Analysis Of BP's 31% CEO Pay Reduction

Table of Contents

Reasons Behind BP's 31% CEO Pay Reduction

The official statement from BP regarding the 31% CEO pay reduction cited a need for alignment with the company's evolving strategic priorities and a commitment to responsible executive compensation. However, a deeper analysis reveals several contributing factors.

-

Shareholder Activism: Growing pressure from activist investors advocating for executive compensation reform played a significant role. Many shareholders argued that CEO pay should be more closely tied to company performance, particularly in light of fluctuating oil prices and the company's transition to renewable energy.

-

Company Performance: BP's financial performance in the preceding year, while not disastrous, might have fallen short of expectations set by some stakeholders. This, coupled with the inherent volatility in the energy market, influenced the decision to reduce CEO pay. Specific financial data regarding profit margins and shareholder returns should be included here for a comprehensive analysis (this data would need to be sourced and included).

-

Energy Transition Investment: BP's substantial investments in renewable energy and its stated commitment to a net-zero future arguably played a part. Reducing CEO pay might have been viewed as a symbolic gesture demonstrating fiscal responsibility during this significant transition.

-

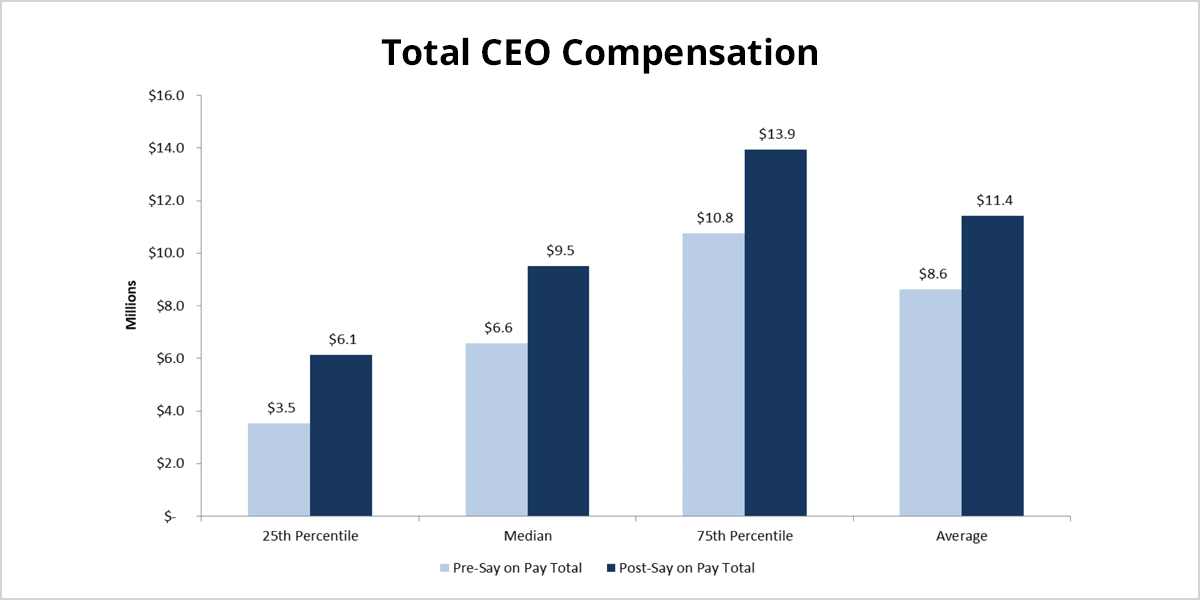

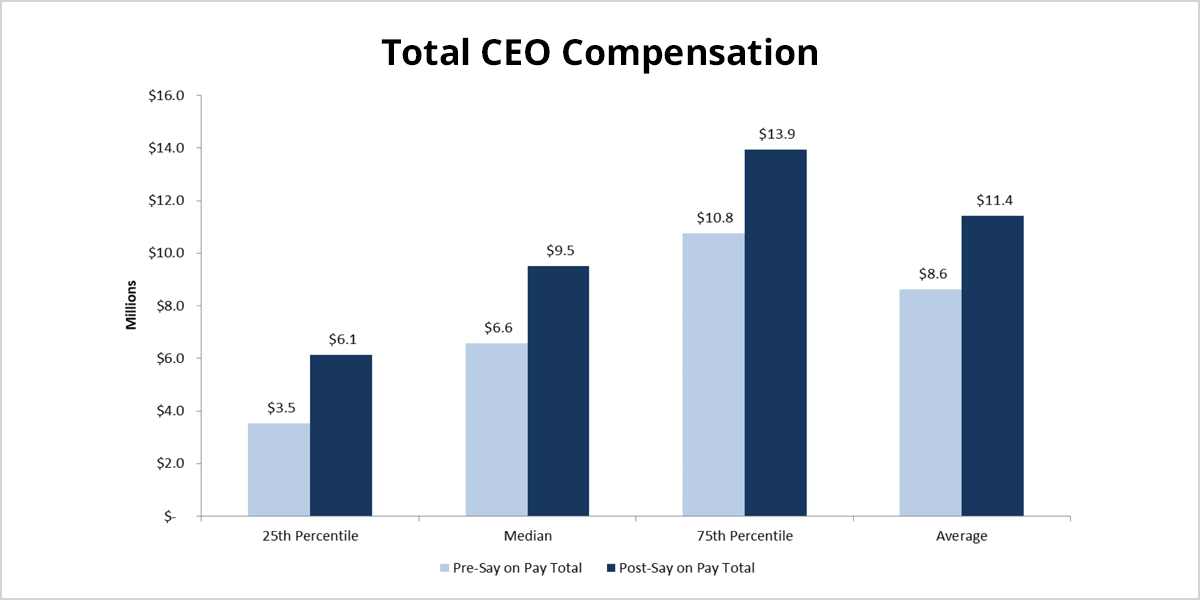

Industry Benchmarking: A comparison of BP's CEO compensation to that of CEOs at similar energy companies likely revealed a disparity. This analysis could have informed the decision, aiming to bring BP's executive pay more in line with industry averages or best practices regarding executive compensation. (This section should include data comparing CEO pay at comparable companies, both before and after the reduction).

