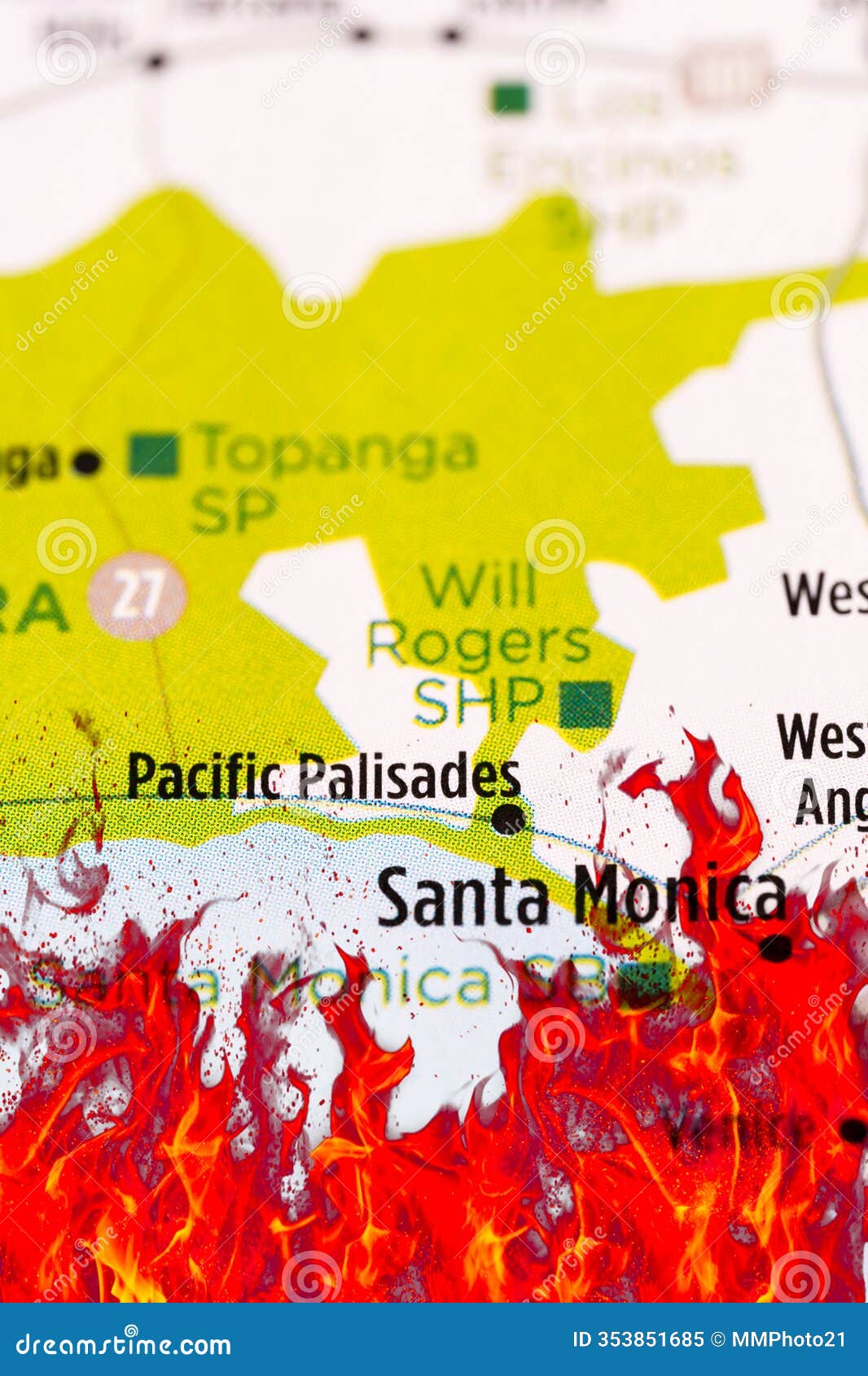

Wildfire Speculation: Examining The Market For Los Angeles Disaster Bets

Table of Contents

The Mechanics of Wildfire Speculation in Los Angeles

Wildfire speculation in Los Angeles, like other forms of disaster speculation, involves attempting to profit from the potential for future wildfire events. This isn't limited to simple bets; it encompasses a range of sophisticated financial instruments and strategies.

