Analyzing Warren Buffett's Investing History: Hits, Misses, And Lasting Wisdom

Table of Contents

Warren Buffett's Greatest Investment Wins

Berkshire Hathaway's Growth

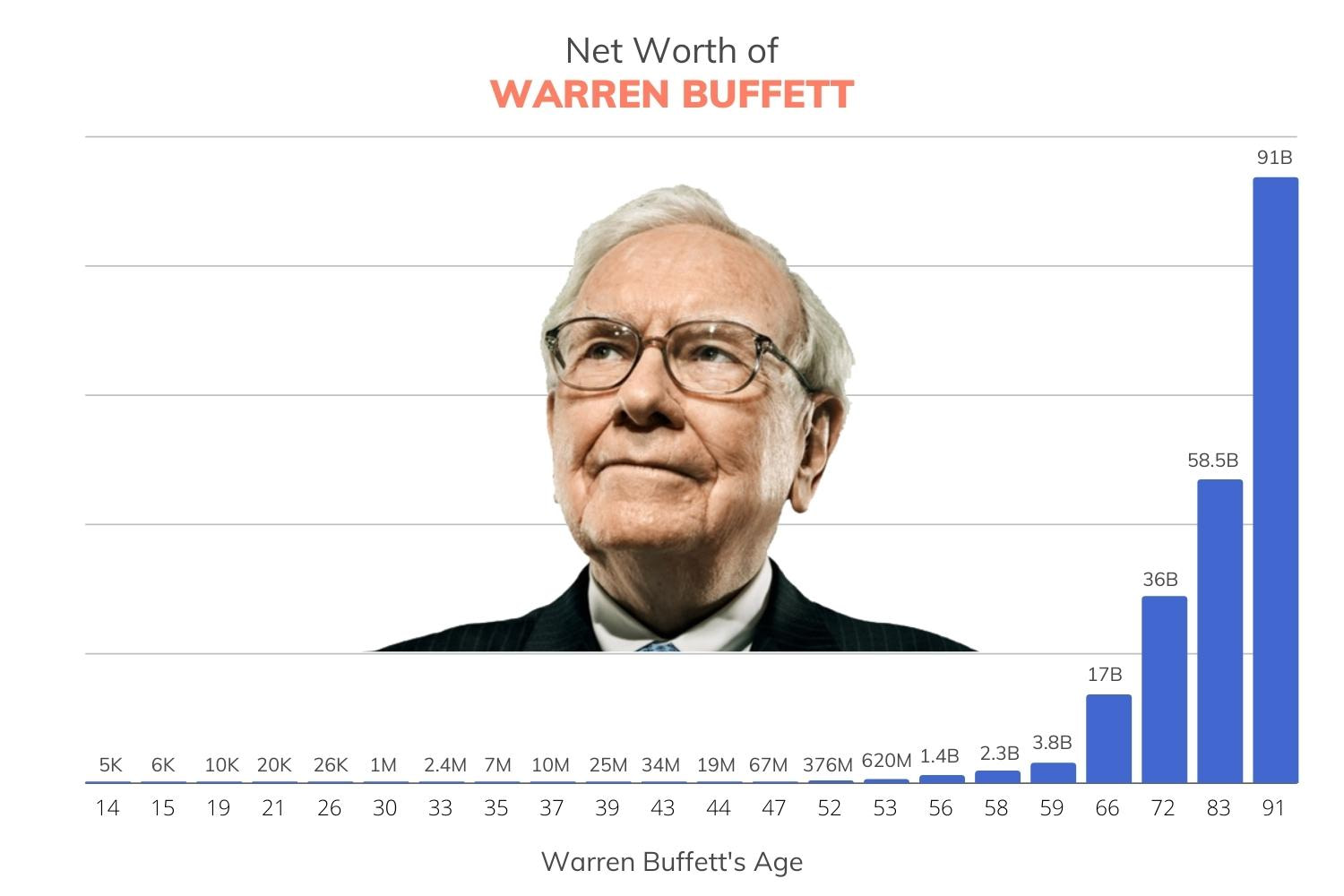

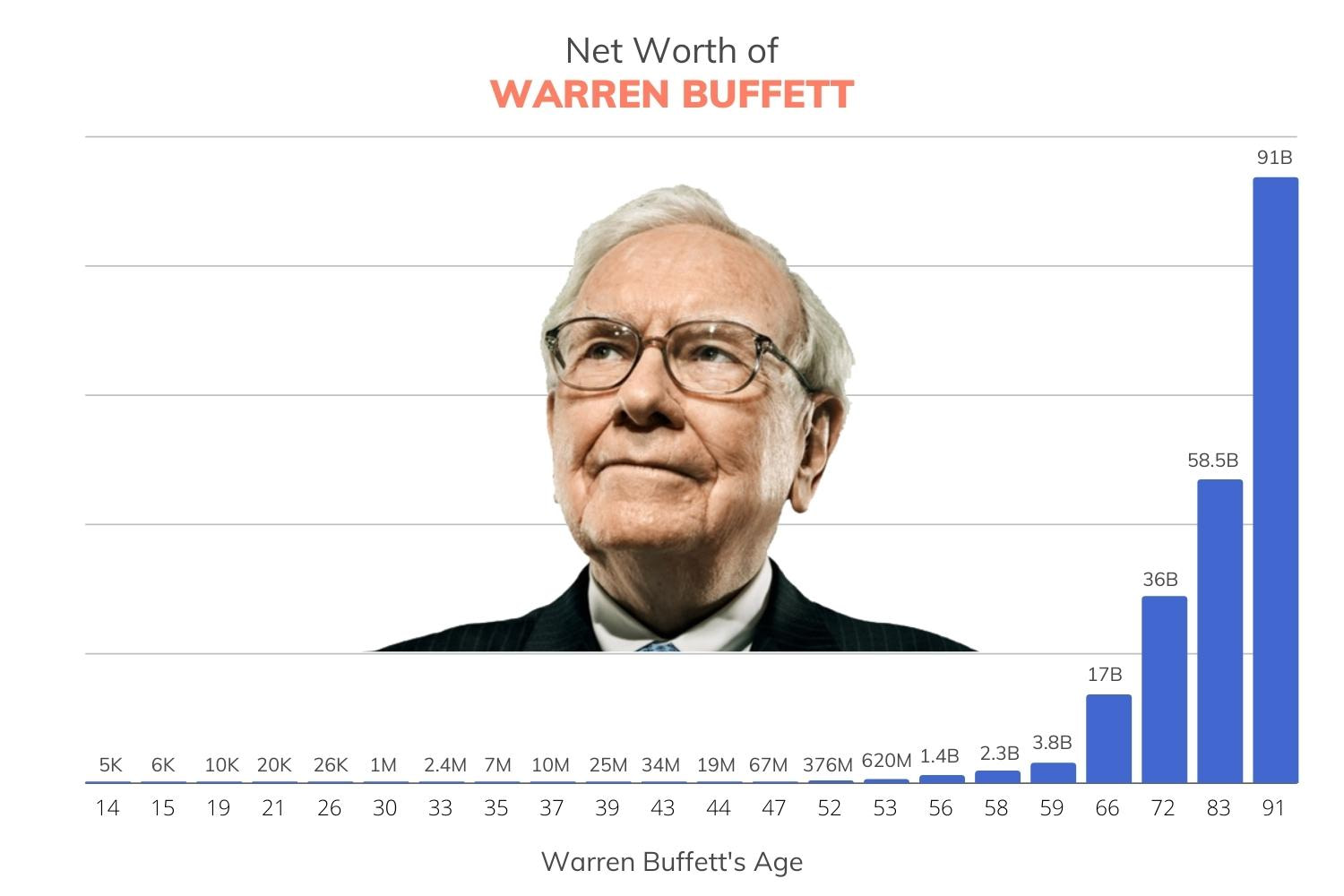

Buffett's acquisition and transformation of Berkshire Hathaway is a masterclass in value investing and long-term growth. His initial investment, a relatively small stake in a struggling textile company, blossomed into one of the world's most valuable conglomerates. This remarkable growth story highlights the power of compounding returns and strategic acquisitions.

