AbbVie (ABBV) Raises Profit Outlook On Strong New Drug Sales

Table of Contents

Strong Sales of Key New Drugs Drive AbbVie's Profit Increase

AbbVie's impressive profit surge is directly attributable to the robust sales of its key newer drugs. This success underlines the company's commitment to innovation and its ability to translate research into market-leading products.

Rinvoq and Skyrizi Fuel Growth

Rinvoq and Skyrizi, two flagship drugs in AbbVie's portfolio, have delivered exceptional results, fueling a substantial portion of the increased AbbVie drug sales. These medications are used to treat various autoimmune diseases, including rheumatoid arthritis and psoriasis, addressing significant unmet medical needs.

- Rinvoq sales exceeded expectations in Q[Insert Quarter], reaching [Insert Sales Figure] compared to [Insert Previous Quarter/Year Figure]. This represents a [Insert Percentage] increase.

- Skyrizi revenue also showed remarkable growth, achieving [Insert Sales Figure] in Q[Insert Quarter], a [Insert Percentage] increase year-over-year. This impressive growth reflects Skyrizi's increasing market share within its competitive therapeutic area.

- Analysts have praised AbbVie's success in differentiating Rinvoq and Skyrizi from competitors, highlighting their superior efficacy and safety profiles. The drugs' strong performance illustrates AbbVie's effective market penetration strategy.

Beyond Rinvoq and Skyrizi: Other Contributing Factors

While Rinvoq and Skyrizi are the primary drivers, AbbVie's overall pharmaceutical sales benefited from contributions from other drugs within its diverse portfolio. Continued success with established products, coupled with new drug approvals and expanded indications, further bolstered the company's overall revenue.

- [Drug Name 1]: Contributed [Sales Figure/Percentage] to the overall increase in AbbVie pharmaceutical sales.

- [Drug Name 2]: Successful launch and market penetration contributed to the positive financial results.

- Strategic partnerships and licensing agreements have also provided additional revenue streams, diversifying AbbVie's income sources and enhancing its overall financial stability.

Revised Profit Outlook: What it Means for Investors

The strong performance of AbbVie's new drugs has led to a significant upward revision of its profit outlook. This positive revision has significant implications for both short-term and long-term investors.

Upward Revision Details

AbbVie has raised its earnings per share (EPS) forecast for [Year] to [New EPS Figure] from the previous estimate of [Old EPS Figure]. This represents an increase of [Percentage] and reflects the company's confidence in its future performance.

- The revised outlook significantly impacts AbbVie's valuation, strengthening its position in the pharmaceutical market.

- The positive EPS growth significantly impacts investor confidence, potentially driving further growth in the AbbVie stock price.

Analyst Reactions and Future Predictions

Following the announcement, financial analysts have generally reacted positively, with many upgrading their ratings and forecasts for AbbVie. Several analysts have cited the strength of AbbVie's new drug pipeline as a key driver of future growth.

- [Analyst Name 1] from [Firm Name] stated "[Quote about AbbVie's future prospects]."

- The AbbVie stock price experienced a [Percentage]% increase immediately following the announcement, showcasing investor enthusiasm.

- Several analysts predict continued strong growth for AbbVie in the coming years, driven by the ongoing success of Rinvoq and Skyrizi and the potential contributions of new products in the pipeline.

Risks and Challenges Facing AbbVie

Despite the positive news, AbbVie, like any pharmaceutical company, faces several risks and challenges that investors should consider.

