Are We In A Recession? The Stock Market's Unexpected Resilience

Table of Contents

Key Economic Indicators Pointing Towards a Recession (or Not)

The economic landscape is a complex tapestry woven with threads of both positive and negative indicators. Let's examine some key data points to understand the conflicting signals.

Inflation and Interest Rate Hikes

Persistent inflation, as measured by the Consumer Price Index (CPI), remains a significant concern. The Federal Reserve's response – aggressive interest rate hikes – aims to curb inflation but also carries the risk of slowing economic growth. These hikes increase borrowing costs for businesses and consumers, potentially dampening investment and consumer spending.

- High inflation erodes consumer purchasing power. Rising prices for essential goods and services reduce disposable income, impacting consumer demand.

- Increased interest rates make borrowing more expensive for businesses and consumers. This can lead to reduced investment and slower economic expansion.

- Slowing economic growth is a potential consequence. Higher interest rates can trigger a slowdown in economic activity, potentially leading to a recession. Recent inflation rates, while showing signs of cooling, remain above the Federal Reserve's target.

Labor Market Strength

Despite recessionary fears, the labor market remains surprisingly robust. Unemployment rates continue to hover near historic lows, a significant counter-indicator to a recessionary environment.

- Low unemployment rates often signify a healthy economy. A strong labor market typically translates to higher consumer spending and overall economic activity.

- Job growth can sustain consumer spending. Continued employment supports consumer confidence and purchasing power, potentially mitigating the impact of other negative economic indicators.

- A tight labor market can lead to wage increases, potentially fueling inflation. This creates a complex dynamic, where wage growth can be both a positive (higher income) and a negative (increased inflation) factor.

Consumer Spending and Confidence

Consumer spending forms the backbone of the US economy. While some sectors show signs of slowing, overall consumer spending remains relatively strong, suggesting resilience despite inflationary pressures. However, consumer confidence indices reveal fluctuating sentiment, indicating uncertainty about the future economic outlook.

- Strong consumer spending can offset other negative economic indicators. Robust consumer demand can sustain economic growth even in the face of other challenges.

- Declining consumer confidence can signal an impending slowdown. A drop in consumer confidence often precedes a decrease in spending and economic contraction.

- Recent data on retail sales and consumer sentiment present a mixed picture. While spending remains relatively robust, the uncertainty reflected in consumer confidence indices warrants close observation.

The Stock Market's Unexpected Resilience: Factors at Play

Despite the mixed economic signals, the stock market's performance has been surprisingly resilient. Several factors contribute to this apparent contradiction:

Corporate Earnings and Profitability

Strong corporate earnings across several sectors have played a vital role in supporting stock market valuations. Many companies have demonstrated an ability to manage costs and maintain profitability despite inflationary pressures.

- High profitability can attract investors. Strong earnings reports often lead to increased investor confidence and higher stock prices.

- Strong earnings reports can boost stock prices. Companies exceeding earnings expectations often see a surge in their share prices.

- Identify sectors showing resilience (e.g., technology, energy). Certain sectors, like technology and energy, have displayed remarkable resilience, contributing significantly to the overall market strength.

Investor Sentiment and Market Volatility

Investor sentiment, influenced by both economic data and market psychology, plays a significant role in shaping stock prices. While periods of increased market volatility reflect uncertainty, the overall sentiment has shown surprising resilience.

- Increased market volatility can be a sign of uncertainty. Fluctuations in stock prices can reflect investor anxieties about the economic outlook.

- Investor optimism or pessimism can drive stock prices. Market sentiment is a powerful force capable of influencing stock prices independently of underlying economic fundamentals.

- Discuss the role of speculation and market psychology. Speculation and market psychology, often defying rational analysis, can significantly impact market behavior.

The Impact of Monetary Policy and Government Intervention

Central bank actions and government policies exert a significant influence on the stock market. The Federal Reserve's monetary policy, while aiming to curb inflation, also indirectly impacts stock valuations through interest rates and credit availability. Government interventions, such as potential stimulus packages, can also play a role.

- Government stimulus packages can influence economic growth. Direct financial aid or infrastructure investments can stimulate economic activity and positively influence market sentiment.

- Central bank actions can impact interest rates and credit availability. Interest rate changes influence borrowing costs for businesses and consumers, which directly or indirectly affects market performance.