- Initial Investment: Buffett's initial investment in Berkshire Hathaway was modest, but his long-term vision and skillful management transformed the company.

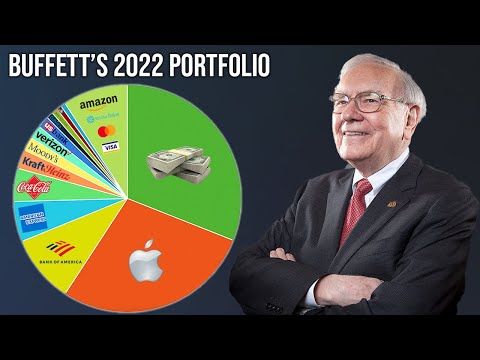

- Key Acquisitions: Strategic acquisitions like Coca-Cola and American Express, driven by fundamental analysis and an understanding of intrinsic value, fueled Berkshire Hathaway's exponential growth. These companies possess strong competitive advantages and enduring moats, offering consistent, long-term value.

- Long-Term Value Creation: Buffett's focus on long-term value creation, rather than short-term gains, is a cornerstone of his success. He consistently seeks companies with strong fundamentals and sustainable competitive advantages.

- Compounding Returns: The power of compounding returns is evident in Berkshire Hathaway's remarkable growth, showcasing the benefits of patience and long-term investment strategies in the stock market.

Successful Stock Selection

Buffett's success stems from his meticulous stock picking, driven by fundamental analysis and a deep understanding of a company's intrinsic value. He looks for businesses with a durable competitive advantage, often referred to as a "moat," that protects them from competition and ensures sustainable profitability.

- Coca-Cola: A classic example of Buffett's long-term approach, his investment in Coca-Cola has yielded phenomenal returns over decades.

- American Express: Another prime example of identifying a company with a strong brand and loyal customer base, resulting in substantial long-term gains.

- Gillette: Before its acquisition by Procter & Gamble, Gillette represented a business with a dominant market share and a strong brand, illustrating Buffett's strategy of investing in high-quality companies with competitive advantages.

- Fundamental Analysis: Buffett's emphasis on fundamental analysis, scrutinizing financial statements and understanding the underlying business, is key to his stock picking success. He seeks companies with a clear path to sustained profitability.

- Intrinsic Value: He focuses on identifying companies trading below their intrinsic value, ensuring a margin of safety for his investments. This long-term investment strategy is crucial to his success.

Mastering Market Timing (Relatively)

While Buffett doesn't claim to be a master market timer, his patience and disciplined approach have allowed him to capitalize on market downturns. He consistently waits for the right price, avoiding speculative bubbles and maximizing returns through strategic buying low and selling high.

- Buying During Market Downturns: Buffett has a history of successfully deploying capital during market crashes, acquiring undervalued assets at bargain prices.

- Waiting for the Right Price: Patience is a vital component of his investment philosophy. He waits until the price aligns with his assessment of the company's intrinsic value before investing.

- Avoiding Speculative Bubbles: He avoids speculative bubbles and fads, focusing instead on companies with solid fundamentals and long-term growth potential. This cautious approach mitigates risk.

Analyzing Buffett's Notable Investment Misses

Deregulation and Mistakes

Even the Oracle of Omaha makes mistakes. Unforeseen circumstances, such as deregulation changes, have occasionally negatively impacted his investments. Analyzing these instances highlights the importance of risk management and adaptability in investing.

- Specific Examples: While he rarely publicly discusses failures in detail, analyzing his portfolio reveals periods of underperformance linked to unexpected regulatory shifts or changes in market dynamics.

- Contributing Factors: These less successful investments often involved unforeseen industry disruptions or changes in competitive landscapes, emphasizing the inherent risks in any investment strategy.

- Lessons Learned from Failures: Buffett's ability to learn from these setbacks and adapt his strategy underscores his ongoing commitment to continuous improvement in investing.

