Copper Market Update: China Weighs Trade Discussions With The United States

Table of Contents

China's Role in the Global Copper Market

China's influence on the copper market is undeniable. Its massive consumption and impact on global copper prices make it a key player in any copper market update.

China's Copper Consumption

China is the world's largest consumer of copper, driving significant demand and influencing global copper prices. Its voracious appetite for the red metal is fueled by rapid industrialization and infrastructure development.

- Massive Imports: China imports a substantial portion of its copper needs, making it highly sensitive to global supply chain disruptions and trade policies. For example, in 2022, China imported X tons of copper (insert actual statistic if available).

- Domestic Production: While China is a significant copper producer, its domestic production often falls short of its consumption needs, leading to reliance on imports.

- Key Demand Drivers: Construction, manufacturing (especially electronics and appliances), and renewable energy projects are key drivers of copper demand in China. The ongoing expansion of its infrastructure contributes significantly to this demand.

[Insert graph or chart visualizing China's copper consumption trends over the past 5-10 years. Source the data clearly.]

Impact of Trade Policies on Copper Imports

Tariffs and trade restrictions between the US and China have historically impacted copper imports into China and global supply. Any disruption to this flow significantly influences copper market trends.

- Past Trade Disputes: Previous trade disputes have led to increased copper prices due to uncertainty and potential supply chain disruptions. (Provide specific examples and quantify the price impact if data is available).

- Potential Scenarios: The outcome of ongoing trade negotiations could lead to various scenarios, from increased tariffs resulting in higher prices, to easing of tensions leading to price stabilization or even a decrease. The level of uncertainty necessitates careful monitoring of any copper market update.

US Economic Conditions and Copper Demand

The health of the US economy, particularly its construction and manufacturing sectors, plays a significant role in influencing global copper demand and subsequently the copper price forecast.

US Construction and Infrastructure Spending

Robust US construction activity and infrastructure spending directly translate into increased copper demand.

- Construction Spending Statistics: (Insert statistics on US construction spending and its correlation with copper prices. Cite your source). Increased investment in infrastructure projects, such as the proposed infrastructure bill, could significantly boost copper demand.

- Planned Infrastructure Investments: Government initiatives and private sector investments in infrastructure projects are key factors to watch in any copper market update, as these directly impact copper consumption.

Manufacturing Sector Performance in the US

The performance of the US manufacturing sector is another crucial indicator for copper demand.

- Key Economic Indicators: The Purchasing Managers' Index (PMI) for manufacturing provides valuable insights into the health of the sector and its potential impact on copper demand. (Include recent PMI data and its interpretation).

- Manufacturing Trends: Growth in the manufacturing sector generally leads to increased demand for industrial metals, including copper. Conversely, a slowdown in manufacturing can negatively impact copper prices.

Geopolitical Factors Affecting Copper Prices

Geopolitical instability and global events can create significant uncertainty and volatility in the copper market.

Global Supply Chain Disruptions

Disruptions to global supply chains, stemming from geopolitical events or natural disasters, can restrict copper availability and drive up prices.

- Potential Bottlenecks: Mining disruptions in key producing countries, port congestion, or logistical challenges can all create bottlenecks and impact the copper price forecast. (Give specific examples of recent disruptions and their impact).

- Geopolitical Risks: Political instability in copper-producing regions can significantly disrupt supply and affect prices. (Mention specific regions and their importance in copper production).

Investment Sentiment and Speculation

Investor sentiment and speculation in copper futures markets can significantly influence price volatility.

- Inflation Expectations: Inflationary pressures can drive up demand for commodities like copper, leading to higher prices.

- Interest Rates: Changes in interest rates can impact investor behavior and influence speculation in the copper market. (Explain the relationship).

Copper Price Forecast and Market Outlook

Predicting copper prices is inherently challenging due to the interplay of various economic and geopolitical factors.

Short-Term Copper Price Predictions

Based on the current economic and geopolitical landscape, we offer a cautious short-term copper price forecast. (Provide a price range and justify your prediction with data and analysis from the preceding sections). It’s important to note that unexpected events could significantly alter this prediction.

- Price Range: (State your predicted price range, clearly indicating the uncertainty involved).

- Influencing Factors: (Reiterate the key factors that could influence price movements in the short term).

Long-Term Copper Market Trends

The long-term outlook for the copper market remains positive, driven by the growth of electric vehicles, renewable energy infrastructure, and continued global industrialization.

- Long-Term Demand Drivers: The transition to electric vehicles and the expansion of renewable energy are expected to significantly boost copper demand in the coming decades.

- Potential Supply Constraints: Concerns remain regarding the potential for supply constraints in the long term, given the finite nature of copper resources and the environmental challenges associated with mining.

Conclusion: Understanding the Copper Market Update and its Future

This copper market update highlights the complex interplay of US-China trade relations, economic conditions, and geopolitical events in shaping copper prices. Understanding these factors is crucial for making informed decisions in this dynamic market. The relationship between US-China relations and copper market trends is particularly significant. Monitoring copper market trends and staying abreast of copper price forecasts are essential for investors and businesses operating in this sector. Subscribe to our updates to stay informed about future copper market updates and insightful analyses. Understanding the nuances of the copper market is key to navigating its complexities and capitalizing on opportunities.

