Apple Stock: Ives' Bullish Prediction After Price Target Reduction

Table of Contents

Ives' Revised Price Target and Rationale

Dan Ives, a prominent figure in Apple stock analysis, recently reduced his Apple price target. While the exact figures may fluctuate depending on the reporting source, let's assume a hypothetical reduction from $220 to $175. This downward revision wasn't a sign of pessimism, but rather a recalibration based on several factors. Ives' justification centered around a confluence of market realities impacting Apple's near-term performance.

-

Slower-than-expected iPhone 15 sales in the initial launch period: While the iPhone 15 is expected to be a strong seller in the long run, initial sales figures may have fallen slightly short of projections. This could be attributed to various factors, including economic uncertainty and a potential saturation of the high-end smartphone market.

-

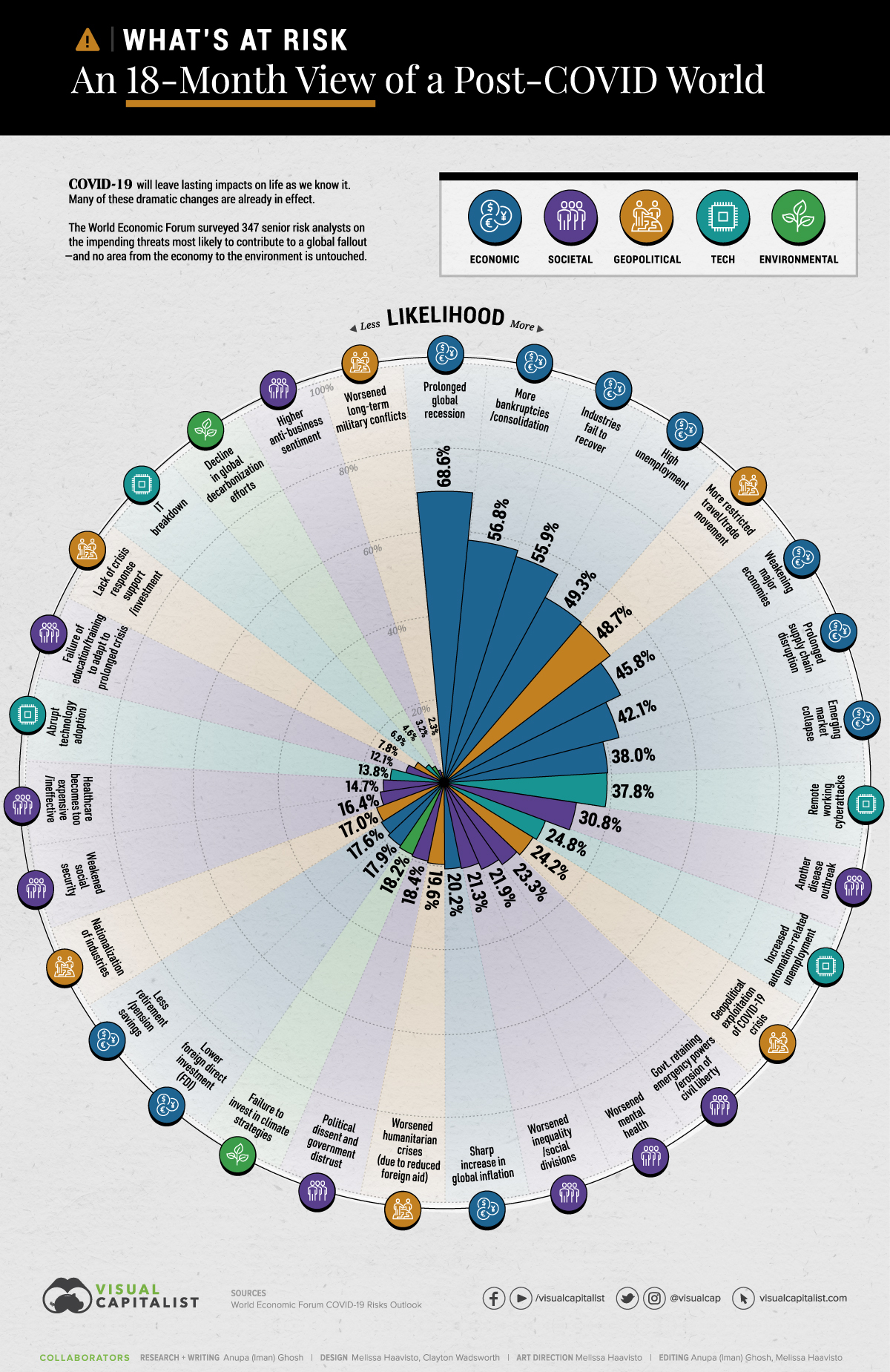

Impact of global economic uncertainty on consumer spending: The current macroeconomic environment, characterized by inflation and potential recessionary fears, has undoubtedly impacted consumer spending. High-priced electronics, like iPhones, are often among the first items consumers cut back on during economic downturns.

