Apple Stock Prediction: $254? Is It A Buy At $200?

Analyzing the Apple Stock Forecast

Apple's Recent Financial Performance and Future Projections

H3: Revenue Growth and Profitability: Apple consistently demonstrates strong financial performance. Analyzing recent quarterly and annual reports reveals impressive revenue growth and profitability. Key Performance Indicators (KPIs) like revenue, net income, and earnings per share (EPS) showcase a healthy financial picture. While precise figures fluctuate, the overall trend points towards sustained growth.

- iPhone Revenue: Remains a significant contributor to overall revenue, consistently delivering strong sales despite market saturation. Innovation and upgrades are crucial for maintaining this revenue stream.

- Services Revenue: This segment shows impressive growth, driven by subscriptions like Apple Music, iCloud, and Apple TV+. This diversification is vital for future stability.

- Mac and Wearables Revenue: These segments contribute significant revenue, with growth potential fueled by continuous product innovation and expansion into new markets.

- Market Share: Apple maintains a strong market share in premium smartphones, tablets, and computers. However, competition remains fierce, requiring constant innovation and marketing efforts.

H3: Growth Drivers and Potential Challenges: Several factors could propel Apple's future growth, but challenges also exist.

- iPhone 15 Launch and Future Product Releases: The launch of the iPhone 15 and anticipated future product releases are major growth drivers, especially in emerging markets.

- Expansion into New Markets: Apple continues to expand its market reach, particularly in developing economies with growing smartphone penetration.

- Subscription Services Expansion: Further growth is expected from expanding the existing subscription services and introducing new offerings.

- Supply Chain Disruptions: Global supply chain issues remain a potential challenge, impacting production and potentially affecting revenue streams.

- Increased Competition: Intense competition from Android manufacturers, particularly in the mid-range and budget smartphone segments, poses a constant threat.

- Macroeconomic Factors: Global economic downturns, inflation, and interest rate hikes could negatively impact consumer spending and therefore Apple's sales.

Market Analysis and Analyst Opinions on Apple Stock

H3: Current Market Sentiment and Valuation: Currently, the market sentiment towards Apple stock is generally positive, reflecting its strong brand reputation and financial performance. The P/E ratio is a key metric to monitor. Comparing Apple's valuation to its competitors provides valuable context for determining whether it's overvalued or undervalued.

- Financial News Sources: Reports from Bloomberg, Reuters, and the Wall Street Journal provide valuable insight into market sentiment and Apple's valuation.

- Value vs. Growth Investing: Apple is often considered a blend of value and growth stock. Its consistent profitability makes it appealing to value investors, while its innovation and growth potential attract growth investors.

H3: Consensus Price Targets and Predictions: Analyst predictions vary, but many suggest the potential for Apple stock to reach or exceed $254. However, it's crucial to consider the range of predictions and understand the assumptions behind them.

- Analyst Reports: Consulting various reputable analyst reports offers a broad perspective on price targets and predictions. It is important to critically assess the methodology and potential biases of each prediction.

- Prediction Reliability: Analyst predictions are not foolproof; unforeseen circumstances can significantly impact stock performance.

Risk Assessment and Investment Strategy

H3: Potential Risks and Downsides: Investing in Apple stock, like any investment, carries inherent risks.

- Market Volatility: General market downturns can significantly impact even strong companies like Apple.

- Competitive Pressures: Increased competition could erode Apple's market share and profitability.

- Geopolitical Events: Global events, such as trade wars or political instability, can affect Apple's operations and stock price.

- Stock Price Decline: There is always a risk that the stock price could fall below the current price of $200.

H3: Buy, Sell, or Hold Recommendation: Based on the analysis, a balanced approach seems prudent. While Apple's long-term prospects appear strong, the current market conditions and potential risks necessitate a cautious strategy. A "hold" or a partial buy, depending on your risk tolerance and portfolio diversification, might be a more suitable approach than a significant investment at this time.

- Disclaimer: This is not financial advice. Consult a financial professional before making any investment decisions.

- Alternative Investment Options: Consider diversifying your portfolio to mitigate risk, exploring other investment options that align with your risk tolerance.