Patent Expiry Concerns

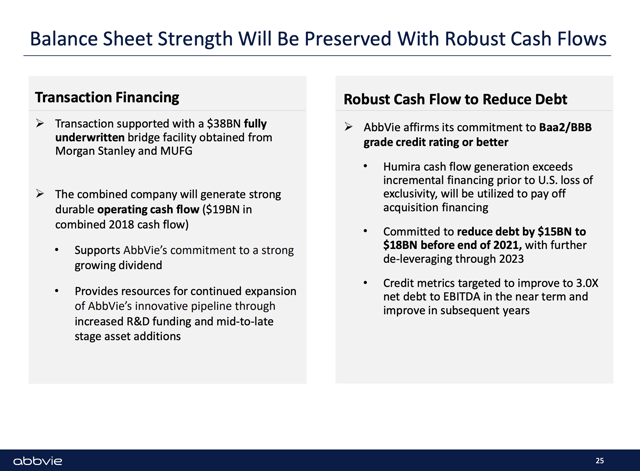

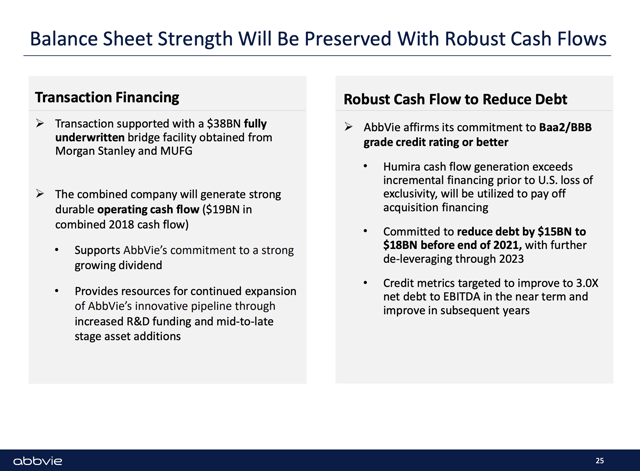

The "patent cliff" – the expiration of patents on key drugs – poses a significant risk to AbbVie's future growth. The loss of exclusivity for blockbuster drugs could lead to increased generic competition and a decline in revenue.

- [Drug Name facing patent expiry]: The loss of exclusivity for this drug could impact AbbVie's revenue by [Estimated Amount].

- AbbVie is actively mitigating this risk by investing heavily in its drug pipeline, developing new products to replace aging medications. Acquisitions of promising biotech companies also contribute to their strategy.

Market Competition and Pricing Pressures

AbbVie operates in a highly competitive pharmaceutical market, facing pressure from other major players. Pricing pressures from both payers and competitors represent a constant challenge.

- [Competitor 1] and [Competitor 2] represent significant competition in several therapeutic areas.

- Regulatory hurdles and pricing negotiations with government agencies pose further challenges to AbbVie's profitability.

Conclusion

AbbVie's raised profit outlook is a testament to the company's successful strategy of focusing on innovation and the strong market performance of its newer drugs, particularly Rinvoq and Skyrizi. The substantial increase in the AbbVie profit outlook signals positive momentum for the company and presents compelling opportunities for investors. However, investors should remain aware of the challenges related to patent expiries and intense market competition. To stay informed on AbbVie's (ABBV) progress and future announcements, continue monitoring its financial reports and analyst commentary. Consider further research into AbbVie stock and its investment prospects to make well-informed decisions regarding investing in AbbVie and tracking AbbVie performance in the future. Understanding the AbbVie future growth outlook is crucial for any investor considering this pharmaceutical giant.