- Types of financial instruments used for wildfire speculation: These can include derivatives such as options and futures contracts on insurance company stocks, catastrophe bonds (which pay out if a predefined level of wildfire damage occurs), and even prediction markets where individuals can bet on the likelihood and severity of future wildfires. Investment in companies developing wildfire prevention technologies also falls under this umbrella.

- Role of weather forecasting and predictive models in influencing bets: Sophisticated weather models and predictive analytics play a huge role. Factors like Santa Ana wind forecasts, fuel moisture levels, and historical fire patterns heavily influence the predictions made and consequently, the speculation. Increased accuracy in prediction models can drastically change the market dynamics of Wildfire Speculation Los Angeles.

- The influence of news and media coverage on market fluctuations: News reports on drought conditions, fire danger warnings, and even the proximity of developments to wildlands can significantly impact market sentiment. Negative news coverage can drive up the perceived risk, potentially leading to increased speculation.

- Examples of specific events that have driven wildfire speculation in Los Angeles: Major wildfires like the Woolsey Fire and the Getty Fire have undoubtedly fueled speculation. These events highlight the real financial consequences of wildfires and encourage increased investment in hedging against future risks, driving the Los Angeles wildfire speculation market.

The Ethical Considerations of Wildfire Speculation

The ethical implications of profiting from natural disasters are complex and often debated. Wildfire speculation in Los Angeles raises serious questions about responsibility and the potential for unintended consequences.

- Potential for exacerbating the consequences of wildfires through irresponsible behavior: Some critics argue that the existence of this market could incentivize reckless behavior. For example, it could discourage proactive fire prevention measures if individuals believe they can profit from the ensuing damage.

- The impact on insurance premiums and affordability for residents: Increased speculation can potentially lead to higher insurance premiums for homeowners and businesses in high-risk areas, making insurance unaffordable for some. This disproportionately affects lower-income communities.

- Arguments for and against regulating this type of speculation: The debate over regulation focuses on balancing the right to invest with the need to protect vulnerable populations and prevent market manipulation. Some argue for increased transparency and stricter regulations, while others advocate for a free market approach.

- The role of social responsibility in the context of disaster betting: The question of social responsibility is paramount. Ethical investors should consider the broader societal implications of their actions and prioritize mitigating risks rather than merely profiting from them. The concept of "responsible investing" is gaining momentum in this context.

The Role of Insurance in the Los Angeles Wildfire Market

Insurance companies are central players in the Los Angeles wildfire market, managing risk and assessing claims. Their actions and strategies are directly influenced by the dynamics of wildfire speculation.

- Types of insurance policies relevant to wildfire risk (homeowners, business): Homeowners and business owners rely on various policies to protect against wildfire damage, including comprehensive property insurance, business interruption insurance, and liability insurance.

- The impact of wildfire speculation on insurance premiums and availability: Increased speculation can lead to higher premiums and even reduced availability of insurance in high-risk areas, forcing some homeowners to become uninsured. This underscores the need for more robust and accessible wildfire insurance policies.

- Strategies insurers use to mitigate losses and manage risk: Insurance companies utilize sophisticated risk models, employ fire prevention strategies, and implement strict underwriting criteria to mitigate potential losses. They might also utilize reinsurance to transfer risk.

- The role of reinsurance in the Los Angeles wildfire market: Reinsurance acts as a safety net for primary insurers, helping them manage catastrophic losses from major wildfires. The reinsurance market plays a key role in ensuring the stability of the overall insurance market in the face of wildfire risk.

Predictive Modeling and Wildfire Risk Assessment

Sophisticated predictive modeling plays a crucial role in assessing wildfire risk and informing speculation. These models utilize various data points to estimate the probability and severity of future wildfire events.

- Key factors considered in wildfire risk models (vegetation, weather, topography): These models incorporate a vast array of data, including vegetation density and type, historical fire patterns, weather forecasts (including wind speed and humidity), and topographical features.

- Accuracy and limitations of predictive models: While these models are becoming increasingly accurate, they still have limitations. Unpredictable weather events and human factors can impact their precision.