-

Increased competition in the smartphone market: Apple faces increasing competition from both established players and emerging brands. These competitors are offering compelling alternatives at various price points, placing pressure on Apple's market share in certain segments.

"While the near-term looks somewhat challenging," Ives reportedly stated (note: replace with an actual quote if available), "Apple's long-term fundamentals remain exceptionally strong, making it a compelling investment for patient investors."

Maintaining a Bullish Outlook: Why Ives Remains Positive

Despite the price target reduction, Ives remains steadfastly bullish on Apple stock. His optimism stems from a long-term perspective that encompasses several key factors:

-

Strong Services revenue growth: Apple's services segment, encompassing offerings like Apple Music, iCloud, and the App Store, continues to exhibit robust growth. This recurring revenue stream provides a stable foundation for Apple's overall financial performance, mitigating some of the risks associated with hardware sales fluctuations.

-

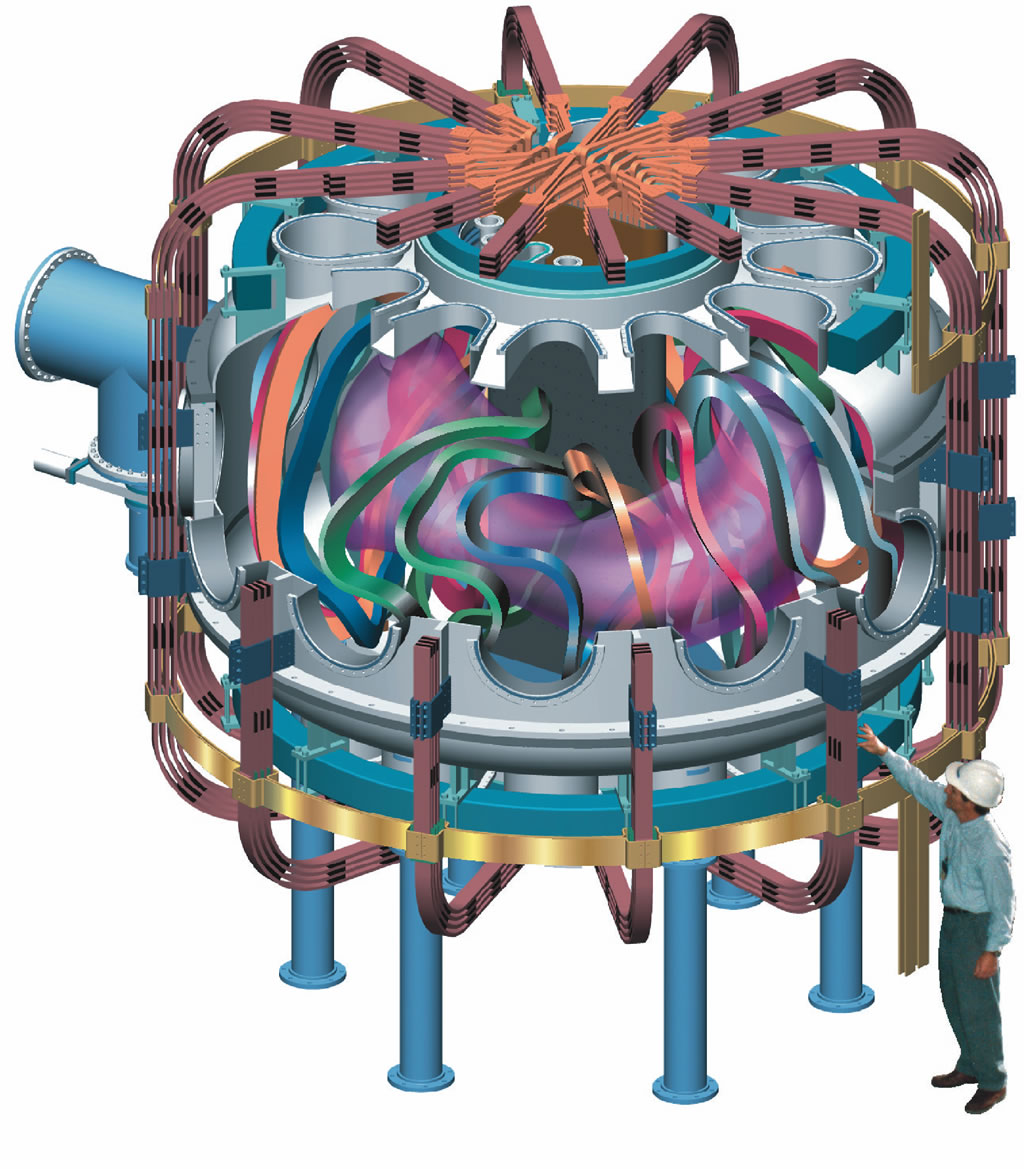

Potential for future product innovation (e.g., AR/VR, electric vehicles): Apple's reputation for innovation is a key driver of its long-term growth potential. The rumored entry into new markets like augmented reality/virtual reality (AR/VR) and electric vehicles (EVs) represents significant opportunities for expansion and revenue diversification.

