Activision Blizzard Deal: FTC's Appeal And The Future Of Gaming

Table of Contents

The FTC's Arguments Against the Activision Blizzard Acquisition

The Federal Trade Commission (FTC) argues that Microsoft's acquisition of Activision Blizzard poses a significant threat to fair competition and consumer welfare. Their primary concerns revolve around market dominance and the stifling of innovation.

Concerns about Market Domination

The FTC's central argument hinges on the potential for the merger to create an anti-competitive behemoth. By combining Microsoft's existing gaming power with Activision Blizzard's vast portfolio of popular franchises, the FTC fears a significant reduction in competition.

- Dominant Franchises: Activision Blizzard owns incredibly popular franchises like Call of Duty, Candy Crush Saga, World of Warcraft, and Diablo, which collectively boast millions of players and generate billions in revenue. These represent a substantial market share across various gaming platforms.

- Reduced Consumer Choice and Higher Prices: The FTC argues that less competition could lead to reduced consumer choice and potentially higher prices for games, subscriptions, and in-game purchases. The fear is that Microsoft could leverage its control over these titles to disadvantage competitors.

Impact on Game Development and Innovation

Beyond market dominance, the FTC also expresses concern that the merger could negatively impact game development and innovation.

- Stifling Smaller Developers: The FTC argues that Microsoft's control over major franchises could create significant barriers to entry for smaller, independent game developers, hindering innovation and diversity in the gaming market.

- Lack of Diversity: The acquisition could lead to a less diverse range of game genres and experiences, as Microsoft might prioritize its own titles and potentially neglect other genres or development styles.

Microsoft's Defense of the Activision Blizzard Deal

Microsoft, naturally, counters the FTC's arguments, maintaining that the acquisition will ultimately benefit gamers and foster greater competition.

Microsoft's Arguments for Competition

Microsoft argues that the deal will actually increase competition, particularly in the burgeoning cloud gaming market.

- Cross-Platform Availability: A key point of Microsoft's defense is its commitment to keeping Call of Duty and other Activision Blizzard titles available on PlayStation and other platforms. They have publicly pledged to continue licensing these games to Sony and other competitors.

- Cloud Gaming Competition: Microsoft contends that the acquisition will strengthen its position in the cloud gaming market, leading to more competition and innovation in this rapidly growing sector.

Benefits for Gamers

Microsoft highlights numerous potential benefits for gamers:

- Expanded Game Pass Catalog: The acquisition would add a vast library of Activision Blizzard games to Xbox Game Pass, offering significant value to subscribers.

- Enhanced Gaming Experiences: Microsoft suggests that combining resources and expertise could lead to improved game development, better graphics, and richer gaming experiences across Activision Blizzard titles.

However, critics counter that these benefits are largely self-serving marketing claims, ignoring the potential downsides of reduced competition.

Potential Outcomes of the FTC's Appeal and its Implications for the Gaming Industry

The FTC's appeal could lead to several scenarios, each with potentially significant ramifications.

Scenarios and their Effects

- FTC Win: An FTC victory would block the merger, maintaining the status quo and likely prompting increased regulatory scrutiny of future large-scale acquisitions in the gaming industry. This would preserve a more competitive gaming market, at least in the short term.

- Microsoft Win: A win for Microsoft would allow the acquisition to proceed, potentially leading to increased market consolidation and the consequences outlined by the FTC. This could influence the pricing and availability of major game titles.

- Settlement: A negotiated settlement could involve concessions from Microsoft, such as stricter conditions on game availability or licensing agreements. The terms of a settlement would be crucial in determining the ultimate impact.

These outcomes could significantly impact game exclusivity, pricing models (such as subscription services), and the overall competitive dynamics within the gaming landscape. Furthermore, the precedent set by this case would have a lasting effect on future mergers and acquisitions in the gaming industry.

The Future of Game Mergers and Acquisitions

This legal battle will undeniably set a precedent for future mergers and acquisitions in the gaming industry.

- Increased Regulatory Scrutiny: Regardless of the outcome, expect significantly increased regulatory scrutiny of large-scale gaming acquisitions. Antitrust regulators worldwide will be closely watching this case.

- Potential for Increased Intervention: The case could lead to greater regulatory intervention in the gaming market, potentially impacting how future deals are structured and approved.

Conclusion: The Activision Blizzard Deal's Ongoing Impact

The FTC's appeal against the Microsoft-Activision Blizzard deal presents a critical juncture for the future of gaming. While Microsoft argues for increased competition and benefits for gamers, the FTC raises serious concerns about market dominance and stifled innovation. The potential outcomes – an FTC win, a Microsoft win, or a settlement – will significantly shape the gaming industry for years to come, impacting game pricing, availability, and the overall competitive landscape. Stay informed about the ongoing legal battle and its impact on the future of gaming by searching for updates on the "Activision Blizzard Deal" and the FTC's appeal and following reputable gaming news sources. The future of gaming hangs in the balance.

