AIMSCAP At The World Trading Tournament (WTT): Strategies And Results

Table of Contents

AIMSCAP's Pre-Tournament Preparation and Strategy Development

AIMSCAP's success at the WTT wasn't a matter of luck; it was the culmination of meticulous planning and rigorous preparation. Months before the tournament, the team embarked on a comprehensive strategy development phase, focusing on several key areas: robust risk management, exhaustive backtesting, and in-depth data analysis. Their approach was characterized by a deep understanding of market dynamics and a commitment to refining their algorithmic trading capabilities.

- Rigorous Backtesting of Algorithms: AIMSCAP subjected their trading algorithms to extensive backtesting using historical market data across various economic scenarios. This process ensured the algorithms' resilience under diverse market conditions, identifying and addressing potential weaknesses before the high-stakes competition.

- Development of Robust Risk Management Protocols: A cornerstone of AIMSCAP's strategy was a robust risk management framework. This involved defining clear risk tolerance levels, implementing stop-loss orders, and employing diversification techniques to mitigate potential losses. Their risk management approach ensured that even unsuccessful trades wouldn't significantly impact their overall portfolio.

- In-Depth Market Analysis and Identification of Key Trading Opportunities: The team conducted extensive market research, identifying potential trading opportunities based on fundamental and technical analysis. They focused on specific market sectors and instruments offering the best risk-reward profiles for their chosen strategies.

- Teamwork and Collaborative Strategy Refinement: AIMSCAP fostered a collaborative environment, where team members shared their expertise and insights. This collaborative approach allowed for continuous improvement and refinement of trading strategies leading up to the tournament.

Key Trading Strategies Employed by AIMSCAP during the WTT

During the WTT, AIMSCAP implemented a multi-faceted trading strategy relying on a combination of algorithmic trading techniques and careful market timing. While the specifics of their algorithms remain proprietary, we can discuss the general approaches employed.

- Algorithmic Trading Strategies: AIMSCAP employed several proprietary algorithms designed to identify and capitalize on short-term market inefficiencies. These algorithms leveraged sophisticated statistical models and machine learning techniques to analyze vast datasets and execute trades with precision and speed. Specific algorithm types included mean reversion and trend-following strategies, adapted and refined based on real-time market data.

- Market Timing Strategies: AIMSCAP's success hinged on their ability to accurately time their entries and exits. Their sophisticated algorithms identified optimal trading windows based on technical indicators and market sentiment analysis, maximizing profit potential and minimizing risk.

- Position Sizing and Risk Management in Specific Trades: AIMSCAP meticulously managed their position sizing, adjusting their trading volume based on risk tolerance and market volatility. This dynamic approach allowed them to adapt to changing market conditions and maintain a consistent risk profile throughout the tournament.

- Adaptation of Strategies Based on Market Fluctuations: The AIMSCAP team demonstrated remarkable adaptability, adjusting their strategies in response to unexpected market events. Their flexible approach proved crucial in navigating the unpredictable nature of the WTT.

Analysis of AIMSCAP's Results and Performance at the WTT

AIMSCAP's performance at the WTT was nothing short of exceptional. Their final ranking placed them among the top performers, showcasing significant profitability and a high return on investment (ROI). While exact figures are confidential, their success is reflected in the following key performance indicators:

- Overall Tournament Ranking and Financial Gains: AIMSCAP secured a top-tier ranking, demonstrating a superior understanding of the market and consistent profitability.

- Analysis of Top-Performing Trades and the Factors Contributing to Success: Their successful trades were characterized by precise market timing, optimal position sizing, and the utilization of sophisticated algorithms that identified high-probability trading opportunities.

- Discussion of Less Successful Trades and the Lessons Learned from Them: Even with their impressive overall performance, AIMSCAP acknowledges some less successful trades. These experiences provided valuable insights for refining their strategies and strengthening their risk management protocols.

- Comparison to Other Competitors' Performance (if possible and relevant): While specific competitor data is unavailable publicly, AIMSCAP’s performance significantly outpaced the average participant, highlighting their advanced strategies and rigorous preparation.

Factors Contributing to AIMSCAP’s Success

AIMSCAP's success at the WTT can be attributed to several factors, including:

- Technological Advantage: Their proprietary algorithms and advanced trading infrastructure provided a significant competitive advantage.

- Team Expertise: AIMSCAP's team comprises highly skilled professionals with extensive experience in algorithmic trading, data science, and financial markets.

- Market Conditions: While market conditions are always a factor, AIMSCAP’s adaptability allowed them to capitalize on prevailing trends.

- Adaptability: The team’s willingness to adapt their strategies based on changing market dynamics proved crucial for their success.

Conclusion

AIMSCAP’s participation in the WTT showcased the potential of sophisticated algorithmic trading strategies and meticulous preparation. Their success demonstrates the importance of rigorous backtesting, robust risk management, and a deep understanding of market dynamics. Their ability to adapt to evolving market conditions and refine their strategies based on real-time data proved crucial in achieving their remarkable results. The key takeaways underscore the benefits of a collaborative team approach, a flexible strategy, and leveraging technological advantages in competitive trading.

