Election Promises And The Looming Deficit: An Economic Analysis

Table of Contents

- The Scale of Promised Spending and its Impact on the Deficit

- Assessing the Economic Feasibility of Election Promises

- The Long-Term Implications of Unfunded Election Promises

- Comparing Fiscal Responsibility Across Different Parties

- Conclusion: Understanding the Economic Realities of Election Promises and the Looming Deficit

The Scale of Promised Spending and its Impact on the Deficit

The magnitude of spending promises made during election campaigns is often staggering. Parties frequently pledge increased funding for various sectors, from infrastructure development and healthcare to education and social welfare programs. These promises, while often popular with voters, significantly impact government spending and contribute to a widening budget deficit. The projected increase in government debt resulting from these commitments can be substantial, potentially jeopardizing the nation's long-term economic stability.

-

Example 1: Cost of Promised Infrastructure Projects and their Effect on Deficit: A pledge to rebuild the nation's aging infrastructure, while beneficial, might require hundreds of billions of dollars in investment, adding significantly to the national debt and the annual deficit. This increased spending must be carefully weighed against its potential economic benefits and the associated long-term fiscal implications.

-

Example 2: Impact of Proposed Tax Cuts on Government Revenue: Tax cuts, another common election promise, can stimulate economic growth but also reduce government revenue. The extent to which these cuts impact the deficit depends on the size of the cuts, the elasticity of tax revenues, and the resulting economic growth. A thorough cost-benefit analysis is crucial.

-

Example 3: Analysis of the Cost of Proposed Social Welfare Programs: Expansion of social welfare programs, such as universal healthcare or increased unemployment benefits, represent significant financial commitments. The long-term budgetary impact of these programs needs to be carefully assessed, considering factors like population aging and economic growth projections.

Assessing the Economic Feasibility of Election Promises

Evaluating the economic feasibility of election promises requires a thorough examination of revenue generation potential and the potential consequences of increased borrowing. Can the promised spending be funded through realistic revenue increases, or will it necessitate significant increases in government debt? Let's examine these key factors:

-

Analysis of the Economic Growth Projections Used to Justify the Spending Plans: Many parties base their spending plans on optimistic economic growth projections. A critical assessment of the realism of these projections is essential. Overly optimistic forecasts can lead to unsustainable levels of government debt.

-

Examination of Alternative Revenue-Generating Measures Proposed: Some parties might propose alternative revenue-generating measures such as increased taxes on corporations or high-income earners, or more efficient tax collection mechanisms. The effectiveness and potential economic consequences of these proposals need to be analyzed carefully.

-

Discussion of the Potential for Crowding Out Private Investment Due to Increased Government Borrowing: Increased government borrowing can drive up interest rates, making it more expensive for businesses to borrow money and invest in growth-generating activities. This "crowding out effect" can hinder private sector investment and economic growth in the long run.

The Long-Term Implications of Unfunded Election Promises

Unfunded or poorly funded election promises can have severe long-term consequences. Unsustainable debt levels can lead to economic instability, jeopardizing future generations' economic well-being.

-

Impact on Future Government Spending Priorities: High debt levels can constrain future government spending, forcing difficult choices between essential public services, such as education, healthcare, and infrastructure maintenance.

-

Potential for Reduced Social Services and Public Infrastructure Investment: To manage debt, future governments may be forced to cut spending on essential social services and public infrastructure, leading to a decline in the quality of life and economic productivity.

-

Risks of a Sovereign Debt Crisis: In extreme cases, high levels of national debt can lead to a sovereign debt crisis, characterized by a loss of investor confidence, rising borrowing costs, and potential defaults on government debt.

