HMRC To Implement Voice Recognition For Faster Call Handling

Table of Contents

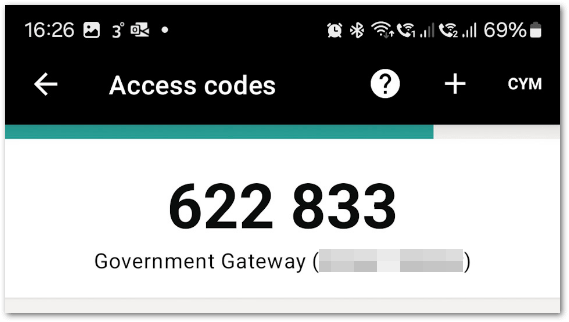

How HMRC Voice Recognition Will Work

HMRC's new voice recognition system aims to streamline the call handling process dramatically. The system will function by analyzing the caller's spoken words, identifying key phrases and keywords related to their query. This information will then be used to intelligently route the call to the appropriate department or agent, minimizing the time spent navigating menus and waiting on hold. For common, simple queries, the system may even provide automated responses, providing immediate solutions without the need for human intervention.

- Faster call routing: Instead of navigating complex phone menus, callers will be connected directly to the relevant department, saving valuable time.

- Reduced wait times: The aim is to significantly reduce the frustratingly long hold times currently experienced by many taxpayers.

- 24/7 availability (potential): Depending on the final implementation, the voice recognition system could potentially offer access to information and basic assistance outside of standard HMRC business hours.

- Improved accessibility: Voice recognition technology can enhance accessibility for individuals with disabilities, offering a more convenient and inclusive way to interact with HMRC. This includes those with visual impairments or motor skill challenges.

Benefits for Taxpayers

The introduction of HMRC voice recognition offers numerous benefits for taxpayers, ultimately leading to a more positive and efficient experience. The most immediate advantage is the considerable time saved by faster call handling. This translates to less time spent on hold and quicker resolution of tax queries.

- Quicker resolution of tax queries: Get answers to your tax questions faster and more efficiently.

- More efficient tax return filing assistance (potential): The system could potentially guide users through the tax return process, providing assistance and answering questions along the way.

- Increased accessibility for those with disabilities or language barriers (potential): Depending on system capabilities, the voice recognition system could offer multilingual support and cater to diverse needs.

- Reduced stress associated with contacting HMRC: A streamlined and efficient process can significantly reduce the stress and anxiety often associated with dealing with tax-related issues.

Challenges and Potential Issues

While the potential benefits of HMRC voice recognition are significant, it's crucial to acknowledge potential challenges. The accuracy of voice recognition technology is paramount. Accents, background noise, and unclear speech can all impact the system's ability to accurately interpret requests. Data privacy and security are also key concerns. HMRC must ensure robust measures are in place to protect sensitive taxpayer information.

- Accuracy of voice recognition: The system's ability to accurately interpret different accents, dialects, and speech patterns will be crucial for its success.

- Data privacy and security: Protecting taxpayer data is paramount. Stringent security measures must be implemented to prevent breaches and misuse of information.

- Integration with existing systems: Integrating the new voice recognition system with HMRC's existing infrastructure and databases will be a complex undertaking.

- Accessibility for users with various accents and dialects: Ensuring the system accurately understands a wide range of accents and dialects will be a key challenge.

The Future of HMRC Customer Service

The implementation of HMRC voice recognition marks a significant step towards a more automated and efficient customer service experience. This technology is likely to shape future interactions, potentially leading to further automation, integration with other digital tools, and improved self-service options.

- Potential for more self-service options using voice commands: Taxpayers might be able to access information and complete simple tasks entirely through voice commands.

- Integration with HMRC's online portal: Seamless integration with the online portal could offer a more unified and convenient experience.

- Expansion of voice recognition to other HMRC services: The technology could be expanded to other areas of HMRC services, improving efficiency across the board.

- Improved overall customer satisfaction: A faster, more efficient, and accessible system should lead to increased customer satisfaction.

Conclusion

HMRC's implementation of voice recognition technology represents a significant step forward in improving customer service. While challenges exist, the potential benefits—faster call handling, increased efficiency, and improved accessibility—are substantial for taxpayers. The use of HMRC voice recognition promises a more streamlined and user-friendly experience for all.

Call to Action: Stay informed about the rollout of HMRC's new voice recognition system and how it will impact your interactions with the tax authority. Keep checking back for updates on the HMRC Voice Recognition implementation. Learn more about how this initiative could improve your HMRC experience.

Featured Posts

-

Starshiy Syn Mikhaelya Shumakhera Stal Ottsom Legendarniy Gonschik Dedushka

May 20, 2025

Starshiy Syn Mikhaelya Shumakhera Stal Ottsom Legendarniy Gonschik Dedushka

May 20, 2025 -

Red Devils Eye Dynamic Premier League Forward Transfer Battle Looms

May 20, 2025

Red Devils Eye Dynamic Premier League Forward Transfer Battle Looms

May 20, 2025 -

Us Army Expands Pacific Presence With Second Typhon Battery Deployment

May 20, 2025

Us Army Expands Pacific Presence With Second Typhon Battery Deployment

May 20, 2025 -

Adressage Du District Autonome D Abidjan Etat D Avancement

May 20, 2025

Adressage Du District Autonome D Abidjan Etat D Avancement

May 20, 2025 -

Marc Lievremont Se Souvient De Millau L Un De Mes Meilleurs Moments

May 20, 2025

Marc Lievremont Se Souvient De Millau L Un De Mes Meilleurs Moments

May 20, 2025

Latest Posts

-

Chinas Demand Philippines Withdraw Typhon Missiles To Maintain Peace

May 20, 2025

Chinas Demand Philippines Withdraw Typhon Missiles To Maintain Peace

May 20, 2025 -

Philippines Stands Strong Against Chinese Pressure Over Missiles

May 20, 2025

Philippines Stands Strong Against Chinese Pressure Over Missiles

May 20, 2025 -

Us Army Expands Pacific Presence With Second Typhon Battery Deployment

May 20, 2025

Us Army Expands Pacific Presence With Second Typhon Battery Deployment

May 20, 2025 -

China Urges Philippines To Remove Typhon Missile System For Regional Stability

May 20, 2025

China Urges Philippines To Remove Typhon Missile System For Regional Stability

May 20, 2025 -

Manila Rejects Chinese Demands Missile System Remains

May 20, 2025

Manila Rejects Chinese Demands Missile System Remains

May 20, 2025