The Canadian Tire And Hudson's Bay Combination: Opportunities And Challenges

Table of Contents

Synergies and Opportunities for Growth

The Canadian Tire and HBC merger offers significant opportunities for growth through various synergistic effects. The combined entity possesses a vast retail footprint and a wealth of customer data, creating a powerful platform for expansion and enhanced customer engagement.

Enhanced Retail Reach and Market Share

The combined footprint of Canadian Tire and Hudson's Bay stores spans across Canada, dramatically increasing market penetration and customer reach. This expanded presence provides numerous advantages:

- Increased Market Share: The merger allows for significant gains in market share, particularly in key product categories.

- Cross-selling and Upselling: Canadian Tire's focus on automotive, home improvement, and sporting goods complements HBC's offerings in fashion, home furnishings, and luxury goods. This allows for strategic cross-selling and upselling opportunities, maximizing revenue streams.

- Retail Expansion: The combined resources could facilitate expansion into new geographic markets or untapped product categories, driving further growth. The strong brand equity of both companies provides a robust foundation for such expansion.

- Strengthened Brand Power: The merger combines two iconic Canadian brands, strengthening their overall market power and consumer loyalty.

Supply Chain Optimization and Cost Savings

Consolidation of operations presents significant opportunities for supply chain optimization and cost reduction:

- Logistics Efficiency: Streamlining logistics, procurement, and distribution processes will result in significant cost savings through economies of scale.

- Reduced Operational Costs: Sharing resources and infrastructure, such as warehousing and transportation, will lead to substantial reductions in operational expenses.

- Improved Procurement Power: Combined purchasing power will allow for better negotiation with suppliers, leading to lower costs on goods.

Leveraging Loyalty Programs and Customer Data

Integrating the loyalty programs of both companies creates a powerful tool for enhanced customer engagement and targeted marketing:

- Comprehensive Loyalty Benefits: A unified loyalty program can offer more comprehensive benefits and rewards, increasing customer loyalty and retention.

- Personalized Marketing: Combining customer data allows for highly targeted marketing campaigns and personalized shopping experiences, boosting sales conversions.

- Enhanced CRM: Improved Customer Relationship Management (CRM) systems will allow for better understanding of customer preferences and needs, leading to more effective marketing strategies.

Challenges and Potential Risks

While the merger promises significant benefits, it also presents substantial challenges and potential risks:

Integration Difficulties and Operational Hurdles

Merging two large and distinct retail organizations is a complex undertaking:

- Cultural Differences: Integrating different corporate cultures, management styles, and operational processes can be challenging and time-consuming.

- IT Integration: Successfully integrating IT systems and migrating data across two large organizations is a significant technical hurdle.

- Operational Disruptions: The integration process itself may cause temporary disruptions to operations, potentially impacting sales and customer satisfaction.

Brand Dilution and Cannibalization

The overlapping product categories between Canadian Tire and HBC pose a risk of brand dilution and cannibalization:

- Brand Confusion: Customers may become confused about the distinct brand identities and product offerings of the merged entity.

- Sales Cannibalization: One brand's products may compete directly with the other's, leading to internal competition and reduced overall sales.

- Clear Brand Differentiation: Implementing a clear brand positioning and differentiation strategy is crucial to mitigate these risks.

Competitive Landscape and Economic Factors

The Canadian retail market is highly competitive:

- Intense Competition: The merged entity will face strong competition from other major retailers and e-commerce players.

- Economic Uncertainty: Economic downturns, inflation, and fluctuating consumer spending habits pose significant risks.

- Fuel Price Volatility: Fluctuations in fuel prices directly impact Canadian Tire's business, posing a potential challenge.

Conclusion: The Future of the Canadian Tire and Hudson's Bay Combination

The Canadian Tire and Hudson's Bay merger presents both significant opportunities for growth and substantial challenges. Successful integration and strategic decision-making will be crucial to realizing the full potential of this combination. The potential for enhanced market share, supply chain efficiencies, and personalized customer experiences is substantial, but overcoming integration hurdles, managing brand risks, and navigating the competitive retail landscape will require careful planning and execution. What are your thoughts? Share your predictions regarding the Canadian Tire merger, the Hudson's Bay future, and the overall retail industry outlook. Let's discuss the future of this significant Canadian retail combination!

