Best Tribal Loans For Bad Credit: Direct Lenders & Guaranteed Approval

Table of Contents

Understanding Tribal Loans and Their Advantages

What are Tribal Loans?

Tribal loans are short-term loans offered by lending institutions affiliated with Native American tribes. These loans operate under the principle of tribal sovereignty, meaning they are governed by tribal laws rather than state or federal regulations. This legal framework allows them to operate differently than traditional banks, often leading to more flexible lending practices. It's important to understand that while tribal lenders might offer advantages for those with bad credit, they also come with their own set of potential drawbacks, including potentially higher interest rates.

The perceived advantages stem from the fact that tribal lenders often have different criteria for approval than mainstream financial institutions. They may place less emphasis on a borrower's credit score, focusing instead on factors like income and employment stability.

Advantages of Tribal Loans for Bad Credit Borrowers:

-

Easier Approval Process: The application process for tribal loans is often faster and simpler than those of traditional lenders.

-

Higher Approval Rates: Borrowers with bad credit might find higher approval rates with tribal lenders compared to banks or credit unions.

-

Quick Access to Funds: Funds can be disbursed quickly, often within a few days of approval, providing vital financial assistance in emergency situations.

-

Flexible Repayment Options (Sometimes): Some tribal lenders offer flexible repayment options, but this is not always the case. Always confirm the repayment terms before accepting a loan.

-

Potential benefits: Tribal loans can offer a solution when traditional loan options aren’t available, providing a financial lifeline in times of need.

Finding Reputable Direct Lenders for Tribal Loans

Importance of Choosing a Reputable Lender:

The tribal loan industry, like any lending sector, contains both reputable and predatory lenders. It's crucial to prioritize finding a legitimate direct lender to avoid exploitative practices. Predatory lenders often charge exorbitant fees and interest rates, trapping borrowers in a cycle of debt.

Red flags to watch out for: High-pressure sales tactics, unclear terms and conditions, hidden fees, and aggressive collection practices.

Tips for identifying legitimate direct lenders:

- Verify Licensing and Registration: Check if the lender is licensed and registered with the appropriate tribal authorities.

- Read Online Reviews: Thoroughly examine customer reviews and testimonials to gauge the lender's reputation.

- Transparency is Key: Ensure the lender provides clear and upfront information about interest rates, fees, and repayment terms.

How to Find and Compare Direct Tribal Lenders:

-

Online Search Engines: Use keywords like "tribal loans near me," "direct tribal lenders," or "tribal payday loans."

-

Comparison Websites: Some websites specialize in comparing various lending options, including tribal loans.

-

Compare Offers Carefully: Don't just focus on the initial interest rate. Compare total loan costs, including fees and interest, to determine the most affordable option.

-

Thorough Research: Always take the time to research several lenders before making a decision.

The Reality of "Guaranteed Approval" Tribal Loans

Understanding the Concept of Guaranteed Approval:

The term "guaranteed approval" is frequently used in advertising for tribal loans, often misleading borrowers. While tribal lenders may have more lenient approval standards than traditional institutions, no lender can truly guarantee approval. They still assess applications based on certain criteria.

Factors Influencing Approval for Tribal Loans:

-

Income Verification: Lenders verify your income to ensure you have the ability to repay the loan.

-

Employment Stability: A stable job history increases your chances of approval.

-

Credit History (Less Emphasis): While credit score is a factor, tribal lenders often place less weight on it than traditional lenders.

-

Debt-to-Income Ratio: Your existing debt obligations will be assessed to determine your capacity to handle additional debt.

-

Responsible Borrowing: Even with a more relaxed approval process, responsible borrowing is still crucial.

Responsible Borrowing and Avoiding Tribal Loan Scams

Tips for Responsible Borrowing:

- Create a Budget: Ensure the loan amount is affordable and fits within your budget.

