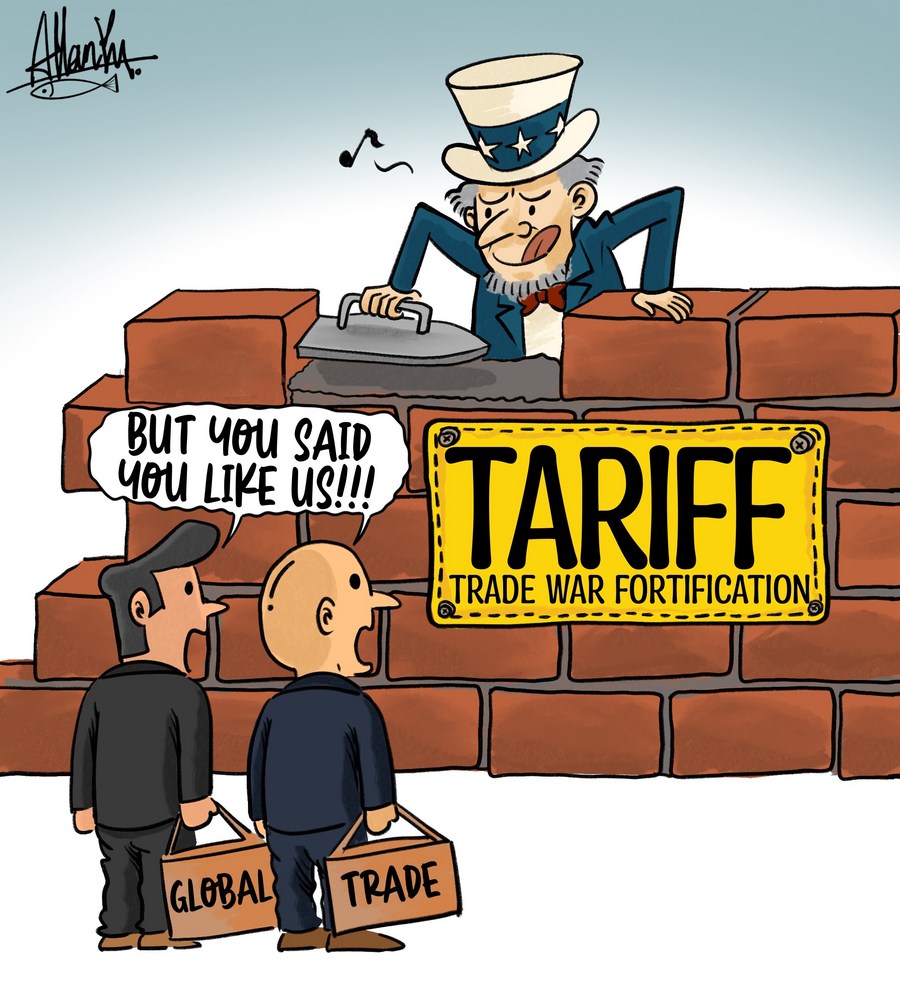

Amsterdam Exchange Down 2%: Impact Of Trump's Latest Tariff Increase

Table of Contents

Immediate Impact on Key Sectors

The immediate impact of the increased tariffs was keenly felt across several key sectors listed on the Amsterdam Exchange. The ripple effect of these trade barriers is undeniable and far-reaching.

Technology Sector Decline

The tech sector, a significant component of the Amsterdam Exchange, suffered particularly steep losses. This sector's heavy reliance on international trade and intricate global supply chains made it highly vulnerable to the increased tariff burden.

- Increased costs for imported components: Many tech companies rely on imported components from countries now subject to higher tariffs, directly increasing production costs.

- Reduced consumer demand due to higher prices: The increased costs are inevitably passed on to consumers, leading to reduced demand for tech products and impacting sales figures.

- Uncertainty impacting investment decisions: The uncertainty surrounding future tariff policies creates a climate of hesitation, discouraging new investments and potentially slowing down innovation.

Automotive Industry Slowdown

The automotive industry, another major player on the Amsterdam Exchange, also saw a significant drop in share prices. Similar to the tech sector, its dependence on global supply chains made it particularly susceptible to the effects of the new tariffs.

- Tariffs on imported parts leading to increased manufacturing costs: The increased cost of imported parts, like engines or specialized electronics, significantly increases the manufacturing cost of vehicles.

- Potential for reduced vehicle sales due to price increases: Higher manufacturing costs lead to higher car prices, potentially reducing consumer demand and impacting sales volumes.

- Concerns about retaliatory tariffs from other countries: The imposition of tariffs often provokes retaliatory measures from other nations, further disrupting supply chains and exacerbating the negative impact.

Energy Sector Volatility

The energy sector experienced considerable volatility, reflecting anxieties surrounding global trade tensions and the impact of Trump Tariffs on the Amsterdam Exchange.

- Impact of tariffs on oil and gas imports/exports: Tariffs on energy imports and exports directly influence prices and can disrupt established trade relationships.

- Uncertainty in future energy prices affecting investment: The uncertainty surrounding future energy prices makes investment decisions far more complex and risky, affecting investment in the sector.

- Potential for supply chain disruptions: Trade disputes can lead to delays and disruptions in the supply chain, leading to shortages and price volatility.

Wider Economic Consequences for the Netherlands

The impact of President Trump's tariffs extends far beyond specific sectors, posing significant challenges to the Netherlands' overall economy. The implications for the Amsterdam Exchange are substantial and long-lasting.

