Analyzing The Dollar's Drop: Implications For Asian Exchange Rates

Table of Contents

Factors Contributing to the Dollar's Decline

Several interconnected factors have contributed to the recent decline in the value of the US dollar against other major currencies. These factors are complex and often intertwined, making a precise attribution difficult but crucial for understanding the current situation.

US Monetary Policy

The Federal Reserve's (Fed) monetary policy decisions are a primary driver of the dollar's value. Recent interest rate hikes, implemented to combat stubbornly high inflation, have had unintended consequences. While aiming to curb inflation, these aggressive increases may be slowing economic growth, potentially impacting the dollar's strength in the long run. Investors are increasingly concerned about a potential US recession, leading to a decrease in demand for the dollar.

- Specific Interest Rate Changes: The Fed raised the federal funds rate by 0.75% in June and July 2022, followed by further increases throughout the year. This aggressive approach, while initially strengthening the dollar, has subsequently led to concerns about its long-term sustainability.

- Inflation Data: Persistent inflation, higher than the Fed's target rate, initially fueled the need for rate hikes. However, the continued high inflation despite rate hikes has raised concerns about the Fed's effectiveness and the health of the US economy, thus impacting dollar's value.

- Quantitative Easing (QE): While QE is currently not in effect, its previous impact on the money supply continues to reverberate through the financial system. The unwinding of QE also influences interest rates and market sentiment, affecting the dollar's value.

Global Economic Uncertainty

Geopolitical risks and escalating global economic uncertainty frequently contribute to a flight to safety, impacting the demand for the dollar. However, the dollar's safe haven status is weakening as investors seek higher returns elsewhere.

- The War in Ukraine: The ongoing war in Ukraine has significantly disrupted global supply chains, leading to energy crises and inflation, thereby weakening the dollar's appeal as a safe-haven asset.

- Energy Crises: The energy crisis in Europe and beyond has exacerbated inflationary pressures and increased global economic uncertainty, impacting the global demand for US dollars.

- Supply Chain Disruptions: Ongoing disruptions to global supply chains continue to impact inflation and economic growth, creating uncertainty and dampening investor confidence in the US dollar. These disruptions are linked to geopolitical events and pandemic-related issues.

Relative Strength of Other Currencies

The US dollar's value isn't solely determined by internal factors. The relative strength of other major global currencies significantly influences its value. The Euro's relative strength, for example, can put downward pressure on the dollar.

- Euro Performance: The Euro has shown strength against the dollar in recent months due to a combination of factors, including a robust European economy and the energy crisis impacting the US more significantly.

- Japanese Yen Performance: While the Yen has experienced significant fluctuations recently, periods of strength in the Yen can directly impact the dollar's value.

- Other Major Currencies: The performance of other currencies, like the British Pound or the Canadian Dollar, also plays a role in the dollar's relative strength. These currencies' movements against the dollar are often correlated.

Impact on Asian Exchange Rates

The dollar's decline has significant implications for Asian economies, affecting both export-oriented and import-dependent nations differently.

Implications for Export-Oriented Economies

A weaker dollar generally boosts exports from Asian countries. Their goods become more price-competitive on the global market, potentially leading to increased sales and economic growth. However, this advantage is often mitigated by increased import costs.

- Vietnam's Export Sector: Vietnam, a major exporter of textiles and electronics, has seen increased export demand as the dollar weakens, but also faces challenges due to higher import costs for raw materials.

- South Korea's Electronics Exports: South Korea, a leading exporter of electronics, is likely to benefit from increased global demand for its products, although the full extent of the benefit depends on various factors including global demand.

- Offsetting Increased Import Costs: While exports may benefit, the weaker dollar also increases the cost of imported raw materials and intermediate goods, potentially offsetting some gains.

Impact on Import-Dependent Economies

Countries heavily reliant on imports, such as Singapore and Japan, face a different scenario. A weaker dollar increases the cost of imported goods, potentially fueling inflation and impacting consumer spending.

