Capitalizing On Connections: Selling Access To Elon Musk's Private Investments

Table of Contents

Understanding the Market for Exclusive Investment Opportunities

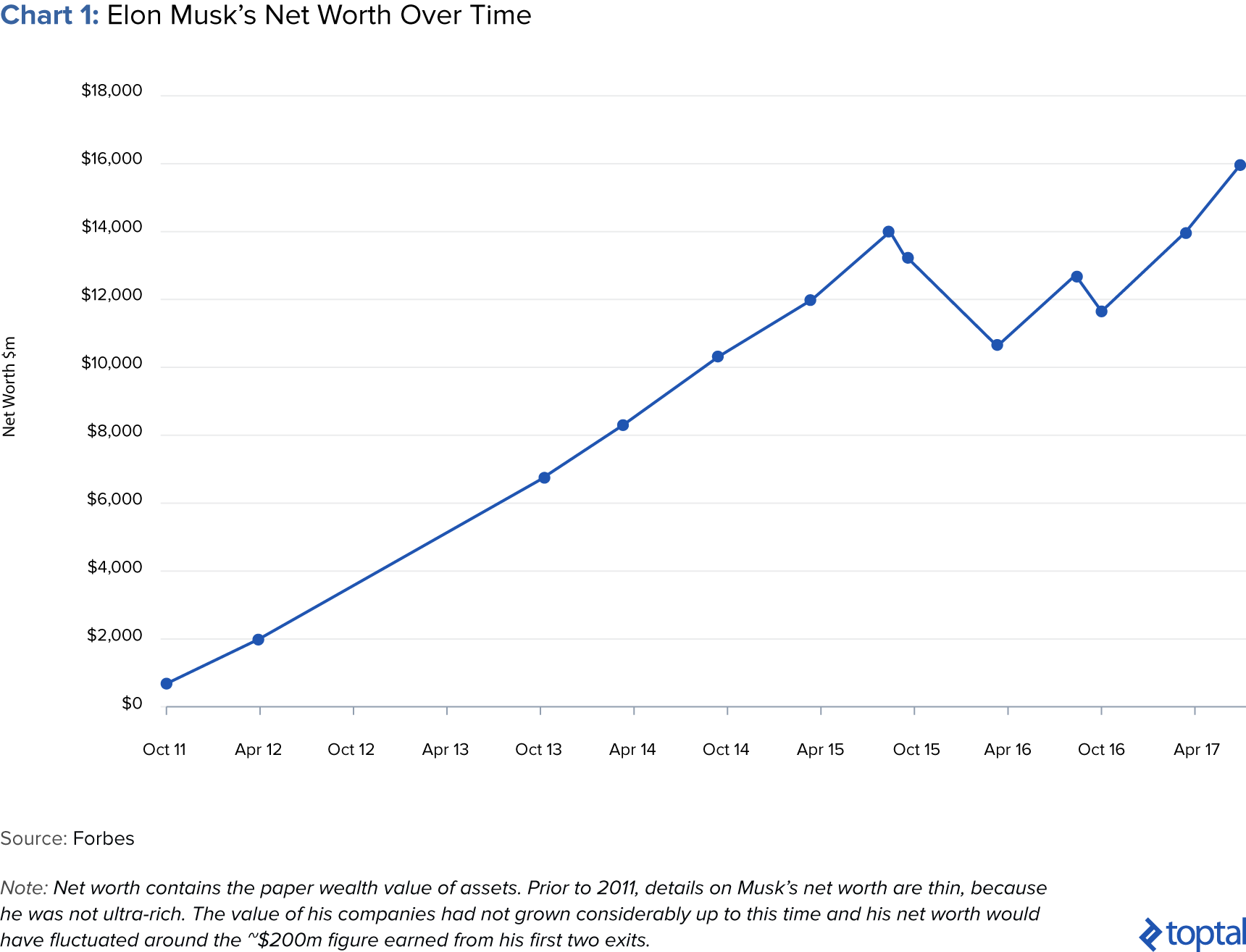

The demand for access to high-growth, exclusive investment opportunities is consistently high. Investors are constantly seeking ways to diversify their portfolios and capitalize on emerging markets. The psychological draw is significant; many investors are motivated by the desire to emulate the success of individuals like Elon Musk, believing that access to his investment choices offers a shortcut to similar returns. This desire fuels a robust market for those who can provide such access.

- High Net Worth Individuals (HNWIs) and Ultra High Net Worth Individuals (UHNWIs): These individuals represent the primary target demographic for this type of offering. They possess the capital and risk tolerance necessary for participation in high-stakes private investments.

- Exclusivity and Perceived Scarcity: The very nature of private investments, particularly those linked to influential figures, creates a sense of exclusivity and scarcity. This perceived scarcity significantly drives demand and willingness to pay premiums.

- Due Diligence and Risk Assessment: It's crucial to emphasize the importance of rigorous due diligence and accurate risk assessment. Transparency and providing realistic expectations are paramount to building trust and maintaining a positive reputation.