-

Bullet Point Summary of Contributing Factors:

- Increased shareholder activism demanding compensation reform.

- Company performance falling slightly short of some stakeholder expectations.

- Significant investment in renewable energy and net-zero targets.

- Comparison with CEO compensation in peer companies showing a potential overpayment.

Impact of the Pay Cut on BP's Corporate Image and Shareholder Relations

The 31% CEO pay reduction has had a demonstrably positive impact on BP's public image. Many viewed the move as a sign of the company's commitment to ethical business practices and responsible corporate governance. This is particularly relevant in an era of increased focus on Environmental, Social, and Governance (ESG) factors in investment decisions.

- Positive Public Perception: The pay cut has been widely reported positively in the media, portraying BP as a company responsive to shareholder concerns and committed to responsible spending.

- Shareholder Reaction: While complete consensus is unlikely, early indications suggest that a significant portion of shareholders reacted favorably to the pay cut, viewing it as a step in the right direction. (Include data or quotes from investor statements if available).

- Investor Confidence: Although long-term effects remain to be seen, the immediate reaction to the announcement suggests a potential increase in investor confidence, particularly among ESG-focused investors.

Wider Implications for the Energy Sector: Executive Compensation Trends

BP's 31% CEO pay reduction has significant implications for the wider energy sector. It might serve as a catalyst for other energy companies to reassess their executive compensation strategies.

- Setting a Precedent: While not guaranteed to be a widespread trend immediately, the decision could influence other companies to adopt more moderate CEO pay structures.

