Are High Stock Market Valuations A Concern? BofA Weighs In

Table of Contents

BofA's Assessment of Current Market Valuations

BofA's assessment of current market valuations is nuanced. While acknowledging the elevated levels, their stance isn't a blanket condemnation of the current market. Their analyses often incorporate multiple valuation metrics, providing a more comprehensive picture than relying on a single indicator. Instead of simply declaring the market "overvalued," BofA's reports usually suggest a more cautious approach.

- Metrics Used: BofA utilizes various valuation metrics, including Price-to-Earnings ratios (P/E), Price-to-Sales ratios (P/S), and the cyclically adjusted price-to-earnings ratio (Shiller PE), to paint a holistic picture. These metrics are compared against historical data and industry benchmarks to assess relative valuation.

- Key Findings: (Note: Specific data from BofA reports would need to be inserted here. For example: "A recent BofA report indicated that the S&P 500's forward P/E ratio is currently at X, exceeding the long-term average by Y%. However, they noted that strong corporate earnings growth has partially offset this elevated valuation.")

- Sector-Specific Analysis: BofA often provides sector-specific valuations, identifying sectors they view as potentially overvalued (e.g., technology) and those appearing undervalued (e.g., energy, depending on market conditions). This granular approach helps investors make informed decisions about portfolio allocation.

- Economic Indicators: BofA's assessment considers macro-economic indicators like interest rates, inflation, and GDP growth. These factors significantly influence market valuations and are crucial in formulating their overall outlook.

Factors Contributing to High Stock Market Valuations

Several interconnected factors have contributed to the current high stock market valuations. Understanding these factors is essential to interpreting BofA's analysis and formulating an informed investment strategy.

- Low Interest Rates: Historically low interest rates have made borrowing cheaper for companies and reduced the attractiveness of bonds relative to stocks, driving investors towards equities. This has pushed up demand and, consequently, prices.

- Quantitative Easing (QE): The implementation of QE policies by central banks injected vast sums of liquidity into the market, further inflating asset prices, including stocks. This artificial boost to liquidity may have played a role in driving valuations beyond levels justified by fundamentals alone.

- Strong Corporate Earnings: Strong corporate earnings growth in many sectors has supported higher valuations. However, the question remains whether this growth is sustainable and whether it fully justifies the current elevated price levels.

- Investor Sentiment: Optimism and bullish investor sentiment can drive prices beyond what might be considered fundamentally justified. This psychological factor can exacerbate market trends, pushing valuations higher in the short term.

Potential Risks Associated with High Valuations

High stock market valuations come with inherent risks. While potential rewards exist, understanding these risks is crucial for prudent investment decision-making.

- Market Corrections or Crashes: High valuations often precede market corrections or crashes. A sharp decline in prices is a significant risk when valuations are already stretched. History shows that periods of high valuations are followed by periods of significant market decline.

- Increased Volatility: Markets with high valuations tend to exhibit increased volatility. Sharp price swings can significantly impact portfolio value and investor sentiment. This increased uncertainty necessitates a more cautious investment approach.