Building Credibility and Trust: Establishing Your Expertise

Successfully selling access to Elon Musk's private investments (or access to similar opportunities) hinges on establishing unshakeable credibility and trust. Investors need assurance that you possess the expertise and connections to deliver on your promises. This requires a strategic approach to building your reputation and network.

- Networking within Relevant Financial Circles: Attend industry events, conferences, and workshops to connect with potential investors and key players in the private investment space.

- Leveraging Social Proof: Testimonials from satisfied clients, documented case studies showcasing successful investments, and strong references are crucial for building trust.

- Creating High-Quality Content: Develop a content strategy including blog posts, webinars, and white papers that demonstrate your in-depth knowledge of private investments and your access to exclusive opportunities. This positions you as a thought leader.

- Transparency and Ethical Considerations: Operate with complete transparency and uphold the highest ethical standards. This is essential for maintaining long-term credibility and avoiding legal issues.

Legal and Ethical Considerations: Navigating the Regulatory Landscape

Navigating the legal and ethical landscape associated with selling access to private investments is paramount. Failure to comply with regulations can result in severe legal repercussions and reputational damage.

- Compliance with Securities Laws and Regulations: Understand and meticulously adhere to all applicable securities laws and regulations in your jurisdiction. This includes disclosure requirements, registration procedures, and anti-fraud provisions.

- Disclosure Requirements for Potential Investors: Provide full and accurate disclosure to potential investors about the risks involved, the terms of the investment, and your fees. Avoid any misleading or deceptive practices.

- Avoiding Misleading or Deceptive Marketing Practices: Ensure your marketing materials accurately represent your capabilities and the opportunities you offer. Avoid making unrealistic promises or exaggerating potential returns.

- The Importance of Professional Legal Counsel: Seek advice from experienced legal counsel specializing in securities law and private investments. They can help you navigate the complexities of the regulatory landscape and minimize legal risks.

Marketing and Sales Strategies: Reaching Your Target Audience

Reaching your target audience of HNWIs and UHNWIs requires a targeted and sophisticated marketing and sales strategy.

- Targeted Advertising on Relevant Platforms: Utilize online platforms frequented by high-net-worth individuals, such as LinkedIn, specialized financial publications, and exclusive online communities.

- Networking Events and Conferences: Attend industry events and conferences to network directly with potential investors and build relationships.

- Developing a Compelling Sales Pitch: Craft a compelling sales pitch that clearly articulates the value proposition of accessing exclusive investment opportunities and highlights your unique expertise and network.

- Building Relationships with Key Influencers and Financial Advisors: Cultivate relationships with financial advisors and other key influencers who can refer potential clients to your services.

Capitalize on the Opportunity: Your Gateway to Selling Access to Elon Musk's Private Investments

Successfully selling access to Elon Musk's private investments, or similar high-value opportunities, requires a multifaceted approach. It necessitates building a strong reputation, navigating the legal landscape, and employing effective marketing and sales strategies. The potential rewards are significant, but ethical conduct and careful planning are essential for long-term success. Remember, prioritizing transparency and adhering to the highest ethical standards will protect your reputation and ensure sustainable growth. Start building your network and capitalizing on the lucrative opportunity of selling access to Elon Musk's private investments today! Learn more about navigating this exclusive market and building your successful business.

Featured Posts

-

Shedeur Sanders Remains Faithful To Deion Sanders Nike Sponsorship

Apr 26, 2025

Shedeur Sanders Remains Faithful To Deion Sanders Nike Sponsorship

Apr 26, 2025 -

Tom Cruises Latest Mission Impossible Stunt A Close Call

Apr 26, 2025

Tom Cruises Latest Mission Impossible Stunt A Close Call

Apr 26, 2025 -

Nyt Spelling Bee Solution For February 26th Puzzle 360

Apr 26, 2025

Nyt Spelling Bee Solution For February 26th Puzzle 360

Apr 26, 2025 -

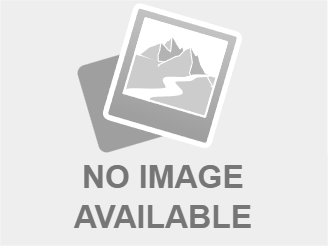

Green Bay Hosts Nfl Drafts First Round What To Expect

Apr 26, 2025

Green Bay Hosts Nfl Drafts First Round What To Expect

Apr 26, 2025 -

Philippine Bank Ceo Warns Of Economic Hardship Amid Tariff War

Apr 26, 2025

Philippine Bank Ceo Warns Of Economic Hardship Amid Tariff War

Apr 26, 2025

Latest Posts

-

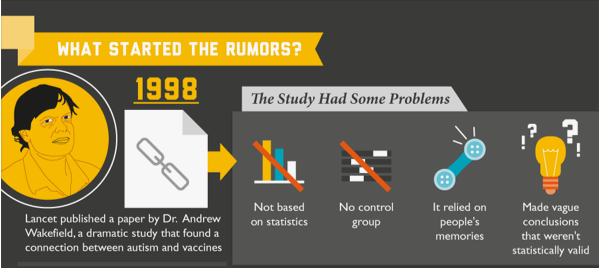

Controversial Appointment Hhs And The Debunked Autism Vaccine Connection

Apr 27, 2025

Controversial Appointment Hhs And The Debunked Autism Vaccine Connection

Apr 27, 2025 -

Immunization Autism Link Study Vaccine Skeptics Leadership Sparks Debate

Apr 27, 2025

Immunization Autism Link Study Vaccine Skeptics Leadership Sparks Debate

Apr 27, 2025 -

Vaccine Skeptic Leading Federal Autism Immunization Study A Troubling Appointment

