Are High Stock Valuations A Concern? BofA's Analysis

Table of Contents

H2: BofA's Key Findings on High Stock Valuations

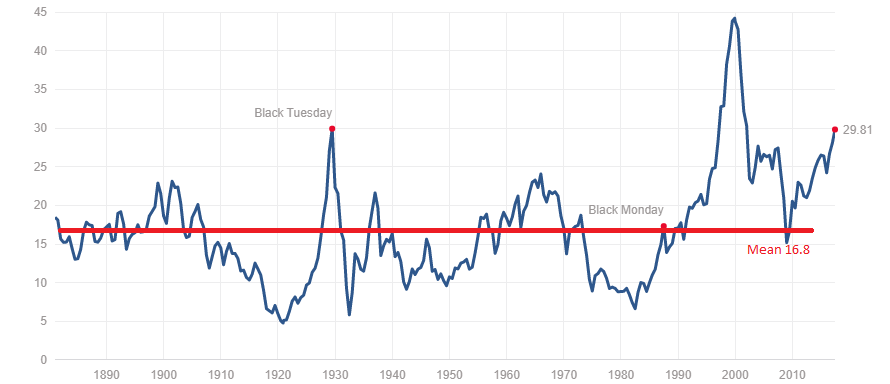

BofA's research delves into the current state of stock market valuation, employing various stock valuation metrics to assess whether the market is fairly valued, overvalued, or undervalued. Their analysis incorporates a range of factors, providing a comprehensive picture of the current investment landscape. While the specific details of their report may vary over time, key valuation metrics like the price-to-earnings ratio (P/E) and the price-to-sales ratio (P/S), along with market capitalization data and comparisons to historical valuation benchmarks, are central to their assessment.

- Key Valuation Metrics: BofA utilizes a range of valuation metrics, including forward and trailing P/E ratios, P/S ratios, and other relevant financial indicators to assess individual stocks and the overall market. These metrics are compared to historical averages and industry benchmarks to determine whether current valuations appear justified.

- Sector-Specific Analysis: The BofA report often identifies specific sectors or industries exhibiting either relatively high or low valuations. This granular analysis allows investors to make more informed decisions based on their risk tolerance and investment objectives. For example, certain technology sectors might show higher P/E ratios than others due to expectations of future growth.

- Discrepancies from Historical Averages: BofA's analysis frequently highlights the discrepancies between current valuation multiples and their historical averages. These comparisons are crucial for determining whether current valuations represent a significant deviation from historical norms and assessing potential risks.

H2: Factors Contributing to High Stock Valuations

Several intertwined factors contribute to the current elevated stock valuations. Understanding these dynamics is vital for comprehending the current market environment and anticipating future trends.

- Low Interest Rates: Historically low interest rates have significantly influenced stock valuations. Low borrowing costs reduce the discount rate used in discounted cash flow (DCF) valuations, making future earnings streams appear more valuable and pushing up stock prices.

- Quantitative Easing (QE): Central bank policies like QE inject liquidity into the market, increasing the money supply and making it easier for investors to borrow and invest, thus inflating asset prices, including stocks.

- Inflation and Economic Growth: While inflation can erode corporate earnings and hurt valuations, strong economic growth can boost corporate profits and justify higher stock prices. The interplay between inflation and growth is a critical factor in determining stock valuations. Investor sentiment, often driven by news and economic forecasts, also plays a powerful role. Periods of optimism can inflate valuations beyond what fundamentals alone would suggest, while fear and uncertainty can have the opposite effect.

H2: The Risks Associated with High Stock Valuations

High stock valuations inherently carry a higher degree of risk. While promising returns, they also expose investors to greater potential losses.

- Market Corrections and Crashes: High valuations often precede market corrections or even more severe downturns. A sudden shift in investor sentiment, rising interest rates, or a negative economic shock could trigger a significant decline in stock prices.