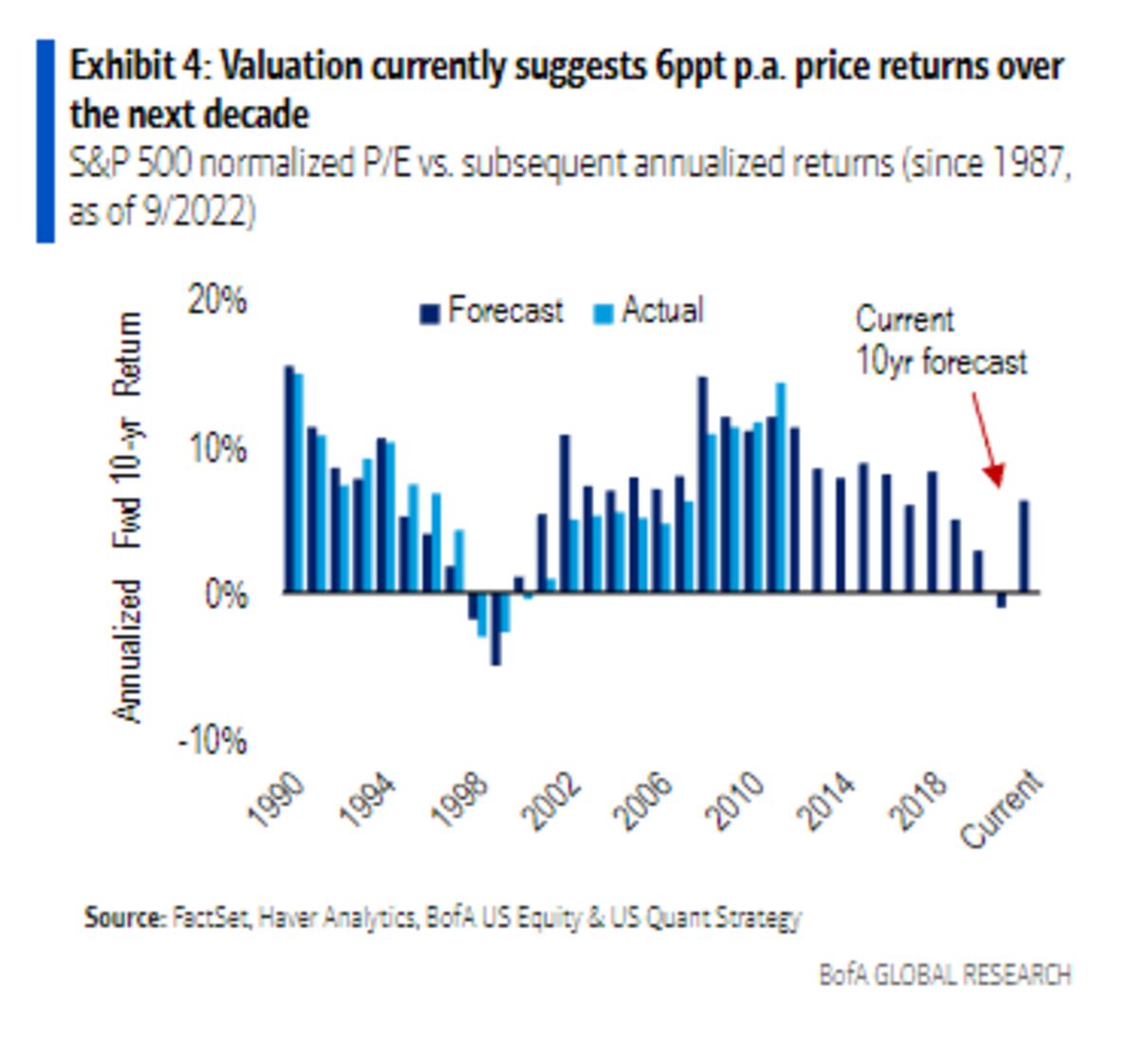

- Reduced Returns: Investing in a market with high valuations often translates to lower future returns compared to investing at historically lower valuations. While past performance doesn't guarantee future results, historical data suggests a correlation between high valuations and lower subsequent returns.

BofA's Recommendations for Investors

BofA's recommendations usually emphasize a cautious but not overly pessimistic approach to investing in a market with high valuations. Their advice typically includes:

- Diversification Strategies: BofA often recommends diversified portfolios to mitigate the impact of market downturns. Spreading investments across different asset classes, sectors, and geographies reduces the overall risk.

- Sector-Specific Approaches: Instead of a blanket approach, they suggest focusing on specific sectors that show relatively strong fundamentals and appear less overvalued compared to the broader market.

- Risk Management Techniques: Effective risk management strategies, including stop-loss orders and hedging techniques, are essential to protect investments during periods of market volatility.

Conclusion: Navigating High Stock Market Valuations – Key Takeaways

BofA's perspective on high stock market valuations highlights a need for careful consideration and a nuanced approach to investing. While they don't necessarily advocate for a complete market exit, they emphasize the importance of risk management and diversification. Understanding the factors contributing to these high valuations, as well as the potential risks associated with them, is crucial for making informed investment decisions. Remember, high stock market valuations are a double-edged sword—presenting both potential rewards and significant risks.

Understanding high stock market valuations is crucial for informed investing. Conduct thorough research, stay updated on market trends, and seek professional financial advice before making any investment decisions. Don't hesitate to consult experts and analyze multiple perspectives before committing your capital. The analysis of high stock market valuations is an ongoing process, requiring constant monitoring and adaptation to changing market conditions.