- ESG Investing Influence: The growing importance of ESG investing is a crucial factor. Companies prioritizing sustainable practices and responsible governance are likely to attract more investment, potentially incentivizing pay structure reform.

- Regulatory Changes: Regulatory changes regarding executive compensation, particularly within the UK and the EU, also play a role in shaping industry practices. (Mention any relevant regulatory developments here).

- CEO Pay Comparison (Pre & Post Reduction): (Include a table comparing BP's CEO pay to competitors before and after the 31% reduction).

Future Outlook: CEO Pay and the Energy Transition

The long-term implications of BP's 31% CEO pay reduction are significant, potentially affecting its strategic direction and the energy sector as a whole.

- Alignment with Strategy: The pay cut demonstrates a commitment to aligning executive compensation with the company's long-term strategic goals, including its ambitious renewable energy targets.

- Performance-Based Incentives: Future compensation packages are likely to incorporate more robust performance-based incentives, further tying executive pay to the success of the company's transition strategy.

- Industry-Wide Trends: It's anticipated that the energy industry will see a continued shift towards more moderate and performance-driven executive compensation structures.

Conclusion: Understanding the Significance of BP's 31% CEO Pay Reduction

BP's 31% CEO pay reduction is a significant event with far-reaching implications. The decision, influenced by shareholder activism, company performance, the energy transition, and industry benchmarking, has enhanced BP's public image and potentially boosted investor confidence. This move signals a potential trend toward more moderate executive compensation within the energy sector, driven by ESG concerns and regulatory changes. It remains to be seen whether this will set a precedent for other energy companies, but BP's decision undeniably contributes to a broader conversation about CEO pay and corporate responsibility in the energy transition. What are your thoughts on this significant BP's CEO pay reduction? Share your insights on BP's executive compensation and its implications for the energy industry in the comments below!

Featured Posts

-

Abn Amros Bonus Scheme Under Investigation By Dutch Regulator

May 21, 2025

Abn Amros Bonus Scheme Under Investigation By Dutch Regulator

May 21, 2025 -

Planning Your Trip The Ultimate Guide To The Peppa Pig Theme Park Texas

May 21, 2025

Planning Your Trip The Ultimate Guide To The Peppa Pig Theme Park Texas

May 21, 2025 -

Walliams Slams Cowell Amid Britains Got Talent Dispute

May 21, 2025

Walliams Slams Cowell Amid Britains Got Talent Dispute

May 21, 2025 -

Tory Councillors Wife Loses Appeal After Migrant Rant

May 21, 2025

Tory Councillors Wife Loses Appeal After Migrant Rant

May 21, 2025 -

The Goldbergs Behind The Scenes Facts And Trivia

May 21, 2025

The Goldbergs Behind The Scenes Facts And Trivia

May 21, 2025

Latest Posts

-

Optimaliseer Uw Verkoop Van Abn Amro Kamerbrief Certificaten

May 21, 2025

Optimaliseer Uw Verkoop Van Abn Amro Kamerbrief Certificaten

May 21, 2025 -

Kamerbrief Certificaten Abn Amro Een Praktische Handleiding Voor Verkoop

May 21, 2025

Kamerbrief Certificaten Abn Amro Een Praktische Handleiding Voor Verkoop

May 21, 2025 -

Effectief Verkoop Van Abn Amro Kamerbrief Certificaten

May 21, 2025

Effectief Verkoop Van Abn Amro Kamerbrief Certificaten

May 21, 2025 -

Is Nederland Aan Het Zaniken Over Huizenprijzen Een Analyse Van Abn Amro En Geen Stijl

May 21, 2025

Is Nederland Aan Het Zaniken Over Huizenprijzen Een Analyse Van Abn Amro En Geen Stijl

May 21, 2025 -

Kamerbrief Verkoopprogramma Certificaten Abn Amro De Complete Gids

May 21, 2025

Kamerbrief Verkoopprogramma Certificaten Abn Amro De Complete Gids

May 21, 2025