- Discuss the potential for future policy shifts. Changes in monetary or fiscal policy can have significant and unpredictable consequences for the stock market.

Analyzing the Discrepancy: Recession Fears vs. Market Performance

The disconnect between seemingly recessionary economic indicators and the relatively strong stock market performance is a notable puzzle. Several potential explanations exist:

- Markets are forward-looking, often anticipating future economic conditions. The stock market may be already pricing in a potential recession or anticipating a softer landing than some economic models predict.

- There is a potential lag between economic indicators and market reactions. Economic data often reflects past performance, while the market anticipates future trends.

- Other unforeseen factors might be influencing the market's behavior. Unforeseen technological breakthroughs, geopolitical events, or other unexpected factors can influence market performance independently of traditional economic indicators.

Conclusion: Understanding Stock Market Resilience in Uncertain Times

The current economic climate presents a paradox: recessionary fears coexist with unexpected stock market resilience. While several economic indicators suggest a potential slowdown, strong corporate earnings, robust consumer spending (in some sectors), and investor sentiment have defied predictions of a sharp market downturn. The interplay between these factors highlights the complexity of the economic system and the forward-looking nature of the stock market. Understanding this dynamic requires ongoing monitoring of key economic indicators and market trends. Stay informed about the latest economic news and market analysis to navigate the complexities of stock market resilience in the face of potential recession.