- The role of technology in improving wildfire risk assessment: Technological advancements, such as remote sensing, drones, and artificial intelligence, are continually improving the accuracy and efficiency of wildfire risk assessment.

- How predictive modeling influences investment decisions in the wildfire speculation market: Investors use these models to inform their investment strategies, assess risk, and make more informed decisions about allocating capital in the Wildfire Speculation Los Angeles market.

Conclusion

Wildfire Speculation Los Angeles is a complex market characterized by a range of financial instruments, ethical considerations, and a significant role for insurance companies and predictive modeling. The potential for profit coexists with the potential for exacerbating the consequences of wildfires and negatively impacting vulnerable communities. Understanding the interplay of these factors is crucial for responsible investment and effective risk management. Further research into responsible investing practices and the evolving landscape of disaster risk management is essential. Continue learning about the impact of Los Angeles wildfire speculation and its implications for the future.

Featured Posts

-

Strengthening Ties Bangladesh And Europe Collaborate For Growth

May 24, 2025

Strengthening Ties Bangladesh And Europe Collaborate For Growth

May 24, 2025 -

Escape To The Country Finding Your Perfect Rural Home

May 24, 2025

Escape To The Country Finding Your Perfect Rural Home

May 24, 2025 -

A Seattle Womans Pandemic Refuge Finding Solace In A Green Space

May 24, 2025

A Seattle Womans Pandemic Refuge Finding Solace In A Green Space

May 24, 2025 -

Despite Apple Price Target Cut Wedbush Remains Bullish Should You

May 24, 2025

Despite Apple Price Target Cut Wedbush Remains Bullish Should You

May 24, 2025 -

The Terrible Idea How A Trump Era Plan Crippled Newark Airport

May 24, 2025

The Terrible Idea How A Trump Era Plan Crippled Newark Airport

May 24, 2025

Latest Posts

-

Ocean City Rehoboth Sandy Point Beach Weather Memorial Day Weekend 2025 Forecast

May 24, 2025

Ocean City Rehoboth Sandy Point Beach Weather Memorial Day Weekend 2025 Forecast

May 24, 2025 -

Kazakhstans Billie Jean King Cup Win Over Australia A Full Report

May 24, 2025

Kazakhstans Billie Jean King Cup Win Over Australia A Full Report

May 24, 2025 -

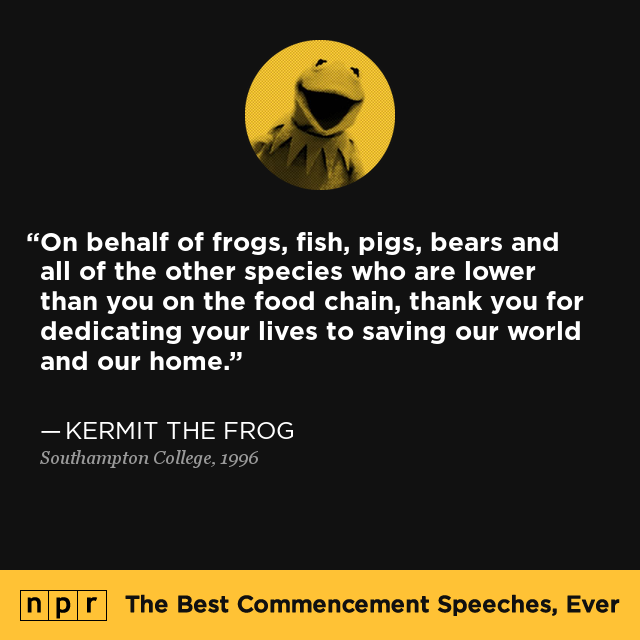

Commencement Address A Celebrated Amphibian At University Of Maryland

May 24, 2025

Commencement Address A Celebrated Amphibian At University Of Maryland

May 24, 2025 -

Internet Reacts Kermit The Frog As Umds 2025 Commencement Speaker

May 24, 2025

Internet Reacts Kermit The Frog As Umds 2025 Commencement Speaker

May 24, 2025 -

Kermit The Frog As Umd Commencement Speaker The Best Reactions

May 24, 2025

Kermit The Frog As Umd Commencement Speaker The Best Reactions

May 24, 2025