Ryanair: Tariff Wars Pose Biggest Threat To Growth, Announces Share Buyback

Table of Contents

The Impact of Tariff Wars on Ryanair's Operations

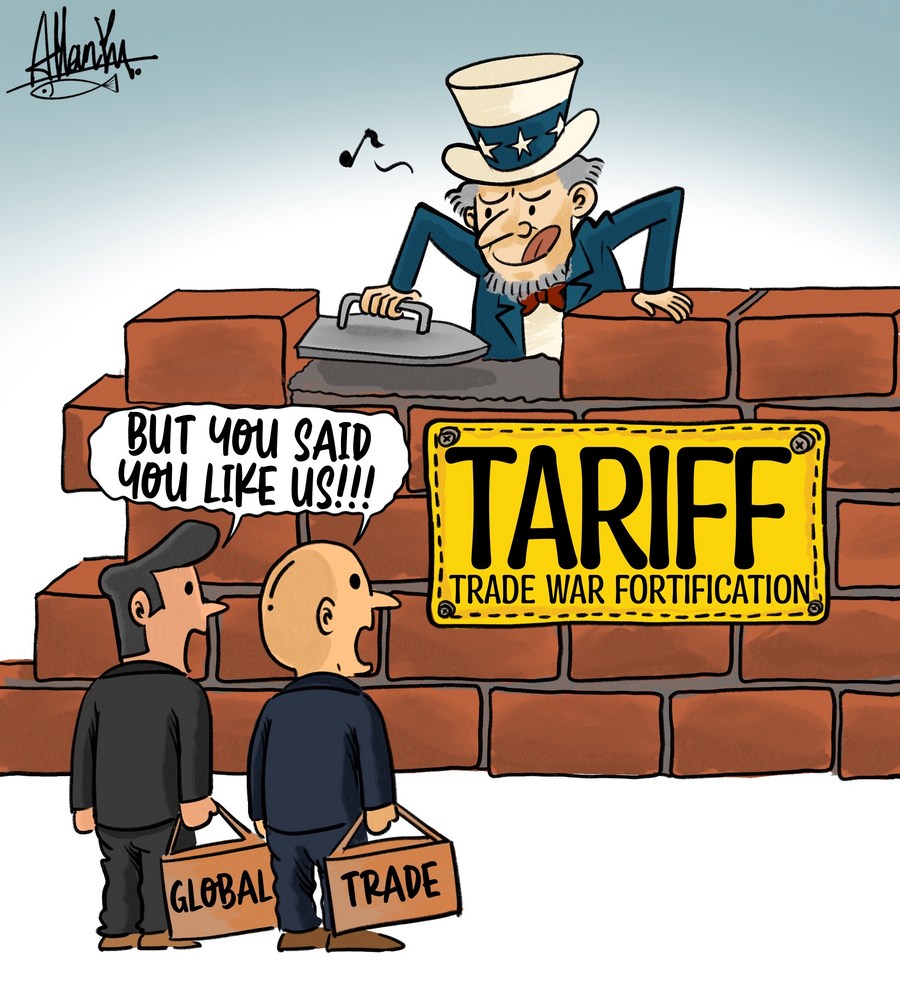

The ongoing global trade tensions, often referred to as "Ryanair trade wars impact," are significantly impacting Ryanair's operations. Increased costs across various aspects of the business threaten to undermine profitability and hinder future expansion. The primary areas of concern include:

-

Increased Fuel Costs: Import tariffs on jet fuel represent a substantial added expense. Fluctuations in global fuel prices, exacerbated by trade disputes, directly impact Ryanair's operational costs and ultimately, ticket prices. This makes Ryanair more vulnerable to price wars with competitors.

-

Supply Chain Disruptions: Tariffs and trade restrictions can disrupt the supply chain for essential aircraft parts and maintenance services. Delays in receiving vital components can lead to grounded planes, flight cancellations, and significant financial losses. This also increases the complexity and cost of managing inventory.

-

Impact on Passenger Numbers: Increased operational costs, driven by tariffs, inevitably translate into higher ticket prices. This can deter price-sensitive passengers, leading to a decrease in bookings and reduced revenue. The competitive landscape requires Ryanair to carefully balance price increases with maintaining market share.

-

Hedging Strategies: To mitigate these risks, Ryanair, like many other airlines, likely employs hedging strategies to manage fuel price volatility. This might involve purchasing fuel futures contracts to lock in prices and reduce exposure to price swings caused by tariffs. However, the effectiveness of these strategies in the face of escalating and unpredictable tariff wars is questionable.

-

Specific Tariff Impacts: For example, increased tariffs on aluminum used in aircraft manufacturing from specific regions could significantly impact production costs. Similarly, tariffs on certain types of electronic components needed for aircraft systems could also affect maintenance and operations.

Ryanair's Share Buyback: A Sign of Confidence or a Defensive Strategy?

Ryanair's announcement of a share buyback program raises questions about its strategic intentions. This significant financial commitment, analyzed in detail as part of "Ryanair share buyback" discussions, could be interpreted in several ways:

-

Demonstration of Financial Strength: The buyback signals that Ryanair believes its financial position is strong enough to withstand current challenges, including the pressures from tariff wars. This action aims to reassure investors and demonstrate confidence in the company's long-term prospects.