Featured Posts

-

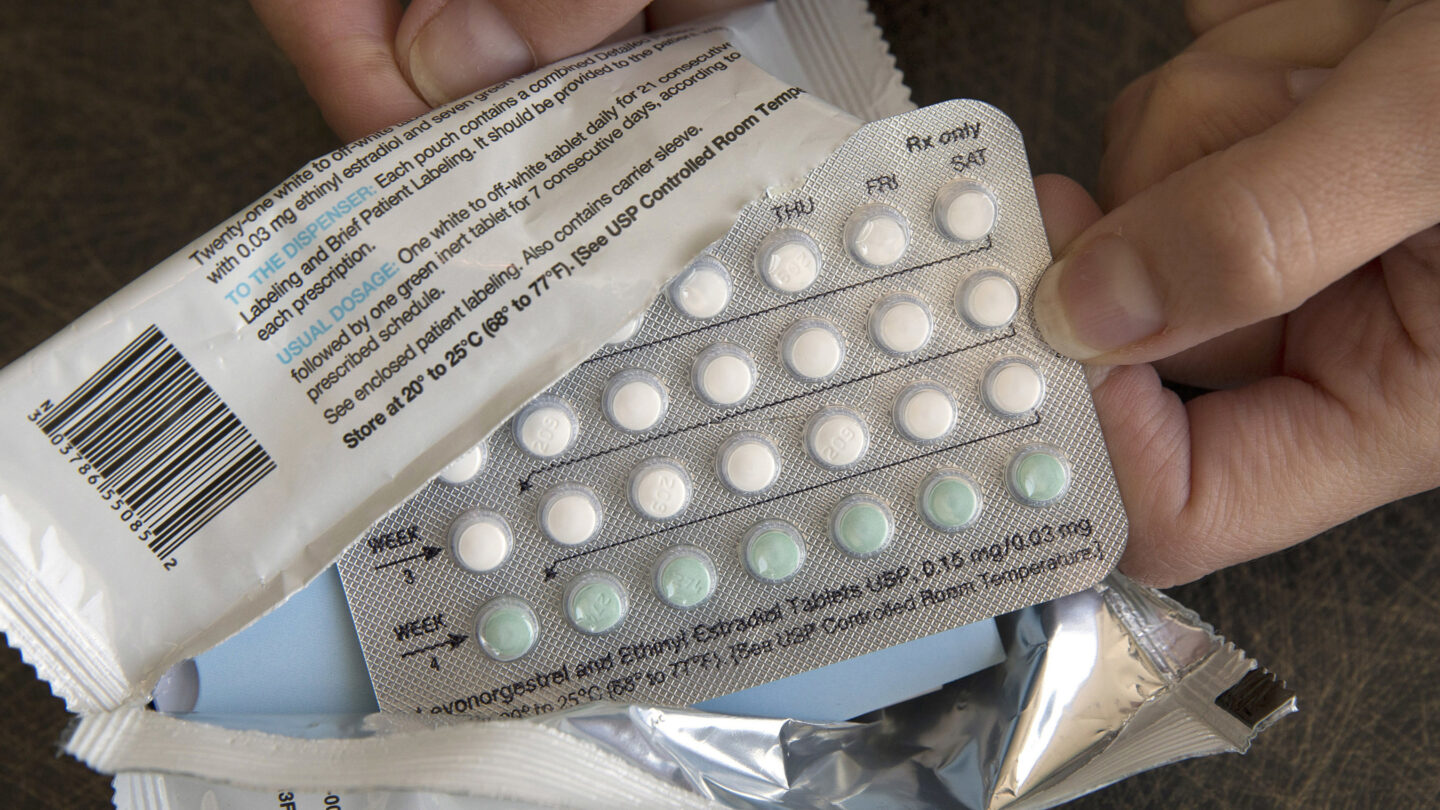

Access To Birth Control The Over The Counter Revolution After Roe

May 06, 2025

Access To Birth Control The Over The Counter Revolution After Roe

May 06, 2025 -

Patrick Schwarzeneggers Wedding To Abby Champion The Reason Behind The Postponement

May 06, 2025

Patrick Schwarzeneggers Wedding To Abby Champion The Reason Behind The Postponement

