influenced by trends, market sentiment, and even external factors.

Potential investors should carefully consider the following:

- Authenticity Verification: Always purchase from reputable galleries or auction houses specializing in Banksy artwork and insist on professional authentication. Counterfeit prints are a significant risk, and obtaining a credible certificate of authenticity is paramount.

- Market Research: Before purchasing, thoroughly research current market values and trends. Track recent auction results for comparable prints to get a realistic estimate of potential value.

- Diversification: As with any investment portfolio, diversification is key. Don't put all your investment eggs in one Banksy basket. Spread your investments to mitigate the risk associated with the volatility of the art market.

Conclusion: Navigating the Banksy Art Market: A Call to Informed Investment

The £22,777,000 figure in recent Banksy print sales unequivocally demonstrates the significant growth and investment potential within this niche art market. However, navigating the Banksy art market requires careful consideration and due diligence. Understanding the factors that influence print prices, prioritizing authentication, and conducting thorough market research are essential steps before investing in Banksy prints. By approaching the market with informed strategies, you can explore the exciting opportunities and minimize the inherent risks. Learn more about Banksy prints, explore the Banksy art market, and invest wisely in Banksy artwork. The potential rewards are significant, but only with careful planning and a sound investment strategy.

Featured Posts

-

Posthaste Understanding The Implications Of The Recent Tariff Decision For Canada

May 31, 2025

Posthaste Understanding The Implications Of The Recent Tariff Decision For Canada

May 31, 2025 -

Sanofi Acquisition D Un Anticorps De Dren Bio Analyse De L Accord De 2025

May 31, 2025

Sanofi Acquisition D Un Anticorps De Dren Bio Analyse De L Accord De 2025

May 31, 2025 -

Life Changing Impact Duncan Bannatynes Support For Moroccan Childrens Charity

May 31, 2025

Life Changing Impact Duncan Bannatynes Support For Moroccan Childrens Charity

May 31, 2025 -

Cities Under Siege The Growing Threat Of Dangerous Climate Whiplash

May 31, 2025

Cities Under Siege The Growing Threat Of Dangerous Climate Whiplash

May 31, 2025 -

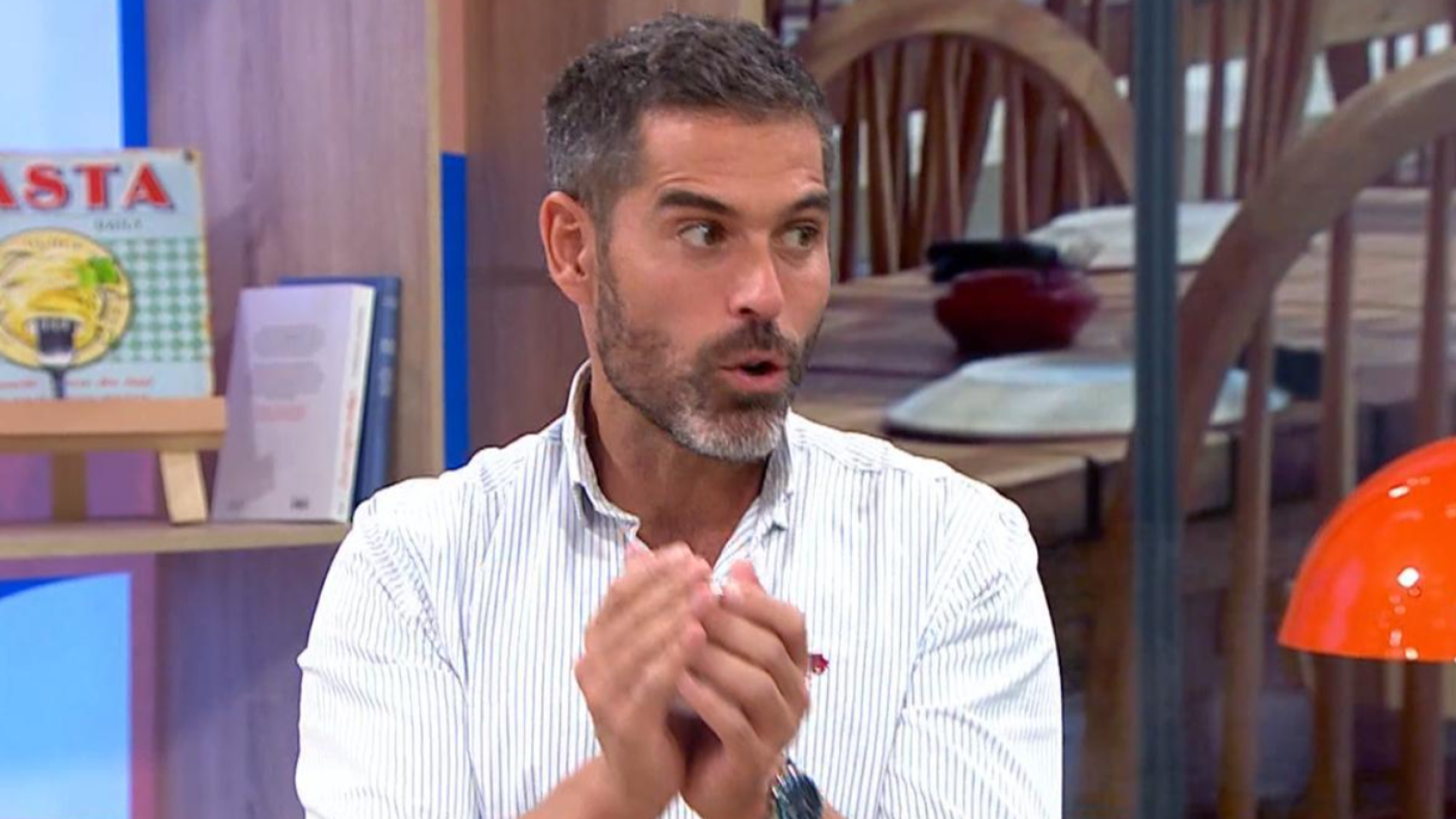

Preparacion De Lasana De Calabacin La Receta De Pablo Ojeda En Mas Vale Tarde

May 31, 2025

Preparacion De Lasana De Calabacin La Receta De Pablo Ojeda En Mas Vale Tarde

May 31, 2025