Featured Posts

-

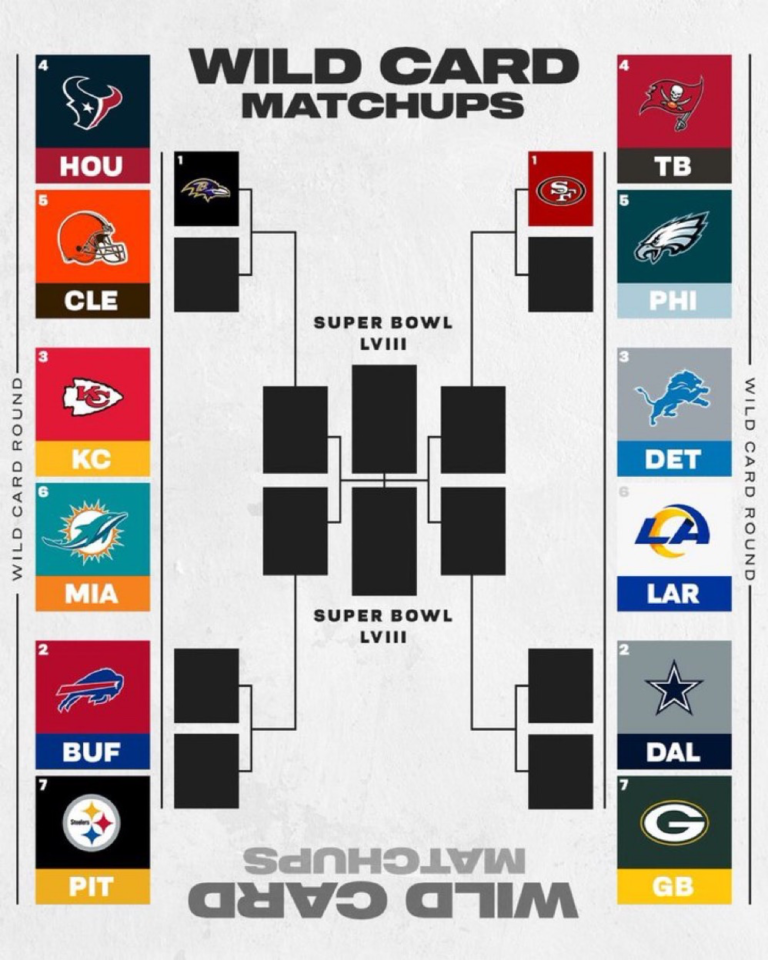

Nba Playoffs 2025 Round 1 Bracket And Tv Listings

May 06, 2025

Nba Playoffs 2025 Round 1 Bracket And Tv Listings

May 06, 2025 -

Nba Round 1 Playoffs 2025 Your Guide To The Games And Tv Schedule

May 06, 2025

Nba Round 1 Playoffs 2025 Your Guide To The Games And Tv Schedule

May 06, 2025 -

Ray Epps Sues Fox News For Defamation January 6th Falsehoods At The Center Of The Case

May 06, 2025

Ray Epps Sues Fox News For Defamation January 6th Falsehoods At The Center Of The Case

May 06, 2025 -

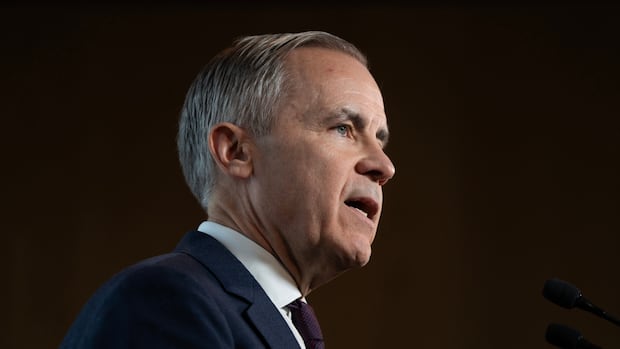

Trump And Carney A Pivotal Meeting For Cusma

May 06, 2025

Trump And Carney A Pivotal Meeting For Cusma

May 06, 2025 -

Sex Lives Of College Girls Cancelled Why The Show Wont Return

May 06, 2025

Sex Lives Of College Girls Cancelled Why The Show Wont Return

May 06, 2025

Latest Posts

-

Sunny 102 3 Fm Sabrina Carpenters Snl Fun Size Surprise

May 06, 2025

Sunny 102 3 Fm Sabrina Carpenters Snl Fun Size Surprise

May 06, 2025 -

Jeff Goldblum And Ariana Grandes Unexpected Collaboration I Dont Know Why I Just Do With The Mildred Snitzer Orchestra

May 06, 2025

Jeff Goldblum And Ariana Grandes Unexpected Collaboration I Dont Know Why I Just Do With The Mildred Snitzer Orchestra

May 06, 2025 -

Sabrina Carpenters Unexpected Snl Collaboration A Fun Size Twist

May 06, 2025

Sabrina Carpenters Unexpected Snl Collaboration A Fun Size Twist

May 06, 2025 -

Snl Surprise Sabrina Carpenter Teams Up With Fun Size Castmate

May 06, 2025

Snl Surprise Sabrina Carpenter Teams Up With Fun Size Castmate

May 06, 2025 -

Listen Now Jeff Goldblum Ariana Grande And The Mildred Snitzer Orchestras I Dont Know Why I Just Do

May 06, 2025

Listen Now Jeff Goldblum Ariana Grande And The Mildred Snitzer Orchestras I Dont Know Why I Just Do

May 06, 2025