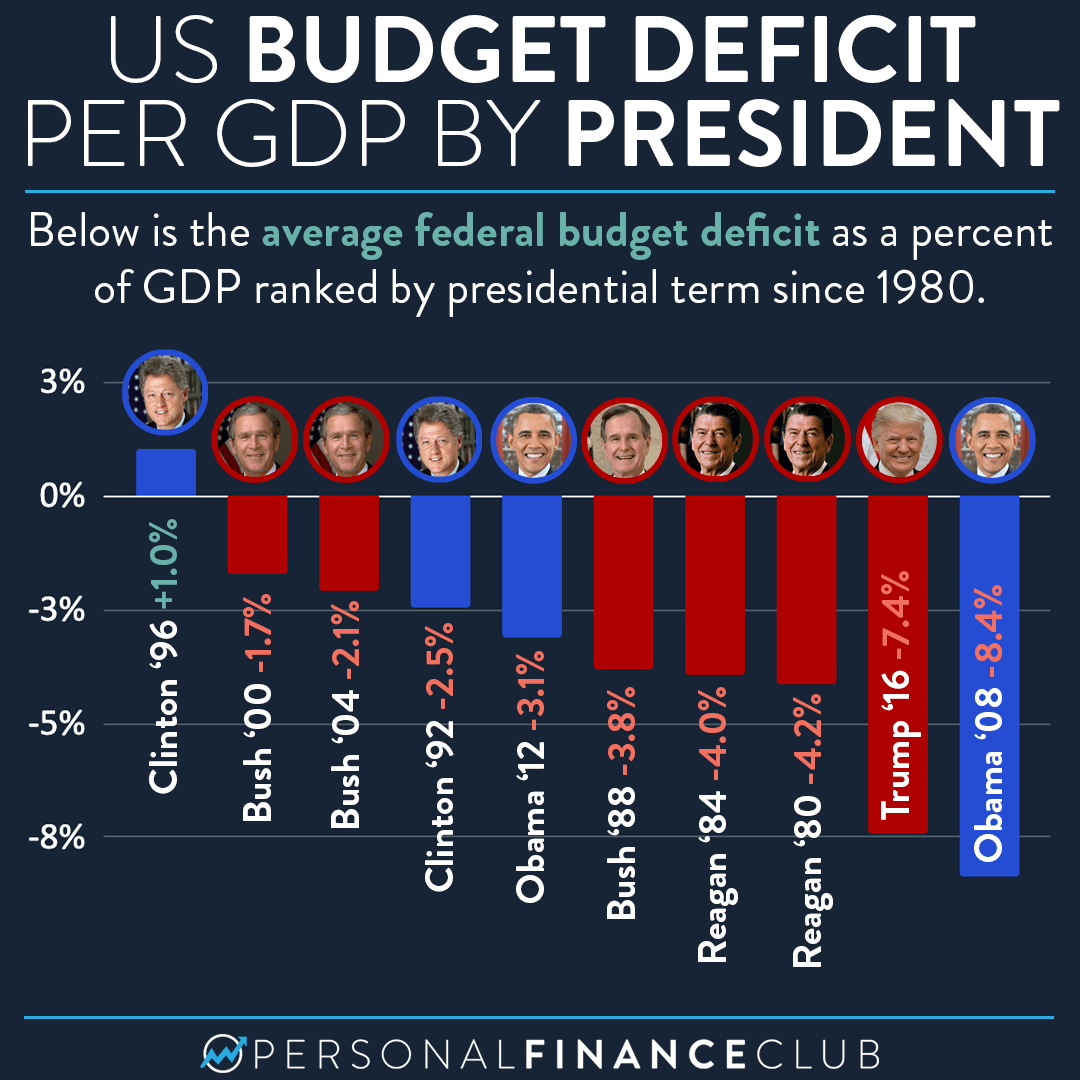

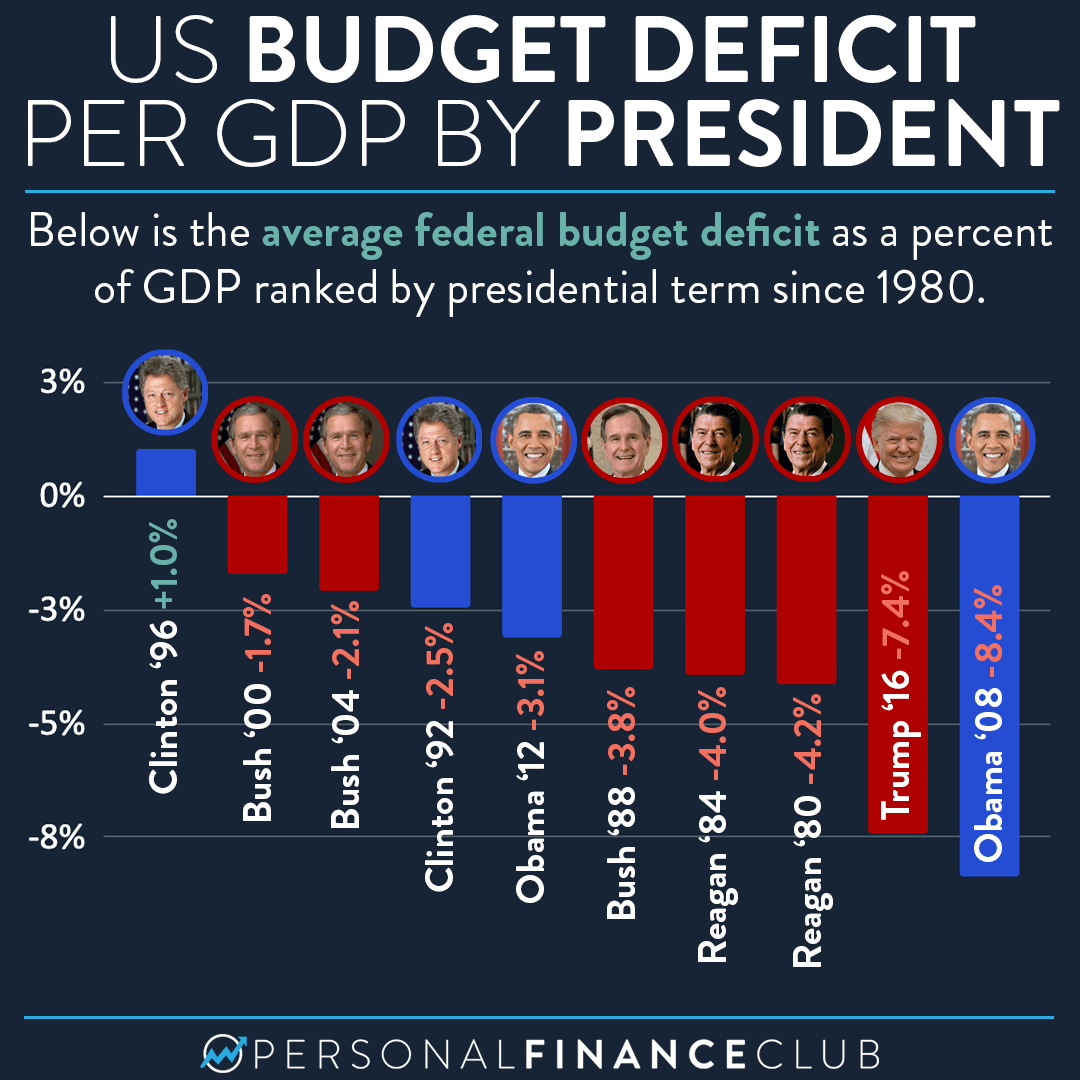

Comparing Fiscal Responsibility Across Different Parties

A comparative analysis of the economic platforms of different political parties is crucial for voters. This analysis should consider the fiscal responsibility and long-term sustainability of each party’s plans.

-

A Table Comparing Key Economic Proposals of Competing Parties: A clear table summarizing key economic proposals (tax plans, spending commitments, deficit projections) across different parties can significantly aid voter understanding.

-

An Assessment of the Credibility of Each Party’s Economic Forecasts: The credibility of each party’s economic forecasts should be assessed, considering the underlying assumptions and potential biases.

-

A Discussion of the Potential Political Consequences of Fiscal Irresponsibility: The political consequences of fiscal irresponsibility, such as loss of investor confidence and decreased economic growth, should be discussed.

Conclusion: Understanding the Economic Realities of Election Promises and the Looming Deficit

Understanding the economic realities behind election promises is paramount. This analysis highlighted the significant impact election promises can have on the national deficit and the long-term economic health of the country. Voters must critically analyze the economic feasibility of these promises, considering the potential long-term consequences. Responsible voting requires a thorough understanding of "election promises and the looming deficit," including the fiscal plans of each political party. We urge readers to delve deeper into the specific party platforms and their detailed fiscal plans before casting their votes. Informed choices are crucial for a fiscally responsible and sustainable future.

Stock Market Valuations Why Bof A Says Investors Shouldnt Worry

Stock Market Valuations Why Bof A Says Investors Shouldnt Worry

Ray Epps Defamation Lawsuit Against Fox News Details Of The January 6th Allegations

Ray Epps Defamation Lawsuit Against Fox News Details Of The January 6th Allegations

2025 Nfl Draft Prospect Scouting Report On Texas Wr Matthew Golden

2025 Nfl Draft Prospect Scouting Report On Texas Wr Matthew Golden

Experience Europes Best 10 Premier Shopping Spots

Experience Europes Best 10 Premier Shopping Spots

Tarihi Fotograflarla Canakkale Nin Dostluk Hikayesi

Tarihi Fotograflarla Canakkale Nin Dostluk Hikayesi