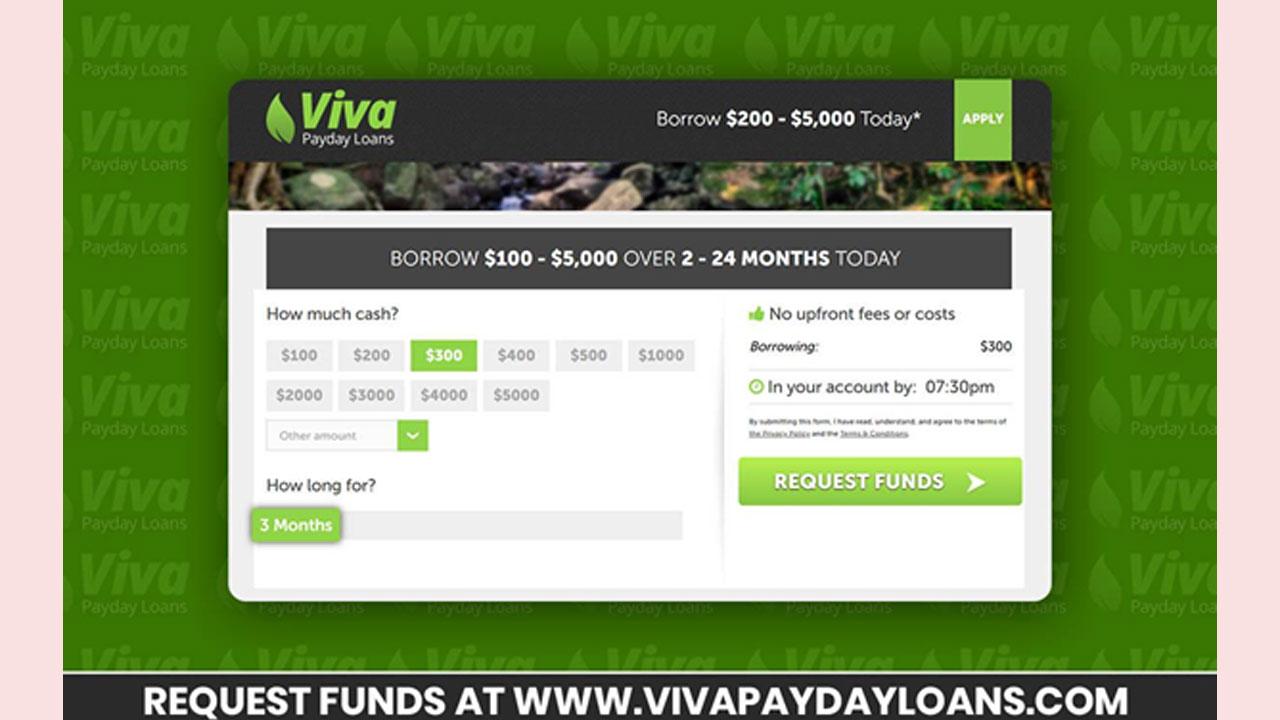

Apply For A No Credit Check Loan: Guaranteed Approval From A Direct Lender

Table of Contents

Understanding No Credit Check Loans

A no credit check loan is a type of loan where the lender doesn't perform a traditional credit check through major credit bureaus like Experian, Equifax, or TransUnion. This makes them attractive to individuals with bad credit, limited credit history, or those who simply want to avoid the potential impact of a hard credit inquiry on their credit score. However, it doesn't mean there's no verification process. Lenders typically assess your eligibility based on alternative criteria.

Instead of a credit check, lenders may consider:

- Employment verification: Proof of stable employment and income is crucial.

- Income proof: Pay stubs, bank statements, and tax returns are commonly requested.

- Debt-to-income ratio (DTI): This ratio helps lenders determine your ability to manage existing debt alongside a new loan.

Pros and Cons of No Credit Check Loans:

- Pros:

- Faster application process

- May be easier to qualify for than traditional loans

- Suitable for emergencies and unexpected expenses

- Cons:

- Potentially higher interest rates than traditional loans

- Shorter repayment terms may lead to higher monthly payments

- Limited loan amounts

Finding a Reputable Direct Lender

Choosing the right lender is paramount when seeking a no credit check loan. Working with a reputable direct lender offers several advantages over using third-party brokers:

- Avoids intermediaries: You deal directly with the lender, eliminating extra fees and potential delays.

- Faster processing: Direct lenders often have streamlined application processes.

- Potentially better terms: You might negotiate better interest rates and repayment terms directly with the lender.