The Dexter Shoe Company

The Dexter Shoe acquisition serves as a valuable case study of a less successful investment for Buffett. While the reasons for its underperformance are complex, it highlights the challenges of entering unfamiliar industries and the importance of thorough due diligence.

- Details of the Acquisition: The acquisition of Dexter Shoe demonstrated the challenges of successfully integrating a company into the Berkshire Hathaway portfolio outside of Buffett's core area of expertise.

- Reasons for Underperformance: Various factors contributed to Dexter's underperformance, including increased competition and operational challenges. The experience highlighted the importance of focusing on industries where Buffett's expertise was strongest.

- What Buffett Learned: The Dexter Shoe experience underscores the value of sticking to what he knows and the significance of thorough due diligence before making large acquisitions.

Overpaying for Businesses

Even a seasoned investor like Buffett can overpay for a company. These instances emphasize the critical role of valuation and thorough due diligence in investment decision-making.

- Examples: While specific examples are not often publicized, there have been instances where the initial investment return wasn’t as significant as other more successful choices.

- The Impact of Overpaying: Overpaying for assets can significantly reduce investment returns and potentially lead to losses.

- The Importance of Thorough Due Diligence: Comprehensive due diligence, including meticulous financial analysis and an in-depth understanding of the business model, is crucial to avoid overpaying.

Enduring Wisdom from Warren Buffett's Investing Journey

Importance of Long-Term Investing

Buffett's success is a testament to the power of long-term, value-oriented investing. Patience and discipline are crucial for riding out short-term market fluctuations and reaping the benefits of compounding returns.

- The Benefits of Patience and Discipline: Buffett consistently emphasizes the importance of patience and discipline in achieving long-term investment success.

- Avoiding Short-Term Market Fluctuations: He largely ignores short-term market noise, focusing on the long-term prospects of the underlying businesses.

- Compounding Returns Over Time: The power of compounding interest is a key driver of his long-term investment strategy.

The Power of Fundamental Analysis

Buffett's approach relies heavily on fundamental analysis, a rigorous process of assessing a company's financials, business model, and competitive position before investing.

- Importance of Researching Financial Statements: He meticulously analyzes a company's financial statements to understand its profitability, cash flow, and debt levels.

- Assessing Its Competitive Advantage: He looks for businesses with sustainable competitive advantages that protect them from competitors.

- Understanding Its Management Team: The quality of the management team is a critical factor in his investment decisions.

Risk Management and Diversification

While Buffett has concentrated positions, he emphasizes the importance of risk management and diversification to mitigate potential losses.

- The Dangers of Over-Concentration: While concentrating his investments, Buffett understands the risk and mitigates by choosing quality companies he understands.

- Strategies for Diversification: Even with concentrated holdings, diversification across different sectors is still important.

- Risk Tolerance Assessment: Understanding one's own risk tolerance and adjusting the portfolio accordingly is critical for any investor.

Conclusion

Analyzing Warren Buffett's investing history reveals a compelling narrative of exceptional success built on a foundation of rigorous research, disciplined investing, and an unwavering commitment to value. While he's experienced setbacks, his resilience, coupled with his consistent application of fundamental principles, has cemented his legacy as one of the greatest investors of all time. By understanding his strategies, both his successes and his occasional failures, we can glean invaluable lessons to inform our own investment approaches. Learning from Warren Buffett's investing history allows us to develop a more robust and successful investment strategy, one that prioritizes value, patience, and a deep understanding of the underlying businesses we invest in. Begin your journey towards informed investing by further researching Warren Buffett’s strategies and applying his timeless wisdom to your portfolio.