- Rising Interest Rates: As central banks raise interest rates to combat inflation, the cost of borrowing increases, impacting corporate profitability and making future earnings streams less valuable, potentially leading to lower stock valuations.

- High Inflation Impact: Sustained high inflation erodes corporate profit margins and reduces the real value of future earnings, negatively influencing stock valuations. A combination of these factors increases the likelihood of market volatility. This emphasizes the importance of risk management strategies such as diversification and hedging to protect portfolios.

H2: BofA's Recommendations for Investors

BofA's recommendations for investors often involve a nuanced approach that considers individual risk tolerance and long-term investment goals. Their advice typically emphasizes the importance of a well-diversified portfolio and a long-term investment strategy.

- Sector Rotation: BofA may suggest strategic sector rotation, moving funds from overvalued sectors to potentially undervalued ones, as part of an overall portfolio adjustment. This dynamic approach helps to balance risk and potential returns.

- Risk Tolerance and Diversification: Regardless of market conditions, BofA consistently emphasizes the significance of matching investment strategies to individual risk profiles and diversifying investments across various asset classes to mitigate risk.

- Long-Term Perspective: Many times, BofA advises maintaining a long-term investment horizon, focusing on the underlying fundamentals of companies and avoiding impulsive reactions to short-term market fluctuations. This approach is crucial for weathering market volatility.

3. Conclusion:

BofA's analysis of high stock valuations highlights the complex interplay of economic factors influencing market conditions. Understanding valuation metrics, considering contributing factors such as low interest rates and quantitative easing, and recognizing potential risks such as market corrections are crucial for informed investment decisions. BofA's recommendations often emphasize a balanced approach, incorporating risk management principles, diversification, and a long-term investment strategy. Conduct thorough research and consult with a financial advisor before making any investment decisions. Continuously monitor high stock valuations and adapt your investment strategies accordingly. Staying informed about high stock valuations and the broader market outlook is vital for successful long-term investing.

Featured Posts

-

Celebrity Hairstylist Sam Mc Knight A Retrospective Of Iconic Looks

Apr 25, 2025

Celebrity Hairstylist Sam Mc Knight A Retrospective Of Iconic Looks

Apr 25, 2025 -

Sadie Sink Visits Stranger Things Broadway Cast A Night Off Photo

Apr 25, 2025

Sadie Sink Visits Stranger Things Broadway Cast A Night Off Photo

Apr 25, 2025 -

High Stock Market Valuations A Bof A Analysis And Investor Reassurance

Apr 25, 2025

High Stock Market Valuations A Bof A Analysis And Investor Reassurance

Apr 25, 2025 -

Tramp I Okonchanie Voyny V Ukraine Neprostye Peregovory

Apr 25, 2025

Tramp I Okonchanie Voyny V Ukraine Neprostye Peregovory

Apr 25, 2025 -

Donald Trump Presidency News April 23 2025 Updates

Apr 25, 2025

Donald Trump Presidency News April 23 2025 Updates

Apr 25, 2025

Latest Posts

-

Singer Wynne Evans Shares Health Update Following Serious Illness

May 10, 2025

Singer Wynne Evans Shares Health Update Following Serious Illness

May 10, 2025 -

Wynne Evans Health Battle His Illness And Potential Showbiz Comeback

May 10, 2025

Wynne Evans Health Battle His Illness And Potential Showbiz Comeback

May 10, 2025 -

Wynne Evans Health Update A Nasty Illness And Showbiz Return Hints

May 10, 2025

Wynne Evans Health Update A Nasty Illness And Showbiz Return Hints

May 10, 2025 -

Ensuring Inclusive Travel Wheelchair Access On The Elizabeth Line

May 10, 2025

Ensuring Inclusive Travel Wheelchair Access On The Elizabeth Line

May 10, 2025 -

The Elizabeth Line Challenges And Opportunities For Wheelchair Accessibility

May 10, 2025

The Elizabeth Line Challenges And Opportunities For Wheelchair Accessibility

May 10, 2025