Addressing Investor Anxiety: BofA's View On High Stock Market Valuations

Table of Contents

BofA's Assessment of Current Market Conditions

Elevated Valuations and Their Implications

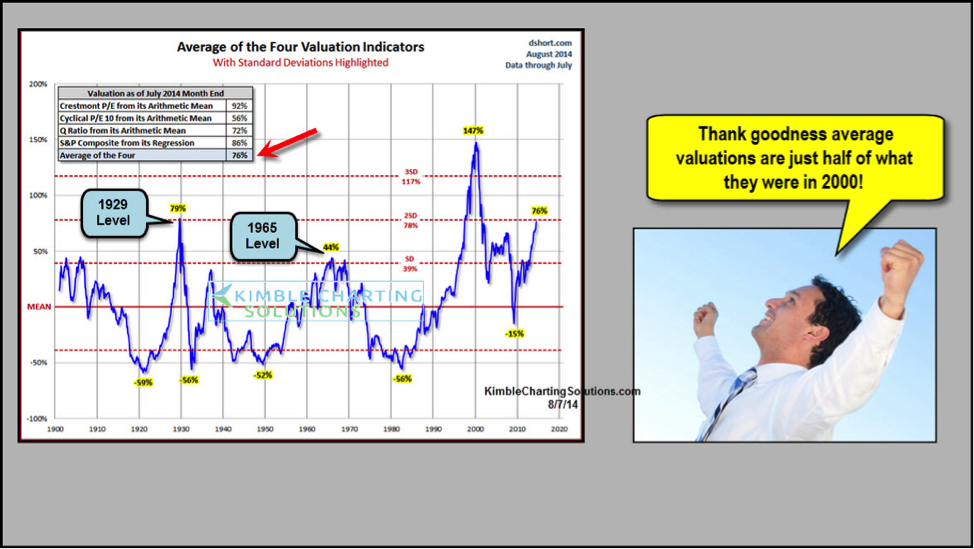

BofA's analysis points to significantly elevated stock market valuations compared to historical averages. While precise figures may vary depending on the specific metrics used (e.g., price-to-earnings ratios, Shiller PE ratio), the bank consistently highlights the substantial premium currently priced into the market. This suggests that future returns may be more modest than in past periods of lower valuations. The implication is clear: investors face a potentially reduced margin of safety, increasing the risk of a significant market correction.

- Comparison to historical valuations: BofA likely compares current valuation metrics to historical averages over the past 50 years, demonstrating the current market's departure from historical norms. This provides context for understanding the extent of the current elevated valuations.

- Analysis of specific sectors with particularly high valuations: Certain sectors, such as technology and growth stocks, are often highlighted as exhibiting exceptionally high valuations, making them potentially more vulnerable to corrections. BofA’s research likely pinpoints these high-risk areas.

- Discussion of potential market bubbles: The bank may discuss the possibility of specific market bubbles forming within certain sectors, drawing parallels to historical instances of market exuberance followed by sharp declines.

Identifying Potential Risks

BofA identifies several key risks contributing to investor anxiety and market volatility. These include:

-

Inflation: Persistent inflation erodes purchasing power and increases the cost of borrowing, potentially impacting corporate profits and slowing economic growth. BofA's assessment likely weighs the impact of inflation on company earnings and overall market sentiment.

-

Interest rate hikes: To combat inflation, central banks, including the Federal Reserve, may raise interest rates. Higher interest rates increase borrowing costs for businesses and consumers, potentially slowing economic activity and putting downward pressure on stock prices. BofA's analysis likely explores the sensitivity of the market to interest rate changes.

-

Geopolitical uncertainty: Global geopolitical events, such as conflicts or trade disputes, can significantly impact market sentiment and investor confidence. BofA's assessment likely considers the potential market effects of various geopolitical risks.

-

Impact of rising interest rates on stock prices: Higher interest rates make bonds more attractive, potentially drawing investment away from stocks.

-

Analysis of the impact of inflation on corporate earnings: Inflation increases costs for companies, squeezing profit margins and potentially impacting stock valuations.

-

Discussion of geopolitical risks and their market effects: Geopolitical instability creates uncertainty, often leading to market volatility and decreased investor confidence.

BofA's Recommendations for Investors

Strategies for Managing Risk

In light of high valuations and potential risks, BofA likely recommends a cautious approach focusing on risk management. Key strategies include:

-

Diversification: Spreading investments across different asset classes (stocks, bonds, real estate, etc.) helps reduce the overall portfolio's vulnerability to market fluctuations. BofA likely emphasizes the importance of a diversified portfolio to mitigate risk.

-

Risk tolerance assessment: Understanding your personal risk tolerance is crucial. Investors should only invest in assets aligned with their comfort level with potential losses. BofA probably stresses the importance of aligning investments with personal risk profiles.