Featured Posts

-

La Wildfires A Reflection Of Our Times Through Disaster Betting

May 06, 2025

La Wildfires A Reflection Of Our Times Through Disaster Betting

May 06, 2025 -

Learning From The Oracle A Deep Dive Into Warren Buffetts Investment Decisions

May 06, 2025

Learning From The Oracle A Deep Dive Into Warren Buffetts Investment Decisions

May 06, 2025 -

Get More For Less Affordable And High Quality Products

May 06, 2025

Get More For Less Affordable And High Quality Products

May 06, 2025 -

The Crucial Role Of Middle Managers In Boosting Company Performance And Employee Satisfaction

May 06, 2025

The Crucial Role Of Middle Managers In Boosting Company Performance And Employee Satisfaction

May 06, 2025 -

Watch Celtics Vs Knicks Live Free Streaming Guide And Tv Channel Info

May 06, 2025

Watch Celtics Vs Knicks Live Free Streaming Guide And Tv Channel Info

May 06, 2025

Latest Posts

-

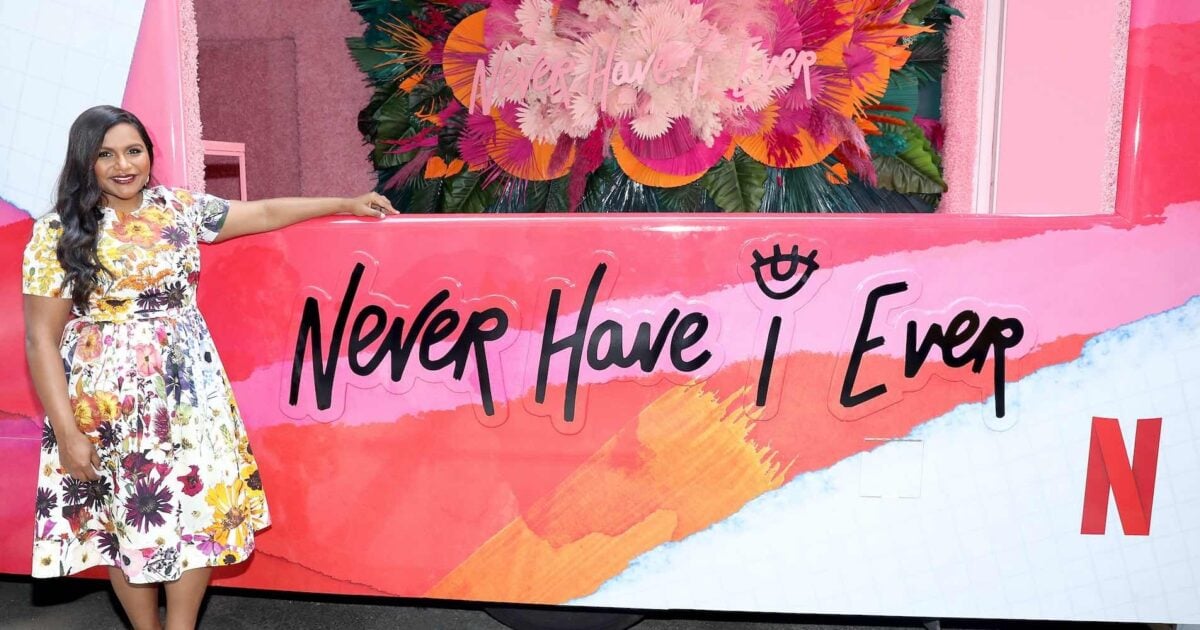

Analyzing The Powerful Women Portrayed In Mindy Kalings Shows

May 06, 2025

Analyzing The Powerful Women Portrayed In Mindy Kalings Shows

May 06, 2025 -

Mindy Kalings Weight Loss A New Look At The Series Premiere

May 06, 2025

Mindy Kalings Weight Loss A New Look At The Series Premiere

May 06, 2025 -

O Relacionamento Secreto De Mindy Kaling Com Ex Colega De The Office A Verdade Revelada

May 06, 2025

O Relacionamento Secreto De Mindy Kaling Com Ex Colega De The Office A Verdade Revelada

May 06, 2025 -

Mindy Kalings Weight Loss Journey Before And After Photos Compared

May 06, 2025

Mindy Kalings Weight Loss Journey Before And After Photos Compared

May 06, 2025 -

Relacionamento De Mindy Kaling Com Ex De The Office A Declaracao De Amor Apos Anos De Silencio

May 06, 2025

Relacionamento De Mindy Kaling Com Ex De The Office A Declaracao De Amor Apos Anos De Silencio

May 06, 2025