Featured Posts

-

Gavin Newsoms Transgender Athlete Policy Unfair Or Necessary

Apr 26, 2025

Gavin Newsoms Transgender Athlete Policy Unfair Or Necessary

Apr 26, 2025 -

Could Deion Sanders Help Shedeur Sanders Join The Cleveland Browns

Apr 26, 2025

Could Deion Sanders Help Shedeur Sanders Join The Cleveland Browns

Apr 26, 2025 -

Unlocking Potential How Middle Managers Drive Company And Employee Success

Apr 26, 2025

Unlocking Potential How Middle Managers Drive Company And Employee Success

Apr 26, 2025 -

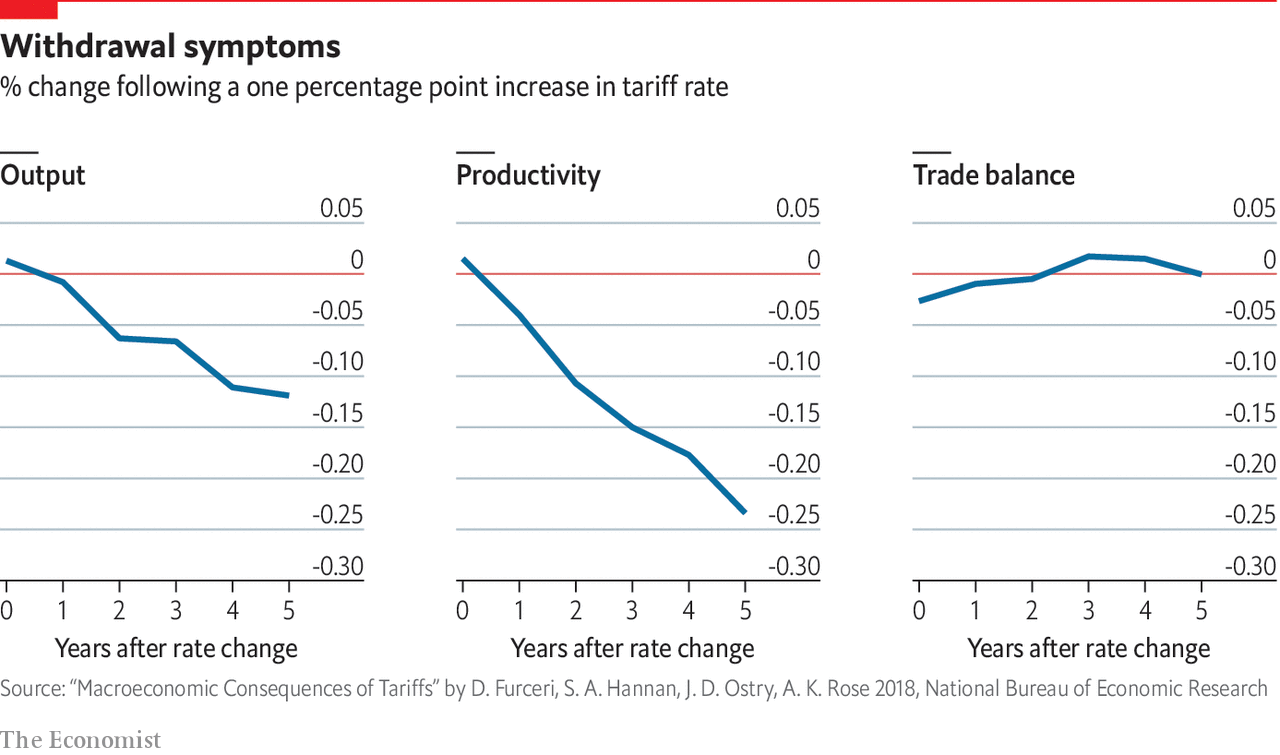

Tariffs Threaten To Curb Big Techs Advertising Growth

Apr 26, 2025

Tariffs Threaten To Curb Big Techs Advertising Growth

Apr 26, 2025 -

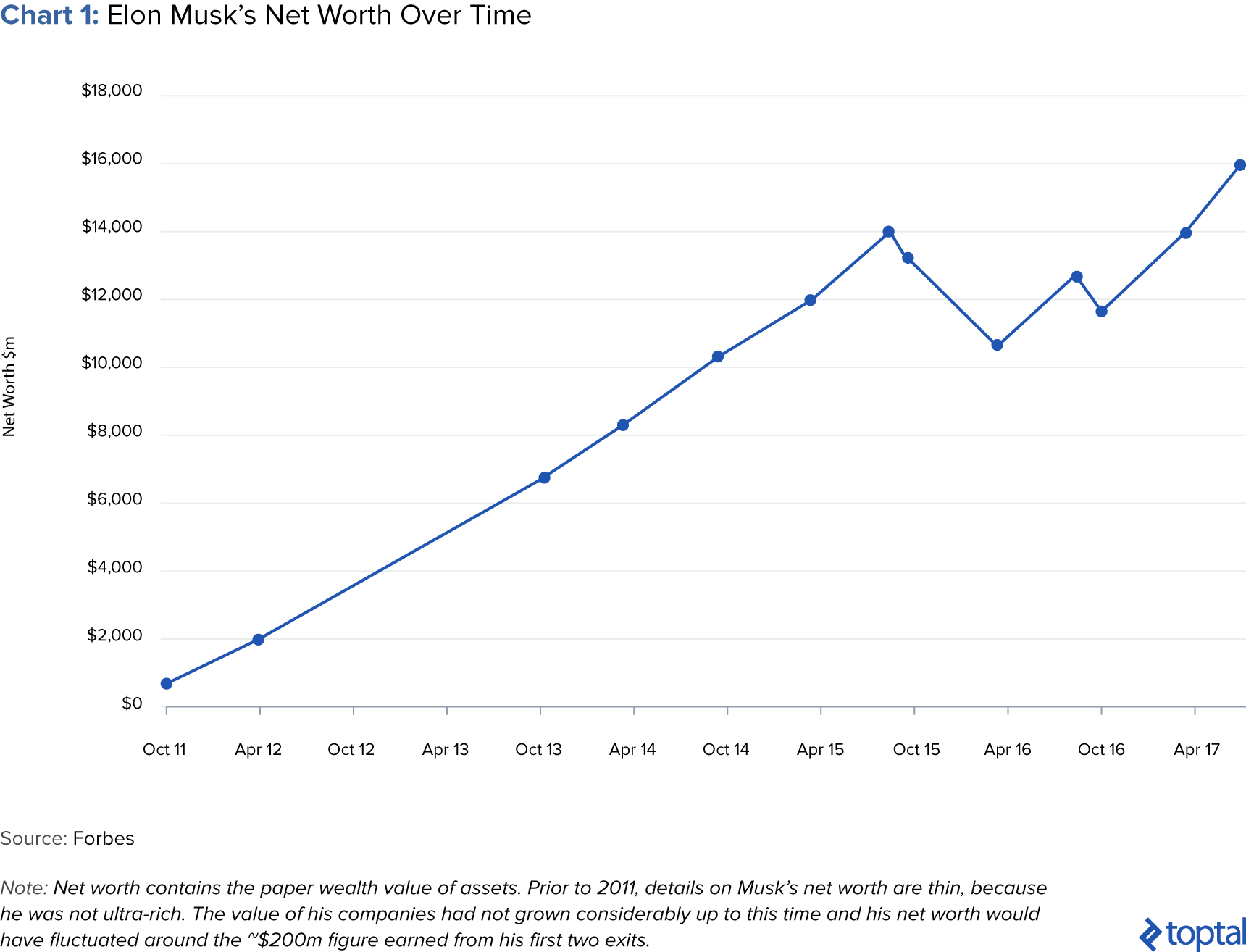

Capitalizing On Connections Selling Access To Elon Musks Private Investments

Apr 26, 2025

Capitalizing On Connections Selling Access To Elon Musks Private Investments

