Analyzing News Corp's Undervalued Assets: A Deep Dive

Table of Contents

News Corp's Diversified Portfolio: Identifying Key Undervalued Holdings

News Corp operates across several key segments: News & Information Services, Digital Real Estate Services (primarily Realtor.com), Book Publishing, and others. This diversification, while seemingly a strength, may contribute to the undervaluation of individual assets. The market struggles to accurately assess the combined value of these distinct but interconnected businesses. Let's examine each segment for potential hidden gems:

-

News & Information Services: This segment includes prominent newspapers like The Wall Street Journal and The Times of London. While facing challenges from digital disruption, many of these publications maintain significant brand loyalty and reach. Specific titles, particularly those with strong digital strategies, might be undervalued by the market. Their subscription models and growing digital audiences indicate future growth potential that isn't yet fully reflected in the stock price. Analyzing key performance indicators (KPIs) like digital subscriber growth and engagement metrics is crucial here.

-

Digital Real Estate Services (Realtor.com): Realtor.com's market position in online real estate is substantial. However, market fluctuations in the real estate sector itself and competition from other digital platforms might temporarily depress its valuation. Analyzing its market share, user engagement, and potential for innovation in areas like iBuying or virtual tours could reveal significant untapped value.

-

Book Publishing: News Corp's book publishing arm houses numerous imprints with established authors and successful franchises. While the publishing industry faces its own unique challenges, specific imprints or authors with consistent sales and strong brand recognition might be overlooked in the overall company valuation. Identifying high-growth authors and focusing on digital distribution strategies are key to unlocking value here.

By performing detailed financial analysis on each of these segments and isolating individual assets within them, a clearer picture of News Corp's undervalued holdings emerges. We'll need to compare their revenue growth, market share, and profit margins against similar assets within their respective markets.

Market Dynamics and Undervaluation: Understanding the Factors at Play

Several factors contribute to the market's apparent undervaluation of News Corp's assets:

-

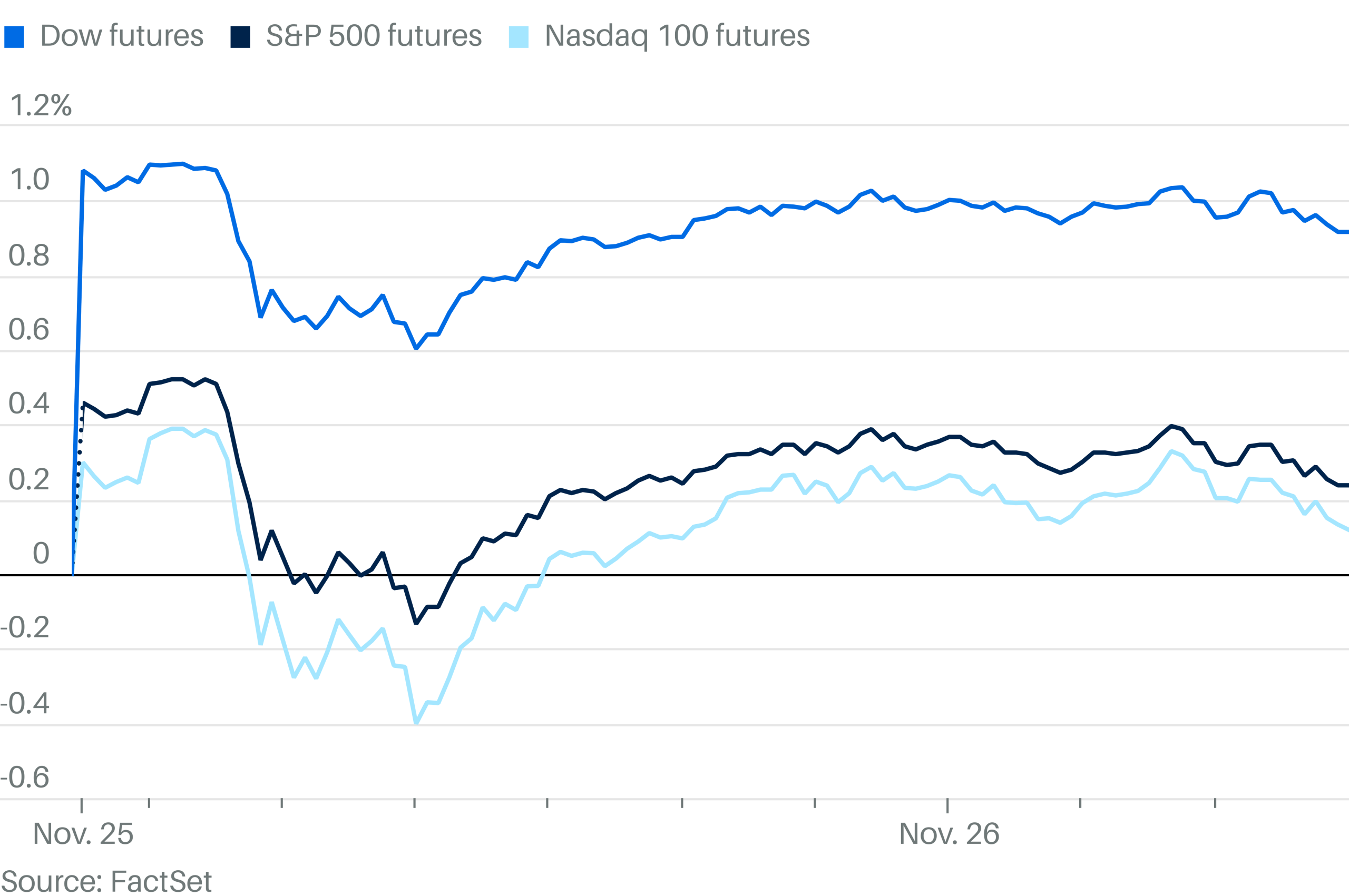

Macroeconomic Factors: Fluctuations in advertising revenue, a key component of media company earnings, directly impact News Corp's valuation. Economic downturns often lead to reduced advertising spending, temporarily depressing the market's perception of the company's prospects.

-

Industry Trends: The shift to digital media has presented significant challenges to traditional media companies. Investor concern about News Corp's ability to navigate this transition effectively may also contribute to a lower valuation.

-

Investor Sentiment: Negative investor sentiment, driven by short-term market volatility and anxieties about the future of traditional media, can suppress the stock price and undervalue its long-term potential.

Here are some key factors contributing to the undervaluation in bullet points:

- Short-term market fluctuations overshadowing long-term growth potential.

- Investor skepticism about the digital transformation strategy.

- Lack of awareness regarding the value of specific assets within the portfolio.

- Competition from larger, more diversified digital media companies.

Strategic Opportunities and Potential for Growth: Unlocking Hidden Value

Several strategies could unlock the hidden value in News Corp's undervalued assets:

- Divestment of non-core assets: Selling underperforming or non-strategic assets could free up capital for investment in more promising areas.

- Strategic acquisitions: Acquiring complementary businesses could enhance News Corp's core competencies and expand its market reach.

- Investment in technology and innovation: Investing in cutting-edge technology to enhance digital offerings and improve user experience is crucial.

- Improved marketing and communication: Effectively communicating the value of its individual assets to investors is essential to change market perception.

Successful examples of similar strategies include media companies that have successfully repositioned themselves in the digital landscape through acquisitions, divestitures, and technology investments, leading to significant increases in their market valuations.