Conclusion: Is Apple Stock a Buy at $200? Final Thoughts and Call to Action

Our Apple Stock Prediction analysis suggests that while the potential for Apple stock to reach $254 exists, it's not a guaranteed outcome. Buying at $200 involves inherent risks, requiring careful consideration of your investment goals and risk tolerance. The long-term prospects for Apple are generally positive, driven by innovation and a strong brand. However, market volatility and competitive pressures must be factored into any investment decision. Thorough research and professional financial advice are crucial before investing in Apple stock or any other asset.

Share your thoughts on this Apple Stock Prediction in the comments section below! Continue your research on Apple stock and other investment opportunities to make informed decisions. Remember, responsible investing involves careful analysis and understanding of associated risks.

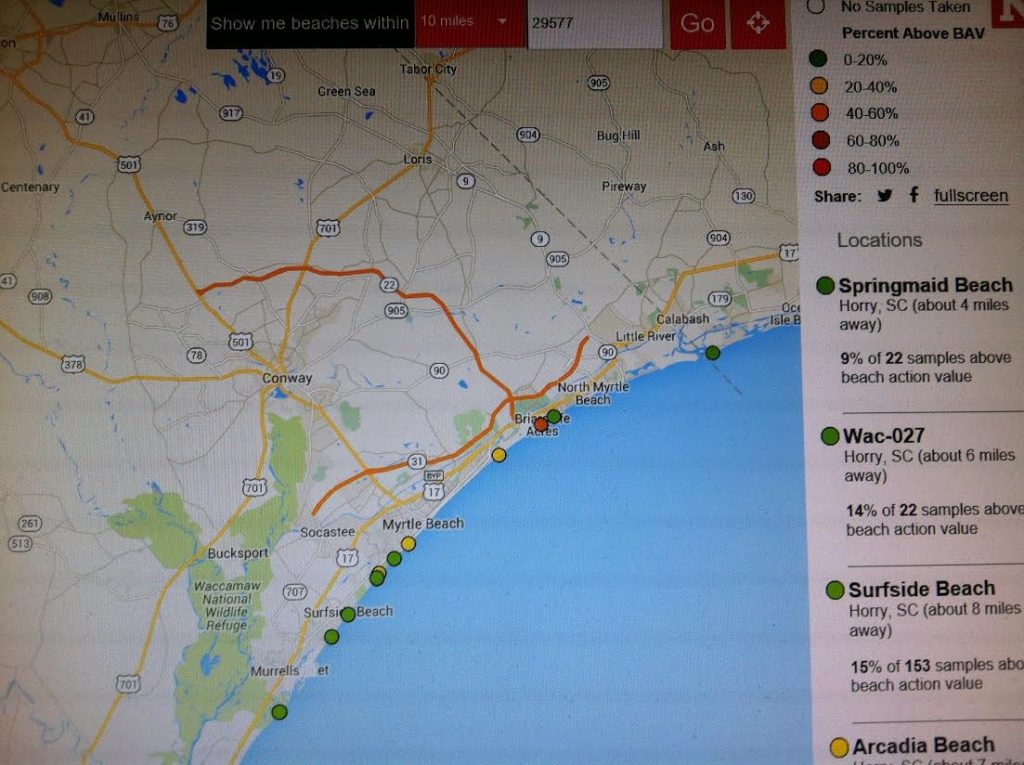

North Myrtle Beach Water Restrictions And Public Safety

North Myrtle Beach Water Restrictions And Public Safety

Boe Rate Cut Odds Fall Pound Climbs On Higher Than Expected Uk Inflation

Boe Rate Cut Odds Fall Pound Climbs On Higher Than Expected Uk Inflation

The Mia Farrow Trump Dispute A Focus On Venezuelan Gang Member Deportations

The Mia Farrow Trump Dispute A Focus On Venezuelan Gang Member Deportations

Discover Emerging Business Opportunities A Map Of The Countrys Hottest Locations

Discover Emerging Business Opportunities A Map Of The Countrys Hottest Locations

Analisi Prezzi Moda Usa L Impatto Dei Dazi

Analisi Prezzi Moda Usa L Impatto Dei Dazi