Featured Posts

-

Ferrari Challenge South Floridas Thrilling Racing Weekend

May 24, 2025

Ferrari Challenge South Floridas Thrilling Racing Weekend

May 24, 2025 -

Terrapins Softball Edges Delaware In Thrilling 5 4 Contest

May 24, 2025

Terrapins Softball Edges Delaware In Thrilling 5 4 Contest

May 24, 2025 -

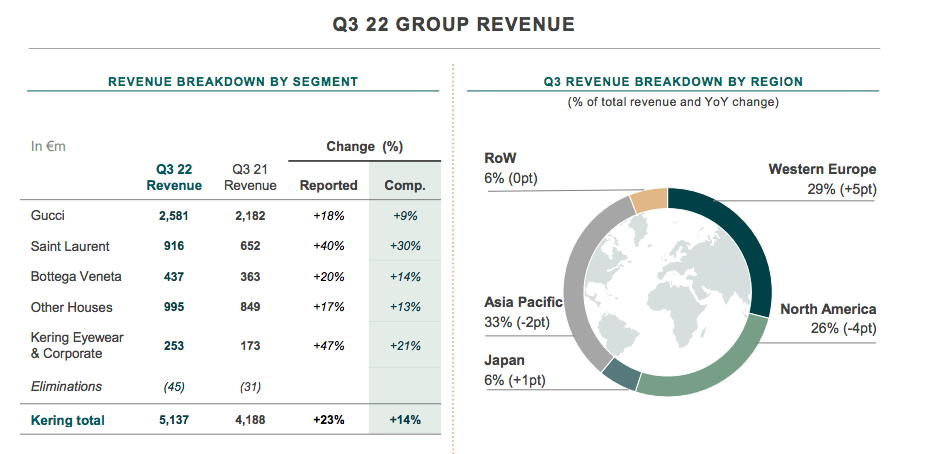

Kering Shares Plunge 6 Following Disappointing Q1 Earnings

May 24, 2025

Kering Shares Plunge 6 Following Disappointing Q1 Earnings

May 24, 2025 -

Pabrik Zuffenhausen Tempat Lahir Porsche 356 Yang Ikonik

May 24, 2025

Pabrik Zuffenhausen Tempat Lahir Porsche 356 Yang Ikonik

May 24, 2025 -

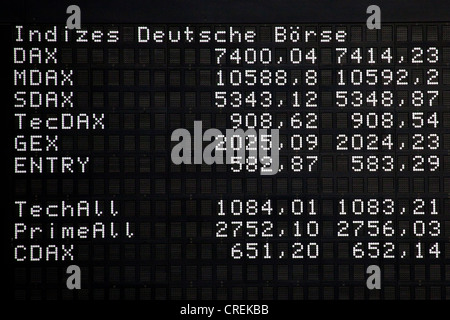

Steady Start For Dax Frankfurt Stock Market Opens After Record Growth

May 24, 2025

Steady Start For Dax Frankfurt Stock Market Opens After Record Growth

May 24, 2025

Latest Posts

-

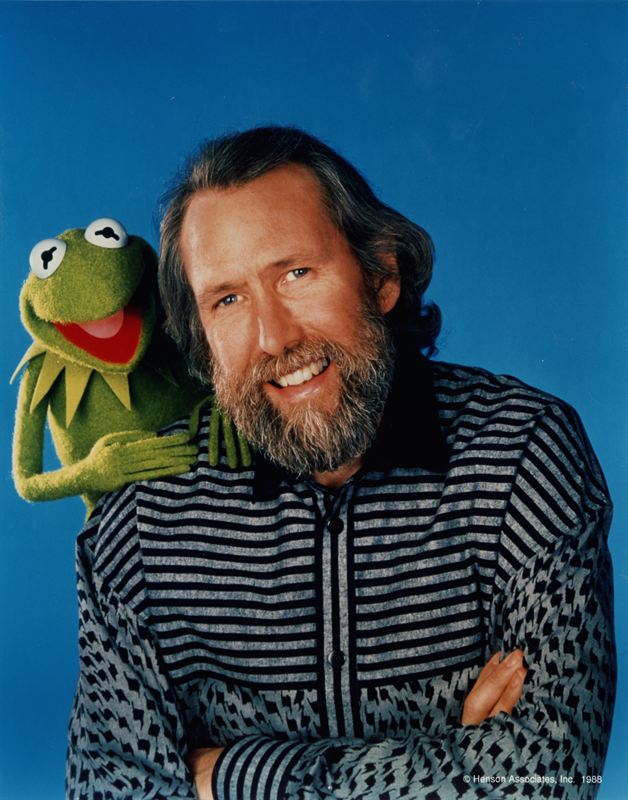

Kermit The Frog To Deliver Commencement Address At University Of Maryland

May 24, 2025

Kermit The Frog To Deliver Commencement Address At University Of Maryland

May 24, 2025 -

Kermits Commencement Speech University Of Maryland Class Of 2025

May 24, 2025

Kermits Commencement Speech University Of Maryland Class Of 2025

May 24, 2025 -

University Of Maryland Selects Kermit The Frog For 2025 Commencement Speech

May 24, 2025

University Of Maryland Selects Kermit The Frog For 2025 Commencement Speech

May 24, 2025 -

Kermit The Frog 2025 University Of Maryland Graduation Speaker

May 24, 2025

Kermit The Frog 2025 University Of Maryland Graduation Speaker

May 24, 2025 -

Kazakhstans Billie Jean King Cup Win A Detailed Look At The Australia Match

May 24, 2025

Kazakhstans Billie Jean King Cup Win A Detailed Look At The Australia Match

May 24, 2025