Learn more about AIMSCAP's success at the WTT and explore the possibilities of competitive algorithmic trading by visiting their website [Insert AIMSCAP Website Link Here]. Discover how AIMSCAP's strategies can inspire your own approach to the World Trading Tournament and beyond.

Featured Posts

-

Is Clean Energys Boom Under Threat Examining The Attacks

May 21, 2025

Is Clean Energys Boom Under Threat Examining The Attacks

May 21, 2025 -

Le Bouillon A Clisson Un Festival De Spectacles Engages

May 21, 2025

Le Bouillon A Clisson Un Festival De Spectacles Engages

May 21, 2025 -

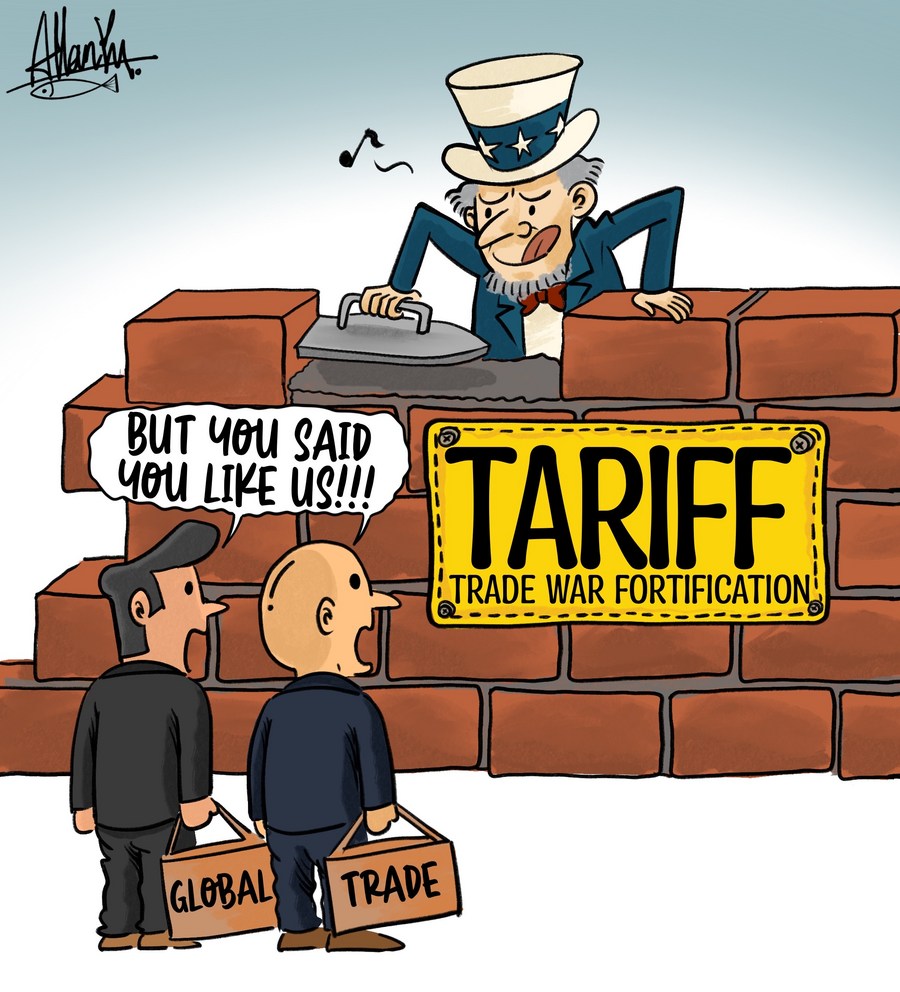

Ryanair Tariff Wars Pose Biggest Threat To Growth Announces Share Buyback

May 21, 2025

Ryanair Tariff Wars Pose Biggest Threat To Growth Announces Share Buyback

May 21, 2025 -

John Lithgow En Jimmy Smits Terugkeer In Dexter Resurrection Wat Kunnen We Verwachten

May 21, 2025

John Lithgow En Jimmy Smits Terugkeer In Dexter Resurrection Wat Kunnen We Verwachten

May 21, 2025 -

Aimscaps Wild Ride A Deep Dive Into The World Trading Tournament Wtt

May 21, 2025

Aimscaps Wild Ride A Deep Dive Into The World Trading Tournament Wtt

May 21, 2025

Latest Posts

-

New Business Hot Spots Across The Country An Interactive Map And Analysis

May 21, 2025

New Business Hot Spots Across The Country An Interactive Map And Analysis

May 21, 2025 -

Analyzing The Decline Bmw And Porsches Performance In The Chinese Market

May 21, 2025

Analyzing The Decline Bmw And Porsches Performance In The Chinese Market

May 21, 2025 -

Are Landlords Exploiting La Fire Victims

May 21, 2025

Are Landlords Exploiting La Fire Victims

May 21, 2025 -

European Citizenship A Growing Trend Among Disaffected Americans

May 21, 2025

European Citizenship A Growing Trend Among Disaffected Americans

May 21, 2025 -

Escape To Europe Americans Seeking Citizenship Amidst Political Uncertainty

May 21, 2025

Escape To Europe Americans Seeking Citizenship Amidst Political Uncertainty

May 21, 2025