- Singapore's Import Dependency: Singapore's reliance on imported goods makes it particularly vulnerable to the effects of a weaker dollar. Increased import costs could put pressure on inflation and potentially slow economic growth.

- Japan's Energy Imports: Japan's significant reliance on energy imports makes it particularly susceptible to increased energy costs, potentially impacting its economy and causing inflationary pressure.

- Potential Inflationary Pressures: Increased import costs contribute to inflationary pressures, potentially reducing purchasing power and dampening consumer confidence.

Investment Flows and Capital Markets

The dollar's decline can shift investment flows toward Asian markets, as investors seek higher returns or greater diversification. This can lead to significant changes in Asian stock markets and other asset classes.

- Foreign Investment Influx: A weakening dollar might attract foreign investment into Asian markets seen as offering better risk-adjusted returns.

- Impact on Stock Markets: The inflow of foreign capital can boost stock markets in Asian countries, leading to potential increases in stock prices.

- Changes in Other Financial Instruments: The changing landscape can also influence other financial instruments, such as bonds and derivatives, within Asian capital markets.

Strategies for Navigating the Shifting Landscape

Navigating the changing currency landscape requires proactive strategies for both businesses and investors.

Hedging Strategies for Businesses

Businesses engaged in international trade must employ effective hedging strategies to mitigate currency risk associated with the dollar's fluctuations.

- Forward Contracts: Businesses can use forward contracts to lock in future exchange rates, reducing uncertainty related to currency fluctuations.

- Options Contracts: Options provide flexibility, allowing businesses to protect against adverse movements in exchange rates while retaining the potential to benefit from favorable movements.

- Other Derivative Instruments: Various other derivative instruments can be used to manage currency risk, tailored to the specific needs and risk tolerance of each business.

Investment Strategies for Investors

Investors can adjust their portfolios to capitalize on the opportunities created by the changing exchange rates.

- Currency Diversification: Diversifying investments across various currencies helps reduce the risk associated with fluctuations in any single currency.

- Emerging Market Exposure: The weakening dollar can make investments in Asian emerging markets more attractive, offering potential for higher returns.

- Asset Allocation Adjustments: Investors should review and adjust their asset allocation strategies to account for the changing currency dynamics.

Conclusion

The decline of the US dollar presents a complex array of challenges and opportunities for Asian economies. Understanding the interplay of factors driving this trend and its diverse impacts on both export-oriented and import-dependent economies is crucial for informed decision-making. Businesses need to implement robust hedging strategies, while investors should adapt their portfolio strategies to navigate this dynamic landscape. Continued monitoring of the dollar's movement and its ripple effects on Asian exchange rates is vital for making sound financial decisions. Stay informed about the implications of the dollar's drop on Asian exchange rates to optimize your strategies in these dynamic markets.

