Amundi MSCI World II UCITS ETF Dist: A Comprehensive Guide To Net Asset Value

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the underlying value of an ETF's assets. It's a crucial metric for understanding the intrinsic worth of your investment. For ETFs, the NAV is calculated by taking the total market value of all the assets held within the fund, subtracting any liabilities (such as management fees), and then dividing that figure by the total number of outstanding shares. This calculation provides a snapshot of the ETF's net worth at a specific point in time.

Unlike the market price, which can fluctuate throughout the trading day based on supply and demand, the NAV is calculated only once per day, typically at the end of the trading day. This daily calculation provides investors with a clear picture of the ETF's true value, unaffected by short-term market volatility.

- NAV represents the underlying value of the ETF's assets.

- Calculated by totaling the market value of all holdings, minus liabilities, divided by the number of outstanding shares.

- Provides a snapshot of the ETF's intrinsic worth.

- Calculated and published daily, offering a consistent valuation benchmark.

Calculating the NAV of Amundi MSCI World II UCITS ETF Dist

The Amundi MSCI World II UCITS ETF Dist aims to track the performance of the MSCI World Index, a broad market-capitalization weighted index of global equities. Therefore, the ETF's holdings primarily consist of a diversified portfolio of stocks from developed markets worldwide. The weighting of each stock within the ETF mirrors its weighting within the MSCI World Index.

Calculating the NAV involves valuing each of these holdings at their respective market prices at the close of the trading day. This process considers various factors:

- The MSCI World Index: The index acts as the benchmark, dictating the ETF’s composition and influencing the NAV calculation significantly. Any changes in the index's constituents or weightings will directly impact the ETF's NAV.

- Currency Exchange Rates: Since the ETF invests globally, currency conversions are necessary to express all asset values in a single base currency (usually the ETF's base currency). Fluctuations in exchange rates can influence the NAV calculation.

- Expense Ratios and Management Fees: These costs are deducted from the total asset value before dividing by the number of outstanding shares, thus impacting the final NAV figure.

Factors Affecting Amundi MSCI World II UCITS ETF Dist NAV

Several factors significantly influence the daily NAV of the Amundi MSCI World II UCITS ETF Dist:

- Global Market Movements: Broad market trends, such as economic growth or recession fears, directly impact the prices of the underlying stocks and therefore the ETF's NAV. A bull market generally leads to a higher NAV, while a bear market will usually result in a lower NAV.

- Performance of Individual Stocks: The performance of individual companies within the MSCI World Index will affect their respective weightings and ultimately influence the overall NAV. Strong performance by a heavily weighted stock will positively impact the NAV.

- Currency Fluctuations: Changes in exchange rates between the base currency of the ETF and the currencies of the underlying assets can cause significant NAV fluctuations, even if the underlying asset prices remain stable.

- Dividend Distributions: When the ETF distributes dividends, the NAV will typically decrease by the amount of the dividend payout. This is because the fund's assets have been reduced. Note that if dividends are reinvested, the impact on the NAV will be less pronounced.

Using NAV to Make Informed Investment Decisions

Understanding and monitoring the NAV of the Amundi MSCI World II UCITS ETF Dist is key to making sound investment decisions. By tracking NAV changes over time, investors gain insight into the ETF's long-term performance.

- Monitoring NAV trends: Tracking the NAV over time reveals the ETF's overall growth trajectory.

- Comparing NAV with Market Price: The market price of an ETF can sometimes trade at a premium or discount to its NAV. Comparing these two figures can reveal potential buying or selling opportunities.

- Evaluating Investment Strategy: By analyzing NAV performance, investors can assess whether the ETF's investment strategy is aligning with their investment goals.

Conclusion

Understanding the Net Asset Value (NAV) of the Amundi MSCI World II UCITS ETF Dist is fundamental to making informed investment decisions. Remember that the NAV is calculated daily, providing a consistent measure of the ETF's underlying value, independent of short-term market volatility. Regularly monitoring the Amundi MSCI World II UCITS ETF Dist NAV, alongside other key performance indicators, enables investors to effectively manage their investments and achieve their financial goals. Learn more about Amundi MSCI World II UCITS ETF Dist NAV and its implications for your portfolio today!

