Analyst's Bitcoin Price Prediction: Entering Rally Zone On May 6th (Chart Analysis)

Table of Contents

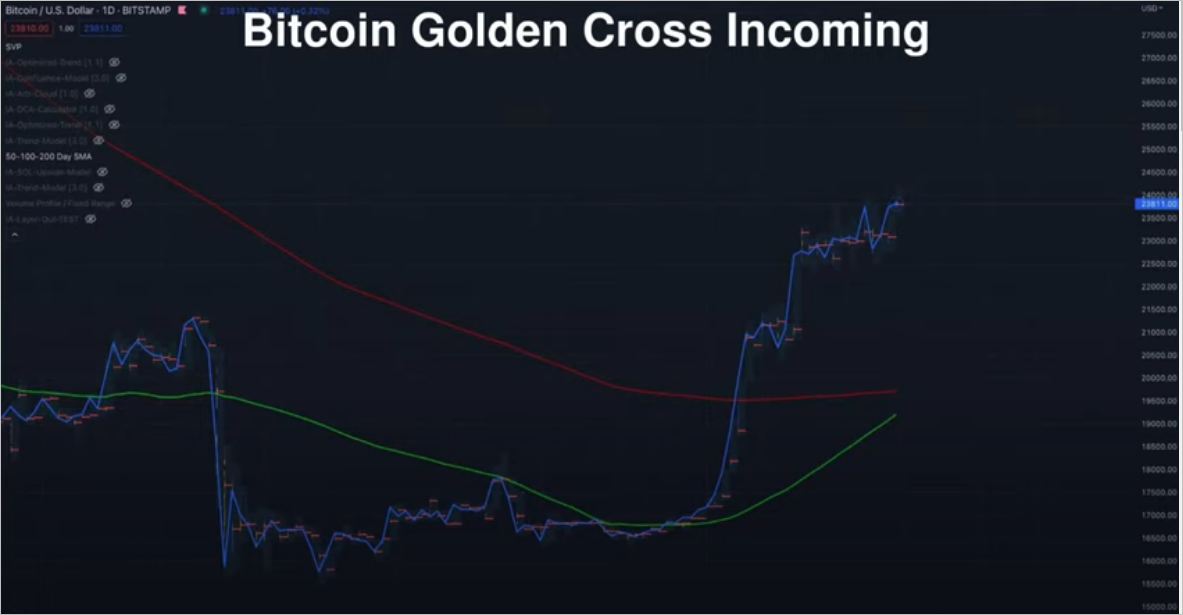

Technical Analysis Supporting the Bitcoin Rally Prediction

The analyst's Bitcoin price prediction for May 6th rests heavily on technical analysis of the Bitcoin chart. Several key indicators point towards a potential rally.

Key Chart Indicators

- Relative Strength Index (RSI): The RSI, a momentum indicator, is showing signs of breaking above the 50 level. This suggests a shift from bearish to bullish momentum. Specifically, a closing price above 52 on [mention specific timeframe, e.g., the 4-hour chart] would significantly strengthen the bullish signal.

- Moving Averages: The 20-day moving average (MA) is nearing a crossover with the 50-day MA. A bullish crossover (20-day MA crossing above the 50-day MA) is often seen as a confirmation of an upward trend. This crossover is projected to occur around May 5th.

- MACD (Moving Average Convergence Divergence): The MACD histogram is showing a positive divergence, indicating potential upward price movement. The recent positive crossing of the MACD lines also adds strength to the bullish outlook.

- Bollinger Bands: The price is currently bouncing off the lower Bollinger Band, suggesting potential support and a likely rebound. A break above the upper band would signal a strong upward trend.

Support and Resistance Levels

Identifying key support and resistance levels is crucial for accurate Bitcoin price prediction.

- Support Level: A strong support level exists around $28,000. A significant drop below this level could indicate a continuation of the bearish trend.

- Resistance Level: A key resistance level sits at $32,000. Breaking above this level would signal a strong breakout and potential acceleration of the upward trend. The ability to sustain the price above $32,000 will be crucial to validate the prediction.

Volume Analysis

Analyzing trading volume is key to confirming price movement signals.

- Increased Volume: An increase in trading volume accompanying a price surge towards the $32,000 resistance level would validate the bullish signal and increase confidence in the prediction. Conversely, low volume on a price increase would suggest weak momentum and a potential reversal.

Macroeconomic Factors Influencing Bitcoin Price

Beyond technical analysis, macroeconomic factors significantly influence Bitcoin's price.

Inflation and Interest Rates

- Inflationary pressures: High inflation generally drives investors towards assets seen as inflation hedges, which could benefit Bitcoin.

- Interest rate hikes: Conversely, rising interest rates can negatively impact Bitcoin's price by making other investment options more attractive. The impact of interest rate changes on Bitcoin remains a complex and debated topic.

Regulatory Landscape

- Positive Regulatory Developments: Clearer and more favorable regulatory frameworks in major jurisdictions can boost investor confidence and drive Bitcoin adoption.

- Negative Regulatory Developments: Conversely, restrictive regulations or crackdowns on cryptocurrencies can negatively affect Bitcoin’s price.

Bitcoin Adoption Rate

- Increased Adoption: Growing adoption of Bitcoin in payments, DeFi (Decentralized Finance), and other sectors fuels demand and pushes the price upward. Increased institutional investment also positively contributes to price appreciation.