Featured Posts

-

Romania Election Update Runoff Election Between Far Right And Centrist Candidate

May 06, 2025

Romania Election Update Runoff Election Between Far Right And Centrist Candidate

May 06, 2025 -

Why Do Popes Choose Different Names Predicting The Next Papal Name

May 06, 2025

Why Do Popes Choose Different Names Predicting The Next Papal Name

May 06, 2025 -

Warren Buffetts Greatest Investing Wins And Losses Key Lessons Learned

May 06, 2025

Warren Buffetts Greatest Investing Wins And Losses Key Lessons Learned

May 06, 2025 -

The Impact Of Staffing Shortages On Newark Airport Operations

May 06, 2025

The Impact Of Staffing Shortages On Newark Airport Operations

May 06, 2025 -

Cassidy Hutchinsons Book Insights From A Key Jan 6th Hearing Participant

May 06, 2025

Cassidy Hutchinsons Book Insights From A Key Jan 6th Hearing Participant

May 06, 2025

Latest Posts

-

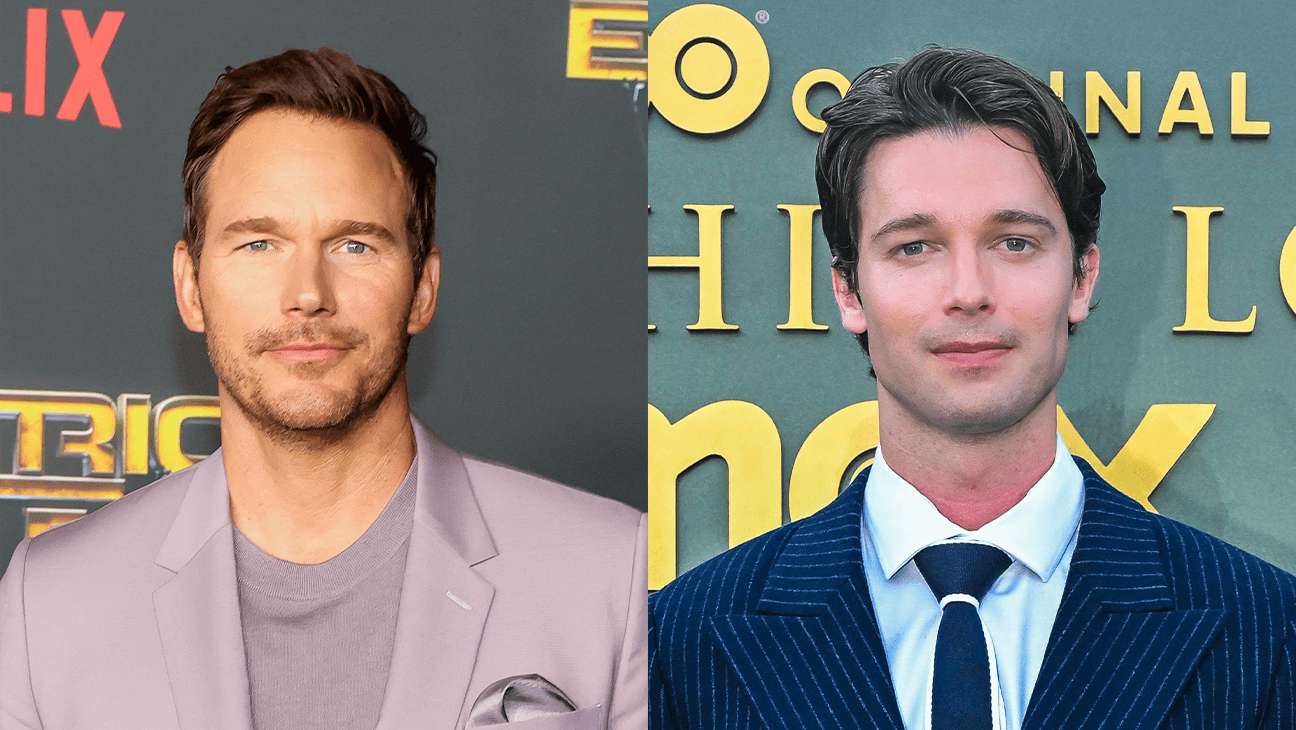

Patrick Schwarzeneggers White Lotus Nude Scene Chris Pratt Weighs In

May 06, 2025

Patrick Schwarzeneggers White Lotus Nude Scene Chris Pratt Weighs In

May 06, 2025 -

Chris Pratts Reaction To Patrick Schwarzeneggers White Lotus Nude Scene

May 06, 2025

Chris Pratts Reaction To Patrick Schwarzeneggers White Lotus Nude Scene

May 06, 2025 -

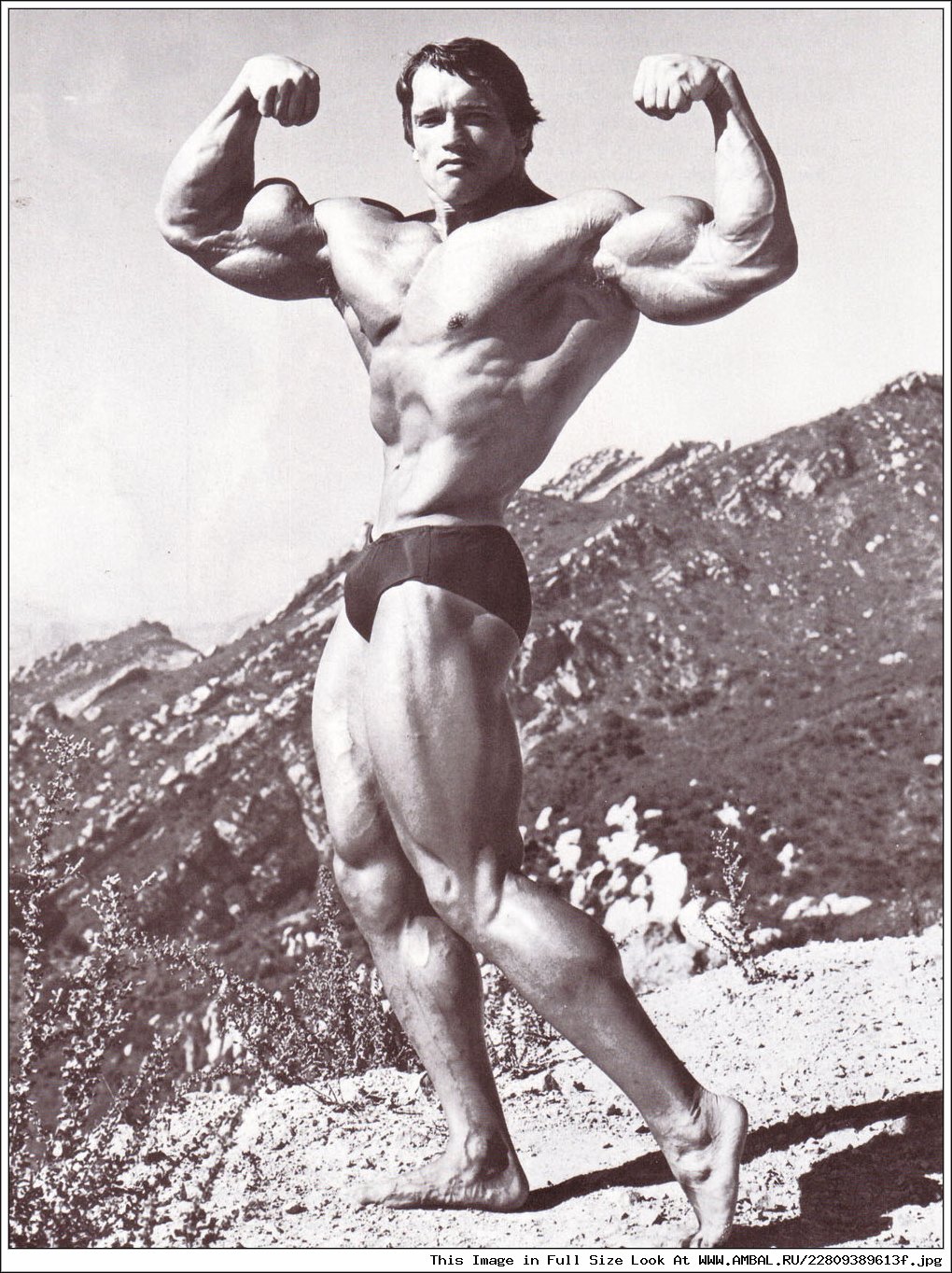

Shvartsenegger I Chempion Pravda O Syemke Dlya Kim Kardashyan

May 06, 2025

Shvartsenegger I Chempion Pravda O Syemke Dlya Kim Kardashyan

May 06, 2025 -

Foto Patrika Shvartseneggera I Ebbi Chempion Dlya Kim Kardashyan

May 06, 2025

Foto Patrika Shvartseneggera I Ebbi Chempion Dlya Kim Kardashyan

May 06, 2025 -

Arnold Schwarzenegger On Patrick Schwarzeneggers Nudity In Film

May 06, 2025

Arnold Schwarzenegger On Patrick Schwarzeneggers Nudity In Film

May 06, 2025