Featured Posts

-

1 3

May 21, 2025

1 3

May 21, 2025 -

Groeiend Autobezit Drijft Occasionverkoop Bij Abn Amro Omhoog

May 21, 2025

Groeiend Autobezit Drijft Occasionverkoop Bij Abn Amro Omhoog

May 21, 2025 -

The Inside Story How Michael Strahan Secured A Key Interview Amidst Stiff Competition

May 21, 2025

The Inside Story How Michael Strahan Secured A Key Interview Amidst Stiff Competition

May 21, 2025 -

Recent Red Light Sightings In France Potential Explanations

May 21, 2025

Recent Red Light Sightings In France Potential Explanations

May 21, 2025 -

Benjamin Kaellman Potentiaali Kehitys Ja Huuhkajien Tulevaisuus

May 21, 2025

Benjamin Kaellman Potentiaali Kehitys Ja Huuhkajien Tulevaisuus

May 21, 2025

Latest Posts

-

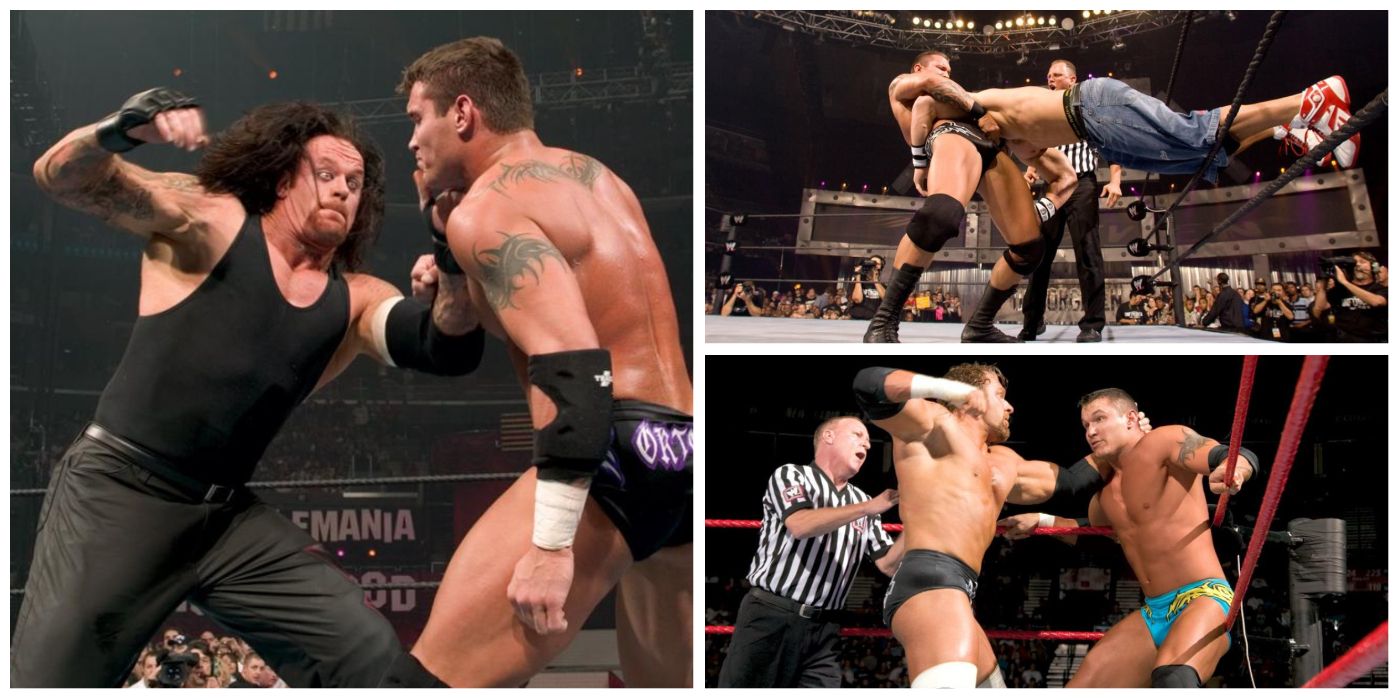

John Cena And Randy Orton Potential Feud And Bayleys Injury News