Impact on Dutch Exports

Increased tariffs could negatively impact Dutch exports to the US and other markets entangled in these trade disputes. This directly impacts the performance of the Amsterdam Exchange.

- Reduced demand for Dutch goods and services: Higher tariffs on Dutch products make them less competitive in international markets, leading to reduced demand.

- Potential job losses in export-oriented industries: Reduced demand can lead to decreased production and potential job losses in export-oriented industries.

- Pressure on the Dutch economy overall: The cumulative effect of these factors places significant pressure on the Dutch economy as a whole.

Inflationary Pressures

Higher tariffs contribute to inflationary pressures within the Netherlands, impacting consumer purchasing power and the Amsterdam Exchange's performance.

- Increased cost of imported goods: Tariffs directly increase the cost of imported goods, translating to higher prices for consumers.

- Potential for wage stagnation or decline: Increased prices without corresponding wage increases can lead to a decline in real wages and reduced consumer spending.

- Reduced consumer spending: Higher prices and reduced purchasing power lead to decreased consumer spending, impacting economic growth.

Investor Sentiment and Capital Flight

Negative investor sentiment, a direct consequence of the tariff increases, could lead to capital flight from the Netherlands and negatively impact the Amsterdam Exchange.

- Uncertainty and lack of confidence in the Dutch market: The uncertainty created by trade wars erodes investor confidence in the Dutch market.

- Movement of investments to other, perceived safer markets: Investors may move their investments to markets perceived as less vulnerable to trade disputes.

- Long-term economic consequences: Capital flight can have significant long-term economic consequences for the Netherlands.

Government Response and Potential Mitigation Strategies

The Dutch government faces a critical challenge in mitigating the negative impacts of these tariffs on its economy and the Amsterdam Exchange.

Government Intervention

The Dutch government may need to implement several measures to lessen the blow to the economy.

- Financial support for affected businesses: Providing financial aid to businesses affected by the tariffs can help them stay afloat during this challenging period.

- Measures to stimulate domestic demand: Stimulating domestic demand can help compensate for reduced export demand.

- Negotiations with the US and other countries to reduce trade barriers: Active diplomatic efforts are crucial in reducing trade barriers and promoting free trade.

Long-Term Economic Planning

The Dutch government must adopt a long-term perspective to lessen the country's dependence on markets susceptible to trade wars and protect the Amsterdam Exchange.

- Diversification of trade partners: Diversifying trade partners reduces reliance on any single market and mitigates risk.

- Investment in domestic industries: Investing in domestic industries strengthens the economy's resilience to external shocks.

- Strengthening of international trade agreements: Active participation in and strengthening of international trade agreements promotes free and fair trade.

Conclusion

The 2% drop in the Amsterdam Exchange following President Trump’s latest tariff increase starkly illustrates the vulnerability of global markets to protectionist policies. The immediate impact on key sectors like technology and automotive, coupled with broader economic implications for the Netherlands, demands a robust and proactive response. The Dutch government must actively implement mitigation strategies and engage in long-term economic planning to safeguard its economy. Understanding the ongoing impact of Trump's tariffs on the Amsterdam Exchange is crucial for investors and policymakers. Continuously monitoring the Amsterdam Exchange's reaction to future tariff announcements will be essential in navigating these turbulent times. Stay informed about developments in international trade to make well-informed decisions regarding investments and economic strategies.

Featured Posts

-

Tathyr Atfaq Aljmark Alamryky Alsyny Ela Mwshr Daks Alalmany 24 Alf Nqtt

May 25, 2025

Tathyr Atfaq Aljmark Alamryky Alsyny Ela Mwshr Daks Alalmany 24 Alf Nqtt

May 25, 2025 -

Amsterdam Market Opens Down 7 Trade War Fears Weigh Heavily

May 25, 2025

Amsterdam Market Opens Down 7 Trade War Fears Weigh Heavily

May 25, 2025 -

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 25, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 25, 2025 -

Farrow Seeks Trumps Imprisonment Focus On Venezuelan Deportation Controversy

May 25, 2025

Farrow Seeks Trumps Imprisonment Focus On Venezuelan Deportation Controversy

May 25, 2025 -

Glastonbury 2025 Announced Lineup Sparks Outrage

May 25, 2025

Glastonbury 2025 Announced Lineup Sparks Outrage

May 25, 2025

Latest Posts

-

Wga And Sag Aftra Strike What It Means For Hollywood

May 25, 2025

Wga And Sag Aftra Strike What It Means For Hollywood

May 25, 2025 -

Marks And Spencers 300 Million Cyberattack A Case Study In Data Security

May 25, 2025

Marks And Spencers 300 Million Cyberattack A Case Study In Data Security

May 25, 2025 -

Anchor Brewing Companys Closure Reflecting On 127 Years Of Impact

May 25, 2025

Anchor Brewing Companys Closure Reflecting On 127 Years Of Impact

May 25, 2025 -

Memoir On The January 6th Hearings Cassidy Hutchinsons Account

May 25, 2025

Memoir On The January 6th Hearings Cassidy Hutchinsons Account

May 25, 2025 -

Ftc Launches Investigation Into Open Ai And Chat Gpt Key Questions Answered

May 25, 2025

Ftc Launches Investigation Into Open Ai And Chat Gpt Key Questions Answered

May 25, 2025