Identifying a Trustworthy Lender:

- Check lender licenses and registrations: Ensure the lender is legally authorized to operate in your state.

- Read online reviews and testimonials: Look for feedback from previous borrowers to gauge their experience.

- Look for secure websites with HTTPS: This indicates a secure connection, protecting your sensitive information.

- Avoid lenders promising guaranteed approval without proper verification: Be wary of lenders who make unrealistic promises.

The Application Process for a No Credit Check Loan

Applying for a no credit check loan from a direct lender is generally a straightforward process. The typical steps include:

- Complete the online application form: This usually involves providing basic personal and financial information.

- Provide necessary documentation: This might include proof of income (pay stubs, bank statements), identification (driver's license, passport), and sometimes proof of address.

- Wait for loan approval or denial: The lender will review your application and inform you of their decision.

- Sign loan agreement: Once approved, you'll need to sign a loan agreement outlining the terms and conditions.

- Receive funds: Funds are typically deposited into your bank account within a few business days.

Factors Affecting Loan Approval

While a credit check might be skipped, several other factors influence loan approval for a no credit check loan:

- Income: A stable and sufficient income is essential to demonstrate your repayment ability.

- Employment history: A consistent employment history shows financial stability.

- Debt-to-income ratio: A lower DTI indicates you have less existing debt relative to your income.

- Accuracy of information: Providing accurate information on your application is crucial for approval.

Managing Your No Credit Check Loan

Responsible borrowing and repayment are crucial for managing your no credit check loan effectively. Here are some tips:

- Create a repayment plan: Budget carefully to ensure you can comfortably make your monthly payments.

- Set up automatic payments: This prevents missed payments and potential late fees.

- Monitor your account regularly: Keep track of your loan balance, payment due dates, and interest charges.

- Contact the lender if you anticipate difficulties making payments: Communicating proactively can help you avoid default.

Defaulting on a loan can have serious consequences, including damage to your credit score (even without an initial credit check), legal action, and difficulty accessing future credit.

Secure Your Financial Future with a No Credit Check Loan

No credit check loans offer a convenient way to access funds when traditional loans are inaccessible. However, it's essential to understand the potential for higher interest rates and the importance of responsible borrowing. Remember to choose a reputable direct lender to avoid scams and ensure fair lending practices. By carefully considering the factors affecting loan approval and actively managing your repayments, you can successfully navigate the world of no credit check loans and secure your financial future. Apply for a no credit check loan today and find the financial relief you need. Secure your no credit check loan now and take control of your finances! Find a guaranteed no credit check loan that fits your needs.

Featured Posts

-

Bandung Hujan Hingga Sore Prakiraan Cuaca Jawa Barat 23 April

May 28, 2025

Bandung Hujan Hingga Sore Prakiraan Cuaca Jawa Barat 23 April

May 28, 2025 -

U 15

May 28, 2025

U 15

May 28, 2025 -

Google Veo 3 Ai Video Generator A Comprehensive Review

May 28, 2025

Google Veo 3 Ai Video Generator A Comprehensive Review

May 28, 2025 -

Best Tribal Loans For Bad Credit Direct Lenders And Guaranteed Approval

May 28, 2025

Best Tribal Loans For Bad Credit Direct Lenders And Guaranteed Approval

May 28, 2025 -

Semarang Hujan Pukul 1 Siang Prakiraan Cuaca Besok 26 Maret Di Jawa Tengah

May 28, 2025

Semarang Hujan Pukul 1 Siang Prakiraan Cuaca Besok 26 Maret Di Jawa Tengah

May 28, 2025

Latest Posts

-

Neuer Sport Und Eheglueck Steffi Graf Verraet Ihre Regel Mit Andre Agassi

May 30, 2025

Neuer Sport Und Eheglueck Steffi Graf Verraet Ihre Regel Mit Andre Agassi

May 30, 2025 -

Agassi Recuerda A Su Rival Sudamericano Rios Entre Sus Principales Oponentes

May 30, 2025

Agassi Recuerda A Su Rival Sudamericano Rios Entre Sus Principales Oponentes

May 30, 2025 -

Andre Agassi De La Tenis La Pickleball O Noua Era

May 30, 2025

Andre Agassi De La Tenis La Pickleball O Noua Era

May 30, 2025 -

French Open 2025 Casper Ruuds Knee Injury And Defeat

May 30, 2025

French Open 2025 Casper Ruuds Knee Injury And Defeat

May 30, 2025 -

Primul Meci De Pickleball Al Lui Andre Agassi

May 30, 2025

Primul Meci De Pickleball Al Lui Andre Agassi

May 30, 2025