-

Strategic Asset Allocation: BofA may recommend adjusting asset allocation to favor less volatile assets in the current market environment.

-

Diversification across asset classes (stocks, bonds, real estate): This approach reduces reliance on any single asset class, lessening potential losses during market downturns.

-

Importance of a well-defined investment strategy aligned with risk tolerance: A clear investment plan is crucial to making informed decisions and managing emotional responses to market volatility.

-

Strategies for managing portfolio volatility: Techniques such as dollar-cost averaging can help smooth out market fluctuations and reduce the impact of short-term volatility.

Identifying Potential Opportunities

Despite the risks, BofA may also identify potential opportunities within the current market:

-

Value investing: Searching for undervalued companies with strong fundamentals can offer potential for long-term growth, even in a high-valuation environment. BofA may suggest analyzing companies trading below their intrinsic value.

-

Specific sectors: While some sectors may be overvalued, others might offer better value propositions. BofA might suggest sectors with strong underlying growth despite current market conditions.

-

Alternative investments: Alternative investments, such as private equity or real estate, may offer diversification benefits and potentially less correlation with traditional stock market fluctuations.

-

Sectors with strong fundamentals despite high valuations: Some companies may be fundamentally strong but temporarily undervalued due to market sentiment.

-

Potential for value investing in undervalued companies: Thorough research can uncover opportunities to buy quality companies at discounted prices.

-

Opportunities in alternative investment strategies: Alternative assets can provide diversification and potentially superior returns in certain market conditions.

Long-Term Outlook and Market Predictions (According to BofA)

BofA's long-term outlook, considering the current high valuations, is likely cautious but not necessarily bearish. They may predict moderate growth, but with increased volatility. Specific predictions regarding market performance will be subject to significant caveats and acknowledge the inherent uncertainty in market forecasting. The bank will likely emphasize the importance of remaining flexible and adaptable to changing market conditions.

- BofA's predicted market growth/correction timelines (if any): The bank might offer a range of potential scenarios, acknowledging significant uncertainty.

- Factors that could influence their predictions (e.g., economic growth, policy changes): BofA's forecasts will be contingent on macroeconomic factors and policy decisions.

- Emphasis on the uncertainty of market forecasting: The bank will likely highlight the unpredictable nature of the market and the limitations of any forecast.

Conclusion

This article explored BofA's analysis of high stock market valuations, highlighting the associated investor anxiety and outlining the bank's recommendations for navigating the current market conditions. BofA's perspective emphasizes the importance of risk management and diversification in a market characterized by high valuations and potential volatility. The bank's analysis suggests a measured approach, combining risk mitigation strategies with the identification of potential opportunities within specific sectors or investment strategies.

Call to Action: Understanding BofA's view on high stock market valuations is crucial for informed investment decisions. Take control of your financial future by carefully considering these insights and developing a robust investment strategy that addresses your unique risk tolerance. Learn more about mitigating investor anxiety and managing high stock market valuations by researching further and consulting with a financial advisor.

Featured Posts

-

Why 10 Year Mortgages Arent Popular In Canada

May 05, 2025

Why 10 Year Mortgages Arent Popular In Canada

May 05, 2025 -

Greater Payment Control Spotifys Latest I Phone Update

May 05, 2025

Greater Payment Control Spotifys Latest I Phone Update

May 05, 2025 -

Lizzos Trainer Shaun T Speaks Out Against Ozempic Claims

May 05, 2025

Lizzos Trainer Shaun T Speaks Out Against Ozempic Claims

May 05, 2025 -

The Return Of Bob Baffert A Look At His Impact On Horse Racing

May 05, 2025

The Return Of Bob Baffert A Look At His Impact On Horse Racing

May 05, 2025 -

From Poop Papers To Podcast Gold Ais Role In Content Transformation

May 05, 2025

From Poop Papers To Podcast Gold Ais Role In Content Transformation

May 05, 2025

Latest Posts

-

Analyzing Fox And Espns Independent Streaming Plans For 2025

May 05, 2025

Analyzing Fox And Espns Independent Streaming Plans For 2025

May 05, 2025 -

Ufc 314 Volkanovski Lopes Main Event Early Betting Odds And Predictions

May 05, 2025

Ufc 314 Volkanovski Lopes Main Event Early Betting Odds And Predictions

May 05, 2025 -

Indy Cars 2024 Season Full Coverage On Fox

May 05, 2025

Indy Cars 2024 Season Full Coverage On Fox

May 05, 2025 -

Indy Car On Fox What To Expect From The New Broadcast Deal

May 05, 2025

Indy Car On Fox What To Expect From The New Broadcast Deal

May 05, 2025 -

2025 Fox And Espn Enter The Standalone Streaming Market

May 05, 2025

2025 Fox And Espn Enter The Standalone Streaming Market

May 05, 2025