Apple Stock: Analyzing The Dip Before Q2 Results

Table of Contents

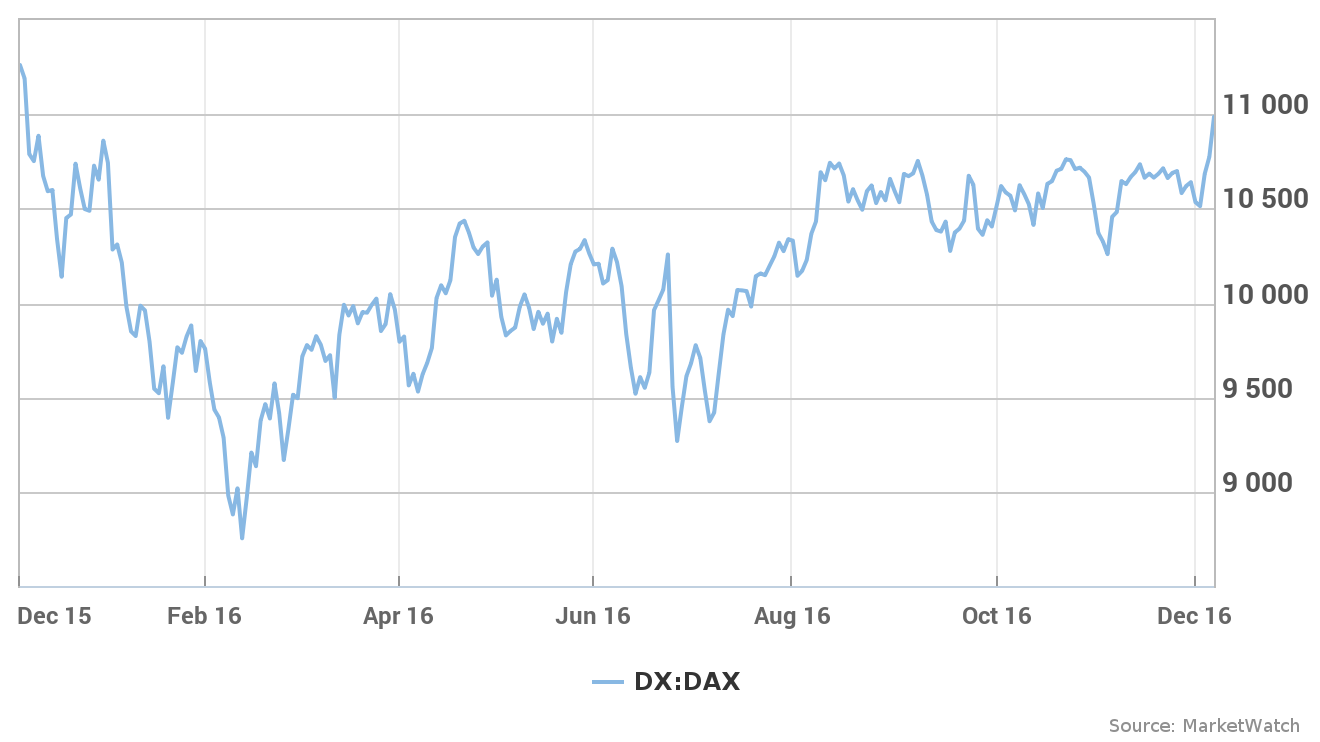

Market Sentiment and Recent Downturn

The recent downturn in Apple stock isn't isolated; it reflects broader anxieties within the tech sector and the global economy. Negative news impacting Apple's stock price includes concerns about slowing iPhone sales growth, particularly in key markets like China, and a potential slowdown in consumer spending due to global economic uncertainty. This downturn is further fueled by broader market trends impacting tech stocks:

- Increased interest rates: Higher interest rates make borrowing more expensive for companies and investors, dampening investment enthusiasm and impacting stock valuations, including Apple stock.

- Global economic uncertainty: Recessions or fears of a recession in major economies directly impact consumer spending, affecting demand for Apple products. This uncertainty makes investors cautious, leading to a sell-off in many stocks, including AAPL.

- Competition in the smartphone and tech markets: Intense competition from companies like Samsung, Google, and other emerging tech players puts pressure on Apple's market share and profit margins. This competition necessitates ongoing innovation and marketing investments to maintain its competitive edge.

Analyst predictions for Apple stock before Q2 results are mixed, ranging from cautiously optimistic to more bearish outlooks. While some analysts believe the dip represents a buying opportunity, others remain wary due to macroeconomic headwinds. This diversity of opinion underscores the complexity of predicting Apple stock's performance accurately.