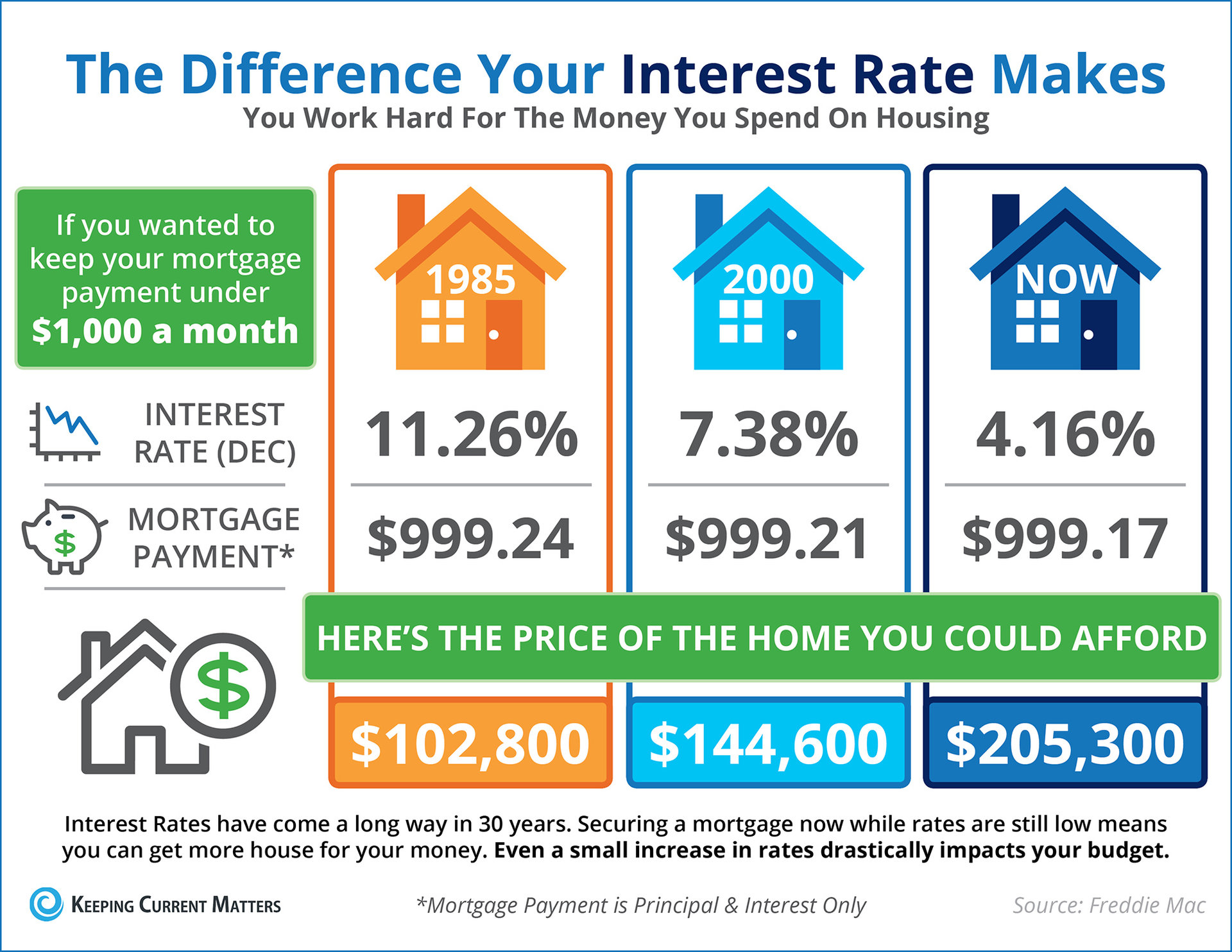

- Understand Total Cost: Calculate the total cost of the loan, including all fees and interest charges.

- Stick to the Repayment Plan: Failing to make timely payments can result in additional fees and damage to your credit.

- Explore Alternatives: Consider alternative financing options before resorting to a high-interest loan.

Identifying and Avoiding Tribal Loan Scams:

-

Beware of High-Pressure Tactics: Legitimate lenders won't pressure you into accepting a loan.

-

Verify Lender Legitimacy: Always verify the lender's credentials before providing personal information.

-

Report Suspicious Activity: If you suspect a scam, report it to the appropriate authorities.

-

Protect Yourself: Be cautious and take steps to protect yourself from fraudulent lenders.