Apr 26, 2025

Latest Posts

-

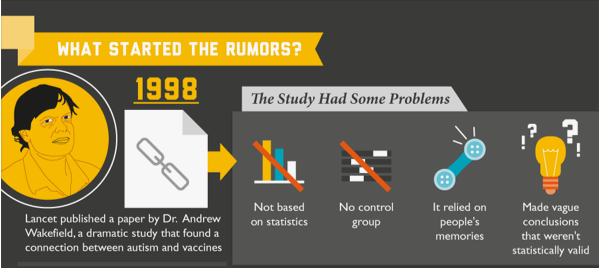

Controversial Appointment Hhs And The Debunked Autism Vaccine Connection

Apr 27, 2025

Controversial Appointment Hhs And The Debunked Autism Vaccine Connection

Apr 27, 2025 -

Immunization Autism Link Study Vaccine Skeptics Leadership Sparks Debate

Apr 27, 2025

Immunization Autism Link Study Vaccine Skeptics Leadership Sparks Debate

Apr 27, 2025 -

Vaccine Skeptic Leading Federal Autism Immunization Study A Troubling Appointment

Apr 27, 2025

Vaccine Skeptic Leading Federal Autism Immunization Study A Troubling Appointment

Apr 27, 2025 -

Eliminacion De Paolini Y Pegula En El Wta 1000 De Dubai

Apr 27, 2025

Eliminacion De Paolini Y Pegula En El Wta 1000 De Dubai

Apr 27, 2025 -

Dubai Dice Adios A Paolini Y Pegula En El Wta 1000

Apr 27, 2025

Dubai Dice Adios A Paolini Y Pegula En El Wta 1000

Apr 27, 2025