Potential Risks and Uncertainties

While the technical indicators and macroeconomic factors suggest a potential rally, it's crucial to acknowledge potential risks.

Market Volatility

- Unexpected News: Negative news related to the crypto market, regulation, or security breaches can trigger significant price drops.

- Market Corrections: The cryptocurrency market is inherently volatile and prone to periodic corrections.

- Black Swan Events: Unforeseeable events can severely impact Bitcoin's price.

Regulatory Uncertainty

- Unpredictable Regulations: Changes in regulatory environments worldwide pose significant risks. Governments' stance on crypto remains in constant flux.

Bear Market Possibility

- Prolonged Bear Market: Even with a short-term rally, the possibility of a prolonged bear market cannot be ruled out. Several factors, including macroeconomic conditions and investor sentiment, could influence the length and depth of a bear market.

Conclusion: Bitcoin Price Prediction - Is a May 6th Rally Realistic?

This analysis suggests a potential Bitcoin rally zone entry around May 6th, supported by technical indicators like RSI and moving average crossovers, along with an assessment of macroeconomic factors. However, significant risks remain, including market volatility and regulatory uncertainty. The analyst's prediction should be viewed with caution, and any investment decisions should be made after thorough research and risk assessment. Stay tuned for further updates on our Bitcoin price prediction, and learn more about effective Bitcoin chart analysis strategies to make informed investment choices. Remember, this is not financial advice. Always conduct your own research before investing in cryptocurrencies.

Featured Posts

-

Bitcoin Price Analysis Rally Potential Spotted By Analyst May 6th Chart Included

May 08, 2025

Bitcoin Price Analysis Rally Potential Spotted By Analyst May 6th Chart Included

May 08, 2025 -

Veteran Wide Receiver Joins Browns Report Details Signing And Return Specialist Role

May 08, 2025

Veteran Wide Receiver Joins Browns Report Details Signing And Return Specialist Role

May 08, 2025 -

The Countrys Evolving Business Landscape A Location Based Guide

May 08, 2025

The Countrys Evolving Business Landscape A Location Based Guide

May 08, 2025 -

Inter Milan Stuns Bayern Munich In Champions League First Leg Report

May 08, 2025

Inter Milan Stuns Bayern Munich In Champions League First Leg Report

May 08, 2025 -

E Bay Listings For Banned Chemicals Section 230 Protection Ruled Invalid

May 08, 2025

E Bay Listings For Banned Chemicals Section 230 Protection Ruled Invalid

May 08, 2025

Latest Posts

-

Counting Crows Snl Performance A Turning Point

May 08, 2025

Counting Crows Snl Performance A Turning Point

May 08, 2025 -

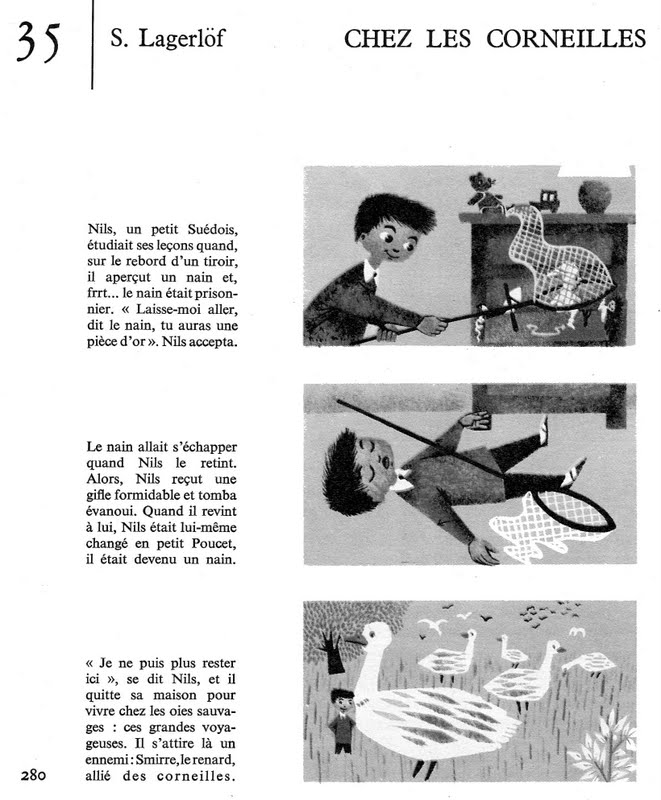

Capacites Cognitives Superieures Des Corneilles Une Etude De Cas En Geometrie

May 08, 2025

Capacites Cognitives Superieures Des Corneilles Une Etude De Cas En Geometrie

May 08, 2025 -

Etude Scientifique Sur Les Capacites Geometriques Des Corneilles

May 08, 2025

Etude Scientifique Sur Les Capacites Geometriques Des Corneilles

May 08, 2025 -

The Lasting Legacy Of Counting Crows Saturday Night Live Appearance

May 08, 2025

The Lasting Legacy Of Counting Crows Saturday Night Live Appearance

May 08, 2025 -

La Geometrie Chez Les Corneilles Une Performance Cognitive Remarquable

May 08, 2025

La Geometrie Chez Les Corneilles Une Performance Cognitive Remarquable

May 08, 2025