ABN Amro's Bonus Scheme Under Investigation By Dutch Regulator

Table of Contents

ABN Amro, a prominent Dutch bank, is currently under investigation by De Nederlandsche Bank (DNB), the Dutch central bank, regarding its bonus scheme. This investigation raises serious questions about the fairness, transparency, and legality of the bank's compensation practices, sparking concerns within the financial sector and beyond. This article delves into the specifics of the investigation, explores its potential ramifications for ABN Amro, and analyzes its broader implications for the Dutch banking industry's bonus culture.

The Nature of the Investigation

The DNB's investigation into ABN Amro's bonus scheme centers on several key concerns related to responsible banking practices and executive compensation. The regulator is scrutinizing the scheme's structure and application, looking for potential breaches of regulations. The investigation focuses on:

-

Allegations of excessive bonuses paid despite poor performance: The DNB is reportedly examining whether bonuses were awarded disproportionately to performance, potentially violating principles of fair and responsible compensation. This includes looking at whether bonuses were awarded even when the bank failed to meet its financial targets or engaged in questionable practices.

-

Concerns regarding the transparency of the bonus calculation methodology: A lack of transparency in how bonuses are calculated can lead to unfairness and potential manipulation. The DNB is likely investigating whether the bonus scheme's methodology is clear, understandable, and objectively applied. This includes scrutinizing the metrics used to determine bonus payouts.

-

Potential conflict of interest issues within the bonus structure: The investigation may be examining whether the bonus scheme creates conflicts of interest for executives, potentially incentivizing risky behavior or prioritizing short-term gains over long-term sustainability.

-

Violation of EU banking regulations regarding executive remuneration: The investigation may involve assessing whether ABN Amro's bonus scheme complies with European Union regulations on executive remuneration, which aim to limit excessive risk-taking and promote responsible banking practices. These regulations often set caps on bonuses and require greater transparency.

Potential Consequences for ABN Amro

If found to be in violation of regulations, ABN Amro faces several serious consequences:

-

Significant fines from the DNB: The DNB has the power to impose substantial financial penalties on ABN Amro for non-compliance. The size of any fine would depend on the severity of the violations found.

-

Reputational damage impacting customer trust and investor relations: Negative publicity surrounding the investigation could severely damage ABN Amro's reputation, leading to a loss of customer trust and impacting investor confidence. This could manifest in reduced customer deposits, decreased share price, and difficulty attracting new business.

-

Pressure to reform bonus structures and improve corporate governance: The investigation will likely force ABN Amro to overhaul its bonus scheme and implement stronger corporate governance measures to ensure compliance with regulations and ethical standards.

-

Potential impact on future profitability and strategic plans: The costs associated with the investigation, potential fines, and reputational damage could significantly impact ABN Amro's future profitability and ability to execute its strategic plans.

Wider Implications for the Dutch Banking Sector

The ABN Amro investigation has far-reaching implications for the entire Dutch banking sector:

-

Increased regulatory scrutiny of banking bonus schemes across the sector: The investigation sets a precedent for increased regulatory oversight of bonus schemes in all Dutch banks. Other institutions can expect similar levels of scrutiny in the future.

-

Potential for stricter regulations regarding executive compensation: The outcome of the investigation could lead to the introduction of stricter regulations on executive compensation in the Netherlands, potentially affecting other financial institutions.

-

Impact on the overall attractiveness of the Dutch banking sector for talent: Increased regulatory pressure and negative publicity surrounding banking bonuses could negatively impact the Dutch banking sector's ability to attract and retain top talent.

-

Increased focus on ethical and sustainable banking practices: The investigation underscores the growing importance of ethical and sustainable banking practices, prompting a greater focus on responsible business conduct within the sector.

ABN Amro's Response and Future Outlook

ABN Amro has publicly stated its cooperation with the DNB's investigation. The bank has committed to reviewing its internal processes and is likely to propose changes to its bonus scheme to ensure compliance with regulations. The specifics of these changes, however, remain to be seen. The long-term outlook for ABN Amro depends heavily on the outcome of the DNB's investigation and the bank's ability to effectively address the concerns raised.

Conclusion

The DNB's investigation into ABN Amro's bonus scheme underscores crucial concerns regarding transparency, fairness, and regulatory compliance within the Dutch banking sector. The potential consequences for ABN Amro, both financially and reputationally, are considerable, and this case sets a precedent for increased scrutiny of banking bonus practices across the Netherlands. The investigation highlights the importance of responsible banking and the need for robust corporate governance to maintain trust and stability within the financial system.

Call to Action: Stay updated on the developments in this ongoing investigation into ABN Amro's bonus scheme and the evolving regulatory landscape of the Dutch banking sector. Follow us for further updates on this case and other crucial developments in the financial world.

Featured Posts

-

New Trans Australia Run Attempt Challenges Existing World Record

May 21, 2025

New Trans Australia Run Attempt Challenges Existing World Record

May 21, 2025 -

Abn Amro Opslag Problemen Met Online Betalingen

May 21, 2025

Abn Amro Opslag Problemen Met Online Betalingen

May 21, 2025 -

Little Britains Resurgence Understanding Gen Zs Appreciation

May 21, 2025

Little Britains Resurgence Understanding Gen Zs Appreciation

May 21, 2025 -

Coldplay Concert Review Music Lights And Powerful Messages

May 21, 2025

Coldplay Concert Review Music Lights And Powerful Messages

May 21, 2025 -

Sound Perimeter How Music Connects Us

May 21, 2025

Sound Perimeter How Music Connects Us

May 21, 2025

Latest Posts

-

V Mware Pricing To Explode At And T Highlights Broadcoms Extreme Increase

May 21, 2025

V Mware Pricing To Explode At And T Highlights Broadcoms Extreme Increase

May 21, 2025 -

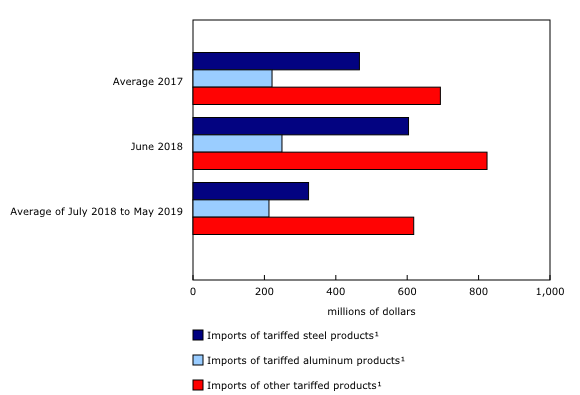

Canadian Beauty Industry Buy Canadian And Tariff Challenges

May 21, 2025

Canadian Beauty Industry Buy Canadian And Tariff Challenges

May 21, 2025 -

The Extreme Cost Of Broadcoms V Mware Acquisition At And Ts Concerns

May 21, 2025

The Extreme Cost Of Broadcoms V Mware Acquisition At And Ts Concerns

May 21, 2025 -

Buy Canadian Assessing The Long Term Effects Of Tariffs On Beauty

May 21, 2025

Buy Canadian Assessing The Long Term Effects Of Tariffs On Beauty

May 21, 2025 -

The Canadian Tire And Hudsons Bay Combination Opportunities And Challenges

May 21, 2025

The Canadian Tire And Hudsons Bay Combination Opportunities And Challenges

May 21, 2025