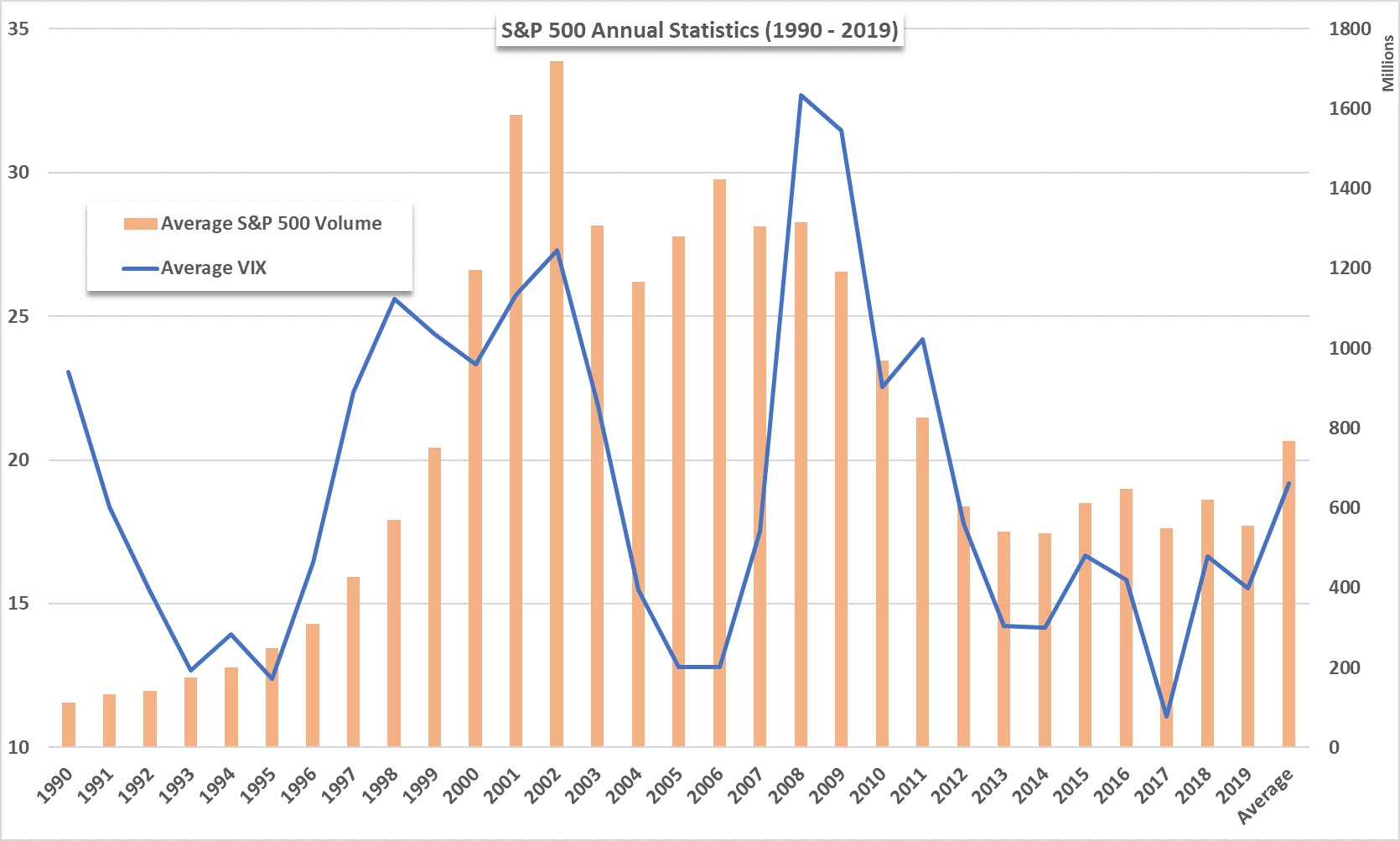

Apple Vs. Trump Tariffs: Will Buffett's Top Tech Stock Crack?

Table of Contents

The Impact of Trump Tariffs on Apple's Supply Chain

A significant portion of Apple's manufacturing relies on China. The Trump administration's tariffs, designed to pressure China on trade practices, directly increased the cost of importing components and finished Apple products. This had a multifaceted impact on Apple's operations.

- Increased Component Costs: Tariffs raised the price of essential components sourced from China, impacting the iPhone's bill of materials and squeezing Apple's profit margins. This wasn't just about the iPhone; it affected the entire Apple product ecosystem, from iPads to MacBooks.

- Supply Chain Disruptions: The added complexity and delays caused by tariffs led to potential production delays and increased manufacturing costs. Navigating these logistical hurdles required significant effort and resource allocation from Apple's supply chain management team.

- Manufacturing Diversification: In response to the tariffs and to mitigate future risks associated with over-reliance on a single manufacturing hub, Apple began exploring diversification of its manufacturing base, investing in production facilities in other countries like India and Vietnam.

- Financial Impact Analysis: The increased costs directly impacted Apple's profit margins. Analysts closely scrutinized Apple's financial reports to assess the extent of the tariff-related impact and its effect on the overall financial health of the company. While Apple absorbed some of these costs, the pressure was undeniable.

Consumer Response to Price Increases

The question became: how would consumers react to potential price hikes stemming from increased manufacturing and import costs? The elasticity of demand for Apple products played a critical role in determining the overall success of the company's strategy.