Apr 27, 2025

Vaccine Skeptic Leading Federal Autism Immunization Study A Troubling Appointment

Apr 27, 2025 -

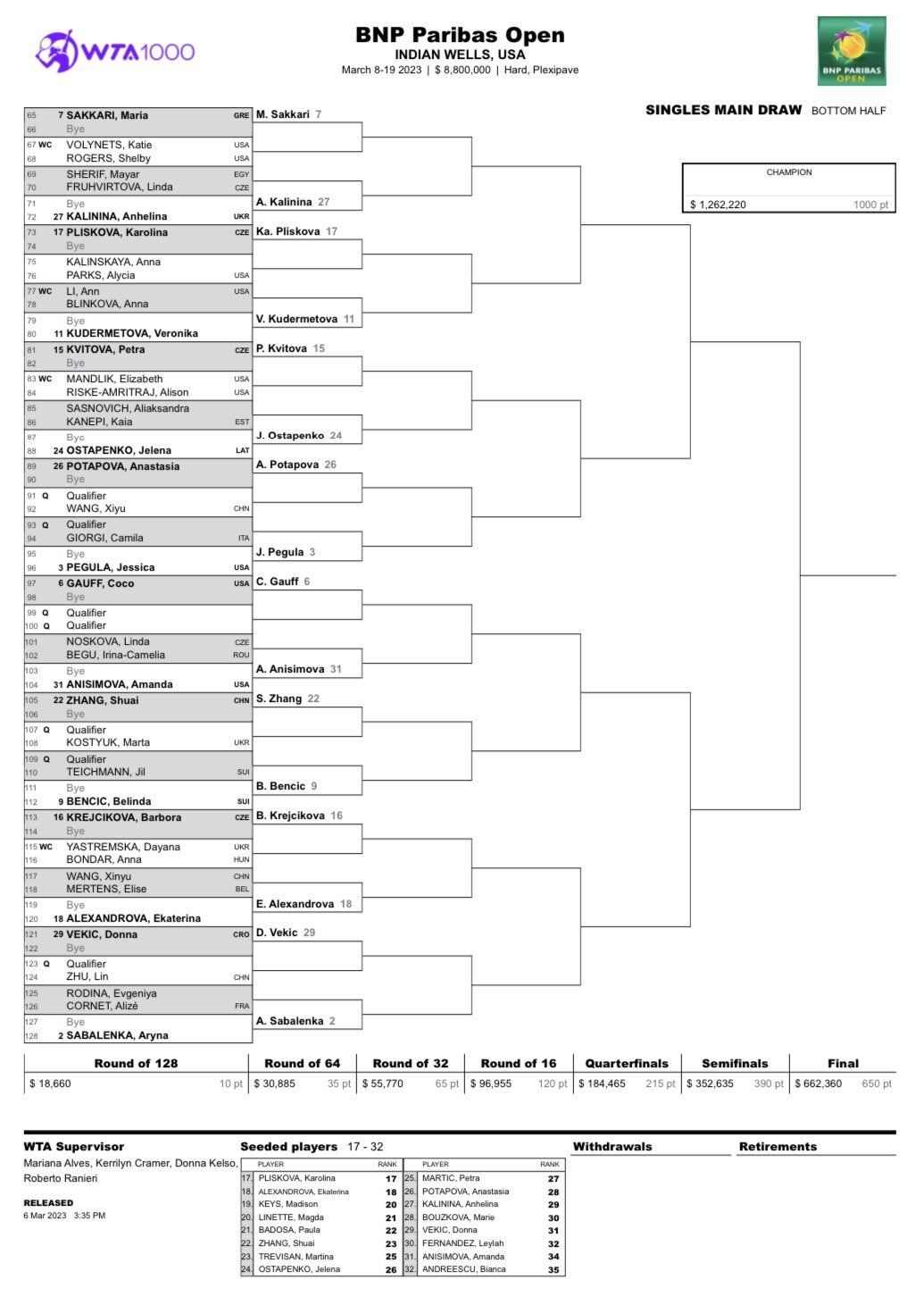

Eliminacion De Paolini Y Pegula En El Wta 1000 De Dubai

Apr 27, 2025

Eliminacion De Paolini Y Pegula En El Wta 1000 De Dubai

Apr 27, 2025 -

Dubai Dice Adios A Paolini Y Pegula En El Wta 1000

Apr 27, 2025

Dubai Dice Adios A Paolini Y Pegula En El Wta 1000

Apr 27, 2025