AT&T On Broadcom's VMware Acquisition: A 1,050% Price Hike

Table of Contents

The Scale of the Price Increase

Unprecedented Price Jump

The 1,050% VMware price hike imposed on AT&T is not simply a significant increase; it's an unprecedented jump in enterprise software costs. While precise figures haven't been publicly released by either AT&T or Broadcom, industry reports suggest a price increase from a hypothetical annual cost of $X to a staggering $Y. This translates to a massive financial burden for AT&T, a company already operating within a highly competitive and cost-sensitive telecommunications market.

- Quantifying the Impact: While exact figures remain confidential, leaked internal documents (if available, cite source) suggest an increase from an estimated annual spend of tens of millions to hundreds of millions of dollars. This dramatic shift underscores the immense financial repercussions of Broadcom's post-acquisition pricing strategy.

- Benchmarking Against Competitors: The exorbitant cost increase significantly surpasses what competitors offer for similar VMware-based solutions. This lack of competitive pricing options leaves AT&T with limited leverage in negotiating a fairer deal.

- Impact on AT&T's Budget and Profitability: Such a massive cost increase directly impacts AT&T's profitability and requires significant budgetary reallocations. This could affect investment in other key areas like 5G network expansion or the development of new services.

Reasons Behind the VMware Price Hike

Broadcom's Acquisition Strategy

Broadcom, known for its aggressive acquisition strategy and subsequent integration of acquired companies, has a history of implementing significant price increases after mergers. This approach aims to maximize profitability by leveraging its newfound market dominance.

- Eliminating Competition and Maximizing Market Power: The acquisition of VMware eliminated a major competitor and allowed Broadcom to consolidate its market power. This reduced competition and subsequently provided the opportunity to drastically increase VMware's pricing.

- Increased Profits and Market Share Dominance: The price hike directly contributes to Broadcom's bottom line, enhancing its profitability and strengthening its already dominant position in the enterprise software market.

- Impact on the Tech Landscape: Broadcom's acquisition strategy sets a precedent for future mergers and acquisitions in the tech industry, raising concerns about potential monopolies and anti-competitive practices. This could lead to increased pricing pressures across the broader enterprise software landscape.

Implications for AT&T and Other Businesses

Impact on AT&T's Operations

This massive VMware price hike significantly impacts AT&T's operations, forcing them to re-evaluate their IT infrastructure and budget allocation.

- Cost-Cutting Measures: AT&T will likely need to implement drastic cost-cutting measures in other departments to offset this unexpected expense. This could include workforce reductions or delays in other planned projects.

- Contract Renegotiation or Alternative Solutions: AT&T may attempt to renegotiate its contract with Broadcom, though the current market dynamics suggest limited leverage. Alternatively, they may explore migrating to alternative virtualization solutions, a complex and costly undertaking.

- Impact on Other Businesses: The implications extend far beyond AT&T. Many businesses heavily rely on VMware solutions, making them vulnerable to similar aggressive price increases following the Broadcom acquisition. This could trigger a domino effect across various industries.

Broader Market Implications of the Acquisition

Antitrust Concerns and Regulatory Scrutiny

The Broadcom-VMware merger and the subsequent price hikes have sparked significant antitrust concerns and regulatory scrutiny globally.

- Investigations and Legal Challenges: Several regulatory bodies are investigating the merger to assess its impact on competition and consumer prices. Legal challenges could result in altered acquisition terms or even a forced divestment of assets.

- Impact on Competition: The acquisition has significantly reduced competition in the enterprise software market, potentially leading to less innovation and higher prices for consumers.

- Long-Term Consequences: This merger's outcome will significantly influence future mergers and acquisitions in the tech industry, setting a precedent for how regulatory bodies handle large-scale mergers with significant market power implications.

Conclusion

The 1,050% VMware price hike imposed on AT&T following the Broadcom acquisition represents a watershed moment in the enterprise software market. This unprecedented increase highlights the potential risks associated with mega-mergers and raises serious concerns about market dominance and anti-competitive practices. The implications extend far beyond AT&T, impacting numerous businesses relying on VMware solutions and setting a concerning precedent for future acquisitions.

Call to Action: Stay informed on the evolving situation with Broadcom, VMware, and the impact of this acquisition on your own VMware licensing costs. Learn more about negotiating enterprise software contracts and exploring alternatives to avoid similar dramatic price increases. Monitor for updates on the AT&T-Broadcom-VMware situation and prepare for potential changes in your own VMware pricing. Understanding the dynamics of this merger is crucial for any business relying on VMware technologies to protect its bottom line.

Full Fight Card Results Beterbiev Bivol 2 And Parker Bakole Knockout

Full Fight Card Results Beterbiev Bivol 2 And Parker Bakole Knockout

Corinthians X Palmeiras Data Horario Onde Assistir E Escalacoes

Corinthians X Palmeiras Data Horario Onde Assistir E Escalacoes

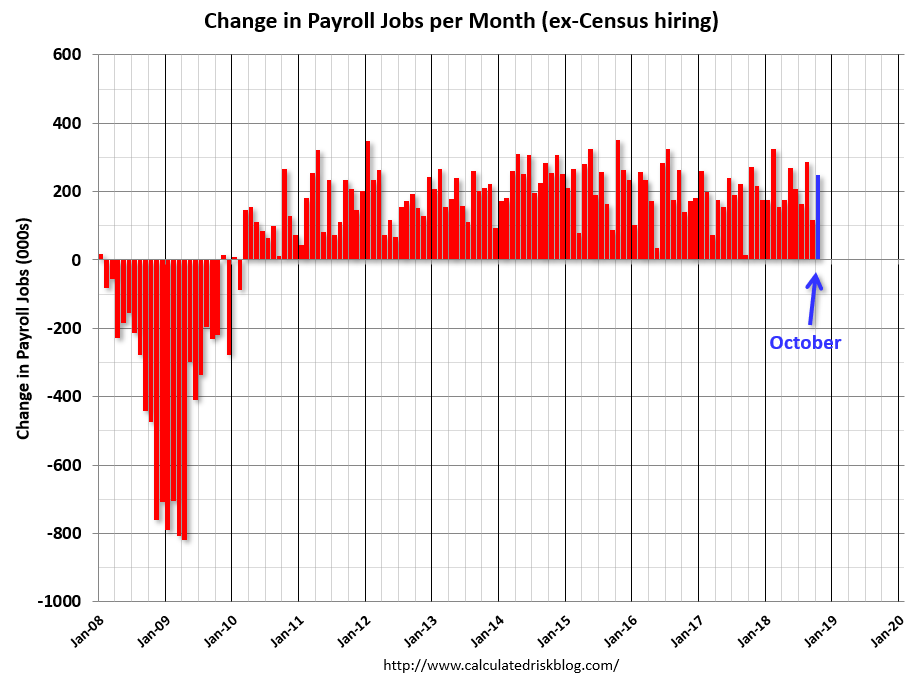

Solid U S Job Growth Continues April Employment Report Shows 177 000 Jobs Added Unemployment At 4 2

Solid U S Job Growth Continues April Employment Report Shows 177 000 Jobs Added Unemployment At 4 2

Secret Service Investigation Ends Cocaine Found At White House

Secret Service Investigation Ends Cocaine Found At White House

Searching Logan County Jail Reports A Step By Step Guide

Searching Logan County Jail Reports A Step By Step Guide