Amundi DJIA UCITS ETF: A Deep Dive Into Net Asset Value

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the intrinsic value of an ETF's holdings. For ETFs like the Amundi DJIA UCITS ETF, which tracks the Dow Jones Industrial Average, the NAV reflects the total value of the underlying 30 company shares held by the fund. This contrasts with the ETF's market price, which fluctuates throughout the trading day based on supply and demand.

- NAV: Represents the total value of the ETF's underlying assets (shares of companies in the Dow Jones Industrial Average) divided by the number of outstanding ETF shares. This calculation provides a snapshot of the ETF's net asset value per share.

- Market Price: The price at which the ETF is currently trading on the exchange. This price can deviate from the NAV due to market forces. The difference between the market price and the NAV can sometimes present arbitrage opportunities for sophisticated traders.

Calculating the Amundi DJIA UCITS ETF NAV

Calculating the Amundi DJIA UCITS ETF NAV involves a precise process:

- Daily Closing Prices: The daily closing prices of all 30 components of the Dow Jones Industrial Average are collected. These prices are crucial in determining the aggregate value of the ETF's holdings.

- Currency Conversion: If the ETF's base currency differs from the currency of the underlying assets, a currency conversion is applied to ensure an accurate NAV calculation.

- Expense Deduction: The ETF's total expenses, including management fees, are deducted from the overall asset value before calculating the NAV per share. This reflects the actual value available to investors.

- Dividend Impact: Dividends received from the underlying DJIA companies are added to the total asset value, increasing the NAV. This is a critical aspect of the NAV calculation, reflecting the income generated from the underlying investments.

Factors Affecting Amundi DJIA UCITS ETF NAV

Several factors significantly influence the Amundi DJIA UCITS ETF NAV:

- DJIA Performance: The performance of the Dow Jones Industrial Average is the most significant factor. A rise in the DJIA typically leads to an increase in the ETF's NAV, and vice-versa. Understanding the DJIA's trends is key to anticipating NAV fluctuations.

- US Dollar Fluctuations: For investors holding the ETF in a currency other than USD, changes in the value of the US dollar against their local currency will directly impact the NAV. A stronger USD generally leads to a lower NAV (in the investor's local currency).

- Underlying Company Dividends: Dividends paid by the companies within the DJIA directly affect the NAV. These dividends increase the overall asset value, leading to a higher NAV.

- Expense Ratio: The ETF's expense ratio, which covers management and administrative fees, indirectly impacts the NAV by reducing the total asset value available to investors.

The Importance of NAV for Amundi DJIA UCITS ETF Investors

Understanding the Amundi DJIA UCITS ETF NAV is crucial for several reasons:

- True Value Assessment: The NAV provides a clear picture of the ETF's true underlying value, independent of short-term market fluctuations.

- Arbitrage Opportunities: By comparing the NAV to the market price, investors can potentially identify arbitrage opportunities where the market price significantly deviates from the intrinsic value.

- Performance Monitoring: Tracking changes in the NAV over time allows investors to monitor the long-term performance of their investment in the Amundi DJIA UCITS ETF.

- Informed Decisions: A comprehensive understanding of the NAV helps investors make more informed buy and sell decisions, optimizing their investment strategy.

Conclusion

Understanding the Amundi DJIA UCITS ETF NAV is essential for maximizing your investment returns. By carefully monitoring its NAV, grasping its calculation, and recognizing the influencing factors, you can make superior investment decisions. Regularly checking the Amundi DJIA UCITS ETF NAV provides a clearer view of your investment's true worth. Start monitoring your Amundi DJIA UCITS ETF NAV and its related metrics today for a more successful investment strategy!

Featured Posts

-

The Bury M62 Relief Road A Forgotten Plan

May 24, 2025

The Bury M62 Relief Road A Forgotten Plan

May 24, 2025 -

60 Minute Delays On M6 Southbound Due To Crash

May 24, 2025

60 Minute Delays On M6 Southbound Due To Crash

May 24, 2025 -

Nyt Mini Crossword April 18 2025 Answers And Clue Help

May 24, 2025

Nyt Mini Crossword April 18 2025 Answers And Clue Help

May 24, 2025 -

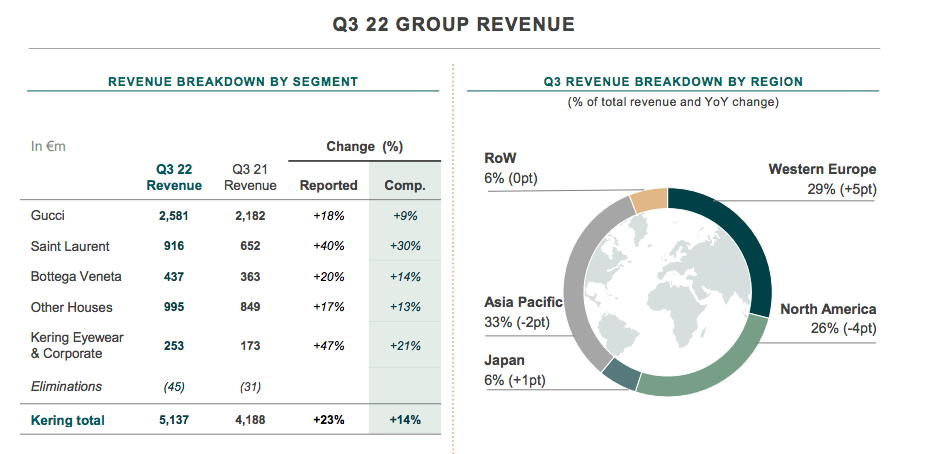

Kering Shares Plunge 6 Following Disappointing Q1 Earnings

May 24, 2025

Kering Shares Plunge 6 Following Disappointing Q1 Earnings

May 24, 2025 -

Astonishing Police Chase Pair Refuels At 90mph

May 24, 2025

Astonishing Police Chase Pair Refuels At 90mph

May 24, 2025

Latest Posts

-

The Demna Gvasalia Era What To Expect From Guccis Creative Redesign

May 24, 2025

The Demna Gvasalia Era What To Expect From Guccis Creative Redesign

May 24, 2025 -

Analyzing Demna Gvasalias Role As Guccis Creative Director

May 24, 2025

Analyzing Demna Gvasalias Role As Guccis Creative Director

May 24, 2025 -

Schekotat Nervy Vzglyad Fedora Lavrova Na Pavla I I Zhanr Trillera

May 24, 2025

Schekotat Nervy Vzglyad Fedora Lavrova Na Pavla I I Zhanr Trillera

May 24, 2025 -

Guccis New Designer Demna Gvasalias Vision And Future Direction

May 24, 2025

Guccis New Designer Demna Gvasalias Vision And Future Direction

May 24, 2025 -

The Demna Gvasalia Effect Reshaping Guccis Aesthetic

May 24, 2025

The Demna Gvasalia Effect Reshaping Guccis Aesthetic

May 24, 2025