Potential Catalysts for Growth in Q2 2024

Despite the current downturn, several factors could drive Apple stock growth in Q2 2024 and beyond:

- iPhone sales, particularly in emerging markets: While mature markets may show slower growth, Apple has significant opportunities for expansion in emerging economies. Increased penetration in these markets could significantly boost iPhone sales and overall revenue.

- Growth in services revenue (Apple Music, iCloud, etc.): Apple's services segment is a high-margin, recurring revenue stream, exhibiting strong and consistent growth. Continued expansion of its services ecosystem is a key driver of future profitability.

- Performance of wearables (Apple Watch, AirPods): The wearables market is a significant growth area, and Apple's dominance in this segment, driven by the Apple Watch and AirPods, contributes considerably to its overall financial health.

Furthermore, the potential launch of new products or significant updates to existing product lines could inject fresh momentum into Apple's growth trajectory. The company's strong financial health, substantial cash reserves, and consistent innovation pipeline offer a solid foundation for future growth.

Risks and Considerations Before Investing in Apple Stock

Before investing in Apple stock, it's crucial to acknowledge potential downsides:

- Supply chain challenges and their impact on production: Global supply chain disruptions can affect Apple's production capabilities and timely product releases, potentially impacting revenue and profitability.

- Geopolitical risks and their potential effect on Apple's business: Geopolitical instability, particularly concerning trade relations and manufacturing locations, could disrupt Apple's operations and negatively impact its stock price.

- Competition from other tech giants: The intense competition in the tech industry means Apple constantly needs to innovate and adapt to maintain its market leadership. A failure to innovate effectively could lead to market share erosion.

The Q2 earnings announcement itself presents a significant risk. Positive results could trigger a sharp upward movement in Apple stock price, while disappointing results could exacerbate the existing downturn. Therefore, carefully weighing the potential outcomes of the earnings report is crucial. Always perform thorough due diligence before making any investment decisions.

Conclusion

The recent dip in Apple stock (AAPL) before Q2 earnings presents a complex investment scenario. While concerns exist regarding broader market trends and competition, significant potential catalysts for growth within key product segments remain. Thorough analysis of both the risks and opportunities is crucial for making informed decisions. Before making any decisions regarding buying or selling Apple stock, conduct your own in-depth research and consult with a financial advisor if necessary. Understanding the factors influencing the current Apple stock price and the potential implications of the Q2 results is paramount for making informed investment choices regarding Apple stock.

Featured Posts

-

Bbc Radio 1 Big Weekend 2025 Your Comprehensive Ticket Buying Guide

May 25, 2025

Bbc Radio 1 Big Weekend 2025 Your Comprehensive Ticket Buying Guide

May 25, 2025 -

Bolshe 600 Svadeb Na Kharkovschine Prichiny Rosta Populyarnosti Brakov

May 25, 2025

Bolshe 600 Svadeb Na Kharkovschine Prichiny Rosta Populyarnosti Brakov

May 25, 2025 -

Demna Gvasalias Gucci Debut What To Expect

May 25, 2025

Demna Gvasalias Gucci Debut What To Expect

May 25, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Dist A Guide To Net Asset Value Nav

May 25, 2025

Amundi Dow Jones Industrial Average Ucits Etf Dist A Guide To Net Asset Value Nav

May 25, 2025 -

Stoxx Europe 600 Ve Dax 40 Endekslerinde Gerileme 16 Nisan 2025 Avrupa Piyasalari Raporu

May 25, 2025

Stoxx Europe 600 Ve Dax 40 Endekslerinde Gerileme 16 Nisan 2025 Avrupa Piyasalari Raporu

May 25, 2025

Latest Posts

-

Wifes Murder Georgia Man Charged After 19 Year Manhunt Nannys Role Investigated

May 25, 2025

Wifes Murder Georgia Man Charged After 19 Year Manhunt Nannys Role Investigated

May 25, 2025 -

Buy And Hold Investing The Long Games Gut Wrenching Truth

May 25, 2025

Buy And Hold Investing The Long Games Gut Wrenching Truth

May 25, 2025 -

Cold Case Solved Georgia Man Charged With Wifes Murder After 19 Year Flight With Nanny

May 25, 2025

Cold Case Solved Georgia Man Charged With Wifes Murder After 19 Year Flight With Nanny

May 25, 2025 -

The Great New Orleans Jailbreak How 10 Inmates Escaped

May 25, 2025

The Great New Orleans Jailbreak How 10 Inmates Escaped

May 25, 2025 -

Georgia Man Arrested For Murder 19 Years After Crime Nanny Involved

May 25, 2025

Georgia Man Arrested For Murder 19 Years After Crime Nanny Involved

May 25, 2025