- Price Sensitivity: While Apple boasts significant brand loyalty, consumers are not entirely immune to price sensitivity. The extent to which increased prices due to tariffs influenced purchasing decisions was carefully analyzed.

- Demand Elasticity: Market research focused on assessing how much consumer demand would shift in response to higher iPhone prices. A significant decrease in demand would have considerably impacted Apple's bottom line.

- Market Share Competition: Increased Apple pricing created an opportunity for competitor brands to gain market share by offering comparable products at lower prices. This competitive pressure added to the challenges Apple faced.

- Long-Term Brand Loyalty: The long-term effects of price increases on consumer loyalty remain a critical factor. Maintaining brand perception and ensuring continued consumer preference amidst increased prices is essential for Apple's continued success.

Buffett's Perspective and Berkshire Hathaway's Strategy

Warren Buffett, the renowned investor, and Berkshire Hathaway's investment in Apple is legendary. His perspective on the Trump tariffs and their impact on Apple is instructive in understanding the resilience of long-term investment strategies.

- Buffett's Public Statements: Buffett's public comments on the tariffs offered insight into his assessment of the situation and its implications for Apple's long-term prospects. His reactions were closely followed by investors worldwide.

- Berkshire Hathaway's Investment Strategy: Did the trade war and resulting tariffs cause Berkshire Hathaway to adjust its investment strategy in Apple or other tech stocks? The answer provides valuable insight into long-term investment approaches during times of economic uncertainty.

- Long-Term Investment Philosophy: Buffett's famed long-term investment philosophy emphasizes patient investing and weathering short-term market fluctuations. This strategy likely played a pivotal role in navigating the challenges posed by the tariffs.

- Unwavering Faith in Apple?: Despite the tariff challenges, did Buffett's faith in Apple's long-term growth potential remain steadfast? His continued investment in Apple signaled his confidence in the company's ability to overcome these headwinds.

Did Apple Adapt and Overcome?

Apple's response to the tariffs was multifaceted and demonstrates its ability to navigate complex economic challenges.

- Mitigation Strategies: Apple employed various strategies to mitigate the negative impacts of tariffs, including exploring alternative sourcing options and optimizing its supply chain.

- Innovation and Market Share: Continued innovation and the introduction of new products played a crucial role in maintaining market share and profitability despite the tariff challenges.

- Long-Term Strategic Planning: Apple's demonstrated ability to adapt its long-term strategic planning in response to global trade dynamics showcases its resilience. This adaptability is vital for maintaining a leading position in the technology sector.

Conclusion

This article explored the impact of Trump-era tariffs on Apple, a cornerstone holding of Warren Buffett's Berkshire Hathaway. We analyzed the effects on Apple's supply chain, consumer behavior, and Buffett's investment strategy. While tariffs presented significant challenges, including increased component costs and potential supply chain disruptions, Apple demonstrated resilience through adaptation, innovation, and diversification of its manufacturing base. The long-term impact remains to be seen, but Apple's position in the tech market and Buffett's continued confidence suggest a robust ability to navigate such economic headwinds.

Call to Action: Understanding the interplay between global trade policies and the performance of major tech stocks like Apple is crucial for informed investment decisions. Stay informed about the evolving landscape of Apple vs. Trump Tariffs and similar economic events to protect your portfolio. Continue reading our analysis of Apple Stock and other key market indicators to make well-informed investment choices.

Featured Posts

-

Michael Caines Unexpected On Set Visit During Mia Farrow Sex Scene Filming

May 24, 2025

Michael Caines Unexpected On Set Visit During Mia Farrow Sex Scene Filming

May 24, 2025 -

Americas Best Beaches 2025 Dr Beachs Top 10

May 24, 2025

Americas Best Beaches 2025 Dr Beachs Top 10

May 24, 2025 -

7 Drop In Amsterdam Stock Market Trade War Uncertainty Creates Volatility

May 24, 2025

7 Drop In Amsterdam Stock Market Trade War Uncertainty Creates Volatility

May 24, 2025 -

Us Band Teases Glastonbury Gig Fans React To Unconfirmed Appearance

May 24, 2025

Us Band Teases Glastonbury Gig Fans React To Unconfirmed Appearance

May 24, 2025 -

Key Changes To The Philips 2025 Annual General Meeting Of Shareholders Agenda

May 24, 2025

Key Changes To The Philips 2025 Annual General Meeting Of Shareholders Agenda

May 24, 2025

Latest Posts

-

Federal Investigation Office365 Data Breach Nets Millions For Hacker

May 24, 2025

Federal Investigation Office365 Data Breach Nets Millions For Hacker

May 24, 2025 -

Ev Mandate Opposition Car Dealers Double Down

May 24, 2025

Ev Mandate Opposition Car Dealers Double Down

May 24, 2025 -

Auto Dealers Push Back Against Mandatory Ev Quotas

May 24, 2025

Auto Dealers Push Back Against Mandatory Ev Quotas

May 24, 2025 -

Bipartisan Senate Resolution Celebrates Canada U S Partnership

May 24, 2025

Bipartisan Senate Resolution Celebrates Canada U S Partnership

May 24, 2025 -

Voice Assistant Development Revolutionized Open Ais Latest Tools

May 24, 2025

Voice Assistant Development Revolutionized Open Ais Latest Tools

May 24, 2025