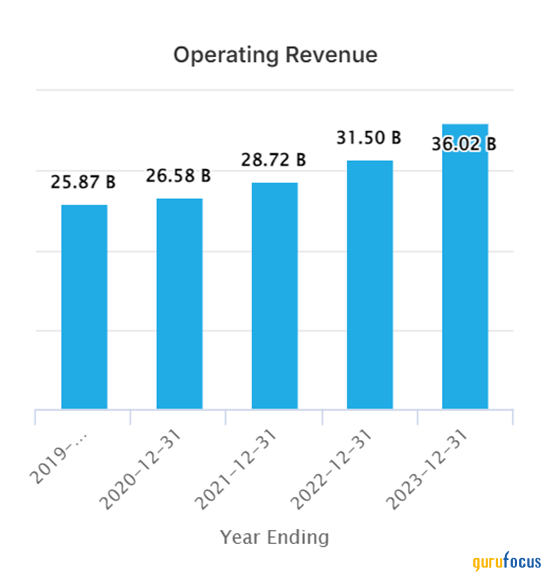

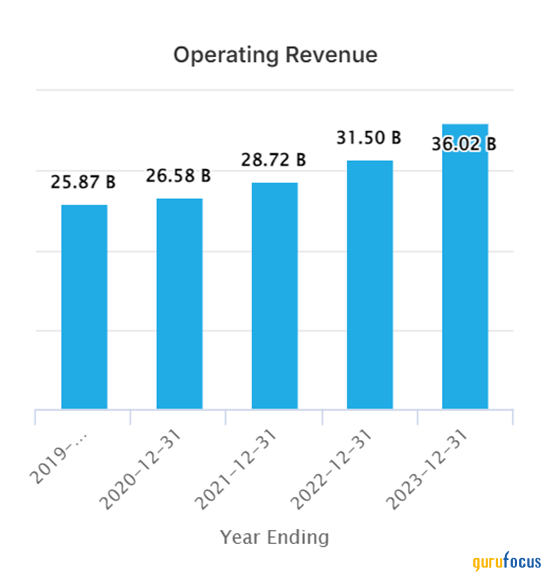

Financial Analysis: Assessing News Corp's True Worth

A comprehensive financial analysis, comparing News Corp's key financial metrics (revenue growth, profit margins, debt levels, etc.) with those of comparable media companies, reveals a significant undervaluation. This analysis should include a detailed examination of the individual segments and their respective assets, comparing their performance against industry benchmarks and highlighting their potential for future growth. Visual aids like charts and graphs will be crucial in presenting this data effectively. The key is to demonstrate that the market is failing to fully recognize the long-term value generation potential of the individual assets within the News Corp portfolio.

Conclusion: Investing in News Corp's Undervalued Assets – A Strategic Opportunity

Our analysis strongly suggests that many of News Corp's undervalued assets represent a significant investment opportunity. The current market price doesn't fully reflect the intrinsic value of the company's diverse portfolio, particularly within its individual segments and specific holdings. By understanding the factors contributing to the undervaluation and implementing strategic initiatives to enhance asset value and improve investor perception, the potential for substantial returns is considerable. Don't miss out on the opportunity to capitalize on News Corp's undervalued assets. Start your research today!

Featured Posts

-

Paris In The Red Luxury Goods Slump Hits City Budget March 7 2025

May 24, 2025

Paris In The Red Luxury Goods Slump Hits City Budget March 7 2025

May 24, 2025 -

Thqyqat Alshrtt Alalmanyt Bed Mdahmat Mshjeyn

May 24, 2025

Thqyqat Alshrtt Alalmanyt Bed Mdahmat Mshjeyn

May 24, 2025 -

Is Glastonbury 2025 The Festival To Beat Analyzing The Lineup

May 24, 2025

Is Glastonbury 2025 The Festival To Beat Analyzing The Lineup

May 24, 2025 -

Gear Essentials For Ferrari Owners And Enthusiasts A Comprehensive Guide

May 24, 2025

Gear Essentials For Ferrari Owners And Enthusiasts A Comprehensive Guide

May 24, 2025 -

Net Asset Value Nav Of Amundi Msci World Catholic Principles Ucits Etf Acc What Investors Need To Know

May 24, 2025

Net Asset Value Nav Of Amundi Msci World Catholic Principles Ucits Etf Acc What Investors Need To Know

May 24, 2025

Latest Posts

-

Trumps Tariff Hike Sends Amsterdam Stock Exchange Down 2

May 24, 2025

Trumps Tariff Hike Sends Amsterdam Stock Exchange Down 2

May 24, 2025 -

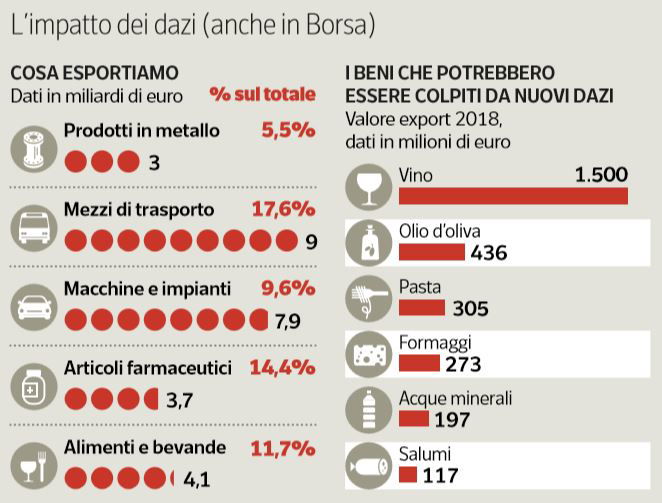

Dazi Usa Come Influenzano I Prezzi Dell Abbigliamento

May 24, 2025

Dazi Usa Come Influenzano I Prezzi Dell Abbigliamento

May 24, 2025 -

Amsterdam Stock Exchange Plunges 2 After Trumps Tariff Hike

May 24, 2025

Amsterdam Stock Exchange Plunges 2 After Trumps Tariff Hike

May 24, 2025 -

Effetti Dei Dazi Sulle Importazioni Di Moda Negli Usa Guida Ai Prezzi

May 24, 2025

Effetti Dei Dazi Sulle Importazioni Di Moda Negli Usa Guida Ai Prezzi

May 24, 2025 -

All Resolutions Adopted At Imcd N V S Annual General Meeting Of Shareholders

May 24, 2025

All Resolutions Adopted At Imcd N V S Annual General Meeting Of Shareholders

May 24, 2025