May 21, 2025

John Cena And Randy Orton Potential Feud And Bayleys Injury News

May 21, 2025 -

Is A John Cena Vs Randy Orton Match On The Horizon Bayleys Injury Status

May 21, 2025

Is A John Cena Vs Randy Orton Match On The Horizon Bayleys Injury Status

May 21, 2025 -

John Cena Vs Randy Orton Feud Brewing Plus Bayleys Injury Update

May 21, 2025

John Cena Vs Randy Orton Feud Brewing Plus Bayleys Injury Update

May 21, 2025 -

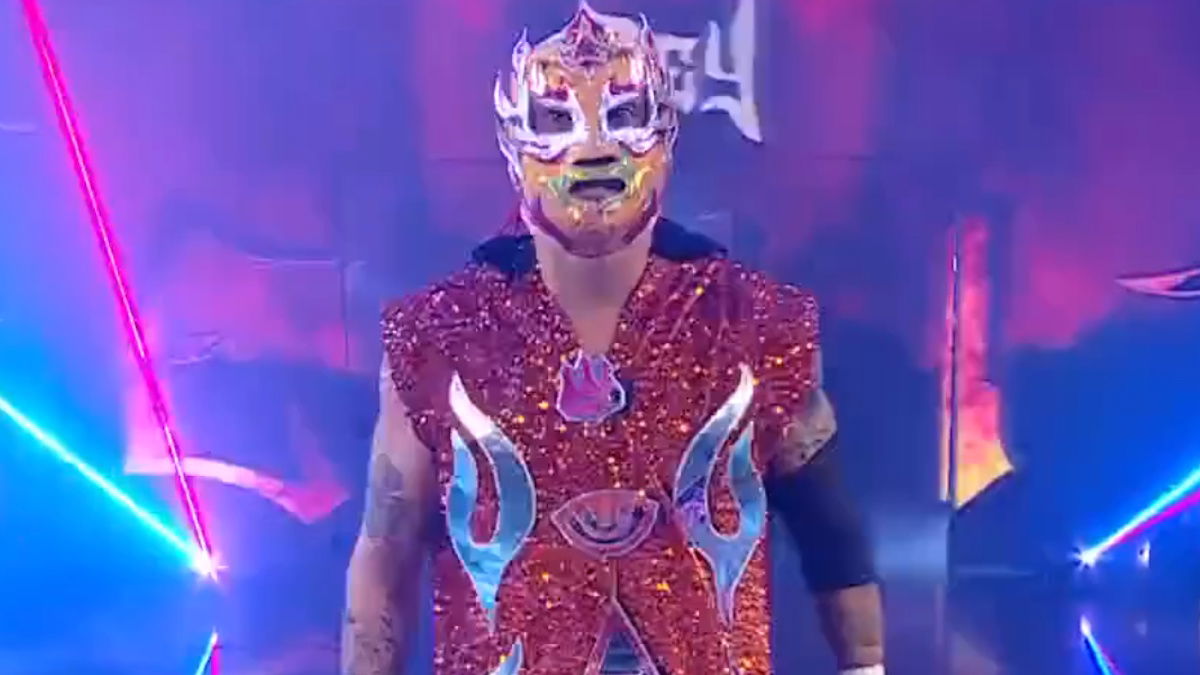

Former Aew Star Rey Fenix Smack Down Debut And Wwe Ring Name Unveiled

May 21, 2025

Former Aew Star Rey Fenix Smack Down Debut And Wwe Ring Name Unveiled

May 21, 2025 -

Aew Star Rey Fenix Debuts On Wwe Smack Down His New Ring Name

May 21, 2025

Aew Star Rey Fenix Debuts On Wwe Smack Down His New Ring Name

May 21, 2025