Conclusion

Tribal loans can be a valuable financial resource for individuals with bad credit facing urgent financial needs. However, navigating this industry requires caution and careful consideration. While the promise of "guaranteed approval" is often a marketing ploy, understanding the factors influencing approval and practicing responsible borrowing will increase your chances of securing a loan and avoiding potential pitfalls. Remember that thorough research and comparison shopping are vital steps in finding the best tribal loan for your circumstances.

Call to Action: Need a tribal loan for bad credit? Start your search today by comparing reputable direct lenders and make informed decisions for your financial well-being. Don't fall prey to scams; find the best tribal loan option, and remember to prioritize responsible borrowing practices.

Featured Posts

-

K Pops Big Night Amas Nominations For Rose Rm Jimin Ateez And Stray Kids

May 28, 2025

K Pops Big Night Amas Nominations For Rose Rm Jimin Ateez And Stray Kids

May 28, 2025 -

Find The Best Personal Loan Interest Rates Today Simple Comparison

May 28, 2025

Find The Best Personal Loan Interest Rates Today Simple Comparison

May 28, 2025 -

Did The Blue Jays Padres Trade Revitalize Vladimir Guerrero Jr

May 28, 2025

Did The Blue Jays Padres Trade Revitalize Vladimir Guerrero Jr

May 28, 2025 -

Is Nintendos New Strategy A Safe Bet Analyzing The Companys Recent Moves

May 28, 2025

Is Nintendos New Strategy A Safe Bet Analyzing The Companys Recent Moves

May 28, 2025 -

French Open Musetti Sabalenka Win Nadal Receives Tournament Honor

May 28, 2025

French Open Musetti Sabalenka Win Nadal Receives Tournament Honor

May 28, 2025

Latest Posts

-

L Integrale De L Emission Europe 1 Soir 19 03 2025

May 30, 2025

L Integrale De L Emission Europe 1 Soir 19 03 2025

May 30, 2025 -

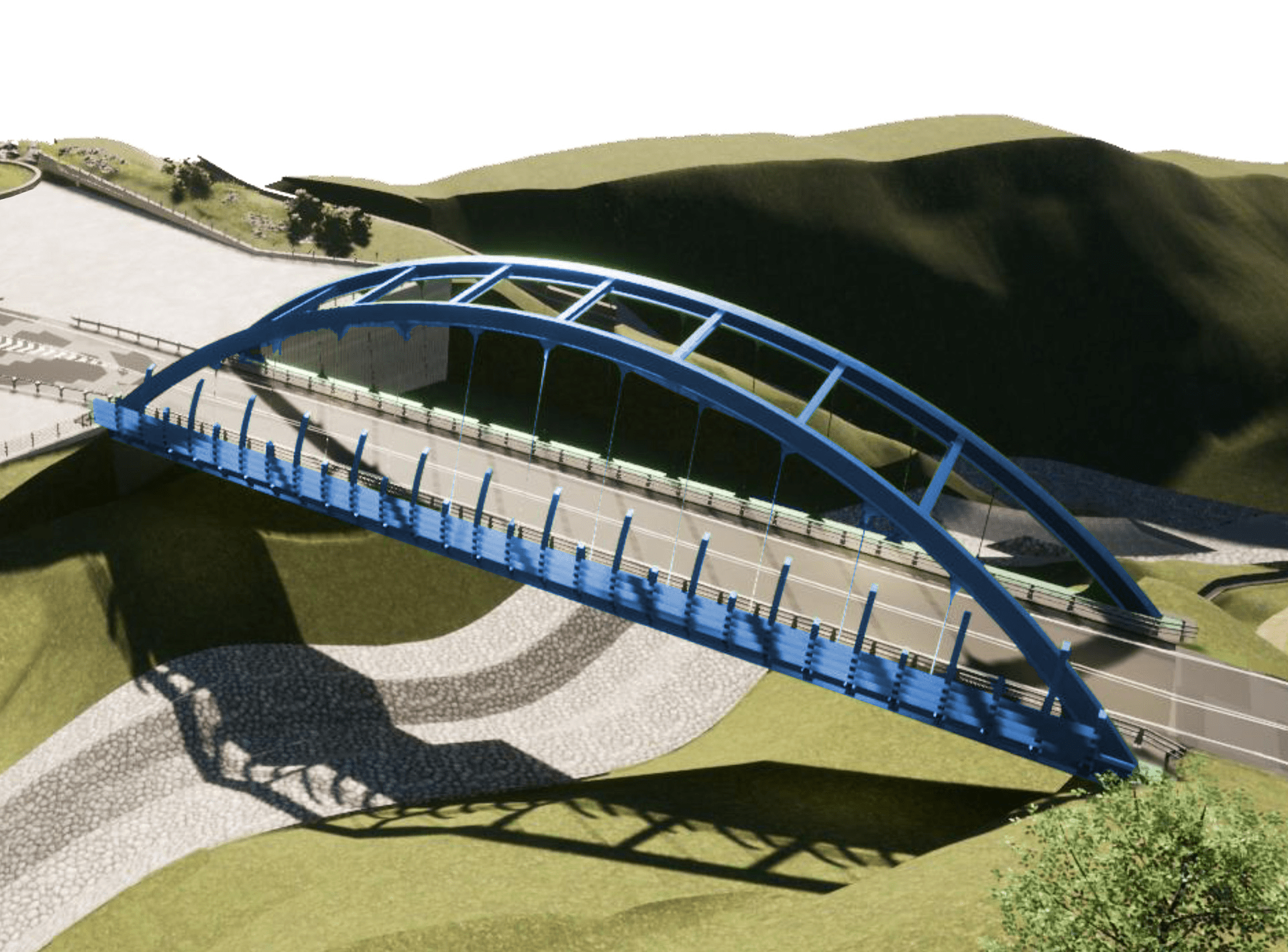

Situation Du Tunnel De Tende Ouverture Annoncee Pour Juin

May 30, 2025

Situation Du Tunnel De Tende Ouverture Annoncee Pour Juin

May 30, 2025 -

From Page To Screen Gisele Pelicots Rape Survivor Story Coming To Hbo

May 30, 2025

From Page To Screen Gisele Pelicots Rape Survivor Story Coming To Hbo

May 30, 2025 -

Podcast Integrale Europe 1 Soir 19 03 2025

May 30, 2025

Podcast Integrale Europe 1 Soir 19 03 2025

May 30, 2025 -

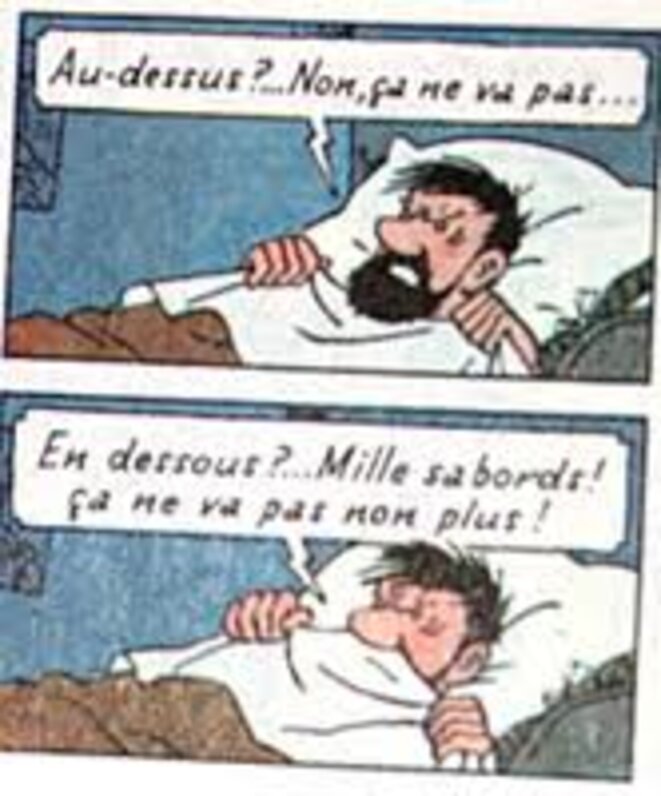

Jacobelli Defend Le Pen Au Dessus Ou En Dessous Des Lois

May 30, 2025

Jacobelli Defend Le Pen Au Dessus Ou En Dessous Des Lois

May 30, 2025