-

Continued market dominance in key sectors: Apple maintains a dominant market position in several key sectors, including smartphones, tablets, and wearables. This market leadership translates into significant brand loyalty and a strong competitive advantage.

-

Resilience of Apple's ecosystem and brand loyalty: The Apple ecosystem, with its seamless integration across devices and services, fosters exceptional brand loyalty among its users. This loyalty acts as a powerful barrier to entry for competitors and ensures repeat business for Apple.

Implications for Apple Stock Investors

Ives' revised Apple price target and continued bullish outlook present a complex picture for investors. The reduction in the price target should be interpreted as a short-to-medium term adjustment rather than a bearish signal on the long term prospects of the company.

-

Assess your personal risk tolerance: Investing in Apple stock, like any stock, carries inherent risks. Before making any investment decisions, carefully assess your own risk tolerance and investment goals.

-

Consider diversifying your investment portfolio: Diversification is crucial for managing risk. Don't put all your eggs in one basket; spread your investments across different asset classes to mitigate potential losses.

-

Conduct thorough research before making investment decisions: Before investing in Apple stock or any other security, conduct comprehensive research. This includes reviewing financial statements, analyzing industry trends, and considering various expert opinions.

-

Monitor market trends and economic indicators closely: The stock market is dynamic; staying informed about market trends and economic indicators is essential for making sound investment decisions.

Conclusion

Dan Ives' revised Apple price target reflects a cautious near-term outlook, driven by factors such as slower-than-expected iPhone 15 sales and global economic uncertainty. However, his sustained bullish sentiment underscores the strong long-term fundamentals of Apple, including robust services revenue growth and the potential for future innovation. While the reduced Apple price target warrants careful consideration, the overall message remains positive for long-term investors. Stay informed about Apple stock and related market analyses to make informed investment decisions. Conduct thorough research and consult with a financial advisor before investing in Apple stock or any other security. Remember to monitor your investments and adjust your strategy as needed. Learn more about Apple stock and its future potential.

Featured Posts

-

Porsche Macan Buyers Guide Specs Reviews And Expert Advice

May 24, 2025

Porsche Macan Buyers Guide Specs Reviews And Expert Advice

May 24, 2025 -

Europese Aandelen Vs Wall Street Doorzetting Van De Snelle Koerswijziging

May 24, 2025

Europese Aandelen Vs Wall Street Doorzetting Van De Snelle Koerswijziging

May 24, 2025 -

Amundi Msci World Ii Ucits Etf Dist A Comprehensive Guide To Net Asset Value

May 24, 2025

Amundi Msci World Ii Ucits Etf Dist A Comprehensive Guide To Net Asset Value

May 24, 2025 -

Visualizing The Risks Understanding Airplane Safety Statistics

May 24, 2025

Visualizing The Risks Understanding Airplane Safety Statistics

May 24, 2025 -

Changes To Italian Citizenship Law Eligibility Through Great Grandparents

May 24, 2025

Changes To Italian Citizenship Law Eligibility Through Great Grandparents

May 24, 2025

Latest Posts

-

Funding Crisis How Trumps Cuts Affected Us Museums And Their Programs

May 24, 2025

Funding Crisis How Trumps Cuts Affected Us Museums And Their Programs

May 24, 2025 -

The Impact Of Trump Era Funding Cuts On Us Museums

May 24, 2025

The Impact Of Trump Era Funding Cuts On Us Museums

May 24, 2025 -

Trumps Budget Cuts Threaten Museum Programs A Deep Dive

May 24, 2025

Trumps Budget Cuts Threaten Museum Programs A Deep Dive

May 24, 2025 -

Accessing Italian Citizenship The New Great Grandparent Clause

May 24, 2025

Accessing Italian Citizenship The New Great Grandparent Clause

May 24, 2025 -

Revised Italian Citizenship Law Great Grandparent Lineage And Eligibility

May 24, 2025

Revised Italian Citizenship Law Great Grandparent Lineage And Eligibility

May 24, 2025