May 06, 2025 -

The Best Cheap Stuff That Doesnt Suck

May 06, 2025

The Best Cheap Stuff That Doesnt Suck

May 06, 2025 -

Copper Market Update China Weighs Trade Discussions With The United States

May 06, 2025

Copper Market Update China Weighs Trade Discussions With The United States

May 06, 2025 -

Romania Election Latest News And Predictions For The Runoff

May 06, 2025

Romania Election Latest News And Predictions For The Runoff

May 06, 2025

Latest Posts

-

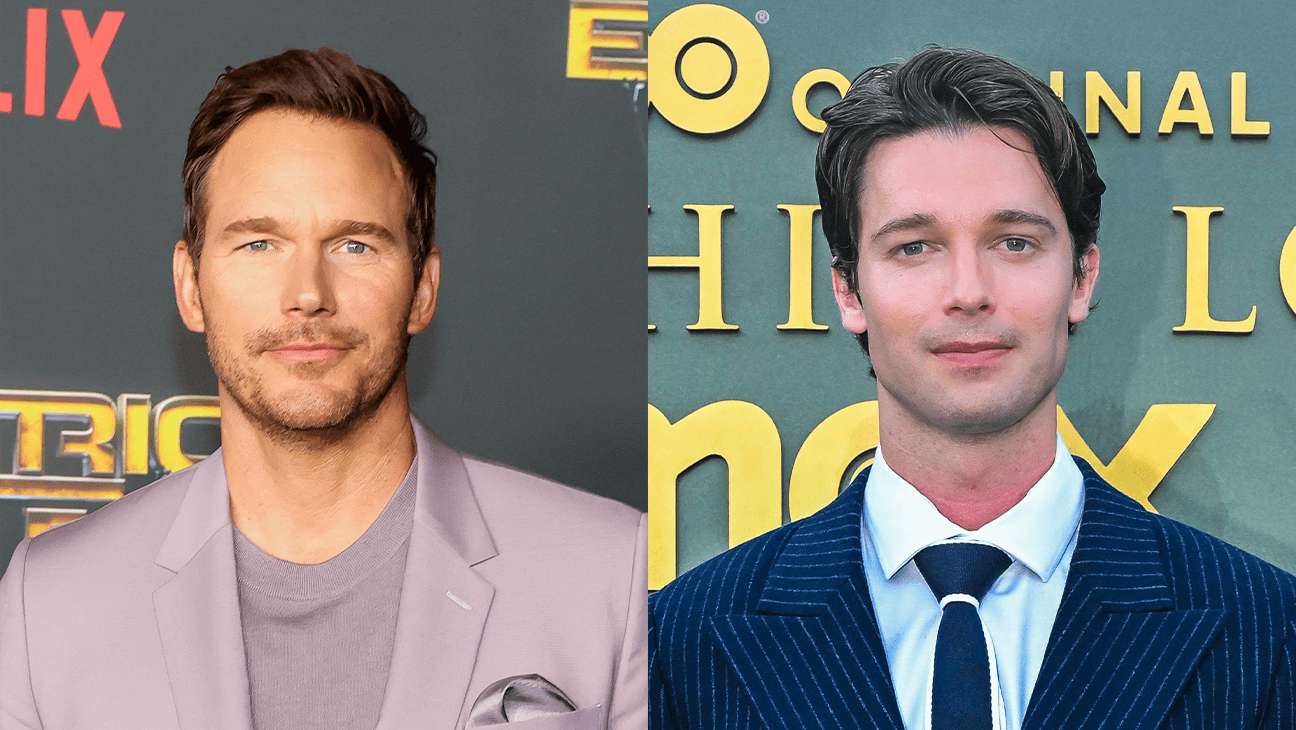

Patrick Schwarzeneggers White Lotus Nude Scene Chris Pratt Weighs In

May 06, 2025

Patrick Schwarzeneggers White Lotus Nude Scene Chris Pratt Weighs In

May 06, 2025 -