-

Boosting Investor Confidence: In the face of negative market sentiment concerning tariff wars, the buyback can be seen as an attempt to bolster investor confidence and stabilize the share price. The reduction in the number of outstanding shares increases earnings per share, potentially making the stock more attractive to investors.

-

Counteracting Negative Market Sentiment: The buyback is a direct response to the negative impact of tariff wars on the company's stock performance. By purchasing its own shares, Ryanair attempts to artificially increase its share price and improve market perception.

-

Buyback Specifics: The buyback program will involve the repurchase of a specific number of shares over a defined period. Details concerning the amounts, timing, and methods employed in the share buyback will be crucial in evaluating its effectiveness.

Alternative Strategies to Mitigate Tariff Risks

Ryanair is not solely relying on share buybacks to navigate these challenges; the company is actively exploring various strategies under "Ryanair Risk Mitigation":

-

Alternative Fuel Sources: Investigating alternative, more sustainable fuel sources can reduce reliance on jet fuel subject to import tariffs. This could involve exploring biofuels or other less volatile options.

-

Supply Chain Diversification: Reducing dependence on regions heavily impacted by tariffs by diversifying its supply chain is crucial. This involves sourcing aircraft parts and maintenance services from multiple regions to minimize disruption.

-

Negotiating with Suppliers: Ryanair can negotiate better terms with suppliers to mitigate increased costs due to tariffs. This could involve securing long-term contracts with price guarantees or exploring alternative sourcing options.

-

Route Adjustments: Adjusting flight routes to minimize exposure to high-tariff regions can help lessen the impact of trade disputes. This may involve focusing on routes within regions less affected by tariffs.

-

Specific Examples: For instance, Ryanair could shift some of its aircraft maintenance to facilities in regions with lower tariff impacts.

The Long-Term Outlook for Ryanair in a Climate of Trade Uncertainty

The long-term outlook for Ryanair, as part of the wider "Ryanair Future Outlook" discussion, remains uncertain amidst global trade uncertainties. Several key factors will shape its future success:

-

Resilience to Economic Downturns: Ryanair's historical resilience during economic downturns will be tested in this new environment. Its ability to adapt to changing market conditions and maintain a competitive edge will be crucial.

-

Profitability and Growth Projections: Tariff wars pose a significant threat to profitability and growth projections. The company’s ability to offset increased costs and maintain passenger numbers will determine its future financial performance.

-

Adaptation to a Changing Landscape: Ryanair's capacity to adapt to a continuously evolving global economic landscape will be key to its long-term success. This will require agility, innovative strategies, and a forward-thinking approach to business management.

-

Key Challenges and Opportunities: The ongoing trade wars, combined with environmental concerns and potential regulatory changes, present both significant challenges and unexpected opportunities for Ryanair. Careful management and adaptation will be crucial for the airline to thrive.

Conclusion

This article examined the significant threat posed by escalating tariff wars to Ryanair’s ambitious growth trajectory. While the airline's share buyback signals a degree of financial confidence, the long-term impact of these trade disputes remains a crucial factor in determining its future success. The airline's ability to mitigate these risks through strategic adjustments to its operations and supply chains will be key to navigating this challenging period.

Call to Action: Stay informed about the evolving situation surrounding Ryanair and the impact of tariff wars on the airline industry. Keep an eye on Ryanair's response to these challenges and how these global trade issues influence the future of budget air travel. Further research into the implications of Ryanair tariff wars is encouraged.

Featured Posts

-

Risicos Voor De Voedingsindustrie Abn Amro Over Afhankelijkheid Van Arbeidsmigranten

May 21, 2025

Risicos Voor De Voedingsindustrie Abn Amro Over Afhankelijkheid Van Arbeidsmigranten

May 21, 2025 -

Is An Arsenal Legend The Next Manchester City Manager A Report Emerges

May 21, 2025

Is An Arsenal Legend The Next Manchester City Manager A Report Emerges

May 21, 2025 -

How To Successfully Do A Screen Free Week With Your Kids

May 21, 2025

How To Successfully Do A Screen Free Week With Your Kids

May 21, 2025 -

Femicide A Deep Dive Into The Statistics And Causes

May 21, 2025

Femicide A Deep Dive Into The Statistics And Causes

May 21, 2025 -

Understanding Tariff Volatility Insights From Fp Videos Global Analysis

May 21, 2025

Understanding Tariff Volatility Insights From Fp Videos Global Analysis

May 21, 2025

Latest Posts

-

Fsv Mainz 05 Vs Bayer Leverkusen Matchday 34 Report And Highlights

May 21, 2025

Fsv Mainz 05 Vs Bayer Leverkusen Matchday 34 Report And Highlights

May 21, 2025 -

Nadiem Amiri His Rise To Prominence In German Football

May 21, 2025

Nadiem Amiri His Rise To Prominence In German Football

May 21, 2025 -

Rb Leipzig Defeated Mainzs Winning Comeback With Burkardt And Amiri

May 21, 2025

Rb Leipzig Defeated Mainzs Winning Comeback With Burkardt And Amiri

May 21, 2025 -

Mainzs Dramatic Turnaround Burkardt And Amiris Impact Against Leipzig

May 21, 2025

Mainzs Dramatic Turnaround Burkardt And Amiris Impact Against Leipzig

May 21, 2025 -

Who Is Nadiem Amiri The Mainz 05 And Germany Player

May 21, 2025

Who Is Nadiem Amiri The Mainz 05 And Germany Player

May 21, 2025