Featured Posts

-

Porsche Macan Rafmagnsutgafan Kemur

May 24, 2025

Porsche Macan Rafmagnsutgafan Kemur

May 24, 2025 -

Porsche Indonesia Classic Art Week 2025 Perayaan Seni Dan Otomotif

May 24, 2025

Porsche Indonesia Classic Art Week 2025 Perayaan Seni Dan Otomotif

May 24, 2025 -

Glastonbury 2025 Lineup Confirmed Artists And How To Buy Tickets

May 24, 2025

Glastonbury 2025 Lineup Confirmed Artists And How To Buy Tickets

May 24, 2025 -

Recenzja Porsche Cayenne Gts Coupe Warto Kupic

May 24, 2025

Recenzja Porsche Cayenne Gts Coupe Warto Kupic

May 24, 2025 -

Bbc Radio 1 Big Weekend 2025 How To Buy Tickets With The Full Lineup

May 24, 2025

Bbc Radio 1 Big Weekend 2025 How To Buy Tickets With The Full Lineup

May 24, 2025

Latest Posts

-

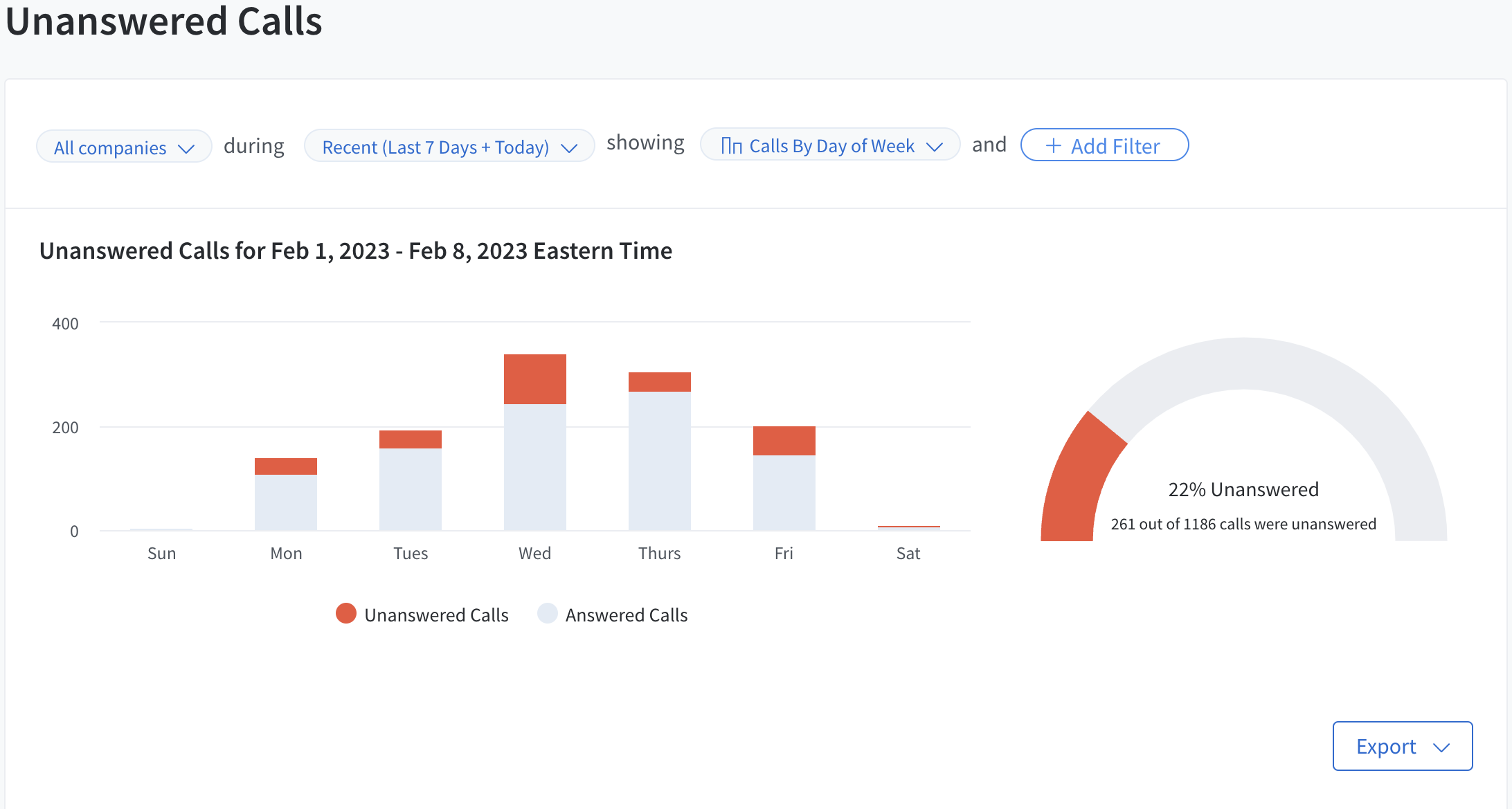

Unanswered Calls The Agony Of Waiting By The Phone

May 24, 2025

Unanswered Calls The Agony Of Waiting By The Phone

May 24, 2025 -

The Endless Wait Reflections On A Silent Phone

May 24, 2025

The Endless Wait Reflections On A Silent Phone

May 24, 2025 -

The Lingering Hope Waiting For A Call That May Never Come

May 24, 2025

The Lingering Hope Waiting For A Call That May Never Come

May 24, 2025 -

Amundi Djia Ucits Etf A Deep Dive Into Net Asset Value

May 24, 2025

Amundi Djia Ucits Etf A Deep Dive Into Net Asset Value

May 24, 2025 -

By The Phone An Account Of Unanswered Calls

May 24, 2025

By The Phone An Account Of Unanswered Calls

May 24, 2025