Featured Posts

-

Amanda Holden And Tess Dalys Daughters On A Desert Island Tv Show

Apr 26, 2025

Amanda Holden And Tess Dalys Daughters On A Desert Island Tv Show

Apr 26, 2025 -

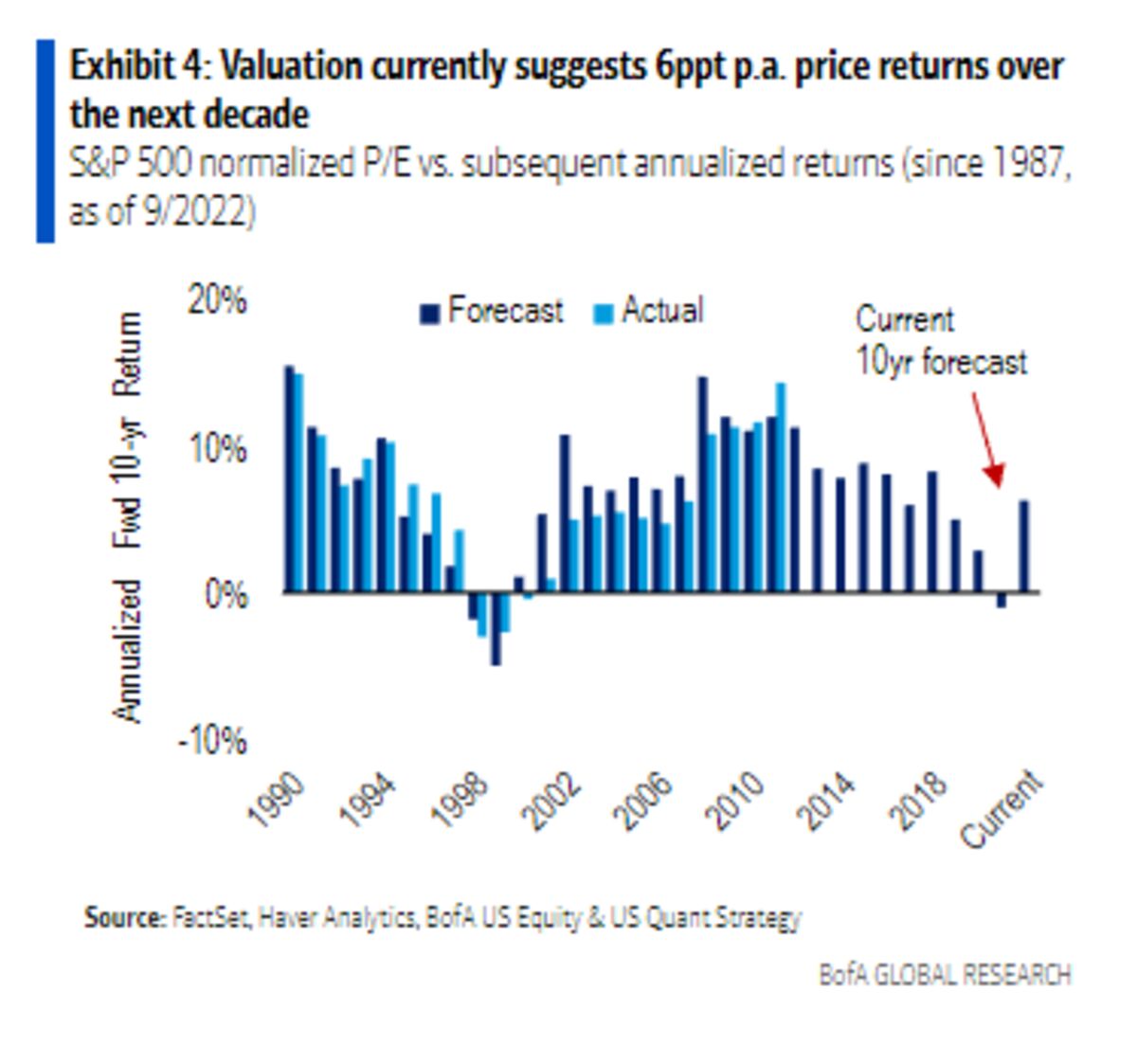

Are High Stock Market Valuations A Concern Bof A Weighs In

Apr 26, 2025

Are High Stock Market Valuations A Concern Bof A Weighs In

Apr 26, 2025 -

Nepo Babies Dominating Television Right Now

Apr 26, 2025

Nepo Babies Dominating Television Right Now

Apr 26, 2025 -

Benson Boone Photos 2025 I Heart Radio Music Awards Sheer Lace Top

Apr 26, 2025

Benson Boone Photos 2025 I Heart Radio Music Awards Sheer Lace Top

Apr 26, 2025 -

The Post Roe Landscape Examining The Role Of Otc Birth Control

Apr 26, 2025

The Post Roe Landscape Examining The Role Of Otc Birth Control

Apr 26, 2025

Latest Posts

-

Celebrity Style Evolution Ariana Grandes Professional Hair And Tattoo Makeover

Apr 27, 2025

Celebrity Style Evolution Ariana Grandes Professional Hair And Tattoo Makeover

Apr 27, 2025 -

The Professionals Behind Ariana Grandes Dramatic Hair And Tattoo Change

Apr 27, 2025

The Professionals Behind Ariana Grandes Dramatic Hair And Tattoo Change

Apr 27, 2025 -

Ariana Grandes Hair And Tattoo Transformation Professional Insights Into Celebrity Styling

Apr 27, 2025

Ariana Grandes Hair And Tattoo Transformation Professional Insights Into Celebrity Styling

Apr 27, 2025 -

Understanding Ariana Grandes Style Evolution The Role Of Professional Hair And Tattoo Experts

Apr 27, 2025

Understanding Ariana Grandes Style Evolution The Role Of Professional Hair And Tattoo Experts

Apr 27, 2025 -

Ariana Grandes Bold New Look Exploring The Professionalism Behind Her Hair And Tattoo Choices

Apr 27, 2025

Ariana Grandes Bold New Look Exploring The Professionalism Behind Her Hair And Tattoo Choices

Apr 27, 2025