Chris Pratts Reaction To Patrick Schwarzeneggers White Lotus Nude Scene

May 06, 2025

Chris Pratts Reaction To Patrick Schwarzeneggers White Lotus Nude Scene

May 06, 2025 -

Shvartsenegger I Chempion Pravda O Syemke Dlya Kim Kardashyan

May 06, 2025

Shvartsenegger I Chempion Pravda O Syemke Dlya Kim Kardashyan

May 06, 2025 -

Foto Patrika Shvartseneggera I Ebbi Chempion Dlya Kim Kardashyan

May 06, 2025

Foto Patrika Shvartseneggera I Ebbi Chempion Dlya Kim Kardashyan

May 06, 2025 -

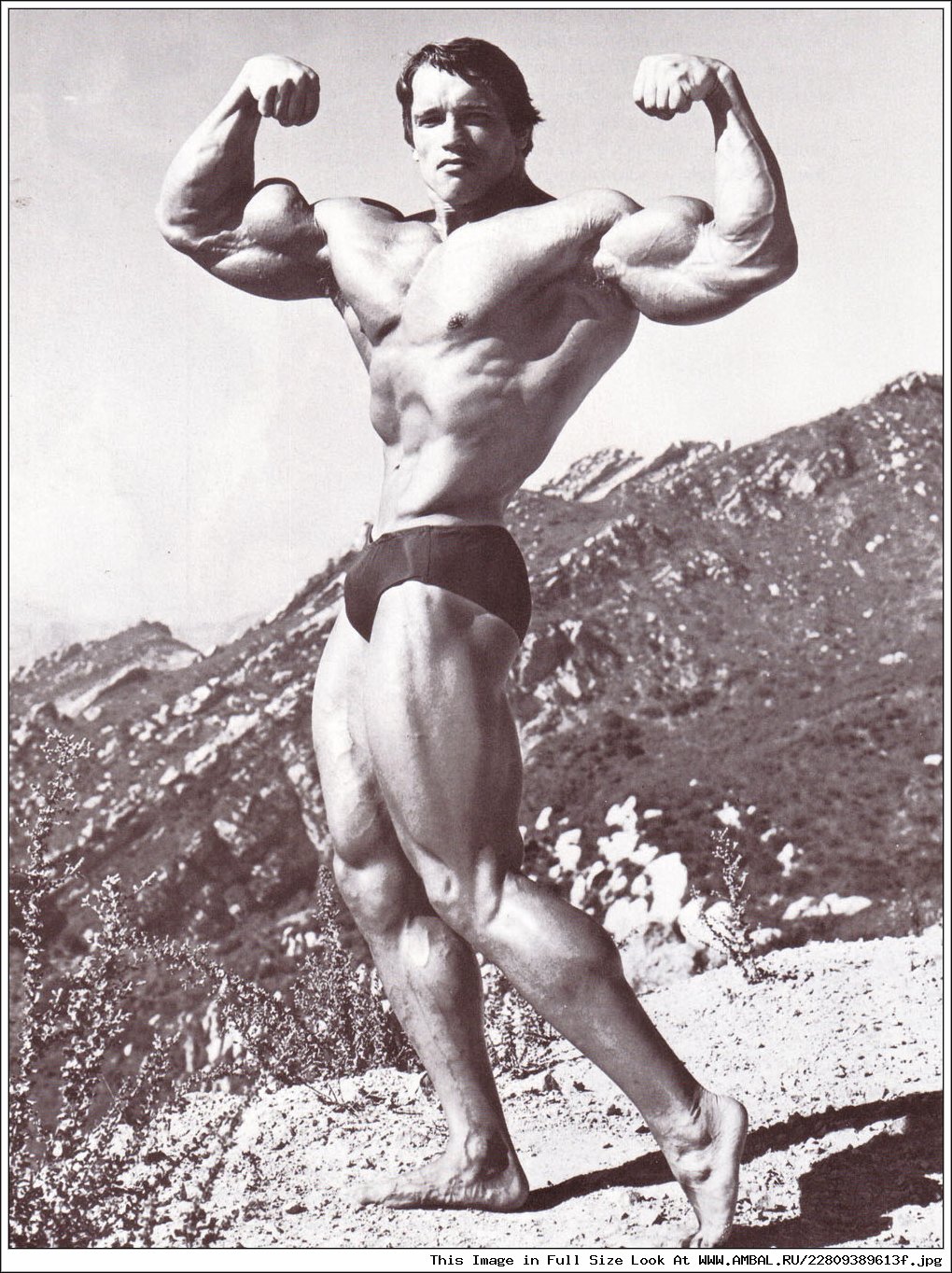

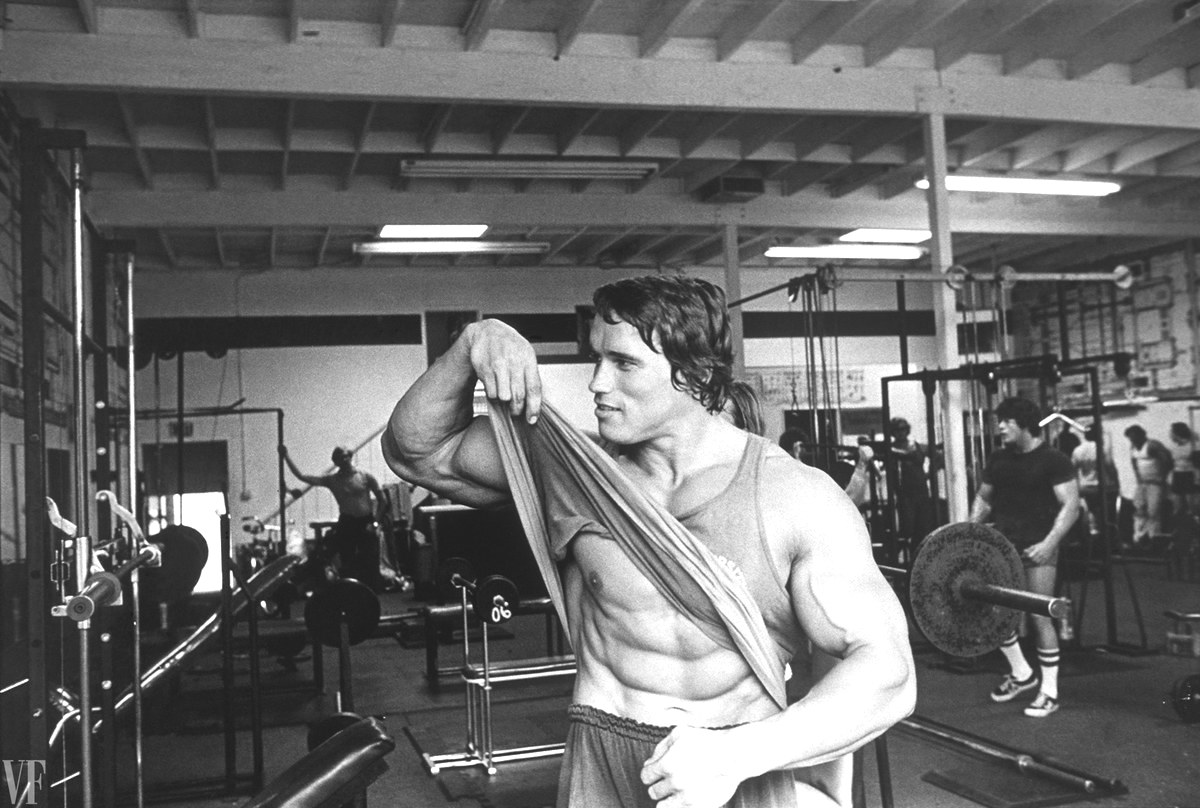

Arnold Schwarzenegger On Patrick Schwarzeneggers Nudity In Film

May 06, 2025

Arnold Schwarzenegger On Patrick Schwarzeneggers Nudity In Film

May 06, 2025